DAMITT Q1 2023: Is Merger Enforcement in Good Health?

Key Facts

United States

- All significant U.S. merger investigations concluded in either a complaint or an abandoned transaction. This marks the second quarter in less than a year without any consent agreements, demonstrating the agencies’ continued hostility to merger remedies and settlements short of litigation.

- The antitrust agencies’ hostile stance on settlements has not been matched by a particularly aggressive number of concluded investigations. The three significant investigations concluded in Q1 2023 are 50 percent fewer than Q1 2022 and follow two other quarters of unusually light enforcement activity.

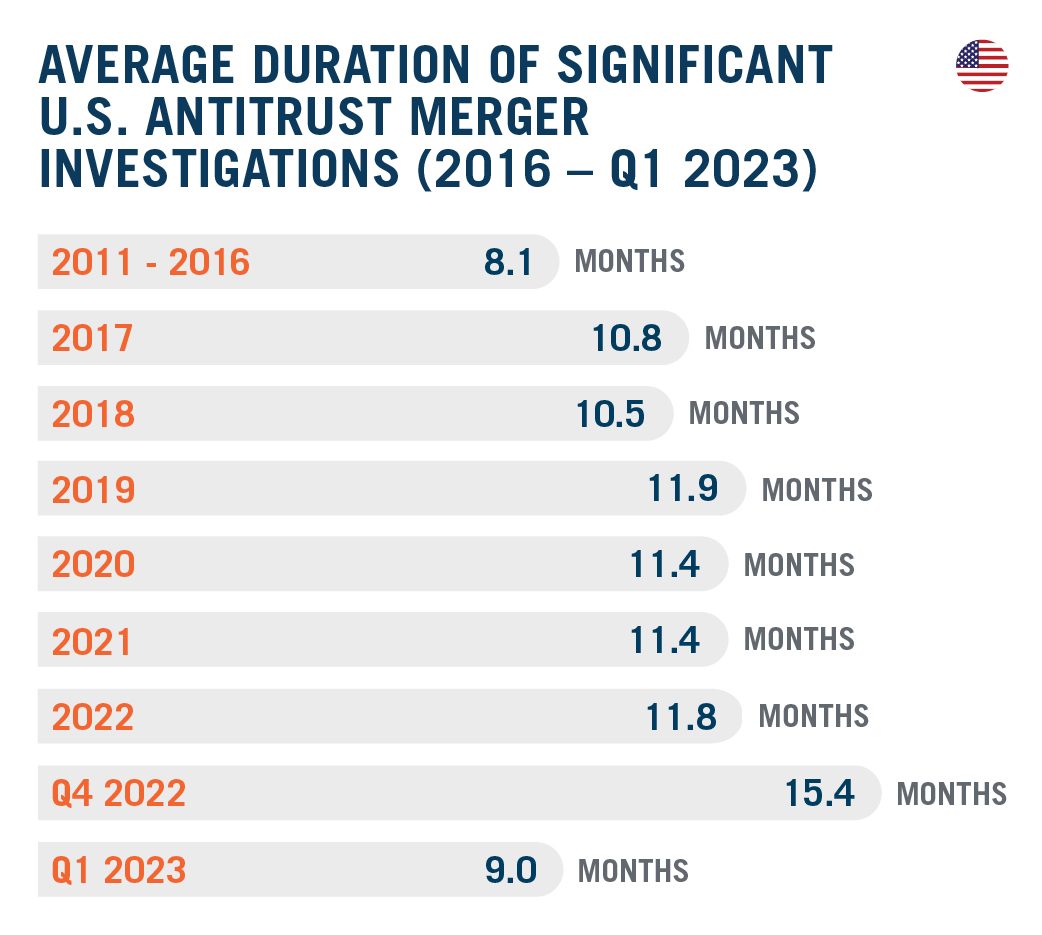

- The average duration of significant investigations for Q1 2023 dropped to 9.0 months after 15.4 months last quarter. For the last 12 months, the average declined to 11.0 months.

