DAMITT Q1 2024: Merger Enforcement Begins 2024 with a Bang

Key Facts

United States

- The U.S. agencies announced the conclusion of six significant merger investigations in Q1 2024, double the number seen last quarter. This marks the end of six quarters of three or fewer significant investigations. In line with recent trends, each significant merger investigation ended with a complaint or an abandoned transaction. Q1 2024 saw no merger settlements.

- Four significant merger investigations ended in an agency-announced abandoned transaction in Q1 2024. This is a DAMITT record high for any quarter back to at least 2011 and more than any full year since then other than 2021 and 2023.

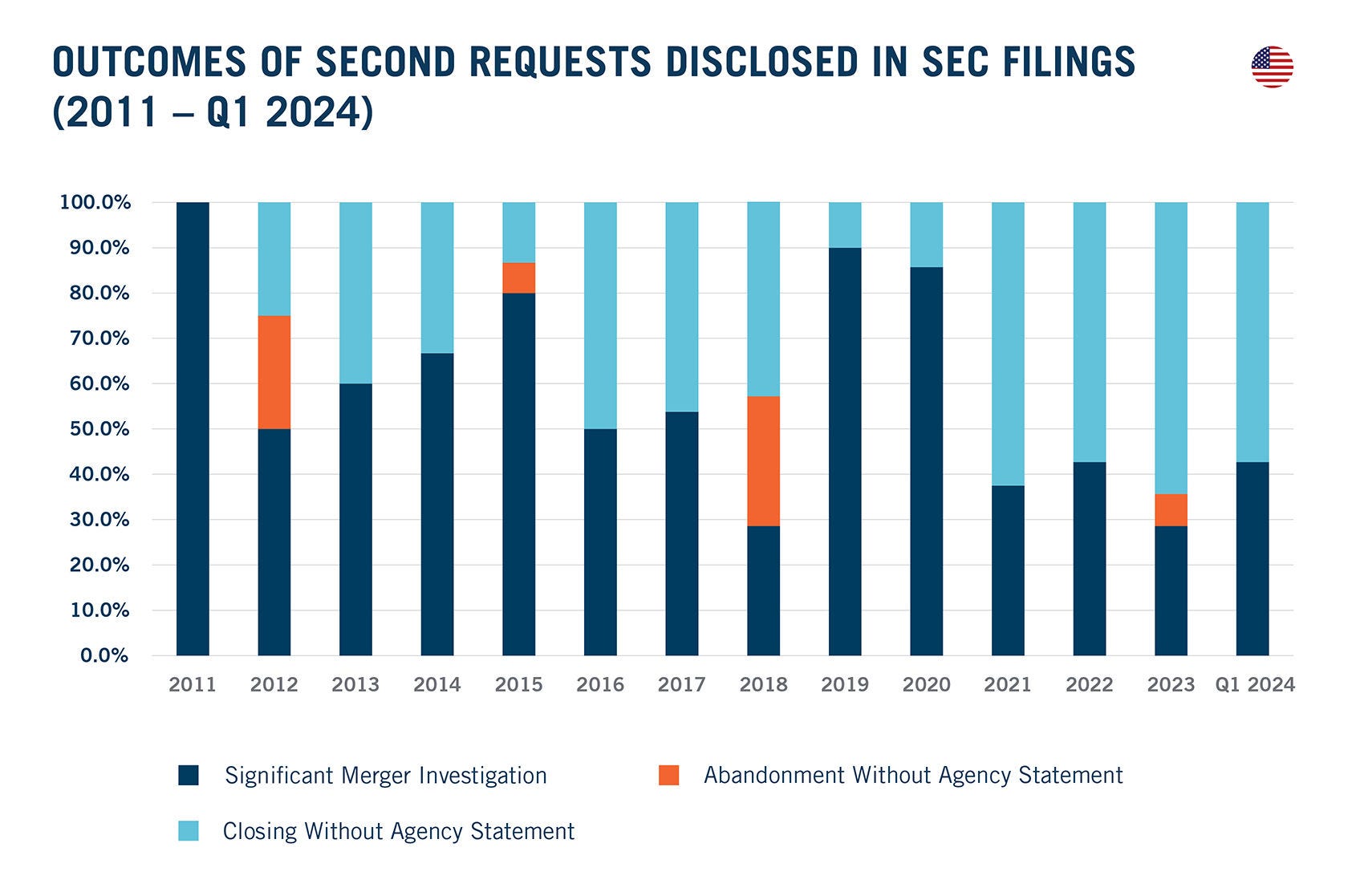

- These outcomes do not mean that every transaction receiving Second Requests is being challenged or abandoned. Instead, an analysis of Second Requests disclosed in SEC filings shows four of those deals closed in Q1 2024 without an adverse agency action. In other words, merger investigations are increasingly binary: either transactions are fully challenged or fully cleared. There is little middle ground.

- The average duration of a significant merger investigation ticked up to 12.3 months in Q1 2024, slightly above the annual DAMITT average in recent years. Over the last 12 months, the average duration of a significant merger investigation was 11.6 months. By contrast, the average duration of transactions with Second Requests disclosed in SEC filings that closed without agency action was 8.3 months in Q1 2024, slightly down from an average of 8.9 months over the last 12 months.

