DAMITT Q2 2017 Update: Fewer Significant US Antitrust Investigations but They Still Took Longer to Conclude

Fast Facts

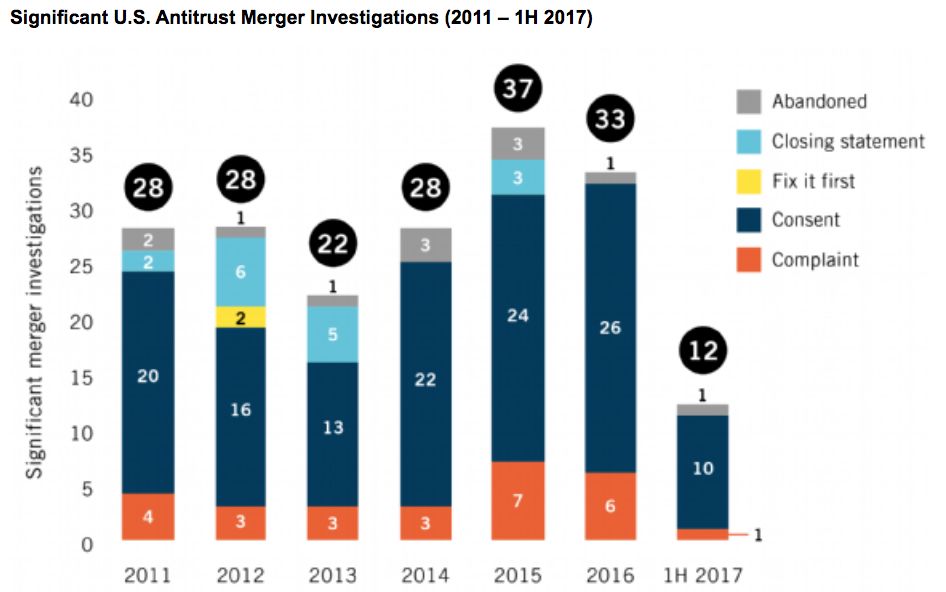

- The number of significant merger investigations was down slightly to 12 in 1H 2017 compared to 14 in 1H 2016, and 31 on a Rolling Twelve Months (RTM) basis compared to 36 during the prior period.

- The antitrust agencies filed four complaints over the RTM ending Q2 2017 compared to six during the prior period.

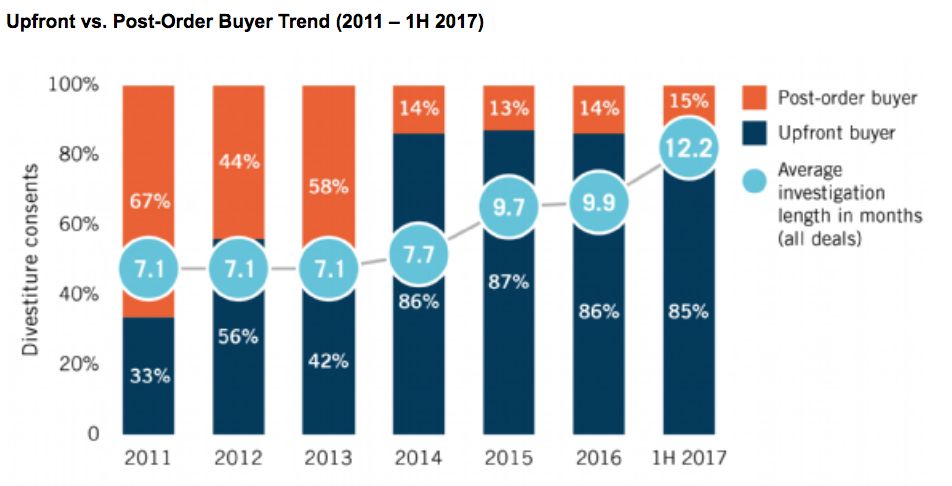

- Despite the reduced number of significant merger investigations, they continued to take longer on average—12.2 months in 1H 2017 compared to 9.5 months in 1H 2016, and 11.0 months on a RTM basis compared to 9.3 months during the prior period.