European Union

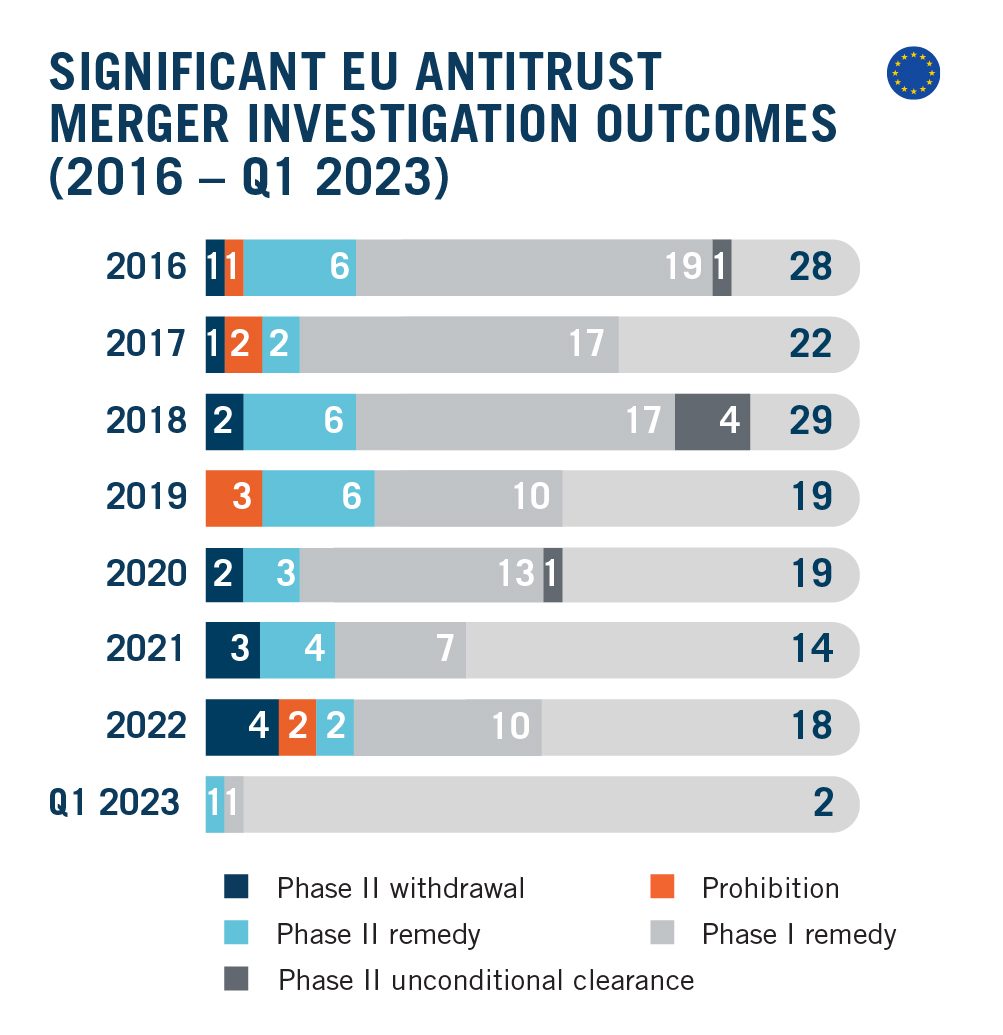

- With only two significant merger investigations concluded in Q1 2023, the EU Commission starts the year with 66 percent fewer significant investigations than in Q1 2022.

