UK Asset Holding Companies – Alternative Credit Funds: A Chance to Shape the Future

The UK government has published a response to the consultation announced last year in relation to the possible introduction of a new tax advantaged regime for UK asset holding companies (AHC) used in the context of alternative fund structures (click here to read the response). See our previous OnPoint for further details in relation to the original consultation here. The government's response also announced a second-stage consultation with a view to introducing legislation for a new AHC regime in this year's Finance Act. Whilst this initiative is proposed to have application to a wide range of alternative funds, this OnPoint is designed to focus in particular on the potential impact for alternative credit funds.

It is clear from the government's paper that HM Treasury and HMRC have listened carefully to the points made by respondents in the first consultation and have set out their understanding of the various tax 'road blocks' that currently stand in the way of an internationally competitive AHC regime in the UK. The paper proposes various possible solutions to clear the road ahead that will be the subject of this second phase of consultation.

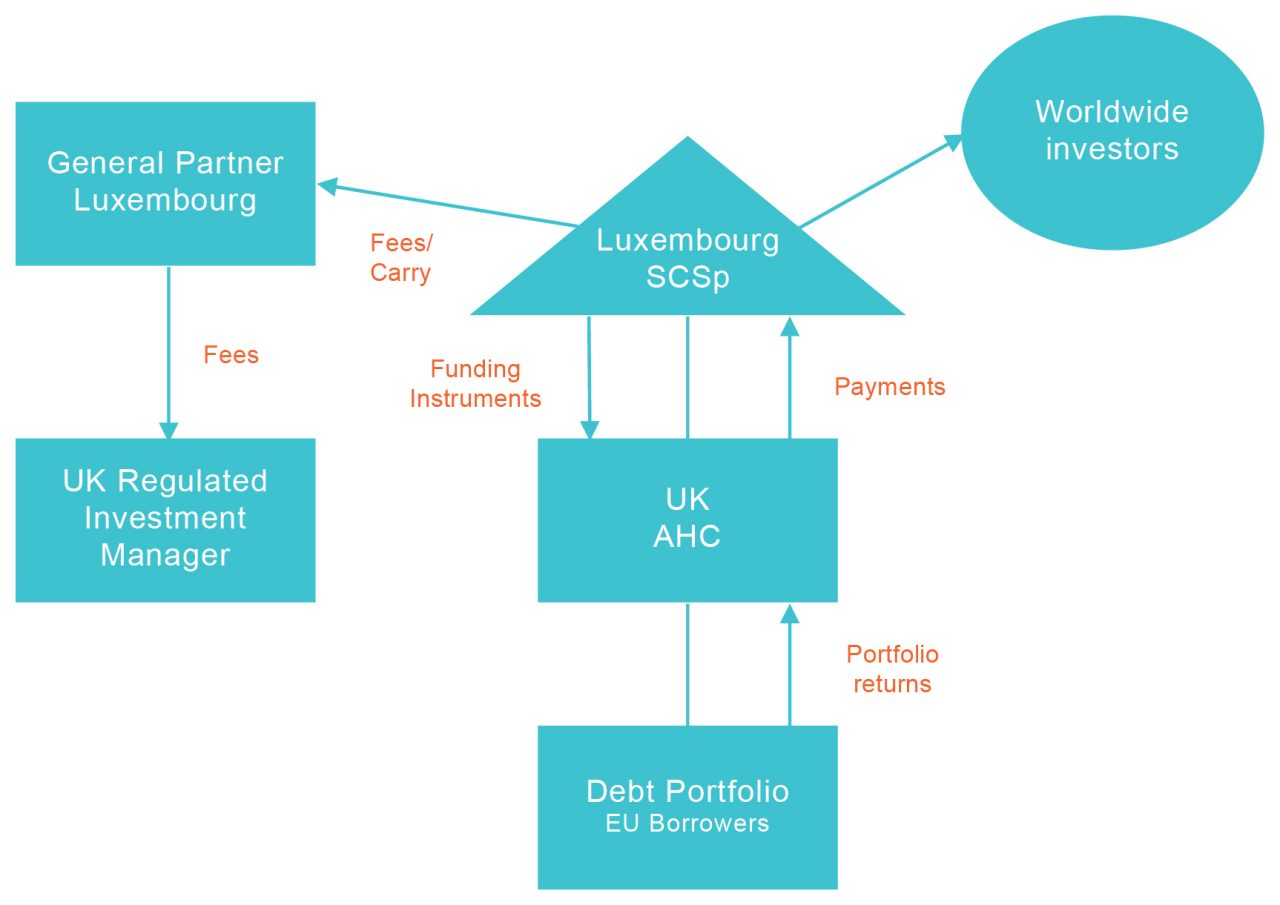

Clearly, creating an AHC regime that works for all fund strategies and all asset classes is a complex undertaking (given the various and interlocking tax issues that arise). However, in order to take a glimpse of a possible new future, consider the following alternative credit fund structure by way of a simplified example to illustrate some of the key tax issues being considered.