European Union

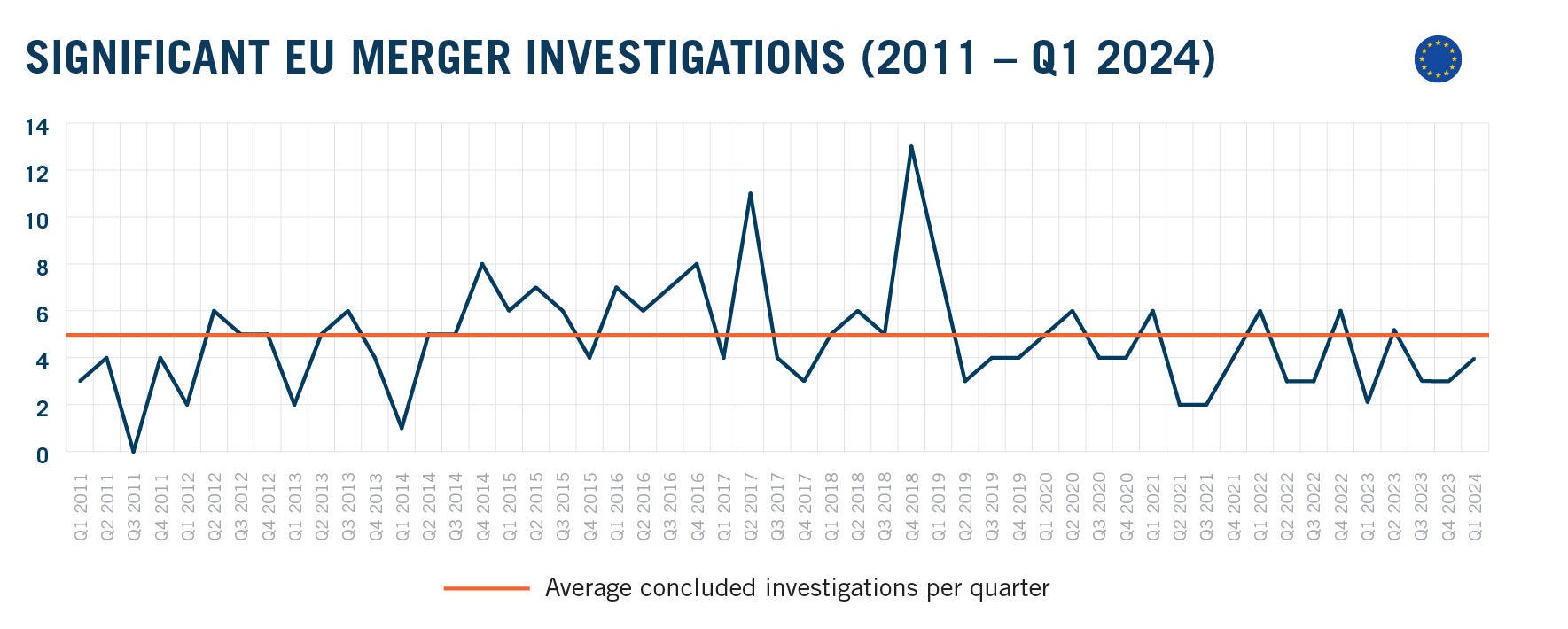

- The EU Commission concluded four significant merger investigations in Q1 2024, a 100 percent increase from Q1 2023, but 23 percent below the Q1 average over the 2019-2023 period.

- Remedy packages agreed in Q1 2024 following Phase II investigations were markedly more complex than remedies agreed in previous mergers in similar industries, hinting that the EU Commission expects more substantial remedies.

