Hart-Scott-Rodino Annual Adjustments Announced for 2021; Slight Decrease Brings Minimum Threshold to US$92.0 Million

Key takeaways

- Rare decrease in filing thresholds for 2021 due to recession; first time since 2010.

- Annual adjustments to dollar-based HSR reporting thresholds to go into effect on or about March 4.

- Similar downward adjustment to thresholds for director interlocks under Section 8 of the Clayton Act already in effect.

- Slight upward adjustment in maximum civil penalties for HSR violations.

HSR Act or Rule Provision | 2021 Indexed Value |

| US$50 million size-of-transaction test | US$92.0 million |

| US$200 million size-of-transaction test | US$368.0 million |

| US$100 million size-of-person test | US$184.0 million |

| US$10 million size-of-person test | US$18.4 million |

| US$50 million notification threshold | US$92.0 million |

| US$100 million notification threshold | US$184.0 million |

| US$500 million notification threshold | US$919.9 million |

| 25% of voting securities valued at US$1 billion notification threshold | US$1,839.8 million |

| US$110 million foreign exemption threshold | US$202.4 million |

Filing Fees | US$45,000 for transactions valued at greater than US$92.0 million but less than US$184.0 million |

| US$125,000 for transactions valued at US$184.0 million or greater but less than US$919.9 million | |

| US$280,000 for transactions valued at or in excess of US$919.9 million |

On February 1, 2021, the U.S. Federal Trade Commission (“FTC”) announced in the Federal Register that the dollar-based thresholds applicable to the Hart-Scott-Rodino (“HSR”) premerger notification program will be lowered about 2.1 percent from the 2020 levels. As a result, the HSR minimum size-of-transaction threshold will be lowered to US$92.0 million from US$94.0 million. Transactions valued below the new US$92.0 million threshold will not require an HSR filing. The dollar thresholds that determine the applicable filing fee will also be revised accordingly.

The HSR changes will become effective on or about March 4, 2021 (30 days after the expected official publication date in the Federal Register). The new HSR thresholds will apply to transactions that close on or after that date. The last time an annual adjustment resulted in a reduction of the HSR thresholds was 2010, due to the economic downturn during the Great Recession.

The FTC also recently reduced the dollar thresholds under Section 8 of the Clayton Act, which prohibits any person from holding positions as an officer or director of competing corporations engaged in commerce, if the corporations meet certain size thresholds. The new Section 8 thresholds became effective on January 21, 2021.

HSR Thresholds Lowered

As a result of this most recent indexing, the HSR Act now provides that transactions resulting in holdings valued in excess of US$368.0 million among parties engaged in commerce are subject to premerger notification regardless of the size of the parties. Transactions that result in holdings valued in excess of US$92.0 million, but not exceeding US$368.0 million, are reportable only if the acquiring and acquired persons meet the “size-of-person” test — either the acquiring or acquired person must have annual net sales or total assets of US$184.0 million or more and the other party must have annual net sales or total assets of US$18.4 million or more. Acquired persons not engaged in manufacturing must meet the US$18.4 million test on the basis of the value of their assets alone, if their annual net sales are less than US$184.0 million. (Of course, certain transactions meeting these size thresholds may nevertheless be exempt under the HSR Act.)

The maximum civil penalties for violations of the HSR Act are similarly indexed, and have increased from US$43,280 per day to US$43,792 per day, effective as of January 13, 2021.

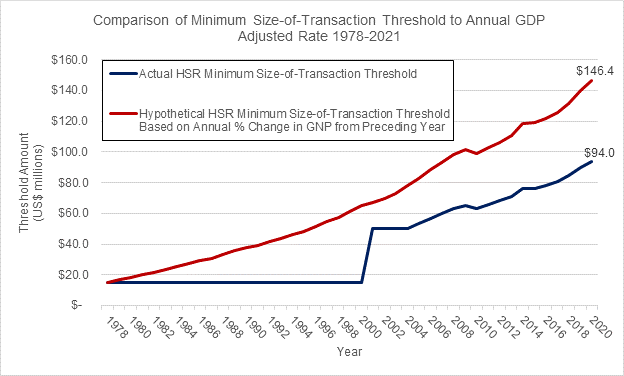

The HSR premerger notification program applies to large transactions involving large parties engaged in commerce. Dollar thresholds defining “large” were increased in 2000 from US$15 million to US$50 million and, since 2005, have been indexed to reflect changes in the gross national product (GNP). The following graph illustrates the changes in the HSR minimum size-of-transaction thresholds, as compared to changes in the GNP since 1978, when regulations implementing the HSR Act first went into effect. If the US$15 million minimum size-of-transaction threshold in 1978 had been indexed to changes in the GNP, it would be at approximately US$143.3 million rather than US$92.0 million.

Revised Rules for Officer and Director Interlocks

Section 8 of the Clayton Act generally prohibits a person from serving simultaneously as a director or officer of two sizable competing corporations engaged in commerce, unless their “competitive sales” — the gross revenues for all products and services sold by one corporation in competition with the other — are minimal. As with the HSR Act, the dollar thresholds defining “sizable” and “minimal” are indexed to changes in the gross national product. As a result of the most recent indexing, the Section 8 prohibition on officer and director interlocks now applies only if each competing corporation has capital, surplus, and undivided profits aggregating more than US$37.382 million. The interlocking officer and director prohibition does not apply, however, if either corporation’s “competitive sales” are less than US$3.7382 million. Other “safe harbors” exist that are based on calculating the competitive sales as a percentage of the corporation’s total sales.

Provision under Section 8 of the Clayton Act | 2021 Indexed Value |

Capital, surplus and undivided profits aggregating more than | US$37,382,000 |

Competitive sales of either corporation are less than | US$3,738,000 |

The Federal Register notices announcing the aforementioned changes may be accessed by clicking on the links below.

Revised Jurisdictional Thresholds for Section 7A of the Clayton Act

Revised Jurisdictional Thresholds for Section 8 of the Clayton Act