Introduction

The 2022 decline in the cryptocurrency and digital assets market resulted in a year with more crypto securities class action litigation than any previous year. This article explores the 2022 crypto securities class action litigation trends, including the increase in the number of cases filed and its correlation with crypto market declines, where the cases were filed, the types of defendant companies and allegations, stock or asset drops, and remaining legal questions.

2022 Increase in Cases Filed Correlates with Crypto Market Declines

In 2022, we saw a significant increase in crypto securities class actions with almost twice as many cases filed as any previous year. A year over year comparison of the number of crypto securities class action lawsuits identified by Cornerstone Research shows the following: 2017 (5 cases), 2018 (14 cases), 2019 (4 cases), 2020 (13 cases), 2021 (11 cases), and 2022 (23 cases).1 In particular, the two years with the most cases—2018 (14 cases) and 2022 (23 cases)—were both considered crypto “bear market” years, suggesting, unsurprisingly, that the worst years for the crypto markets were also the years with the most litigation. The market capitalization of crypto assets fell dramatically in 2022 and crypto securities litigation skyrocketed.2

Of the 23 securities class action cases, the number of 2022 crypto securities class action litigation cases varied by month: January (0), February (0), March (2), April (5), May (2), June (2), July (2), August (1), September (0), October (0), November (2), December (7). Quarterly, the cases included: Q1 (2), Q2 (9), Q3 (3), Q4 (9). Interestingly, the monthly and quarterly amount of crypto securities class action litigation corresponds with notable price declines in bitcoin and the cryptocurrency market cap, which occurred in May 2022 after the collapse of stablecoin TerraUSD or UST and Terra’s token LUNA.3 There was another downturn in the bitcoin and cryptocurrency market and substantial increase in litigation after one of the world’s largest cryptocurrency exchanges, FTX. filed a high-profile bankruptcy in early November, with a total of nine cases filed in November and December combined. Yet, it should be noted that only three of these nine complaints mention FTX at all.4

Jurisdiction of First Filed Cases

In 2022, crypto securities class action litigation cases were primarily filed5 in California (eight cases) and New York (seven cases), which is also where most of the crypto securities class action litigation has been filed in previous years.6 Specifically, California had five cases in the Northern District of California, two cases in the Southern District of California, and one case in the Central District of California. New York had five cases in the Southern District of New York and two in the Eastern District of New York. New Jersey was the state with the third most cases, with four in the District of New Jersey. Florida had two cases, with one in the Southern District of Florida and another in the Middle District of Florida. And both Texas and Utah had one case each, in the Western District of Texas and District of Utah, respectively.

Types of Crypto Defendants and Allegations

Plaintiffs brought cases against a variety of crypto and blockchain related companies including “coin issuers, cryptocurrency exchanges, cryptocurrency miners, securitizers of cryptocurrencies or cryptocurrency mining contracts, and companies adjacent to cryptocurrency” with a majority of cases brought against exchanges or trading and lending platforms.7 The key issues generally raised in the complaints include allegations regarding (1) the sale or offering of unregistered securities (i.e. those not registered with the U.S. Securities & Exchange Commission), in violation of §§ 5, 12, and 15 of the Securities Act of 1933 and/or (2) false and/or misleading statements and/or omissions/failures to make proper disclosures, resulting in alleged financial losses for purchasers or investors.

Of the crypto-related cases filed, Plaintiffs brought cases against companies involved with non-fungible tokens or NFTs, blockchain networks, and speculative cryptocurrencies. The majority of 2022 cases (thirteen) were brought against crypto exchanges and/or lending or trading platforms such as: Gemini (a crypto asset exchange and lending platform)8, Compound (a business allowing users to borrow and lend crypto assets)9, Silvergate (which provides payments, lending, and funding solutions for digital currency companies and investors)10, Voyager (a cryptocurrency trading, lending, borrowing company and platform) (two cases)11, Coinbase (a centralized marketplace for cryptocurrency traders) (two cases)12, Celsius (a cryptocurrency trading, lending, and borrowing company)13, BAM Trading Services (a crypto-asset exchange)14, HUMBL (an app for paying or transferring digital assets)15, Bakkt (a digital asset marketplace)16, Uniswap (a crypto-asset exchange)17, and Blockfi (a cryptocurrency trading, lending, and borrowing company)18. Notably, investors brought securities class actions against two of the larger platforms, Voyager (which filed for bankruptcy in July 2022) and Coinbase. It is likely that exchanges will continue to be a target of class actions until the SEC and courts provide additional clarification and guidance as to what crypto assets are considered securities.