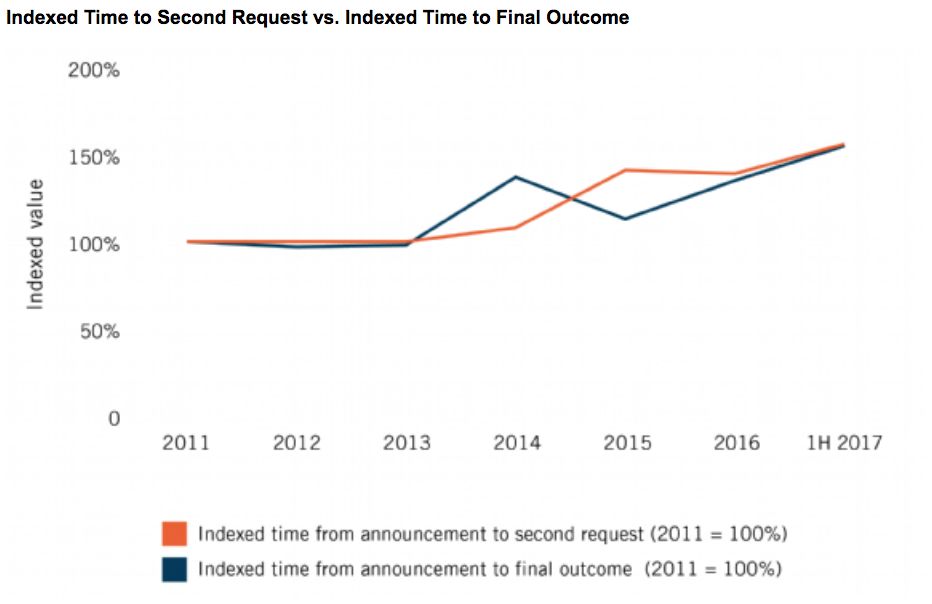

- Because merging parties either waited longer to file HSR or more of them pulled-and-refiled, the time period between deal announcement and the issuance of a second request increased by about one month between CY2011 and CY2017.

- The percentage of divestiture consent orders requiring upfront buyers held steady at 85% over the last 12 months, practically unchanged from CY2014 through CY2016.

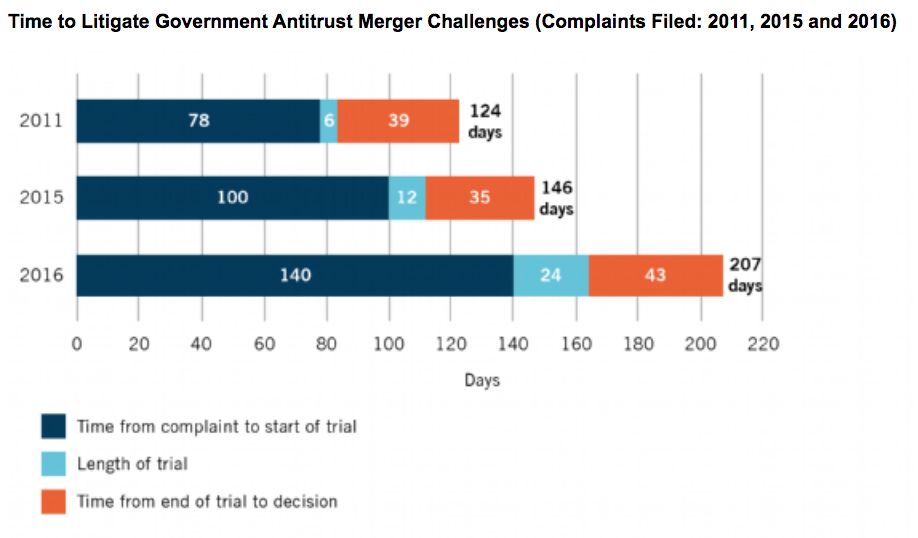

- Merger litigation cases filed in 2016 and litigated to a decision lasted nearly seven months on average—about two months longer than cases filed in 2015 and three months longer than those filed in 2011.

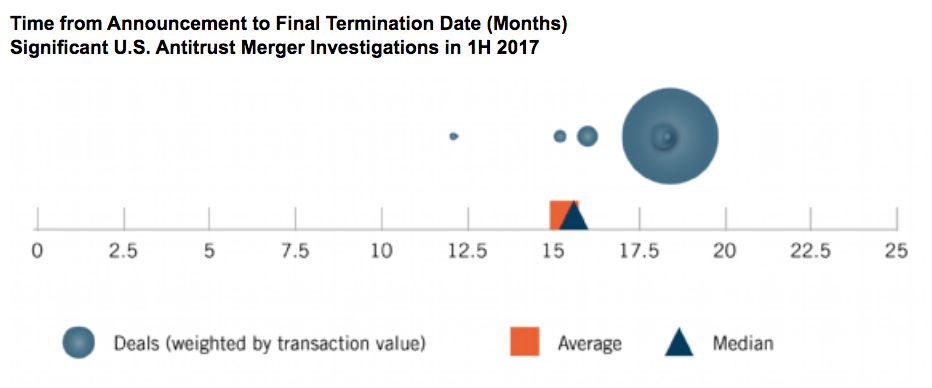

- Companies continue to respond to the longer duration of significant merger investigations and litigations by allotting more time in transaction agreements for antitrust review—about 15.3 months on average in 1H 2017.

