DAMITT 2018 Year in Review: No Trump Effect Yet, But Some EU Durations Decrease; Brexit Looms with Potentially Significant Implications

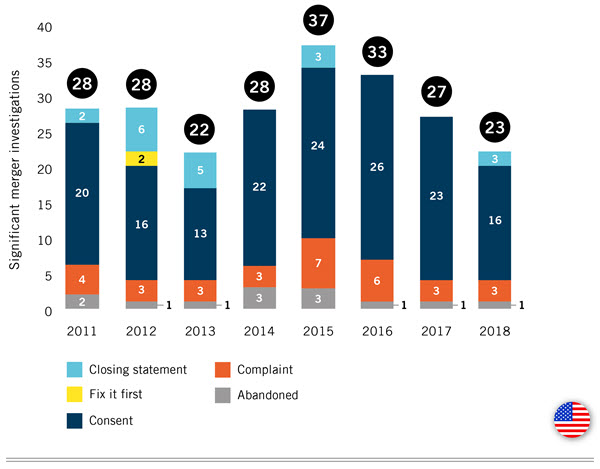

- In the U.S., the number of significant antitrust merger investigations in 2018 reached a near-record low over DAMITT’s eight years of data, while their average duration remained near the record high.

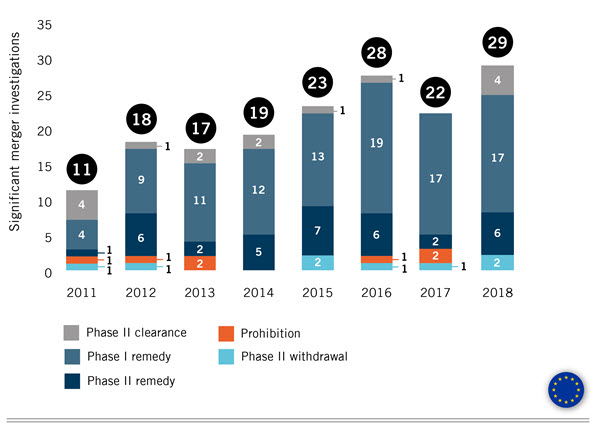

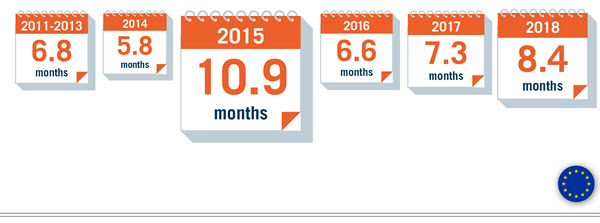

- In the EU, the number of significant investigations reached a DAMITT record high while duration results were mixed in 2018: cases proceeding to Phase II were nearly 20% faster and Phase I remedy cases were about 15% slower compared to 2017.

- Twelve of the 29 significant EU merger investigations involved Phase II proceedings, a new DAMITT record that exceeded the eight-year average by 48%. Also, four EU Phase II investigations were resolved with unconditional clearances accounting for 40% of Phase II decisions adopted by the Commission, which was twice the historical DAMITT average.

- New DAMITT data show that the number of significant U.S. investigations with vertical aspects has increased in the last three years and that investigations of these deals tend to take longer than purely horizontal significant investigations.