A few 2022 crypto securities class action cases involved NFT companies or allegations related to NFTs: Nifty Gateway (a platform for NFTs)19, Yuga Labs (a company selling digital assets including NFTs such as its Bored Ape Yacht Club collection)20, Safemoon (a company that announced an intention to develop an NFT exchange)21, Universal Navigation (which developed the Uniswap protocol allowing for the trade of various tokens related to NFTs or tokens with plans to incorporate NFTs)22, Legacy Bakkt (a digital asset marketplace where NFTs could be traded)23, HUMBL (which launched an NFT Gallery allowing for the creation and purchase of NFTs)24, and Solana (which is a blockchain network upon which decentralized apps such as NFTs are built)25. It should be noted that because celebrity promotions have been common to NFT’s, investors brought complaints against celebrity individual defendants as well.26

For example, plaintiffs filed an action against Yuga Labs (Yuga Labs, Inc.: ApeCoins, NFTs Securities Litigation), a Delaware company that sells digital assets, including its flagship NFT collection known as the Bored Ape Yacht Club (“BAYC”), ApeCoins, and virtual land. The complaint was brought on behalf of all investors who purchased Yuga’s NFTs or ApeCoin tokens and also named as defendants many celebrities including Paris Hilton, James (“Jimmy”) Fallon, Justin Bieber, Gwyneth Paltrow, Serena Williams, Kevin Hart, and Stephen Curry II, among others.27 The securities class action suit was filed in the Central District of California, alleging violations of Sections §§ 10(b) and 20(a) of the Securities Exchange Act of 1934 (“Exchange Act”) and Rule 10b-5 and §§ 5, 12(a)(1), and 15 of the Securities Act of 1933 (“Securities Act”).28 Plaintiffs alleged a “vast scheme” between a blockchain start-up company and a Hollywood talent agent, and a “front operation”, who “all united for the purpose of promoting and selling a suite of digital assets” by misleading potential investors through the use of celebrities.29 Plaintiffs alleged that defendant Yuga Labs thereby mislead investors regarding the “failed launch of the BAYC metaverse and botched sale of virtual land in the Otherside."30 Plaintiffs alleged that upon this failed launch and botched sale, the price of “BAYC NFT fell from a floor price of $114,000 to a Relevant Period low of 50 ether (i.e., approximately $62,000) on November 14, 2022,” the price of ApeCoins dropped by 90%, and the price of Otherdeed NFT “went from a Relevant Period high of 4.7 ether (about $13,200) on May 1, 2022 all the way down to a low of 0.8 ether (worth only $1,000) on November 15, 2022.31

In addition to cases brought against NFT companies, there were a number of cases brought against crypto mining companies, which engage in cryptocurrency mining, “a process of creating new digital ‘coins.’”32 In 2022, there were four complaints filed against crypto mining-related companies, including Singularity (a global logistics company involved in selling and marketing crypto mining equipment)33, Iris (owner and operator of Bitcoin mining data centers)34, Core Scientific (a blockchain computing data center provider and digital asset mining company)35, and Stronghold (a Bitcoin mining company).36 For example, in Iris Energy Limited Securities Litigation, investors brought a securities class action in the District of New Jersey, alleging violations of §§ 10(b) and 20(a) of the Exchange Act and §§ 11 and 15 of the Securities Act.37 In particular, Plaintiffs alleged “the Offering Documents made false and/or misleading statements and/or failed to disclose that: (i) certain of Iris’s Bitcoin miners, owned through its Non-Recourse SPVs, were unlikely to produce sufficient cash flow to service their respective debt financing obligations; (ii) accordingly, Iris’s use of equipment financing agreements to procure Bitcoin miners was not as sustainable as Defendants had represented; (iii) the foregoing was likely to have a material negative impact on the Company’s business, operations, and financial condition.”38 “On November 2, 2022, Iris issued a press release disclosing, among other things, that ‘[c]ertain equipment (i.e., Bitcoin miners) owned by [NonRecourse SPV 2 and Non-Recourse SPV 3] currently produce insufficient cash flow to service their respective debt financing obligations, and have a current market value well below the principal amount of the relevant loans’ and that ‘[r]estructuring discussions with the lender remain ongoing.’”39 Plaintiffs alleged that upon this news, the stock dropped by “$0.51 per share, or 15.04%, to close at $2.88 per share on November 2, 2022—a nearly 90% decline from the Offering price.”40

