Foreign Land Owners Come into the Light…UK Government introduces new “Register of Overseas Entities”

On 1 March the Home Office introduced the Economic Crime (Transparency and Enforcement) Bill (the "Bill"). The most significant change, introduced in Part 1 of the Bill, is the creation of a new, public "Register of Overseas Entities" to be held by Companies House (the "ROE"). This OnPoint summarises the new ROE process and explains how it will impact overseas entities which own land interests in the UK.

Sophisticated investors will already be familiar with the concept of reporting beneficial ownership. The People with Significant Control ("PSC") Register has been publicly available since 20161 , and the UK made a commitment around the same time to establish a publish register of beneficial owners of non-UK entities that own or buy land in the UK.2 The ROE is not, therefore, a surprise.

The Explanatory Notes to the Bill state that the ROE has two primary objectives:

- To prevent and combat overseas entities using UK land to launder money; and

- To increase transparency and public trust in overseas entities who own or buy land in the UK.3

Whilst those objectives are commendable, there are many legitimate reasons for purchasing land through an overseas entity, and the impact of the Bill on law-abiding overseas entities will be significant. The Bill proposes additional administrative obligations on overseas entities to provide and update information about their beneficial owners, and it is backed by financial and criminal penalties. It also makes changes to the land registration system in the UK so that overseas entities who have purchased qualifying land in the UK since 1 January 1999 will be prevented from making disposals unless they have properly registered with the ROE, so it is important that companies get this right.

The ROE is likely to be implemented quickly. Part 1 comes into force on a date to be set by regulations. The Government has asked Parliament to expedite the passage of the Bill as part of its urgent response to the Russian invasion of Ukraine, and the Bill has already reached the committee stage in the House of Lords.4 It is therefore likely that the Treasury will publish the necessary regulations as a matter of urgency once the Bill becomes law, so overseas entities and those representing them should start preparing now to avoid falling foul of the new regime.

Registrable Beneficial Owners ("RBOs")

The Bill defines "overseas entity" simply as "a legal entity that is governed by the law of a country or territory outside the United Kingdom".5 This includes companies, partnerships and other entities which constitute a legal person under the law by which they are governed.6

The Act defines RBOs as any individual, legal entity or government or public authority which, with respect to an overseas entity:

a) Holds directly or indirectly more than 25% of the shares or voting rights;7

b) Has the right to appoint or remove a majority of the board of directors;

c) Has the right to or does exercise significant control over the company;

d) Any trustee of a trust, or member of a partnership or unincorporated association which meets any of the conditions outlined above and has the right to exercise significant influence over the activities of the trust or entity.8

"Indirect ownership" refers to beneficial owners who own land through a chain of companies or via a complex corporate structure, which means entities will have to provide information about registrable beneficial owners all the way up the ownership ladder.

The Bill will require all overseas entities to apply for registration on the ROE and:

a) Make a statement that the entity has no reasonable cause to believe that it has any RBOs; OR

b) Make a statement that:

i. The entity has identified one or more RBOs; or

ii. the entity believes that registrable beneficial owners exist that it has not identified; or

iii. the entity is not able to provide information about one or more registrable beneficial owners.9

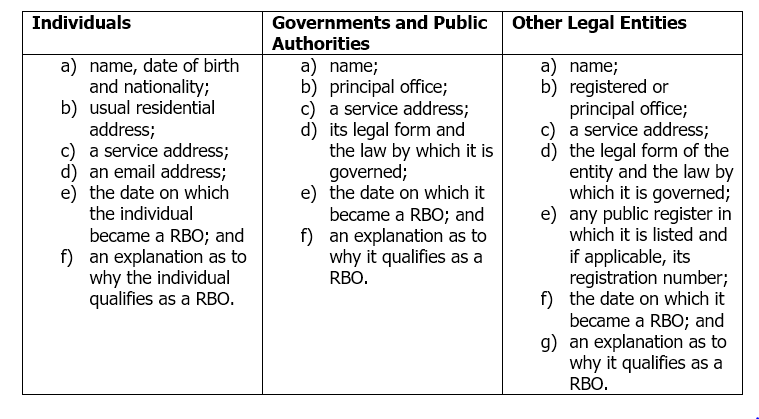

"Relevant Information"

Overseas entities who identify RBOs will be required to provide "relevant information" about any identifiable RBOs. Schedule 1 of the Bill sets out the information that is to be provided, which is summarised in the table below.

The Bill includes provisions to protect certain information, including personal information such as date of birth, residential addresses and contact details of individuals but ONLY if it is contained in a document delivered to the registrar in which that information is required to be given in accordance with Schedule 1. It is therefore vital that overseas entities file relevant information correctly, because the Bill specifically states that the registrar is not obliged to check all documents to ensure the absence of date of birth or residential address information. Regulations may also allow for applications to the Registrar to withhold certain information from public inspection, and to rectify errors or out of date information, either by application or court order.10

Following initial registration with the ROE, overseas entities will be subject to annual updating obligations.11 Overseas entities disposing of land in the UK will also be required to apply to be removed from the register.12 The Bill will also require the land registrar to enter restrictions on the register of all qualifying estates if satisfied that the registered proprietor is an overseas entity and its proprietorship was registered after 1 January 1999.13 As such, all overseas entities who have acquired qualifying estates in land after 1 January 1999 will be required to register with the ROE before making any disposals.