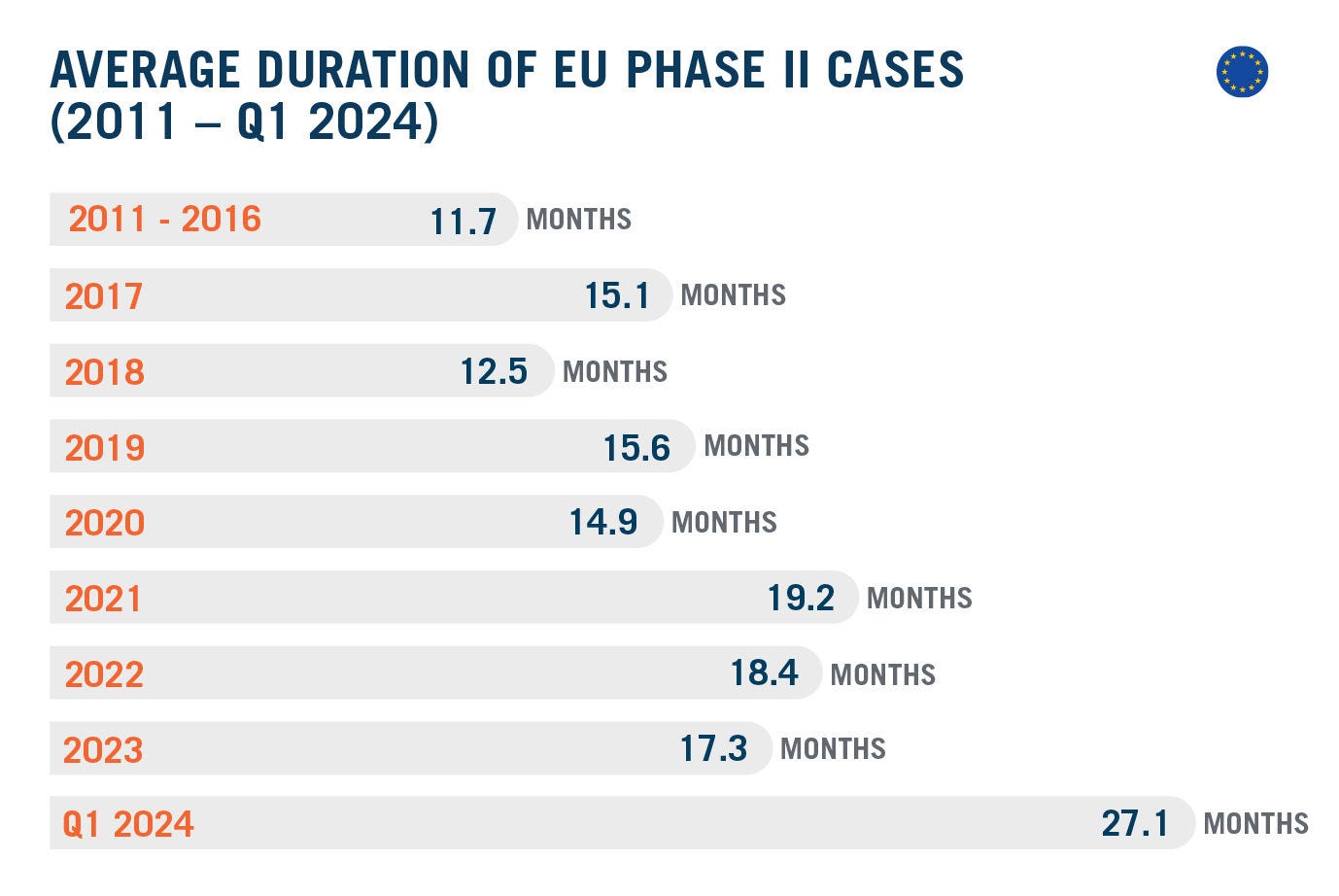

- The average duration of Phase II merger investigations concluded in Q1 2024 hit a new record-length of 27.1 months (more than two years!). While the increase is driven by an outlier, the 39.5-month review of Korean Air/Asiana Airlines, it still confirms a move towards challenging Phase II investigations for merging parties.