In addition, Plaintiffs also filed two complaints against blockchain networks including Solana (a blockchain network upon which decentralized apps (“dApps”) are built)41 and Terraform Labs (which “operates the Terra blockchain and its related protocol, which hosts, supports, and funds a community of decentralized financial applications and products known collectively as the Terra ecosystem.”).42 In Terra Tokens Securities Litigation, investors brought a securities class action in the Northern District of California, alleging violations of §§ 10(b) and 20(a) of the Exchange Act and Rule 10b-5, and §§ 5, 12(a)(1) and 15 of the Securities Act.43 According to the complaint, defendant, TFL, a company operating the Terra blockchain and ecosystem, allegedly “made a series of false and misleading statements regarding the largest Terra ecosystem digital assets by market cap, UST and LUNA, in order to induce investors into purchasing these digital assets at inflated rates.”44 The complaint alleges that “these misrepresentations and omissions related to: (i) the stability of the UST/LUNA algorithmic stablecoin pair, the Anchor Proto[co]l’s yield rate, and the Terra ecosystem itself; (ii) the ability for the Luna Foundation Guard to defend and maintain the peg of UST/LUNA during periods of high volatility in the market; and (iii) the inability for TFL to support Anchor’s yield rate the Anchor Yield Reserve fund.”45 Upon the news regarding structural vulnerabilities in the Terra ecosystem, the price of UST and LUNA Tokens dropped by 91% and 99.7%, respectively from May 7, 2022 to May 12, 2022.46 Last, there were two complaints filed against speculative cryptocurrencies LGBCoin (a controversial digital commodity)47 and Safemoon token (a speculative digital token).48

Of the twenty-three complaints filed in 2022, only eight were filed against companies traded on a public exchange with five on NASDAQ, two on the New York Stock Exchange, and one Over-the-Counter Bulletin Board.

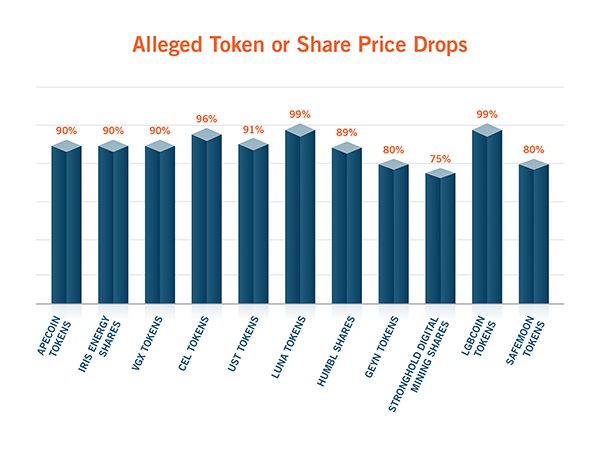

Stock or Crypto Asset Price Declines

Another unique aspect of cryptocurrency securities class action litigation cases is that stock or crypto asset price drops are typically more extreme than those seen in other securities litigation cases.49 For example, the price of ApeCoin tokens dropped approximately 90% in value from its high50, Iris Energy shares nearly declined 90% from the offering price51, VGX token declined over 90%52, CEL Tokens declined from a high of $7.73 to a low of $0.28 just over a year later53, UST and Luna Tokens fell by 91% and 99.7%54, HUMBL price declined 88.8% from its peak price55, GEYN’s value fell 80% in one day56, Stronghold Digital Mining stock declined more than 75% of its IPO price57, and speculative crypto assets such as LGBCoin58 fell to nearly $059 while Safemoon dropped 80% from which it has failed to recover.60 While such large price drops may prompt investors to file suit, such drops come with increased bankruptcy risk, which may impact potential recovery. Nevertheless, to the extent similar price drops occur to crypto assets in 2023, the 2022 trend of increased securities litigation will most likely continue.

