Refresher on U.S. Market-Wide Circuit Breakers

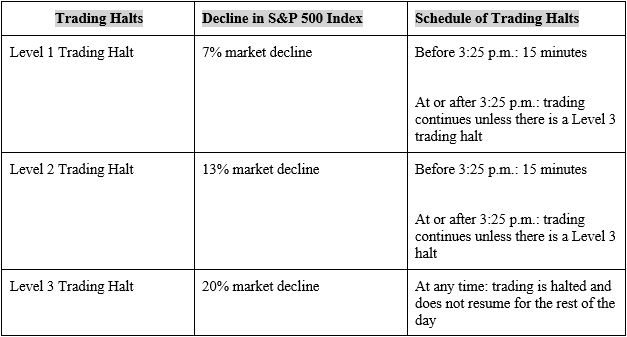

The U.S. equity, options and futures markets have adopted market-wide circuit breakers that automatically halt trading across markets in the event of severe market declines, as measured by certain benchmarks against the S&P 500®. There are three breach thresholds (7 percent, 13 percent and 20 percent), which are calculated daily. (See Release No. 34-67090 (May 31, 2012)).

In light of the imposition of market-wide trading halts on March 9, 2020, below is a summary of when these circuit breakers are imposed and their duration.

The Chicago Mercantile Exchange (CME) futures and options on futures markets follow the cash equity markets. If a trading halt as described above is declared in the cash equity markets, trading in all U.S.-based equity index futures and options on futures will halt. Futures and options on futures trading resumes when trading in the cash equity market resumes, not following a prescribed time period (although that will most likely be the same time period as in the cash equity market).(See https://www.cmegroup.com/trading/equity-index/faq-sp-500-price-limits.html). The Intercontinental Exchange (ICE) uses interval price limits that are periodically reset. If a bid or offer crosses the interval price limit, a market hold is triggered which will halt trading in that price direction, but trading is still permitted in the opposite direction.