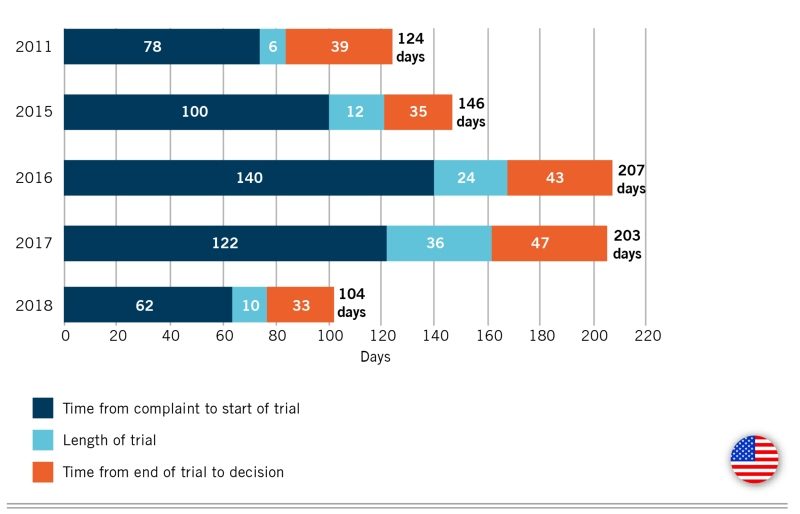

- U.S. merger litigations filed in 2018 were completed in a DAMITT record low of 105 days on average, although signs point to litigation timelines returning to the more than 200-day averages observed in 2016 and 2017.

- Look for potentially significant DAMITT trend reversals in 2019, with the U.S. antitrust agencies trying to implement reforms to the merger review process (after citing DAMITT data in recognizing the need for reform).

- But the current partial government shutdown in the U.S. may lead to short term distortions, while Brexit may add generally to the burden of European clearance processes.

Antitrust trends in the United States and European Union diverged in 2018. The United States saw its second-fewest number of significant antitrust merger investigations over DAMITT’s eight-year history with only 23 concluding in 2018, nearly matching the record low of 22 set in 2013. The EU, meanwhile, finished with 29 significant investigations concluding in 2018, the highest in DAMITT’s eight-year history. The average duration of significant U.S. investigations from deal announcement to agency action clocked in at 10.5 months in 2018, nearly matching the 10.8-month record high set in 2017. After positive signs earlier in 2018 that the Trump administration was completing significant investigations more quickly, this trend failed to fully materialize in 2018, although recently implemented reforms could cause a turnaround in 2019 (at least post-shutdown). Duration results in the EU were more mixed, with significant investigations proceeding to Phase II averaging 12.5 months (down nearly 20% from the record 15.1-month average in 2017) but Phase I remedy cases averaged 8.4 months (up about 15% from the 7.3-month average in 2017).

With the recent attention focused on vertical merger concerns in deals such as CVS Health/Aetna, AT&T/Time Warner, and Bayer/Monsanto, DAMITT for the first time has begun isolating trends for significant investigations having vertical aspects. DAMITT found that there have been 14 significant U.S. merger investigations with vertical aspects over the past three years (2016-2018), a 250% increase from the four significant investigations in the three prior years (2013-2015). On average, over the eight years tracked by DAMITT, significant U.S. investigations involving vertical aspects last two months longer than those without vertical aspects, possibly due to the greater complexity of the analysis.

Looking forward, 2019 could be a year of changes in these antitrust merger trends. Citing DAMITT findings, the U.S. antitrust agencies announced encouraging merger review process reforms late in 2018 and had begun implementing them prior to the partial government shutdown. DAMITT will track whether these reforms prove successful in speeding up merger reviews that conclude in 2019.

In Europe, a no-deal Brexit could increase the U.K. Competition and Markets Authority’s workload significantly, creating possible delays and uncertainties in merger reviews. For cross-border deals that trigger UK and EU filings, the UK’s longer fixed statutory timetable could create inconsistencies between durations of the EU and UK reviews. The business community should plan accordingly for these contingencies in transaction agreements.

Lowest Number of Significant U.S. Merger Investigations Since 2013

The number of significant U.S. investigations was the second-lowest in DAMITT’s eight-year history. There were 23 significant U.S. merger investigations concluded during 2018 by the Department of Justice (DOJ) and Federal Trade Commission (FTC). Only 2013 - with 22 significant U.S. investigations - had fewer.

“Significant U.S. merger investigations” include investigations of proposed Hart-Scott-Rodino (HSR)-reportable transactions that result in a closing statement, consent order, complaint challenging a transaction, or transaction abandonment for which the antitrust agency issues a press release during the year in question.