Numbers of Both Significant Investigations and Filed Complaints Were Down

According to the Dechert Antitrust Merger Investigation Timing Tracker (DAMITT), through the first half of 2017, the number of significant U.S. merger investigations concluded by the Department of Justice (DOJ) and Federal Trade Commission (FTC) declined. “Significant” merger investigations include Hart-Scott-Rodino (HSR) Act reportable transactions resulting in a closing statement, consent order, complaint challenging a transaction, or transaction abandonment for which the antitrust agency issues a press release. All of the significant investigations coming to a close in the first half of 2017 involved deals that were announced during President Obama’s tenure but concluded after President Trump’s inauguration.

There were 12 significant investigations that concluded in the first half of 2017, down from 14 in the first half of 2016. Over the 12 months ending Q2 2017, there were 31 significant investigations, down from 36 in the prior 12-month period. Likewise, the number of significant merger investigations resulting in a complaint seeking to block the transaction fell to four over the 12 months ending Q2 2017 compared to six complaints in the prior 12-month period.

But Trend Toward Longer Significant Merger Investigations Continued

Despite the slight decline in the number of significant merger investigations, those concluded during the first half of 2017 still took longer than ever -- an average of 12.2 months, roughly 2.7 months longer than the 9.5 month average during the first half of 2016. For the 12 months ending Q2 2017, the average duration was 11.0 months, as compared to the 9.3 month average over the prior 12 months.

The cause of this spike remains unclear but agency workload may be a significant factor. As reported by Thomson Reuters, the number of both announced and completed transactions involving U.S. targets also spiked in 1H 2017 relative to 1H 2016, albeit at a slightly lower rate than the increase in the average duration of significant merger investigations.

New DAMITT Data and Analysis Indicate It Took Longer to Get to the Issuance of a Second Request

Officials at the antitrust agencies have suggested that merging parties are waiting longer to make their pre-merger HSR filing or are more frequently using the one-time-only pull-and-refile procedure. This suggestion is supported by new DAMITT data and analysis. But it is unclear from the data whether this phenomenon is a symptom or a cause of the trend toward longer investigations.

Based on publicly available data for about 60% of the significant merger investigations comprising the DAMITT database, the average time between deal announcement and the issuance of second requests has increased almost a month from about 51 days in CY2011 to 76 days in 1H 2017, and rose more sharply in 2016 and 2017 than in prior years. When indexed to 2011 levels, the duration of the pre-second request period and the duration of the total investigation appear to follow very similar trends.

Merging parties often delay filing or pull and refile in the hope that the additional time up front will enable the staff to streamline and shorten the investigation. If that was the reasoning in the deals tracked by DAMITT, the strategy was a failure because investigations have continued to take longer. Alternatively, the extension of time earlier in the process may reflect a concession to the reality of the longer investigation process or it may constitute a response to increased staff requests that parties pull and refile. Regardless of the explanation, parties allocating more time prior to the issuance of a second request do not necessarily face longer – or shorter – overall investigations than parties that allocate less time pre-second request.

Percentage of Divesture Consents Requiring Upfront Buyers Remained Steady

The agencies’ consent orders continued to reflect a high frequency of upfront buyer requirements. The percentage of divestiture consent orders requiring upfront buyers was 85% in the 12 months ending Q2 2017, practically unchanged compared to CY2014 through CY2016, but up sharply from 43% over the CY2011 through CY2013 period when post-order buyer consents were more common.

When an upfront buyer is required, before the merging parties can consummate their transaction, they must find a willing and able buyer, negotiate a purchase agreement with that buyer for the divested assets, and present that purchase agreement, the buyer’s business plan, and other information to the agency as part of the approval process. This process can add significant time to the investigation. In CY2016, investigations ending with consents requiring upfront buyers lasted about two months longer than those with consents permitting the merging parties to find and negotiate with divestiture buyers after consummating their transaction.