The above fund structure probably looks fairly standard in most respects with the exception of the introduction of a UK AHC as a subsidiary vehicle of the fund (rather than a Luxembourg SARL or securitisation vehicle). If we were to try to use this structure today, there would likely be a number of key UK tax issues that might pose problems. Some of the key UK tax issues and potential solutions currently being considered by HM Treasury/HMRC are:

1. Corporate Interest Restriction. The UK imposes 19% corporation tax on profits of a UK company. Due to the corporate interest restriction rules that generally currently apply in the UK, interest deductions in respect of payments made by the AHC to the fund on its funding instruments are likely to be restricted, leading to taxable income at the level of the AHC (and therefore tax leakage). In jurisdictions such as Luxembourg, it is generally possible to limit corporate tax exposure in relation to an ordinary corporate entity acting as an AHC by reference to a small margin representing the difference between amounts received from the underlying fund portfolio and the interest paid on the funding instruments issued to the fund. For example, there is generally no restriction on tax deductions for profit-related interest payments.

Possible solution – Consideration is being given to restricting the corporation tax levied in relation to a UK AHC to an amount proportionate to the role of the AHC, potentially equivalent to that which might arise in the example of ordinary Luxembourg corporate entity. Exemptions from UK tax rules restricting tax deductions would also be necessary and are being contemplated (including the anti-hybrid rules).

2. Capital Gains. Although less common in the context of credit funds, capital gains arising in relation to assets or more commonly gains in relation to distressed debt could also give rise to 19% corporation tax for a UK AHC.

Possible solution – Consideration is being given to introducing an exemption from taxation on capital gains arising to a UK AHC. As gains arising in respect of distressed debt would likely be taxed as income under the loan relationship rules, the corporation tax would need to be limited in the same way as envisaged in 1 above, perhaps through a tax deductible payment on a profit-related funding instrument.

3. Withholding Taxes. The UK (unlike Luxembourg) imposes a 20% withholding tax on interest payments with respect to most types of unlisted loans to UK borrowers. This could give rise to additional tax leakage with respect to interest payments by the AHC to the fund on the funding instruments.

Possible solution – Consideration is being given to introducing a specific exemption from such withholding tax for AHC's.

4. Pass Through of Gains. UK investors (including UK individuals entitled to carried interest) may prefer capital gains realised by the AHC to be passed through to them so as to be taxed as a capital gain at lower tax rates rather than being converted into income (e.g., as a consequence of an income payment on a funding instrument).

Possible solution – Consideration is being given to introducing new tax rules that will track the underlying nature of the capital gains received by the AHC so that payments of these capital gains can still be taxed as capital gains in the hands of investors even if received in the form of income.

5. Stamp Duty. The UK has a stamp duty regime that could result in an additional 0.5% charge in relation to certain transactions in shares (and possibly certain debt instruments) of UK AHCs.

Possible solution – Consideration is being given to introducing specific reliefs or exemptions from stamp duty for UK AHCs.

6. VAT. VAT recovery issues for UK AHCs will also be considered in the context of the wider UK funds review, although often in practice investment management fees are charged to the General Partner of the offshore fund.

Whilst different fund structures can present different tax issues, if these key tax issues can be addressed, it could open the way for the more frequent use of UK AHCs for international alternative credit funds, in particular where the fund is to be managed by a UK-regulated investment manager. The potential ability to avoid offshore meetings for the corporate subsidiary of the fund plus the ready availability of UK substance (in the form of the UK investment manager, in particular) makes the UK AHC an attractive proposition. The UK also has a wide network of double taxation treaties that should enable any necessary double tax treaty withholding tax claims to be made in respect of portfolio debt and would totally remove the need for treaty claims to be made in relation to interest paid by UK borrowers.

AHC Eligibility Conditions for Favourable Tax Treatment

If the above proposals are implemented, the UK AHC would offer a very favourable UK tax regime compared to ordinary asset holding companies. As a consequence, it is unsurprising that HMRC and HM Treasury also propose to impose eligibility criteria around the circumstances in which an AHC can benefit from such treatment. The paper suggests that attention is focused on structures where capital from diverse or institutional investors is pooled and managed by an independent, regulated or authorised asset manager in which the AHC plays an intermediate, facilitative role. The options being considered here include whether the AHC must be a subsidiary of a widely held fund (or potentially also a more limited number of institutional investors), or whether the AHC might also be directly owned by appropriate investors. In addition, there is also a desire to ensure that the activities of the AHC are commensurate with its intermediate facilitative role rather than, for example, enabling an AHC to carry on a primary trading activity in its own right. Here, of course, it is recognised that some care will be needed to ensure that a genuine UK AHC isn’t excluded merely because it might trip into the trading test whilst acting in its facilitative role. It will also be necessary for a UK AHC to elect into the special tax regime through its company tax return.

Conclusions – and Cautious Optimism for the Future

This OnPoint is designed as a high-level summary only, and it is important to note that a greater level of detail and complexity will need to be considered in order to deliver appropriate and balanced solutions, and reference should be made to the government paper in this regard.It will therefore be crucial for HM Treasury and HMRC to ensure that the proposed solutions to the tax issues do not result in an AHC tax regime that is overly complex or with overly stringent eligibility conditions that may limit the competitiveness of the UK as compared to other EU jurisdictions as an asset holding regime for alternative funds. Nevertheless, a great deal of progress appears to have been made in a relatively short space of time, and it may be that the UK will soon be able to offer a competitive onshore solution for a new post-Brexit fund environment. The consultation will run until February 23, 2021, and there will also be opportunities to discuss specific aspects of the proposals with HM Treasury and HMRC in “Town Hall” meetings being held during January involving representative industry bodies. If you have any comments or questions in relation to this consultation exercise, please get in touch with your normal Dechert contact.