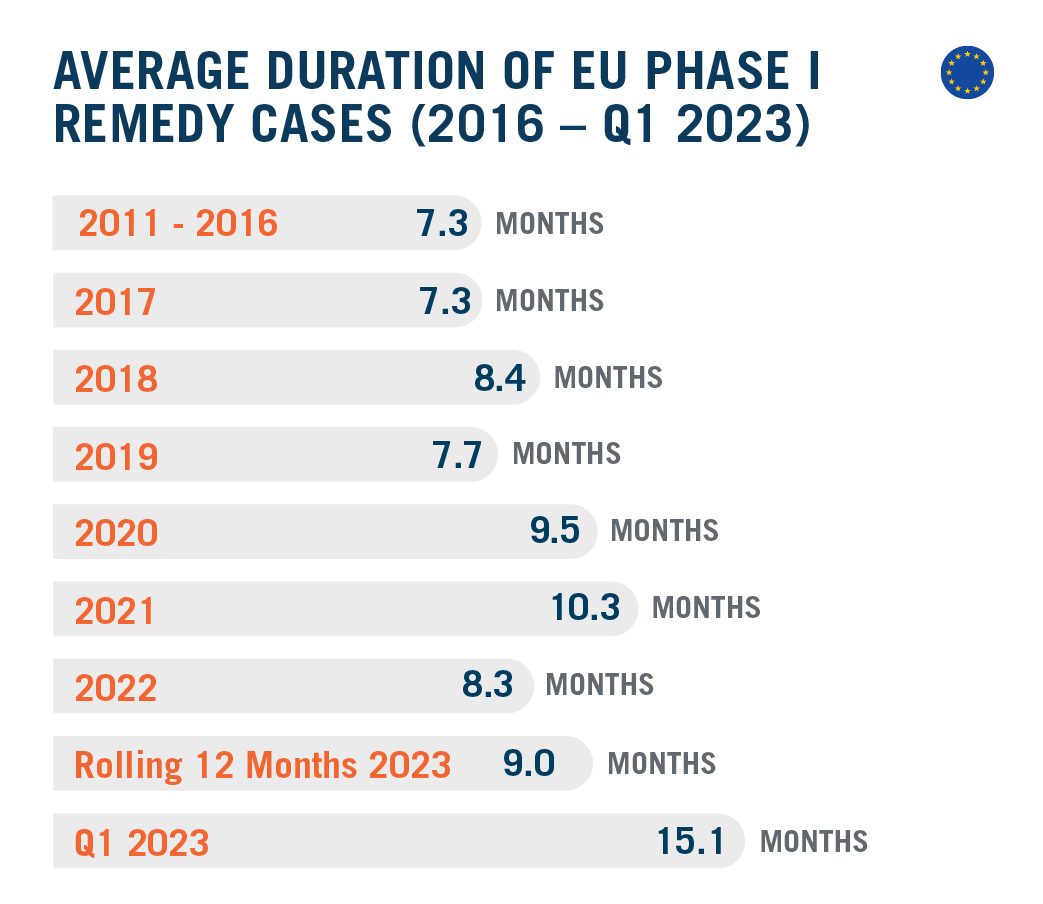

- Only one Phase I remedy case concluded in Q1 2023, indicating a move away from accepting remedies without an in-depth investigation. That case even had a longer duration than the sole Phase II case.

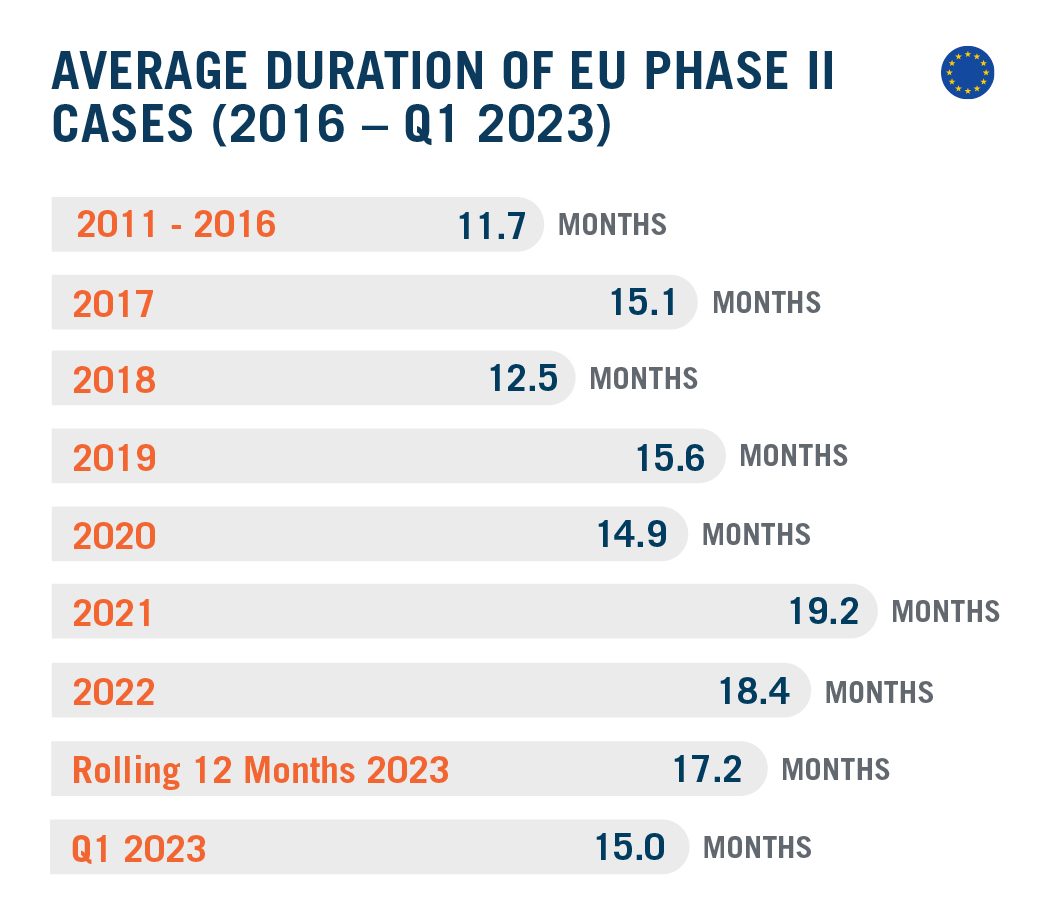

- The duration of Phase II investigations is likely to remains high, despite a few faster investigations. The average duration of Phase I remedy cases dipped slightly over the last 12 months, despite the outlier in Q1 2023.