Since reaching a peak in 2015 of 37 significant U.S. investigations, the number of significant U.S. investigations has steadily declined. Overall, the Trump Administration has averaged 25 significant investigations over the past two years, down slightly from the average of 29 during the six years (2011-2016) for which DAMITT tracked the data under the Obama Administration. This decrease under the Trump Administration does not necessarily reflect a decline in enforcement or aggressiveness by the agencies, but instead could be the result of fewer antitrust-sensitive deals due to a general decline in deal volume, or a trailing consequence of higher enforcement activity in recent years.

Closing statements made a comeback in 2018, providing increased transparency to the antitrust bar and business community. After no significant U.S. investigations resulted in a closing statement in the prior two years, three were issued in 2018.

Significant U.S. Antitrust Merger Investigation Outcomes (2011 – 2018)

The Number of Significant EU Investigations in 2018 Sets New DAMITT Record High

The number of significant EU antitrust merger investigations concluded during 2018 was 29, growing nearly 30% from 2017 to set the record for the busiest year in DAMITT’s eight-year history. This record high in the EU stands in stark contrast to the near-record low for significant investigations in the United States.

In view of the procedural differences between the EU and the United States, DAMITT defines “significant” EU merger investigations to include transactions subject to the EU Merger Regulation and resulting in either Phase I remedies or the initiation of a Phase II investigation.

Of the 29 significant EU merger investigations, 12 involved Phase II proceedings, a new DAMITT record that exceeded the eight-year average by 48%. Unlike in 2017, which saw the Commission issue two prohibition decisions, no transactions were blocked in 2018 as a result of Phase II investigations, although two filings were withdrawn following EU objections.

Four of the 2018 Phase II cases were cleared without remedies (i.e., unconditional clearances), which was twice the historical average according to the Commission’s statistics. The rise in the number of unconditional clearances, which accounted for a third of Phase II resolutions, has contributed to a corresponding decrease in the average duration of Phase II investigations.

In 2018, 17 of the 29 significant merger investigations were resolved in Phase I with remedies, matching 2017 and well above the eight-year average of 12.8 per year.

The increase in significant EU merger investigations may reflect the fact that 2018 was the busiest year on record since the EU Merger Regulation came into force in 1990. There were 414 EU notifications, an increase of 8.2% from the previous year’s total of 380. 302 of these mergers were notified under the short form/simplified procedure, which represents 73% of the cases reviewed by the Commission. The average duration of the Commission’s review of those short-form cases, measured from notification to decision, was 18.5 working days. This is considerably below the maximum Phase I review period of 25 working days. The revised simplified procedure has been one of the most successful features of the 2013 overhaul of the EU merger control regime, resulting in a significant reduction in the time it takes the Commission to review cases that give rise to no substantive issues.

Significant EU Antitrust Merger Investigation Outcomes (2011 - 2018)

No “Trump Effect” Yet as Duration of Significant U.S. Merger Investigations in 2018 Nearly Unchanged

After early indications that the Trump Administration was on track to significantly reduce the average duration of significant U.S. merger investigations in 2018, the final result was more muted. Significant U.S. investigations in 2018 averaged 10.5 months from deal announcement to the date of the antitrust agency’s action, which was down slightly from the 10.8-month average in 2017 but still above the 9.9-month average in 2016 - President Obama’s final full year in office.

The median for 2018 was 9.3 months, up slightly from the 9.1-month median in 2017 but below the 9.7-month median in 2016. The gap between the average and median in both 2017 and 2018 is larger than in prior years, suggesting that more mergers on the high-end of the spectrum (e.g., Bayer/Monsanto at more than 24 months and Praxair/Linde at nearly 17 months) are pushing the average higher even though the median has held steady between 9-10 months for four years in a row. But these medians in the 9-10 month range still significantly exceed the 7.0-month median observed in 2011, 2012, and 2013.

Citing DAMITT findings, the U.S. antitrust agencies announced planned reforms to the merger review process. Because these reforms were announced late in 2018, their impact likely will not be reflected until 2019 and following the end of the partial U.S. government shutdown.