It is likely that some of the cryptocurrency-related securities class actions brought in 2022, seemingly as a result of such larger price drops, may result in litigation that could last for many years. Such cases may resemble the length of those that arose from the 2007 to 2008 global financial crisis, some of which have only been recently resolved. The majority of the 2022 cases are still in the very early stages of litigation and thus it is difficult to predict the viability of such cases. In some (approximately nine cases) only the complaint has been filed, with no motion for lead plaintiff or motion to dismiss filed. In others (approximately eight cases) a motion for lead plaintiff has been filed and/or granted but no other substantive filings. In two cases the motion for lead plaintiff was granted and a motion to dismiss has been filed.61 Two cases have been stayed and administratively closed after a suggestion of bankruptcy regarding the defendants, Voyager Digital and BlockFi.62 In two other cases motions to compel arbitration have been filed, with one case where the motion was granted, and the other (Gemini) where it is still pending.63 Thus, it appears that the vast majority of these cases will continue being litigated into 2023, and possibly beyond.

Legal Questions Remain

For 2022 and the near future, the key underlying issue that is still unsettled are the parameters as to when a cryptocurrency or digital asset is considered a security.64 Thus, the significant legal challenges regarding cryptocurrency and digital assets seem to relate to regulatory enforcement brought by the SEC, particularly, cases focused on whether a cryptocurrency or digital asset would have to register with the SEC as a security. Further, there are many class action lawsuits brought by private entities as demonstrated above. Legal questions also remain as to valuation.65 Notably, “of the 30 SEC cryptocurrency-related enforcement actions in 2022, four had a parallel securities class action filing.”66 In Takata v. Riot Blockchain, Inc. the most recent ruling on a motion to dismiss in a 2022 crypto securities class action, the court granted without prejudice a motion to dismiss in the District of New Jersey. The plaintiffs brought the case against defendant Riot Blockchain, Inc., its current and former officers and directors, and large shareholders, alleging violations of §§ 10(b), 13(d), and 20(a) of the Exchange Act.67 Plaintiff alleged “that Defendants, conspiring with one another and acting in concert with an undisclosed control group of other Riot shareholders to: (1) amass a controlling interest in Riot; (2) conceal their control through false and misleading statements and omissions regarding Riot's beneficial ownership in violation of Section 13(d) of the Exchange Act, Regulation 13d, and Items 403 and 404 of Regulation S-K; (3) drive up the price and trading volume of Riot stock through manipulative trading, promotional activity, and false and misleading disclosures; (4) engage in undisclosed related-party transactions at the expense of the Company and its shareholders; and (5) dump their shares into the artificially inflated market on unsuspecting retail investors.”68 In dismissing the case, the court held that “the Section 13(d) violation may not give rise to a private right of action for damages under Section 10(b) [and] [a]ccordingly, the Court finds that Plaintiff’s Section 20(a) claim necessarily fails as well.”69

Conclusion

As the 2022 trends above demonstrate, crypto securities class action litigation progressively increased as the crypto asset market declined. Against the backdrop of a tumultuous 2022 in the crypto market, high profile investigations and bankruptcies, along with increased regulation, challenges remain relating to cryptocurrency trading and token valuation, tracing, along with analyzing on chain transactions through smart contracts and decentralized exchanges in conjunction with the trading on centralized exchanges. As crypto-related filings become more prevalent and courts continue taking on more cases, we may see a continued uptick in the number of securities class action lawsuits in 2023.70

Footnotes:

- Securities Class Action Filings 2021 Year in Review, CORNERSTONE RESEARCH at 5 (2022), https://www.cornerstone.com/wp-content/uploads/2022/02/Securities-Class-Action-Filings-2021-Year-in-Review.pdf ; Securities Class Action Trend Cases, CORNERSTONE RESEARCH, https://www.cornerstone.com/insights/research/securities-class-action-trend-cases/ (last visited Mar. 13, 2023); Securities Class Action Clearinghouse a collaboration with Cornerstone Research: Cryptocurrency Litigation, STANFORD LAW SCHOOL, https://securities.stanford.edu/current-trends.html.