Final Data for Complaints Filed in 2016 Confirm Antitrust Merger Litigation Also Took Longer

In addition to investigations taking longer, antitrust merger litigation cases filed in 2016 also took longer than cases filed in previous years. Three significant investigations resulted in complaints being filed in 2016 that were litigated to a final court decision. Because these cases were in progress at the time of DAMITT’s previous reports, DAMITT relied on litigation scheduling orders to estimate the likely length of these litigations. Now that all three of the 2016 complaints have been litigated to a decision, the final DAMITT data confirm that merger litigation continues to lengthen the time to closing for antitrust-sensitive transactions. Overall, the 2016 cases have lasted about two months longer than the 2015 cases and about three months longer than the 2011 cases. The average time between the complaint and the first day of trial for the cases filed in 2016 was 140 days, and the average trial length was 24 days. By comparison, cases filed in 2015 took an average of 100 days to get to trial and an average of 12 days to try the case, both figures representing sharp increases from the last batch of HSR-reportable, litigated merger cases, which were filed in 2011. Thus, merging parties considering litigation options in a transaction agreement need to consider the increasing length of litigation in addition to the increasing length of merger investigations.

Companies Continued to Respond to Increased Investigation and Litigation Durations with More Extended Termination Dates

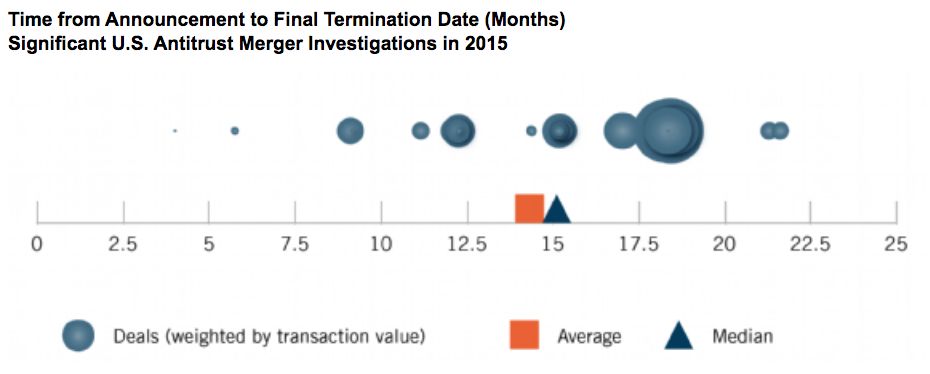

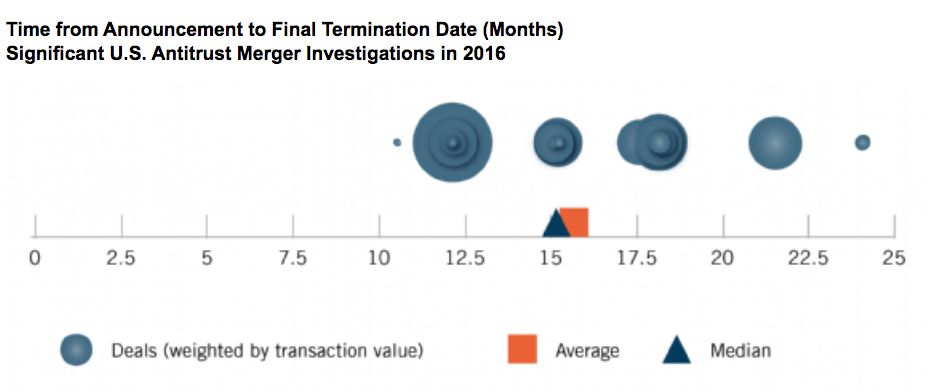

DAMITT’s analysis of publicly available transaction agreements for deals involved in significant merger investigations shows that merging parties continue to allot more time for antitrust investigations. The average time period from deal announcement to the final termination date in transaction agreements among parties involved in significant merger investigations was 15.3 months in 1H 2017, on par with the 2016 average of 15.7 months, but up slightly from the 14.3 month average in 2015. These trends suggest that companies are adjusting the termination periods in their transaction agreements in response to the increased duration of significant merger investigations and litigations.

Conclusion

Although merger enforcement has declined slightly over the past year, the duration of significant merger investigations and subsequent litigation continues to trend upward to record levels. While the circumstances of future antitrust-sensitive transactions may lead to results above or below DAMITT averages, the latest trends suggest that parties to the hypothetical average deal would have to plan on approximately 12 months for the agencies to investigate a transaction and another seven months if they want to preserve their right to litigate an adverse agency decision. Perhaps, if the current trends toward longer investigations and litigations continue, even more time may need to be allotted going forward.