Average Duration of Significant U.S. Antitrust Merger Investigations (2011 – 2018)

Significant U.S. Investigations with Vertical Concerns Increasing in Frequency and Taking Longer than Deals Without Vertical Aspects

Vertical antitrust merger theories have received increased public attention in recent years. With deals such as the $70 billion CVS Health/Aetna, $85 billion AT&T/Time Warner, and $66 billion Bayer/Monsanto mergers grabbing headlines in 2018, the business and antitrust communities have sought greater clarity on vertical merger analysis. Perhaps in response, top officials from the antitrust agencies gave speeches in 2018 dedicated to these vertical issues; the U.S. antitrust agencies contemplated issuing new vertical merger guidelines to address uncertainties; and the FTC held hearings to explore what this vertical analysis might look like.

Data for the United States show an uptick in significant vertical investigations that is consistent with this increased public attention. Over the past three years (2016-2018), there were 14 significant investigations with vertical aspects (i.e., those with at least one vertical allegation identified in the complaint, one vertical remedy included in the consent decree, or one vertical issue mentioned in the closing statement), up 250% from only four over the prior three years (2013-2015).

Over the eight years tracked by DAMITT, significant U.S. investigations with vertical aspects lasted two months longer on average than those without vertical aspects. This result could be driven by the fact that vertical analyses are not as straightforward as pure horizontal analyses. Economic modeling of vertical issues can also be more complex than that required for horizontal mergers.

The Duration of Significant EU Investigations Going to Phase II Decreased Nearly 20% in 2018, While the Duration of Phase I Remedy Cases Increased 15%

EU investigations in 2018 that went to Phase II lasted on average 12.5 months from announcement to resolution, double the theoretical duration of the fixed timetable under the EU Merger Regulation but a sharp decrease from 2017’s record high year over the eight-year period tracked by DAMITT. Phase I remedy cases lasted an average of 8.4 months, nearly 10% higher than the 2011-2018 average and more than five times the theoretical period under EU Merger Regulation. The difference between the statutory timetable and actual review period is in part attributable to companies engaging in extensive pre-filing talks with Directorate-General for Competition (DG Competition) staff over the scope and detail of the parties’ filings, and the ever-growing use of timetable extensions in Phase II.

Phase II Proceedings

In 2018, the average duration of EU proceedings that were resolved in Phase II dropped to 12.5 months from an average of 15.1 months in 2017. The 17.3% decline in this average duration is the sharpest decrease recorded in DAMITT’s eight-year history.

This significant drop is in part attributable to the reduction in the average time between the announcement and the notification of transactions. In 2018, the average time that elapsed between announcement and notification of transactions was 5.8 months, down from the 8.3-month record high recorded in 2017 and bucking the trend of year-on-year increases. Despite this decrease, the average remains well above the 2011 low of 3.2 months from announcement to notification. Merging parties invariably institute pre-filing talks with DG Competition staff very shortly after transaction announcement, if not before, and the recent growth of the period between announcement and notification is mostly explained by the intensity of staff demands for the inclusion of data and internal documents in the filing before the formal timetable is triggered. In contrast, the time between notification and the resolutions of investigations remains unchanged from the previous year with an average of 6.7 months.

Another key factor accounting for the drop in the average duration of Phase II investigations is the number of unconditional clearances decisions adopted in 2018. Unconditional clearances went from representing only about 20% of Phase II decisions adopted by the Commission from 2013-2017 to 40% in 2018. Phase II investigations resulting in unconditional clearances in 2018 took an average of 11.1 months, whereas Phase II transactions that were cleared with remedies (conditional clearances) took an average of 14.6 months - more than 30% longer. This difference in the average duration is further reflected in both a decrease of the average duration of pre-filing discussions - 4.7 months for transactions resulting in unconditional clearances compared to an average of 6.9 months for transactions that were conditionally cleared - and a decrease of the formal review period with unconditional clearances taking an average of 6.4 months, compared to 7.7 months for transactions resulting in conditional clearances.