The Bill also creates new statutory notices requiring a person to provide information about a RBO which may be served by an overseas entity on any person it knows or has reasonable cause to believe has information about a RBO.14 Failing to reply will be a criminal offence. The Home Secretary will also be able to require an overseas entity by notice to apply for registration if it appears to them that the entity is registered as the proprietor of a relevant interest in land and they are not registered on the ROE.15

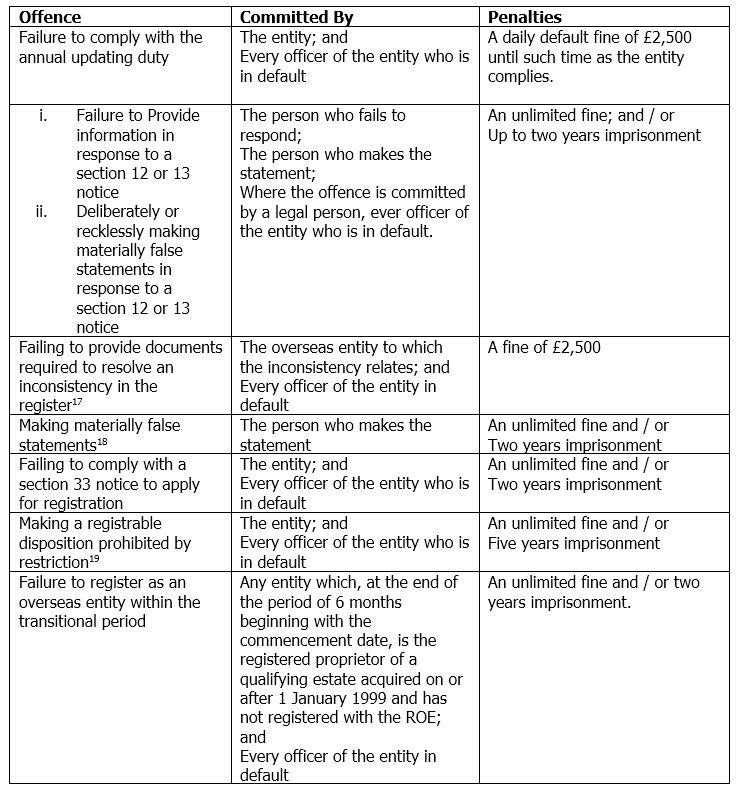

Criminal Penalties

The Bill is backed by criminal sanctions and creates a number of new offences, which are summarised below.16

The Bill allows the Home Secretary to make regulations providing for exemptions to the ROE regime, for example, in the case of overseas entities who have provided beneficial ownership information to registers in their own jurisdiction and the Government considers those registers to be equivalent to the ROE.20

The Bill also allows the Home Secretary, on a case by case basis exempt someone from registering with the ROE if it is necessary to do so:

a) in the interests of national security

b) in the interests of the economic wellbeing of the UK; or

c) for the purpose of preventing or detecting serious crime.

Concluding Remarks

In the explanatory notes to the bill the government sets out that the ROE will mirror as far as possible the PSC regime, but in imposing criminal sanctions for certain land disposals executed in breach of the Bill, it goes further. Overseas entities preparing to register with the ROE will have to get to grips quickly with new powers to require parties to provide information, and new obligations to file in some cases extremely private and personal information correctly, to avoid breaching UK, EU and local privacy laws. Daily default fines will rack up quickly whilst company officers and directors could find themselves defending criminal proceedings in the UK with the threat of imprisonment hanging over their heads. With the Government pushing to expedite the process in response to the crisis in Ukraine, the timeline for this is likely to be a short one. The Bill is still being debated in the House of Lords, so the detail as to how the final system will work in practice remains to be seen but it is likely that these provisions will remain largely unchanged. Dechert will circulate an updating OnPoint once the Bill has passed.

Dechert can assist clients in investigating, identifying and obtaining relevant information on registrable beneficial owners as well as with preparing and filing relevant information with the registrar, prior to and once the Bill comes into force. If you have any questions regarding the Bill, the ROE or the UK Parliamentary process please do not hesitate to contact one of our experts listed below.

Endnotes:

1) House of Commons Research Briefing, 3 February 2022, “Registers of beneficial ownership”, access here.

2) Explanatory Notes, page 5 paragraph 5.

3) Explanatory Notes, page 5 paragraph 6.

4) Explanatory Notes, page 10, paragraph 44; UK Parliament Update “Lords debates Economic Crime (Transparency and Enforcement) Bill”. 9 March 2022

5) Clause 2(1) of the Bill.

6) Clause 2(2) of the Bill.

7) Indirect ownership includes ownership of a majority stake via a chain of legal entities (Schedule 2, Part 5, Paragraph 18.)

8) Schedule 2 of the Bill.

9) Clause 4 of the Bill.

10) Clauses 26 – 30.

11) Clause 7 of the Bill. Companies may shorten the reporting period if they wish.

12) Clause 9 of the Bill.

13) A qualifying estate is a freehold estate or a leasehold estate granted for a term of more than seven years (Clause 32 and Schedule 3, clause 3).

14) Clauses 12 and 13.

15) Clause 33.

16) The table does not include certain offences specific to the land registration processes in Northern Ireland and Scotland.

17) Clause 26.

18) Clause 31.

19) Schedule 3 Part 1 clause 6.

20) Explanatory Notes, page 17, paragraphs 88 – 89.