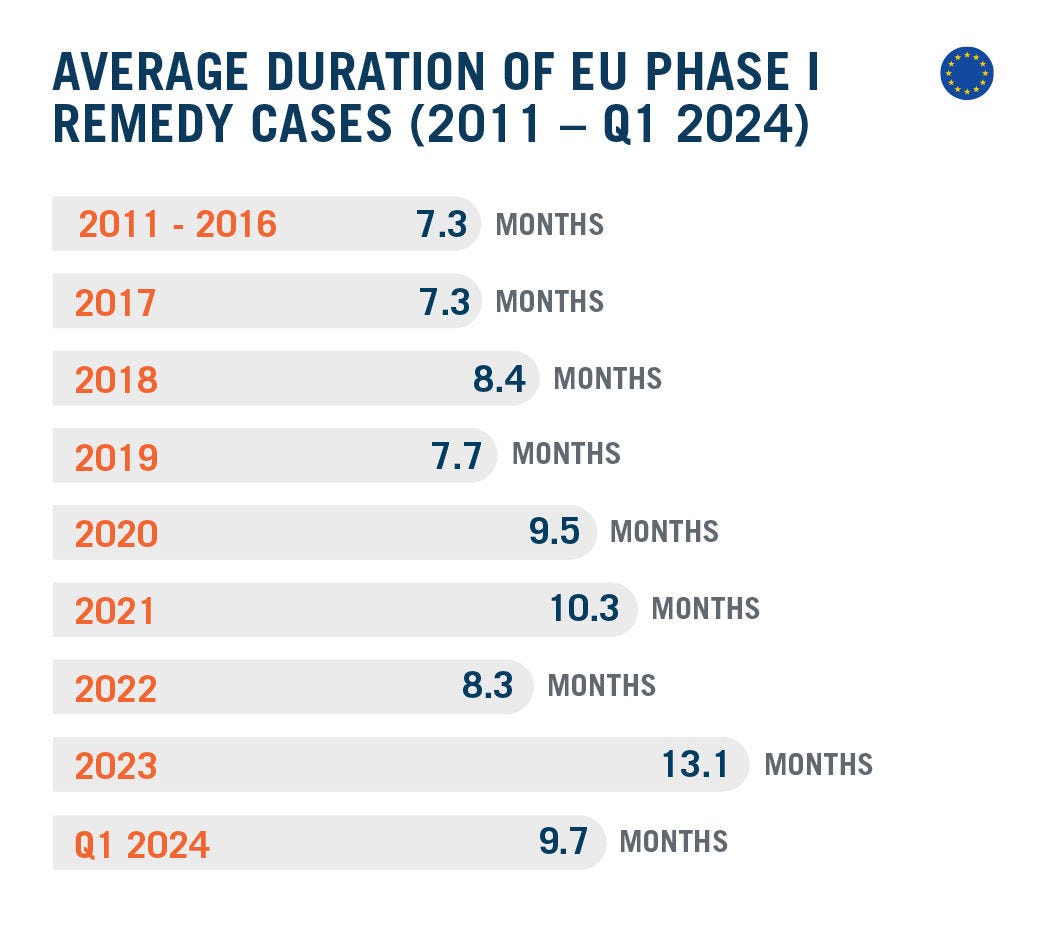

- Phase I remedy investigations averaged at 11.7 months over the last 12 months, slightly below the record-high duration observed in 2023 but still 20 percent above the 2019-2023 average.

U.S. Merger Enforcement Activity Picks Up

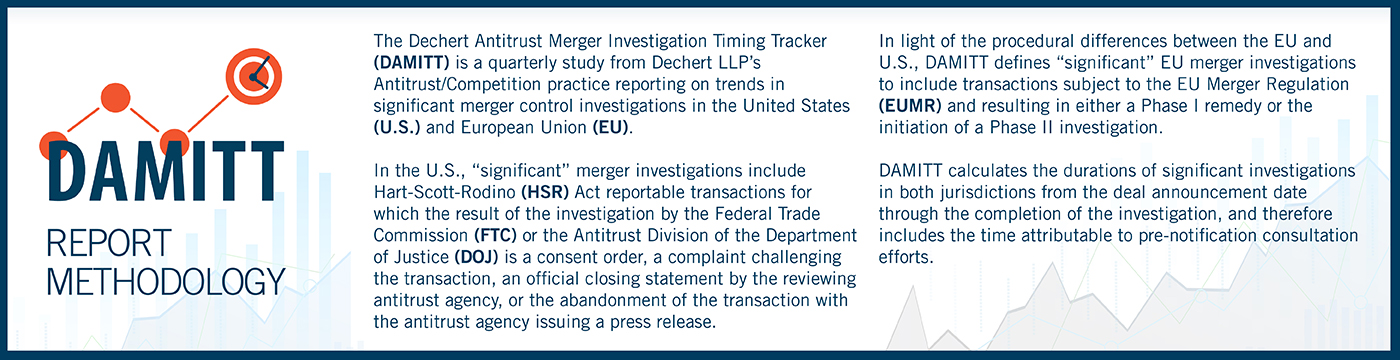

The Number of Significant Merger Investigations Has Doubled Over the Last Quarter