Notably, 2 of the 4 unconditional clearance decisions - Essilor/Luxottica and Apple/Shazam - mainly gave rise to vertical or conglomerate issues. Qualcomm/NXP, which was cleared in Phase II subject to behavioral remedies, was also a primarily non-horizontal merger. This observation could be interpreted as a sign that the Commission, like its counterparts in the United States, is paying closer attention to vertical and conglomerate mergers. But in two of these cases, at least, the Commission determined that they were not problematic, albeit after extended consideration.

All but one Phase II investigations entailed the use of “voluntary” extensions of time under Article 10(3) of the EU Merger Regulation. These Article 10(3) extensions are common practice, occurring in 86% of all Phase II investigations during the 2011-18 period analyzed by DAMITT and on average adding approximately 0.8 months. These extensions may be at the behest of the parties (for example to create space for a remedy discussion), but they are often conceded at the instigation of staff. The maximum duration permitted for “voluntary” extensions is 20 working days (0.9 months).

In addition to the extensive use of voluntary extensions of time, the Commission used its powers under Article 10(4) of the EU Merger Regulation to “stop the clock” in 50% of 2018 Phase II investigations, adding an average of 1.3 months to each affected investigation. Excluding Qualcomm/NXP, which was an outlier suspended for an exceptional period of 4.4 months, would bring the average time added to the remaining 11 investigations down to 0.7 months. The proportion of investigations that were hit with “stop the clock” orders in 2018 remains below the all-time high of 71% recorded in 2014, but there has been a steady increase in the Commission’s use of this procedural tool in the last three years (from 33% in 2016 to 40% in 2017 to 50% in 2018).

Average Duration from Announcement to End of EU Phase II Cases (2011 – 2018)

Phase I Cases

The average duration of Phase I cases resolved with remedies was 8.4 months, an approximately 15% increase from the 7.3-month average in 2017 but about 10% higher than the 7.5-month average over the 2011-2018 period tracked by DAMITT. This increase in 2018 is in part attributable to the increase in the duration of pre-filing talks, which is reflected in the period from announcement to the notification of transactions going up more than 20% from 5.5 months in 2017 to 6.6 months in 2018.

The increase in the average duration of Phase I cases is further explained in part by the decision of parties to pull-and-refile in at least two cases - Knauf/Armstrong and Quaker/Global Houghton. Both notifications were withdrawn approximately one month into the review, with one transaction re-notified approximately 3 months later, while the other transaction was re-notified after a delay of approximately 7 months. In total, from announcement to decision, Knauf/Armstrong and Quaker/Global Houghton were resolved in 12.7 and 20.5 months, respectively. “Pull and refile” is not a familiar device in the EU, by way of contrast to U.S. practice. The reason for its use in these two cases is unclear. Excluding these two transactions would bring the average duration down to 7.3 months, which is slightly below the 2011-2018 average.

Average Duration from Announcement to End of EU Phase I Remedy Cases (2011 – 2018)

A No-Deal Brexit Could Significantly Impact the Merger Review Process and Complexity of Cross-Border Deals in Europe

The effect of the UK’s impending exit from the EU remains a matter of speculation but there could be a significant impact on merger review filings and timing in Europe.

In the event the UK Government is able to get the Withdrawal Agreement (or a similar agreement) signed into law, the UK competition regime will remain tethered to the EU during the implementation and transition period until at least the end of 2020. During that period, the EU Merger Regulation will continue to apply and the Commission will have exclusive jurisdiction over transactions that meet the EU jurisdictional thresholds under the one-stop shop principle. This outcome would delay any impact until at least 2021, allowing for better merger planning.