- Chris Opfer et. al., Crypto Lawyers Bet Big on Class Action Lawsuits as Market Slides, Bloomberg Law (Sept 21, 2022, 5:30 AM), https://news.bloomberglaw.com/business-and-practice/crypto-lawyers-bet-big-on-class-action-lawsuits-as-market-slides; Farshad Ghodoosi, Crypto Litigation: An Empirical View, 40 Yale J. on Reg. 87, 88 (2022), https://www.yalejreg.com/bulletin/crypto-litigation-an-empirical-view/#:~:text=In%20the%20early%20part%20of,since%20the%20start%20of%202020.

- Pascale Davies, Terra Luna stablecoin collapse explained: Is this the 2008 financial crash moment of cryptocurrency?, Euronews (May 15, 2022), https://www.euronews.com/next/2022/05/12/terra-luna-stablecoin-collapse-is-this-the-2008-financial-crash-moment-of-cryptocurrency.

- Houghton, et al. v. Compound DAO, et al. (COMP tokens Sec. Litig.), 22-CV-07781, (N.D. Cal. Dec. 8, 2022), CAC at ¶ 84; Adonis Real, et al. v. Yuga Labs, Inc., et al. (Yuga Labs, Inc. : ApeCoins, NFTs Sec. Litig.), 22-CV-08909, (C.D. Cal. Dec. 8, 2022), CAC at ¶¶ 144-46, 149, 190, 194-95, 197, 208-09; Picha, et al. v. Gemini Trust Co., LLC, et al. (Gemini Interest Accounts Sec. Litig.), 22-CV-10922, (S.D.N.Y. Dec. 27, 2022), CAC at ¶¶ 1, 57, 71, 73-77, 79, 108, 126.

- This refers to the total number of first filed cases and does not include every additional action regarding the same matter.

- Securities Class Action Clearinghouse a collaboration with Cornerstone Research: Cryptocurrency Litigation, Stanford Law School, https://securities.stanford.edu/current-trends.html.

- Securities Class Action Filings 2022 Year in Review, Cornerstone Research (2023) at 39, https://www.cornerstone.com/wp-content/uploads/2023/01/Securities-Class-Action-Filings-2022-Year-in-Review.pdf.

- Gemini Interest Accounts Sec. Litig., CAC at ¶ 1. Please note that herein “CAC” refers to the “Class Action Complaint”, “SACAC” refers to the “Second Amended Class Action Complaint”, and “CSCAC” refers to the “Corrected Securities Class Action Complaint” for the corresponding citation.

- COMP tokens Sec. Litig., CAC at ¶ 1.

- Rosa, et al. v. Silvergate Capital Corp., et al. (Silvergate Capital Corp. Sec. Litig.), 22-CV-01936, (S.D. Cal. Dec. 7, 2022), CAC at ¶ 2.

- Roberts, et al. v. Ehrlich, et al. (Voyager Tokens Sec. Litig.), 22-CV-09590, (S.D.N.Y. Nov. 9, 2022), CAC at ¶ 2; Cassidy, et al. v. Voyager Digital Ltd., et al. (Voyager Earn Program Account Sec. Litig.), 21-CV-24441, (S.D. Fla. Apr. 28, 2022), ACAC at ¶ 34.

- Patel, et al. v. Coinbase Global, Inc., et al. (Coinbase Global, Inc. Sec. Litig.), 22-CV-04915, (D.N.J. Aug. 4, 2022), CAC at ¶ 2; Donovan, et al. v. Coinbase Global, Inc., et al. (GYEN Tokens Sec. Litig.), 22-CV-02826, (N.D. Cal. May 12, 2022), ACAC at ¶ 4.

- Goines, et al. v. Celsius Network LLC, et al. (CEL Tokens Sec. Litig.), 22-CV-04560, (D.N.J. July 13, 2022), CAC at ¶ 2.

- Lockhart, et al. v. BAM Trading Services Inc., et al. (BAM Trading Services Inc. Cryptocurrency Sec. Litig.), 22-CV-03461, (N.D. Cal. June 13, 2022), ACAC at ¶ 1.

