Using Corporate Structures to Own UK Residential Property - A Dead End?

Historically, UK resident non-domiciled individuals have been able to achieve certain tax advantages through holding interests in UK residential property through offshore companies. In recent years, the UK government has introduced a series of tax changes that have stripped away most, if not all, of the tax advantages previously enjoyed by corporates holding UK residential property. Examples include the introduction of the Annual Tax on Enveloped Dwellings (ATED), the extension of capital gains tax to non-UK residents making disposals of UK residential property and the 15% flat rate of stamp duty land tax (SDLT) for corporate purchasers. A further adverse change to inheritance tax for non-domiciled individuals using offshore corporate structures to own UK residential property will also soon be in force. As of 6 April 2017, the UK government will legislate to ensure that such arrangements will be ineffective for non-domiciled individuals in avoiding UK inheritance tax on the UK residential property, thus removing the last tax advantage of holding UK property through an offshore company.

In addition, from a non-tax perspective, the UK will likely introduce in the near future the need to disclose the beneficial owners of offshore companies which buy UK residential property where such ownership is not publically available. If introduced, this will mean that the benefit of anonymity will end which will effectively remove one of the last practical benefits of holding UK residential property via an offshore company.

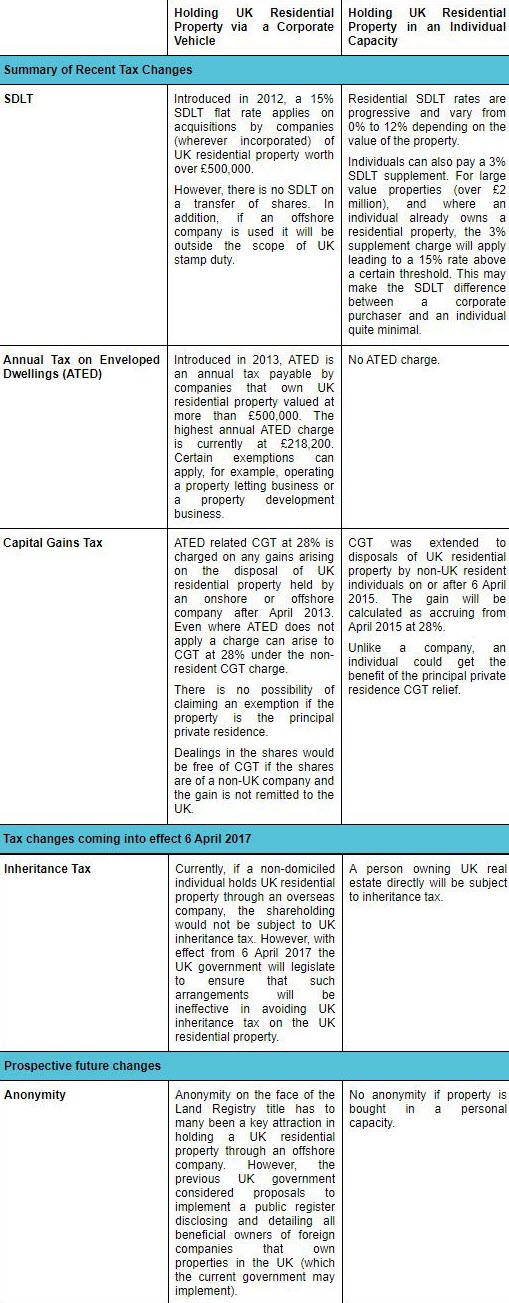

Following the recent and proposed changes there will generally be little advantage (and substantial potential cost) to holding UK residential property through a corporate structure, whether it be onshore or offshore. The table below briefly summarises the application of certain taxes to holding UK property directly in an individual capacity or indirectly through a corporate structure.

Dechert can assist in the reorganisation or restructuring of arrangements where ownership of UK residential property is currently held through a corporate vehicle to mitigate the effects of the recent and incoming tax changes (especially ATED and SDLT).