The U.S. Agencies Again Avoid Settlements, but Conclude Remarkably Few Investigations Three Quarters in a Row

U.S. Agencies Remain Hostile to Merger Remedies

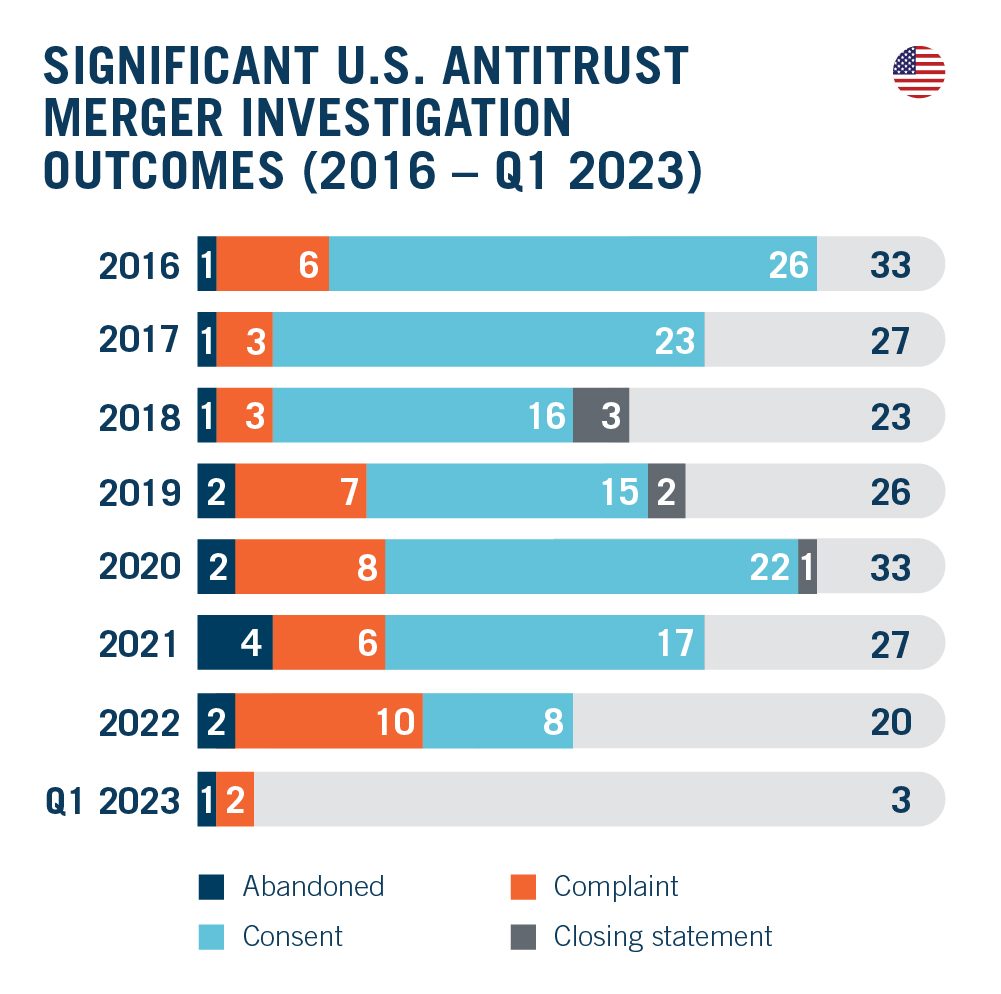

We have been consistently warning since our DAMITT 2021 Report that parties to transactions subject to significant merger investigations were more likely to see the FTC or DOJ sue to block their deal or push them to abandon it prior to being sued.

Indeed, as reported in our last DAMITT 2022 Report, a full 60 percent of investigations concluded in 2022 resulted in either a complaint or an abandoned transaction. And in Q3 2022, all concluded investigations resulted in either a complaint or an abandoned transaction. Q1 2023 confirms that this was not an anomaly; with one quarter down, neither agency has entered into a single consent in 2023.

The DOJ has not entered into a single settlement to resolve a significant investigation since DOJ Assistant Attorney General Jonathan Kanter began warning, shortly after taking office in November 2021, that investigations resolved with merger remedies should be the “exception, not the rule.” With this record, it is worth asking whether the exception even exists. If it does, we have not seen it.

As important, the anti-remedy contagion appears to have spread to the FTC. As the outgoing FTC Director of the Bureau of Competition warned in February 2023, “parties should expect the agency to be skeptical and risk averse when considering offers to settle in our merger investigations." The data from Q1 2023 suggests that the DOJ and FTC are increasingly on the same page in this area.