- Pasquinelli, et al. v. Humbl, LLC et al. (Humbl, LLC Cryptocurrency Sec. Litig.), 22-CV-00723, (S.D. Cal. May 19, 2022), ACAC at ¶ 12.

- Poirier, et al. v. Bakkt Holdings, Inc., et al. (Bakkt Holdings, Inc. Sec. Litig.), 22-CV-02283, (E.D.N.Y. Apr. 21, 2022), ACAC at ¶ 2.

- Risley, et al. v. Universal Navigation Inc., et al. (Universal Navigation Inc. Cryptocurrency Sec. Litig.), 22-CV-02780, (S.D.N.Y. Apr. 4, 2022), ACAC at ¶ 19.

- Mangano, et al. v. BlockFi, et al. (BlockFi Cryptocurrency Sec. Litig.), 22-CV-01112, (D.N.J. Mar. 1, 2022), ACAC at ¶ 3.

- Hastings, et al. v. Nifty Gateway, LLC, et al. (Nifty Gateway, LLC : NFTs Sec. Litig.), 22-CV-10517, (S.D.N.Y. Dec. 13, 2022), CAC at ¶ 2.

- Yuga Labs, Inc. : ApeCoins, NFTs Sec. Litig., CAC at ¶¶1 n.1, 4.

- Blacksher, et al. v. SafeMoon LLC, et al. (SafeMoon LLC Cryptocurrency Sec. Litig.), 22-CV-00642, (D. Utah Oct. 31, 2022), CSCAC at ¶¶ 174-75, 182.

- See Universal Navigation Inc. Cryptocurrency Sec. Litig. ACAC at ¶¶ 330, 335, 396, 410, 461, 479, 489, 561, 581, 615, 625.

- Bakkt Holdings, Inc. Sec. Litig., ACAC at ¶ 2.

- Humbl, LLC Cryptocurrency Sec. Litig., ACAC at 26.

- Young, et al. v. Solana Labs, Inc., et al. (Solana Tokens Sec. Litig.), 22-CV-03912, (N.D. Cal. July 1, 2022), CAC at ¶ 2.

- See Chris Opfer, Crypto Lawsuit Deluge Has Big Firms Scrambling to Keep Up, Bloomberg Law (May 17, 2022, 5:30 AM), https://news.bloomberglaw.com/securities-law/crypto-lawsuit-explosion-has-big-law-scrambling-to-keep-up.

- Yuga Labs, Inc. : ApeCoins, NFTs Sec. Litig., CAC at ¶¶ 1 n.1, 2, 4.

- Id. at ¶¶ 257-301.

- Id. at ¶¶ 1-3.

- Id. at ¶ 210.

- Id. at ¶¶ 71, 211-213.

- Shivam Arora, What is Bitcoin Mining? How Does It Work, Proof of Work and Facts You Should Know, Simplilearn (Feb. 23, 2023), https://www.simplilearn.com/bitcoin-mining-explained-article#:~:text=Cryptocurrency%20mining%20is%20a%20process,distributed%20ledger%20to%20locate%20them.

- Crivellaro, et al. v. Singularity Future Tech. Ltd., et al. (Singularity Future Technology Ltd. Sec. Litig.), 22-CV-07499, (E.D.N.Y. Dec. 9, 2022), CAC at ¶ 2.

- Malouf, et al. v. Iris Energy Limited, et al. (Iris Energy Limited Sec. Litig.), 22-CV-07137, (D.N.J. Dec. 7, 2022), CAC at ¶ 2.

- Pang, et al. v. Core Scientific Inc., et al. (Core Scientific Inc. Sec. Litig.), 22-CV-01191, (W.D. Tex. Nov. 14, 2022), CAC at ¶ 2.

- Winter, et al. v. Stronghold Digital Mining, Inc., et al. (Stronghold Digital Mining, Inc. Sec. Litig.), 22-CV-03088, (S.D.N.Y. Apr. 14, 2022), ACAC at ¶ 3.

- Iris Energy Limited Sec. Litig., CAC at ¶¶ 80-109.

- Id. at ¶ 41.

- Id. at ¶ 9.

- Id. at ¶ 68.

- Solana Tokens Sec. Litig., CAC at ¶ 2.

- Patterson, et al. v. TerraForm Labs Ptd Ltd., et al. (Terra Tokens Sec. Litig.), 22-CV-03600, (N.D. Cal. June 17, 2022), ACAC at ¶ 3.

