DAMITT Q1 2016 Update: Is the Use of Upfront Buyers Causing Longer Merger Investigations? Q1 2016 Update Confirms 2015 Trends

Fast Facts

- Significant merger investigations lasted 9.5 months on average over the 12 months ending Q1 2016, about 20% longer than observed over the prior 12 months.

- There were 33 significant merger investigations during the 12-month period ending Q1 2016, compared to 32 during the prior 12-month period.

- Increased use of upfront buyers may be partially responsible for the increase in duration. In 2015, consents requiring upfront buyers took 2.1 months longer than consents requiring post-order buyers.

The Trend of Longer Investigations Continues

Significant merger investigations lasted 9.5 months on average over the 12 months ending Q1 2016, about 20% longer than the 8.0 month average over the prior 12 months. The median length was 8.9 months through Q1 2016, compared to 7.6 months in the prior period. There are several potentially significant merger investigations in the pipeline that have been ongoing for more than 8 months and are likely to continue the trend of longer merger investigations.

Number of Significant Investigations Comparable to Prior Year

The number of significant investigations was relatively flat, with 33 concluding over the 12 months ending Q1 2016 compared to 32 in the prior period. There were only four significant merger investigations resolved during the Q1 2016 period. Since 2011, however, Q1 tends to have the fewest significant investigations reach a conclusion relative to the other three quarters. As noted above, there are also many second request investigations in the pipeline that we expect will be concluded by the end of 2016.

DAMITT, Why Are Merger Investigations Taking Longer? The Increased Use of Upfront Buyers

When an “upfront buyer” is required by the agencies, as has been the case with greater frequency in recent years, merger investigations take about two months longer than when post-order buyers are permitted. Upfront buyer consent orders require the merging parties to find an acceptable buyer and execute an acceptable purchase agreement for the divestiture assets before the agency will approve a merger. The process of finding an adequate buyer (or buyers), having the buyer(s) present their business plan and other information to the agency, and executing a purchase agreement that is acceptable to both the buyer(s) and the agency’s staff can be time consuming. By contrast, when an upfront buyer is not required, the divestiture consent order is issued and the merging parties are allowed to consummate their transaction without first identifying and presenting a particular buyer to the agency. The parties are then given a set period of time after the consent order is issued or after their merger is consummated to find a buyer acceptable to the agency and complete the divestitures.

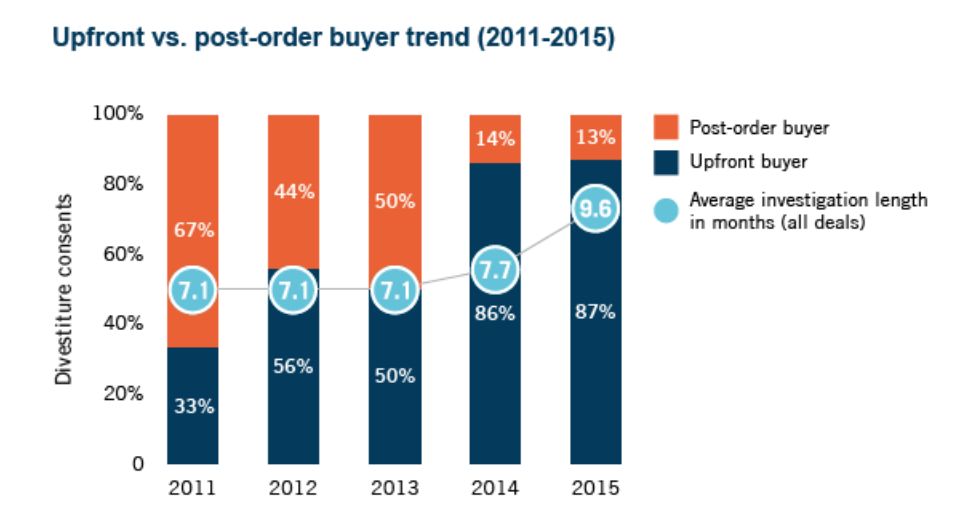

The agencies are making increased use of upfront buyers in consent orders. As shown in the chart below, the percentage of divestiture consent orders requiring upfront buyers rose from only 33% in 2011 to 87% in 2015. The investigations that ended with consents requiring upfront buyers lasted 2.1 months longer than consents requiring post-order buyers, which may be partially driving the increase in the duration of significant merger investigations observed by DAMITT since 2011.

Conclusion

DAMITT continues to observe a significant increase in the duration of significant merger investigations in the past year, with investigations lasting about 20% longer year-over-year at the end of Q1 2016. With many lengthy second requests in the pipeline this year and with the increased use of upfront buyers in consent orders, we do not expect any significant decreases in the duration of investigations during 2016.