Number of Investigations Remains Low

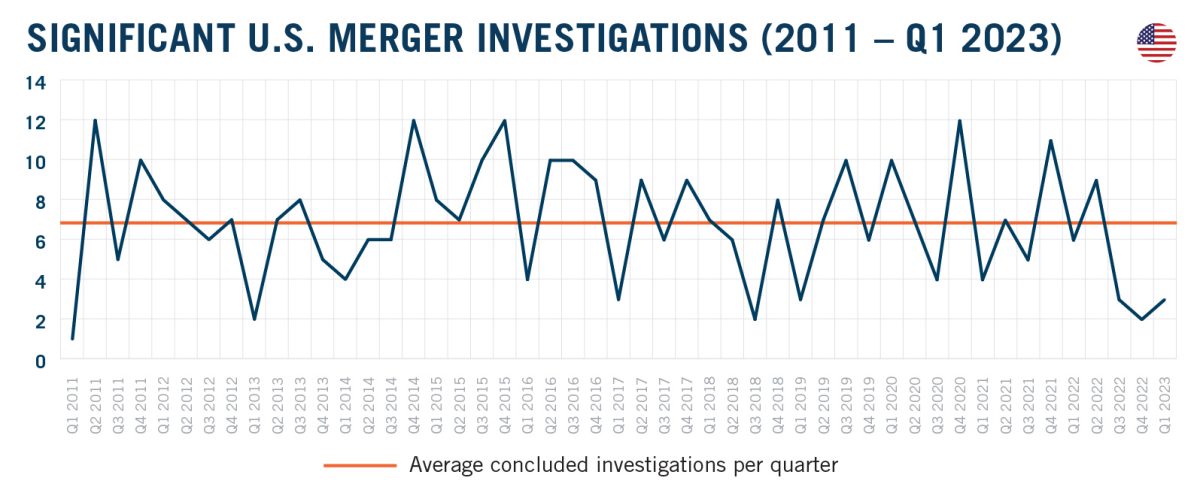

Of note, the antitrust agencies’ tough talk on merger settlements has not been matched by a particularly aggressive number of concluded investigations. To the contrary, the number of concluded investigations has been anemic, never rising above three over each of the last three quarters.

To put these numbers in context, the Trump administration concluded more significant merger investigations in Q1 2020 – the first quarter of its last year in office – than the Biden administration has concluded in the last three quarters combined. Q1 2020 saw one more complaint than Q1 2023 and six consent decrees imposing conditions on other proposed transactions.

Last month, DOJ Assistant Attorney General Jonathan Kanter cautioned that official releases do not reflect all investigations where deals were abandoned during pending investigations. While this may be true, the same applies for prior administrations. Moreover, it is equally true that official releases do not disclose transactions where the agencies could have sought an enforcement action – including merger remedies through consent decrees – but instead chose to pass. The publicly-available data suggest that is happening more than the agencies acknowledge, but it is difficult to further quantify the extent to which deals with potential concerns that previously may have been resolved by settlements may now be flying below the radar.