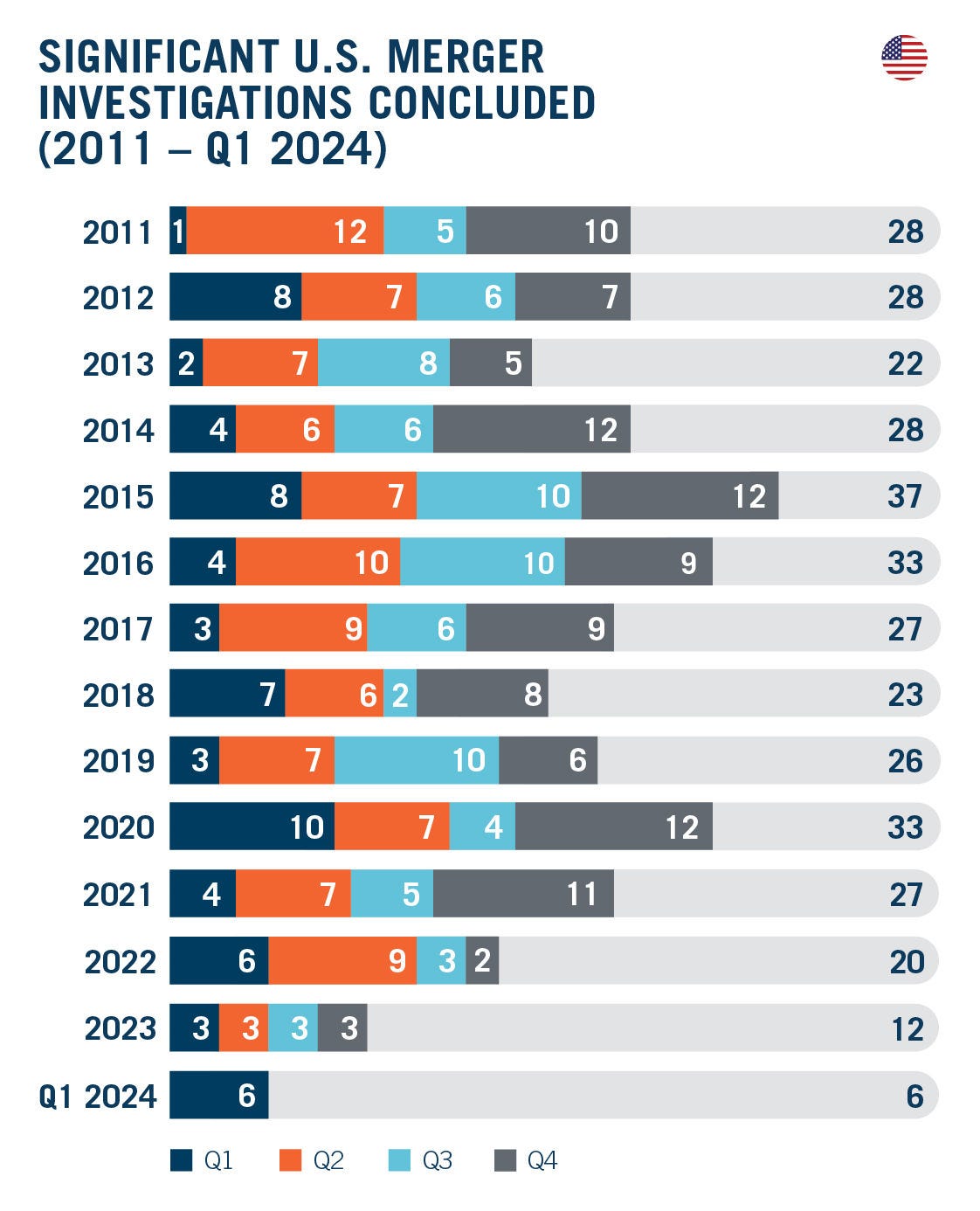

While the count of significant merger investigations is often low in the first quarter, Q1 2024 was an exception. The six significant merger investigations concluded in Q1 2024 amount to double the number concluded in each quarter of 2023 and half the total number concluded in all of 2023. The math here is easy; we did not even need a calculator.

Lest we make a mountain out of a molehill, it is important to put this surge in activity into perspective. While above average for a typical first quarter, Q1 2024 fell slightly below the DAMITT quarterly average since 2011.

Indeed, the relatively strong showing in Q1 2024 only reinforces our DAMITT 2023 Annual Report, which highlighted the abnormally low number of significant U.S. merger investigations concluded in 2023. It is precisely the prolonged drought over the last six quarters that makes Q1 2024 look like a flood. In this regard, it is unclear whether this higher number of significant merger investigations is an anomaly or the start of a new trend.

Still, when we look at the U.S. significant merger investigation heartbeat by quarter, the sharp uptick in Q1 2024 is notable.