- Id. at ¶¶ 243-99.

- Id. at ¶ 5.

- Id. at ¶ 252.

- Id. at ¶ 159.

- De Ford, et al. v. LGBcoin, et al. (LGBcoin Cryptocurrency Sec. Litig.), 22-CV-00652, (M.D. Fla. Apr. 1, 2022), SACAC at ¶¶ 3, 198.

- SafeMoon LLC Cryptocurrency Sec. Litig., CSCAC at ¶ 45.

- See Universal Navigation Inc. Cryptocurrency Sec. Litig., ACAC at ¶¶ 204, 234, 355, 362, 372, 393, 434, 446, 457, 522, 535, 547, 560, 612 (describing numerous price drops of tokens down over 99% from their all time highs).

- Yuga Labs, Inc. : ApeCoins, NFTs Sec. Litig., CAC at ¶ 212.

- Iris Energy Limited Sec. Litig., CAC at ¶ 10.

- Voyager Tokens Sec. Litig., CAC at ¶ 114.

- CEL Tokens Sec. Litig., CAC at ¶ 214.

- Terra Tokens Sec. Litig., ACAC at ¶ 10.

- Humbl, LLC Cryptocurrency Sec. Litig., ACAC at ¶ 204.

- GYEN Tokens Sec. Litig., ACAC at ¶ 6.

- Stronghold Digital Mining, Inc. Sec. Litig., ACAC at ¶ 16.

- LGBcoin Cryptocurrency Sec. Litig., SACAC at ¶ 130.

- Id.

- SafeMoon LLC Cryptocurrency Sec. Litig., CSCAC at ¶ 327.

- Stronghold Digital Mining, Inc. Sec. Litig.; Universal Navigation Inc. Cryptocurrency Sec. Litig.

- Voyager Earn Program Account Securities Litigation; BlockFi Cryptocurrency Securities Litigation.

- GYEN Tokens Securities Litigation; Gemini Interest Accounts Securities Litigation.

- See, e.g., Audet v. Fraser, No. 3:16-CV-940 (MPS), 2022 WL 1912866, at *18 (D. Conn. June 3, 2022) (Court disagreeing with the jury’s finding that Paycoin, a cryptocurrency mining company’s new cryptocurrency, is not an investment contract, ordering a new trial on that issue alone.); Sec. & Exch. Comm’n v. LBRY, Inc., No. 21-CV-260-PB, 2022 WL 16744741, at *1, *8 (D.N.H. Nov. 7, 2022) (Court applying an expansive interpretation of the Howey test with the SEC winning its lawsuit against LBRY Inc, a blockchain based video-sharing company, its LBC coins which were offered and sold as unregistered securities violating § 5 of the Securities Act).

- Diamond Fortress Techs., Inc. v. EverID, Inc., 274 A.3d 287, 308 (Del. Super. Ct. 2022) (Defendant failed to deliver securities after payment on a contract, the Court found that damages should be calculated as the higher value of the tokens’ value at time that the agreement was breached or by the token’s highest intermediate value between when the breach was noticed and a reasonable time of a plaintiff’s discovery of the breach.)

- Securities Class Action Filings 2022 Year in Review, Cornerstone Research at 36 (2023), https://www.cornerstone.com/wp-content/uploads/2023/01/Securities-Class-Action-Filings-2022-Year-in-Review.pdf.

- Takata v. Riot Blockchain, Inc., No. CV1802293ZNQTJB, 2022 WL 1058389, at *1 (D.N.J. Apr. 8, 2022).

- Id. at *1.

- Id. at *10.

- Kevin LaCroix, 2022 Federal Court Securities Suit Filings Decline Slightly Relative to Recent Years, D&O Diary (Jan. 2, 2023), https://www.dandodiary.com/2023/01/articles/securities-litigation/2022-federal-court-securities-suit-filings-decline-slightly-relative-to-recent-years/; Kevin LaCroix, What to Watch Now in the World of D&O, D&O Diary (Sept. 5, 2022), https://www.dandodiary.com/2022/09/articles/director-and-officer-liability/what-to-watch-now-in-the-world-of-do-11/.