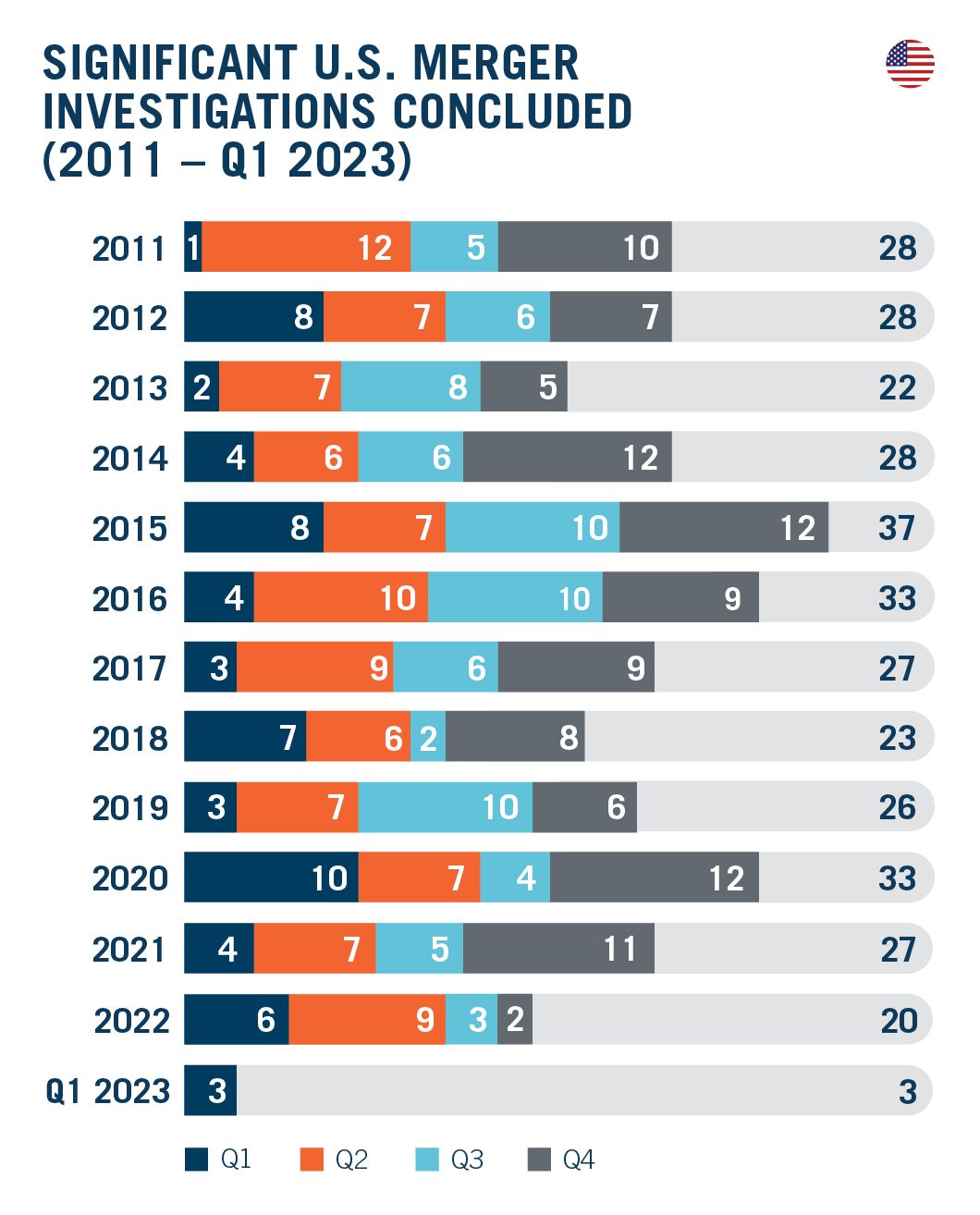

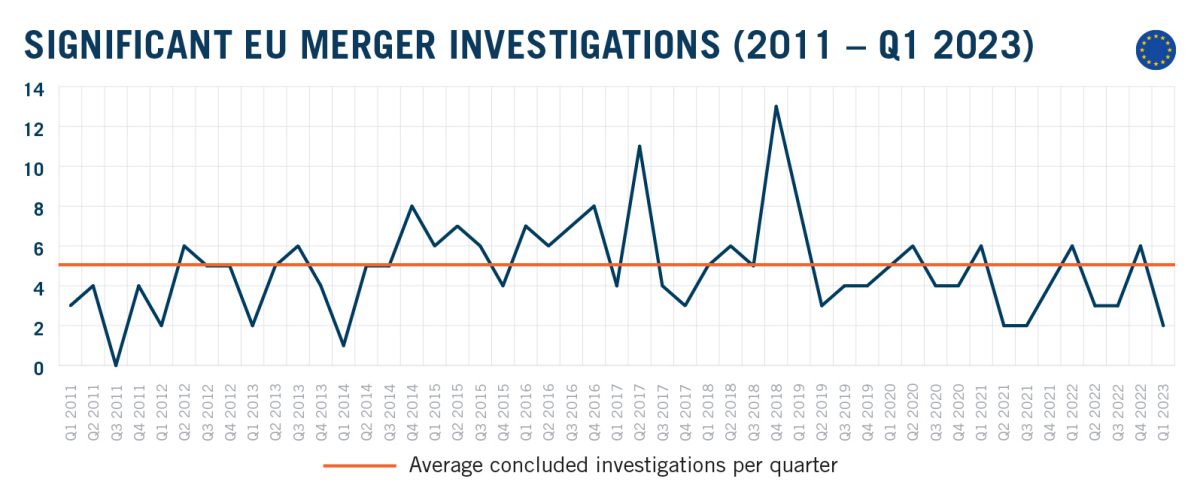

To put the data in perspective, we can map out the number of significant investigations by quarter, as shown below.

As this view demonstrates, quarters tend to balance each other out over time. Quarters that see fewer concluded significant merger investigations typically are followed by quarters with more activity. By contrast, the last three quarters show a very different trend. A doctor looking at a similar EKG readout might have some real concerns about the health of the patient.

Average Duration of Investigations Declines; Individual Durations

Show Higher Volatility

The publicly-observable duration of concluded significant merger investigations also is starting to look a bit erratic. In Q4 2022, for example, the average duration shot up to 15.4 months. The average duration in Q1 2023, by contrast, dropped down to nine months – within sight of lows last seen in 2016. Despite this variation between quarters, the average over longer periods appears stable. Over the last four quarters, the average was 11.0 months, which is slightly below the average for the last six years.

Keep in mind, of course, that these durations only measure the time from the deal announcement to a settlement, abandoned transaction, closing statement, or complaint. Parties also may need to plan for time to litigate to defend the transaction for investigations that could conclude with a complaint, which can add an extra 10 to 12 months.

And before getting too excited by dropping durations, we should bear in mind that the limited number of investigations concluded over the last three quarters has raised the significance of transactions that might be considered outliers that may be skewing the data.

Take, for example, the JetBlue/Spirit investigation, where DOJ filed a complaint less than eight months after the parties announced a definitive agreement. On April 6, 2022 – just over three months before the parties reached that agreement – the DOJ Principal Deputy Assistant Attorney General already had stated that DOJ may seek “faster access to courts” in some cases, explaining that “[t]here are some problems you can see from outer space.” Apparently, some problems can be seen from 30,000 feet as well.