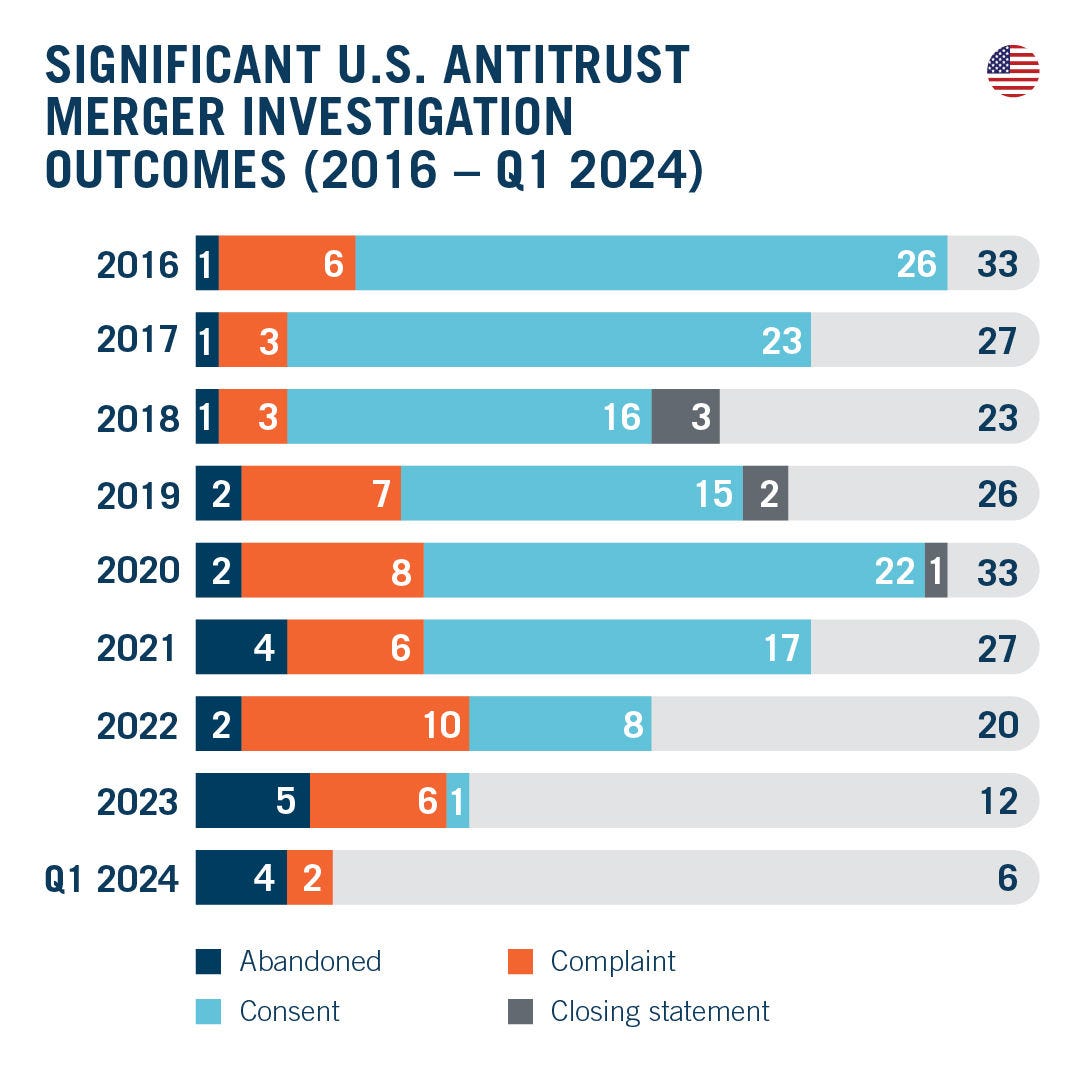

Q1 2024 Marks the Fifth Quarter Without a Pre-Litigation Merger Settlement Under the Current Administration

Unlike the number of significant U.S. merger investigations, the number of merger settlements remains anemic.

Merger settlements used to be the most common form of U.S. merger enforcement. Between 2011 and 2021, DAMITT data show that only one quarter went by without a merger settlement from the U.S. agencies. Yet since 2022, we have now seen five quarters without a single pre-litigation settlement. It is an undeniable pattern.

Indeed, as early as our DAMITT 2021 Report, we have warned that transactions subject to significant merger investigations were more likely to be abandoned or blocked than settled. At that time, 37 percent of significant investigations resulted in a complaint or an abandoned transaction, the highest observed going back to 2011. By the time of our DAMITT 2023 Report, that figure had shot up to 92 percent. With the first quarter of 2024 down, that figure currently stands at 100 percent for 2024. That is not a new record as both Q1 2023 and Q2 2023 similarly saw no consent decrees with merger settlements. The absence of pre-litigation merger settlements is becoming par for the course.

What is new is the high number of agency-announced abandoned transactions in Q1 2024. Four transactions resulted in an agency-announced abandonment in Q1 2024, which is a DAMITT record for any quarter going back to at least 2011 and more than any full year except 2021 and 2023—both under the current administration. These numbers align with statements from various agency officials that more parties are abandoning deals prior to a formal agency enforcement action.

Not all Second Requests Result in Enforcement Actions

At DAMITT, “significant” U.S. merger investigations are defined as those ending in a consent order, a complaint challenging a transaction, an official closing statement by the agencies, or the abandonment of a transaction with the agency issuing a press release. These metrics are objective and publicly observable, and they align with what the agencies themselves categorize as newsworthy in their own statements. While these agency statements increasingly focus on complaints and abandoned transactions, it is important to keep in mind what the recent agency statements do not cover: transactions cleared after the completion of a Second Request investigation without a closing statement from the agencies.

We can, however, infer from data collected from U.S. Securities & Exchange Commission (“SEC”) filings that not all Second Requests result in an enforcement action or an abandonment. In Q1 2024, for example, four transactions that had previously received Second Requests disclosed in SEC filings closed without a significant U.S. merger investigation. By contrast, only three transactions that had previously received Second Requests disclosed in SEC filings were the subject of a significant U.S. merger investigation. In other words, looking at all investigations that concluded in Q1 2024 with Second Requests disclosed in SEC filings, nearly 60 percent ended with no action by the agencies. This matches a trend observed for the last three years but marks a sharp departure from the last two years of the previous administration, as shown below.

Here, it is important to acknowledge that SEC filings do not capture all transactions. SEC filings may not capture merger activity by foreign issuers, non-public companies, or public companies that fall beneath certain materiality thresholds. This is a key reason why DAMITT data focus on public statements and filings directly from the agencies.

The SEC filings do, however, demonstrate that the outcome of Second Requests, once issued, is not pre-ordained. Instead, the proportion of Second Requests disclosed in SEC filings that end with a complaint or an abandonment appears to be falling. Getting a deal through a Second Request investigation without a complaint or an abandoned transaction is still possible.

Average Durations Return to Around a Year

The average duration of concluded significant merger investigations in Q1 2024 was 12.3 months, which is above the annual average recorded each year since 2011 but not a record. Over the last 12 months, the average duration was 11.6 months, a full month longer than the average duration in 2023 but otherwise in line with the average duration between 2019 and 2022.

Digging deeper into the numbers, the average duration from deal announcement to a complaint was 13.9 months and the average duration for abandoned transaction was 11.5 months in Q1 2024.

Not surprisingly, these durations exceed the durations from deal announcement to closing for deals with Second Requests disclosed in SEC filings that did not result in an agency statement. The average duration of transactions with Second Requests disclosed in SEC filings that closed without a statement was 8.3 months in Q1 2024, slightly down from an average of 8.9 months over the last 12 months.