However, in the event of a no-deal Brexit, which remains a possibility amid the political turmoil, the UK will at once become a significant new standalone jurisdiction. According to the UK Competition and Markets Authority’s own estimates, Brexit could increase the merger control caseload of the UK’s Competition and Markets Authority (CMA) by 50% or more. Despite recent recruitment drives and an increase in funding, the prospect of this sudden increase in workload is a real challenge. Conversely, there will likely be a slight reduction in the number of cases that qualify for review under the EU Merger Regulation since revenues generated in the UK will no longer count towards the EU jurisdictional thresholds. But this is likely to be a slight reduction only, since many of the cases triggering UK review will still need EU filing. And it is true of course that cases taken out of EU review will then be likely to trigger national filings at the member state level.

For cross-border transactions that trigger multiple filings including the EU and the UK, in addition to the increased administrative burden, there is a risk that companies may encounter difficulties where they are seeking to coordinate the various review timelines. This risk is particularly higher in cases that require remedies. In this regard, U.S. merger control practice provides for a somewhat flexible review period, which allows some scope for coordinating the timing of EU-US merger reviews. In contrast, the UK operates under a theoretically fixed statutory timetable, which is not aligned with the EU timetable, and has a remedies process that is entirely separate from the substantive review.

The most immediate challenge of a no-deal rupture concerns transactions under DG Competition review at the moment of Brexit. It appears that these deals will become subject to UK review, in addition to the ongoing EU examination.

Given these contingencies and uncertainty, companies should plan accordingly by negotiating appropriate flexibility in their transaction agreements.

2018 U.S. Merger Trials Completed Faster than Prior Years

U.S. merger litigations brought in 2018 were completed significantly more quickly than in prior years. The FTC’s 2018 preliminary injunction litigations blocking both the Tronox/Cristal and Wilhelmsen/Drew Marine transactions averaged only 104 days from the filing of the complaint to the judge’s decision, significantly more rapid than the 207-day average for 2016 and the 203-day average for 2017.

The shorter duration was primarily driven by the Tronox litigation, which had a unique procedural posture, and may not be representative of future durations. Typically, the FTC files complaints in administrative and district court proceedings nearly simultaneously. In Tronox, however, the FTC filed an administrative complaint in December 2017 and a district court complaint in July 2018 - more than seven months later. The FTC and Tronox were able to engage in discovery during this seven-month period and even completed the administrative trial, obviating the need for extensive discovery in the federal court proceeding. Consequently, the Tronox district court hearing began only 28 days after the district court complaint was filed, more than three months sooner than average for complaints filed in 2016 and 2017. Overall, Tronox was decided only 58 days after the filing of the district court complaint. By comparison, the FTC’s case against Wilhelmsen was decided 149 days after the complaint, which was closer to, but still faster than, the average duration of preliminary injunction actions over the prior two years. Wilhelmsen and the 5-7 month average observed in recent years should be viewed as more representative of the current duration of merger litigation.

Time to Litigate Government Antitrust Merger Challenges in Federal Court (Complaints Filed in 2011, 2015, 2016, 2017, and 2018 and Litigated to a Decision)

Outlook for 2019: Impact of Brexit and U.S. Merger Review Reforms (Amid Partial U.S. Government Shutdown)

While the circumstances of future antitrust-sensitive transactions may lead to results above or below DAMITT averages, 2018 statistics suggest that parties to the hypothetical average “significant” deal subject to review only in the United States would have to plan on approximately 10-11 months for the agencies to investigate a transaction, and another five to seven months if they want to preserve their right to litigate an adverse agency decision. Deal timetables for EU cases where the investigation is likely to proceed to Phase II need to account for an average lapse of almost 13 months from announcement to clearance.

These trends could see significant shifts in 2019. In the United States, citing results from DAMITT, the antitrust agencies announced several encouraging reforms late in 2018. If these reforms are fully and successfully implemented in 2019, following an end to the partial government shutdown, we expect the duration of significant U.S. antitrust merger investigations will likely shorten. In Europe, Brexit could add a layer of complexity on the merger review process. A no-deal Brexit in particular would increase the workload of the CMA, potentially creating merger delays and uncertainty; it could also trigger additional national filings at member state level. Due to these uncertainties, businesses should plan accordingly by negotiating flexibility into transaction agreements to address these contingencies.