For many reasons, the low duration for the JetBlue/Spirit investigation may be deceptive. While the parties only announced a definitive agreement in late July 2022, for example, JetBlue very publicly floated an offer to buy Spirit more than three months earlier. In an ironic twist, that JetBlue announcement was made on the same exact day that the DOJ Principal Deputy Assistant Attorney General warned that some problems could be seen from outer space. DOJ accordingly had plenty of advance notice to investigate JetBlue’s proposed transaction with Spirit. Moreover, DOJ also presumably needed less information from JetBlue because the Antitrust Division was already challenging JetBlue’s Northeast Alliance with American Airlines in federal court. The low duration of the JetBlue/Spirit investigation accordingly should be viewed as the exception, and not the rule.

At the same time, there appear to be more exceptions these days. A prime example is Booz Allen Hamilton/EverWatch, which was only publicly announced 3.5 months before DOJ filed its complaint to block the transaction. Of course, public filings indicate that this deal was notified several months before it was publicly announced – likely based on a letter of intent – such that the recorded duration may not tell the full story. But there is no denying that DOJ acted quickly to file a complaint in that matter, even as DOJ ultimately failed to obtain a preliminary injunction to block the transaction.

Rushing investigations, of course, can have consequences. The federal court overseeing DOJ’s Assa Abloy/Spectrum challenge, for example, recently criticized DOJ as follows: “I think that you all saw a problem a mile away, in your view, and instead of giving the defense an opportunity to fully explain to you the divestiture, to fully set out the divestiture, to find a buyer, to get this done, you all cut off the talks and initiated a lawsuit.” Because of that rush, the court explained that “I am beyond... unsympathetic to this idea that having created this situation, that having put everyone on a fast-moving train, the government now complains that it does not have enough time or that things are moving quickly.” On that basis, the court denied DOJ requests to move back the trial date and exclude newly-introduced evidence.

In oral arguments in that case, DOJ insisted that the Assa Abloy/Spectrum investigation was not rushed. Looking purely at averages, DOJ was correct; the Assa Abloy/Spectrum investigation had a duration above 12 months, which falls above the DAMITT average. But the court obviously viewed the DOJ’s investigation of the presented divestiture as rushed and held that against the agency.

Pace of Significant EU Mergers Investigations Slows Down Again, Raising Questions About Vitality of Phase I Remedy Process

Low number of Concluded Significant Investigations Points to Move Away from Phase I Remedies

If the total number of significant EU investigations concluded in 2022 seemed to indicate a rebound in enforcement activity across the Atlantic, Q1 2023 is a big step down. Only two significant investigations concluded in Q1 2023, falling 66 percent from the number of investigations concluded in Q1 2022.

Both EU investigations concluded with remedies – one in Phase I and the other after an in-depth investigation – so the low number of cases should not be mistaken for more leniency in enforcement.

Nine Phase II investigations are also currently pending with the EU Commission and, in three of those cases, the parties have already offered commitments. Time will tell whether these deals will be approved – with or without commitments – or whether a significant portion will be abandoned or prohibited, following trends consistently observed since our DAMITT 2021 Report.