Keep in mind: none of these durations take into account proposed changes to the HSR rules that are expected to substantially increase burdens on parties filing notifications and may require additional time to prepare initial HSR filings. Any delays to initial HSR filings under the new rules, once finalized, can be expected to increase durations in the future.

2024 Promises Longer Significant EU Merger Investigations and More Substantial Remedies, but a Lower Enforcement Rate

Number of Significant EU Merger Investigations Likely to Remain Low in 2024, Despite Slight Uptick in Q1

The EU Commission concluded twice as many significant merger investigations in Q1 2024 as in Q1 2023, bringing the total number of significant EU merger investigations concluded thus far in 2024 to four. As in the U.S., however, this is only a relative high. On the whole, while this number of significant EU merger investigations is in line with the quarterly average over the 2019-2023 period, and only slightly below the overall DAMITT average, it is 23 percent below the average for Q1 over the last five years.

More importantly, the available data shows that the EC pipeline is close to running dry, with only two pending Phase II investigations. By comparison, as noted in our DAMITT Q1 2023 Report, nine Phase II investigations were pending at the same time last year. Considering the average duration of Phase II reviews, this may indicate the start of a very slow year in terms of merger enforcement in the EU.

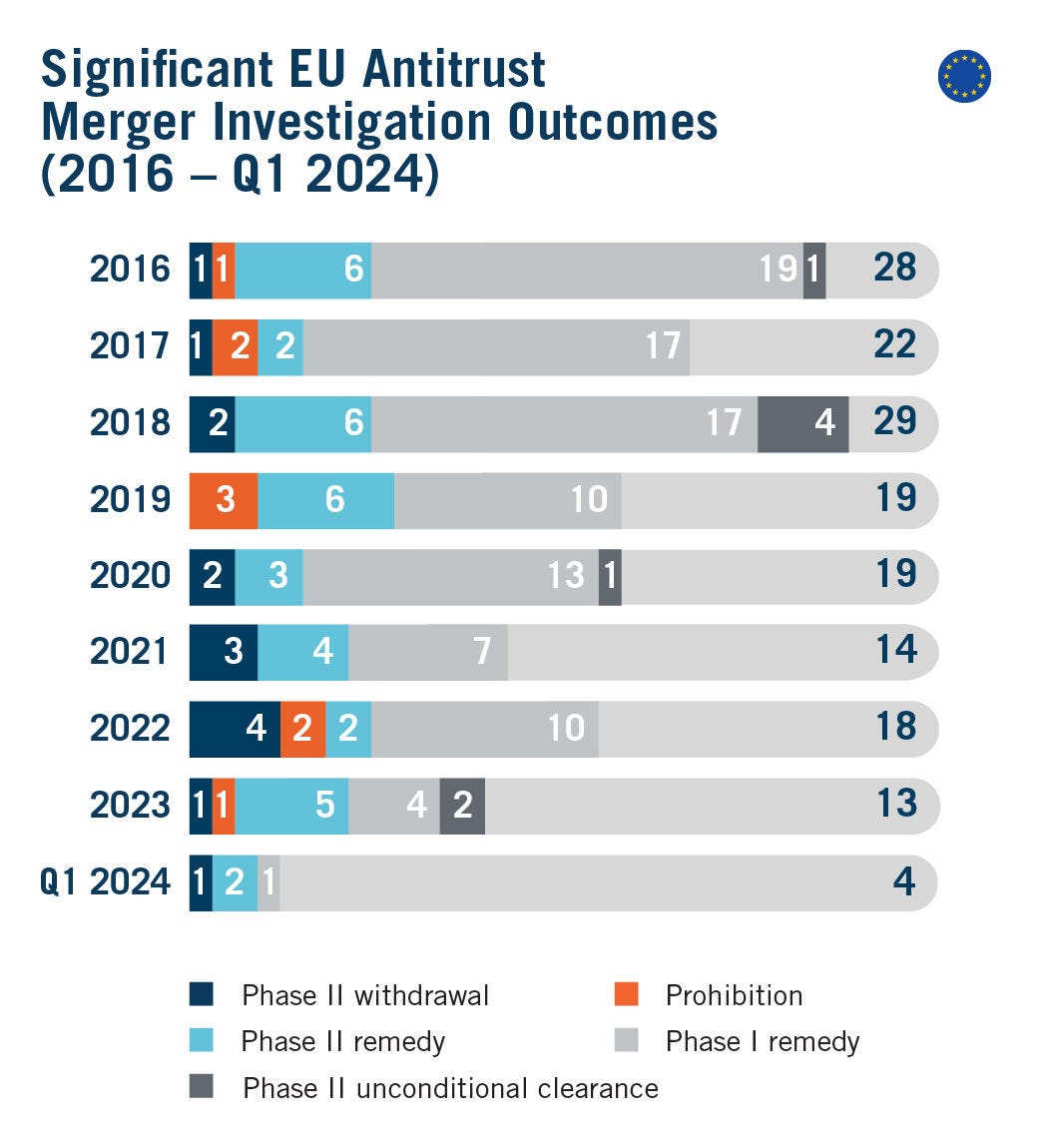

EU Commission Expects More Substantial Remedies, with More Cases Going to Phase II

In terms of outcomes, Q1 2024 confirmed the trend highlighted in our DAMITT 2023 Report towards the near extinction of cases concluded in Phase I with remedies and the corresponding increase in Phase II cases (in-depth investigations). With only a single deal cleared in Phase I with remedies so far in 2024, the number of Phase I remedy cases is 56 percent below the quarterly average over the 2019-2023 period, while the number of Phase II cases concluded last quarter is 50 percent above the quarterly average for the same period.

