Securities class action litigation on the whole remained at a steady high in 2020, and life sciences companies were, once again, popular targets of such lawsuits.

In the most recent edition of our annual survey, we analyze and discuss trends identified in last year’s filings and decisions so that prudent life sciences companies can continue to take heed of the results.

How Many Class Action Securities Lawsuits Were Filed Against Life Sciences Companies Last Year?

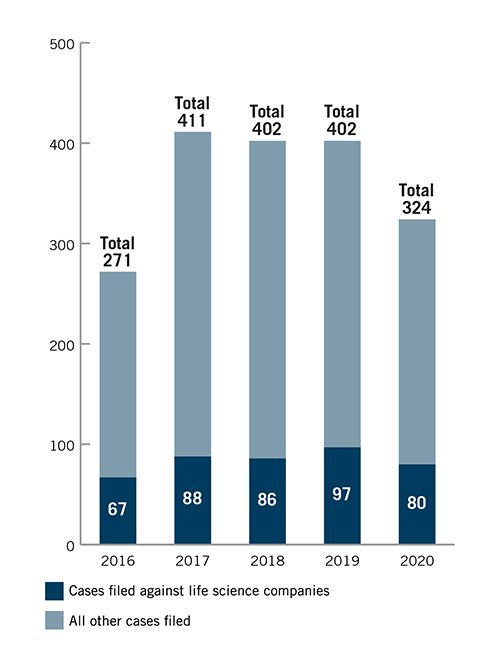

The number of securities fraud class action lawsuits in general has been increasing steadily since 2012, peaking in 2017 before reaching a plateau in 2018. Naturally, the coronavirus pandemic upended the recent trend: “only” 324 securities fraud class action lawsuits were filed in 2020. While this total pales in comparison to the number of suits filed per year from 2017 through 2019, it still marks the fifth-highest number of filings since 1996.

Although the overall number of securities lawsuits filed has decreased since last year, the proportion of such actions brought against life sciences companies has remained unchanged. Indeed, a total of 80 class action securities lawsuits were filed against life sciences companies in 2020—almost one out of four of all securities fraud class action lawsuits. This percentage is similar to 2019, where 97 out of 402 securities fraud class actions—24%—were filed against life sciences companies.

Despite the disruption in 2020, common patterns from previous years emerged once again, particularly relating to when and where suits were filed, and the claims involved.

Where Lawsuits Against Life Science Companies Were Filed

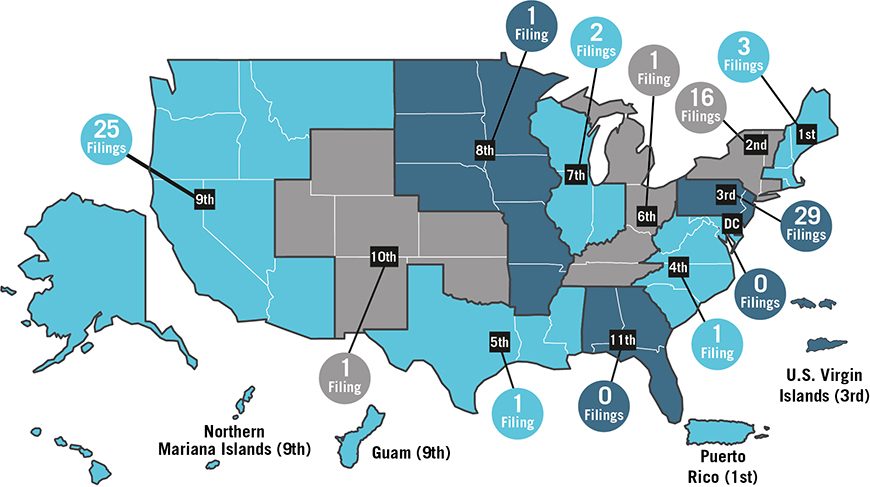

Consistent with historic trends, the majority of the 80 class action securities fraud suits brought against life sciences companies were again filed in courts in three federal circuits: the Third Circuit with 29; the Ninth Circuit with 25; and the Second Circuit with 16. There were some notable shifts: The Third Circuit saw a 27.5% decrease in complaints filed in its district courts. The Second Circuit saw a similar decrease of 36%. The Ninth Circuit witnessed a rise in numbers: 25 in 2020 as opposed to 13 in 2019.

In 2020, over half of all cases were brought in the federal district courts of two states. Unlike in 2019, California and Delaware accounted for the greatest number of filings.16 The Third Circuit, while accounting for the most filings against life sciences companies in 2020, also saw a shift in the distribution of filings among its federal district courts: Delaware with 21 (or 72.4%), New Jersey with four (13.8%), the Eastern District of Pennsylvania with three (or 10.3%), and the Western District of Pennsylvania with one (or 3.5%).

In 2020, these three firms were associated with about two thirds of filings against life sciences companies:

- Rigrodsky & Long, P.A.

- RM Law, P.C.

- Pomerantz LLP

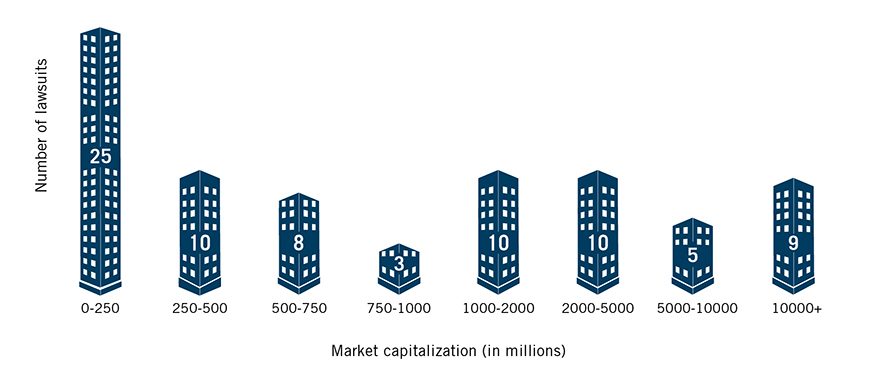

Breaking Down the Lawsuits By Market Capitalizations

Companies with market capitalizations of more than US$500 million continued to be popular targets of class action complaints filed against life sciences companies—with those against companies with market capitalizations more than US$1 billion accounting for about 42.5% of the total cases filed.

Previous Survey Results

See the results from some of our previous editions of the survey.