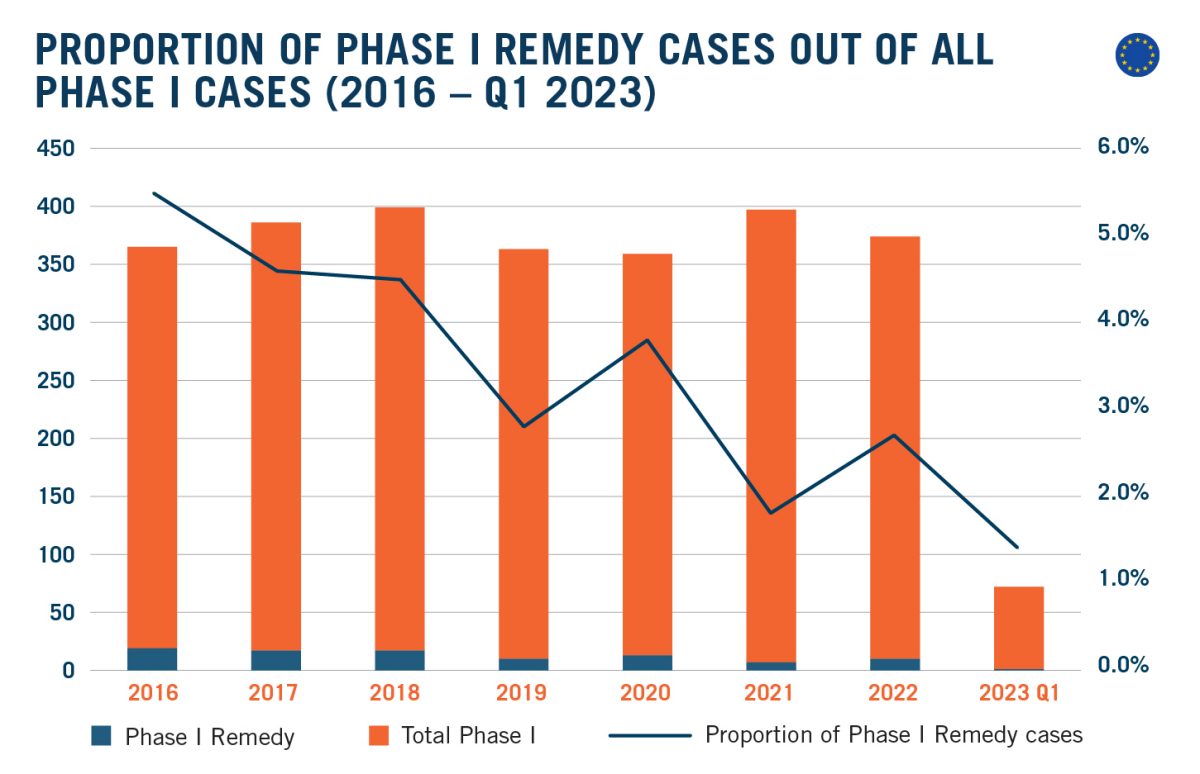

Q1 2023 data also confirms that remedies in Phase I may be a thing of the past. Breaking down the number of significant investigations between Phase I remedy and Phase II cases reveals that the drop in the number of investigations is entirely driven by a sharp decrease in cases cleared in Phase I with remedies, while the number of Phase II cases remains in line with previous years.

Looking more broadly at Phase I cases, data shows that 5.5 percent of Phase I cases were cleared with remedies in 2016, but this proportion has continuously decreased over the subsequent years to reach less than 2 percent in Q1 2023. This likely signals a reluctance from the EU Commission to accept remedies without having the time to fully assess whether they would sufficiently address identified concerns.

Finally, looking back at the number of significant investigations concluded by quarter since 2011, data show trends close to what is observed in the U.S.

Although significant merger investigations are by nature cyclical, the data unmistakably show a downward trend. Since 2019, the number of significant investigations concluded each quarter was more often below than above the quarterly average for the 2011-2022 period. To mirror the U.S. diagnosis, the EU patient is slowly flatlining, and doing so below usual averages.

Duration of EU Phase II Cases Remains Stable, While Average Duration of Phase I Remedy Cases Sees Slight Dip

With only one Phase I and one Phase II investigation this quarter, the quarterly “average” for Q1 2023 is not much of an average – and we would caution parties against overreliance on either figure.

In an astonishing reversal of the theoretical EU timeframe, for example, the only Phase I remedy investigation in Q1 2023 recorded a duration of 15.1 months – a period that managed to be slightly longer than the 15.0-month duration of the only Phase II investigation concluded the same quarter. So far, this lengthy investigation appears to be an outlier. Looking at the full rolling 12-month period ending Q1 2023, the duration of Phase I remedy cases remained close to nine months, which is nearly one month faster than the rolling 12-month average at the end of Q1 2022.

Just as the 15.1-month duration of the only Phase I investigation concluded in Q1 2023 falls significantly above the average for the last 12 months, the 15.0-month duration of the only Phase II investigation concluded in Q1 2023 falls notably below the average duration for Phase II investigations. The duration of in-depth Phase II investigations concluded over the last 12 months averaged at 17.2 months, which itself is nearly two months faster than the rolling 12-month average at the end of Q1 2022. However, if excluding the Kronospan/Pfleiderer Polska investigation that lasted an unusually short period of less than ten months, the average duration increases to 19.7 months, in line with the rolling 12-month average in Q1 2022. Duration of formal review of Phase II investigations concluded over the rolling 12-month period ending Q1 2023 averaged at 11.5 months, downgrading the so-called “fixed” EU timetable to a more indicative timeframe. As the Phase II investigations currently pending with the Commission have already clocked, on average, more than 17 months, we expect the average 2023 duration to remain at those higher levels.

Conclusion

Parties to transactions subject to significant merger investigations continue to face an elevated risk of seeing their deal blocked or abandoned on both sides of the Atlantic, even if the intervention rate shows relatively few deals may receive this level of scrutiny. To ensure the ability to defend their deals through a potential investigation, parties to the average “significant” deal in the U.S. should plan on at least 12 months for the agencies to investigate their transaction and may want to add on additional time to address the continuing uncertainty at the agencies. Parties should also plan for another nine to 10 months if they want to preserve their right to litigate an adverse agency decision. On the EU side, parties to transactions likely to proceed to Phase II investigations should allow for at least 20 months from announcement to clearance and should not rely on the theoretical deadlines provided for in the EU Merger Regulation, even after a deal has been formally notified. Parties should be aware that the EU Commission is less and less likely to accept remedies without an in-depth investigation; in any case, if parties still plan on obtaining a Phase I clearance with commitments, they should plan on around nine months from announcement to a decision, with significant time set aside for pre-notification talks with the Commission.