Looking more closely at Phase II cases concluded in Q1 2024, one transaction, Amazon/iRobot, was abandoned and two cases were cleared with remedies. The remedy packages agreed in these latter cases deserve attention.

First, the Orange/Masmovil joint venture was cleared following the agreement of a remedy package including both structural remedies (i.e. spectrum divestment) and behavioral commitments (i.e. national roaming agreement). Such combined remedies have been relatively rare in the past, and agreed only in eight percent of the EU cases cleared with remedies since DAMITT started tracking. Looking more closely at telecommunications deals, they are however slightly more common: deals in this industry cleared with remedies have involved combined remedies in 28 percent of cases since DAMITT started tracking in 2011.

Second, the remedies agreed to obtain approval for the Korean Air/Asiana Airlines merger are also uncommon. In past airlines transactions, remedy packages agreed with the EU Commission have overwhelmingly focused on slots divestitures, i.e. merging parties divesting their rights to take-off or land, at a specific time in a given airport. In this case, slots remedies appear to have been insufficient; beyond divesting slots and traffic rights as well as access to the required aircraft for four routes, Korean Air also had to agree to wait until the divestiture buyer started operating the overlapping routes to complete the merger. Korean Air also had to agree to divest Asiana's global cargo freighter business to obtain clearance. Commenting on slot remedies, EVP Vestager noted in February 2024 that she had doubts about the capacity of such remedies to solve competition concerns, noting that “they work only under very, very specific circumstance”. Decisions in the pending investigations into the Lufthansa/ITA and IAG/Air Europa mergers will tell whether this is the start of a stricter EU approach to airline mergers, although it is admittedly more permissive than the recent no-settlement approach favored by the U.S. Department of Justice in the Northeast Alliance and JetBlue/Spirit matters.

Record-High Durations of EU Phase II Investigations

The duration of Phase II investigations concluded in the first quarter of 2024 reached a gobsmacking record of 27.1 months. This is nearly eight months longer than the previous DAMITT record of 19.2 months and significantly longer than the 15.0-month average observed in Q1 2023.

This increase is primarily driven by the Korean Air/Asiana Airlines investigation, which lasted an unprecedented 39.5 months, making it the longest Phase II case since DAMITT started tracking. The deal was however notified more than 26 months after being announced, which is a striking departure from the average 8-month pre-filing duration over the 2019-2023 period. But even leaving this deal aside, the average duration of Phase II investigations concluded thus far in 2024 averaged at 20.9 months, still the longest ever recorded.

Looking at the last 12 months, the average duration of Phase II investigations decreased slightly to 20.2 months – 18.2 months if excluding Korean Air/Asiana Airlines, still more than a month above the 2019-2023 average.

The “formal review” period for these deals, i.e. counting only the duration of the investigation starting as of the formal notification, averaged at 11.2 months, tying the record duration observed in 2022. These lengthy formal investigations are driven by the EU Commission intensely using its statutory powers to agree voluntary extensions with the parties and stop the clock. The EU Commission used these tools in all of the cases concluded in Q1 2024, agreeing to the maximum extension of 20 workings days in all but one case, and stopping the clock on the investigation for 3.7 months on average.

Turning to Phase I remedy cases, the 9.7.-month duration of the only Phase I investigation concluded with remedies this quarter falls notably below the record 13.1-month duration observed in 2023 and is in line with the average observed over the 2019-2023 period.

Over the last 12 months, however, the duration of the four cases concluded in Phase I with remedies averaged at 11.7 months, markedly above average.

Conclusion

Parties to transactions subject to significant merger investigations continue to face an elevated risk of seeing their deal blocked or abandoned on both sides of the Atlantic, even if the intervention rate shows relatively few deals receive this level of scrutiny. To ensure the ability to defend their deals through a potential investigation, parties to the average “significant” deal in the U.S. should plan on at least 12 months for the agencies to investigate their transaction and may want to add on additional time to address the continuing uncertainty at the agencies. Parties should also plan for another 6 to 12 months if they want to preserve their right to litigate an adverse agency decision. On the EU side, parties to transactions likely to proceed to Phase II should allow for at least 20 months from announcement to clearance and should less than ever rely on the theoretical deadlines provided for in the EU Merger Regulation, even after the deal has been formally notified. Parties should also be ready to put forward substantial remedy packages if they hope to convince the EU Commission to clear the deal. Finally, companies should be aware that the EU Commission is less and less likely to accept remedies without an in-depth investigation. If parties still plan on obtaining a Phase I clearance with commitments, they should factor in around 12 months from announcement to a decision, with significant time set aside for pre-notification talks with the Commission and the potential need to pull and refile their filing.