Dechert Survey: Developments in Securities Fraud Class Actions Against U.S. Life Sciences Companies

2021 Edition

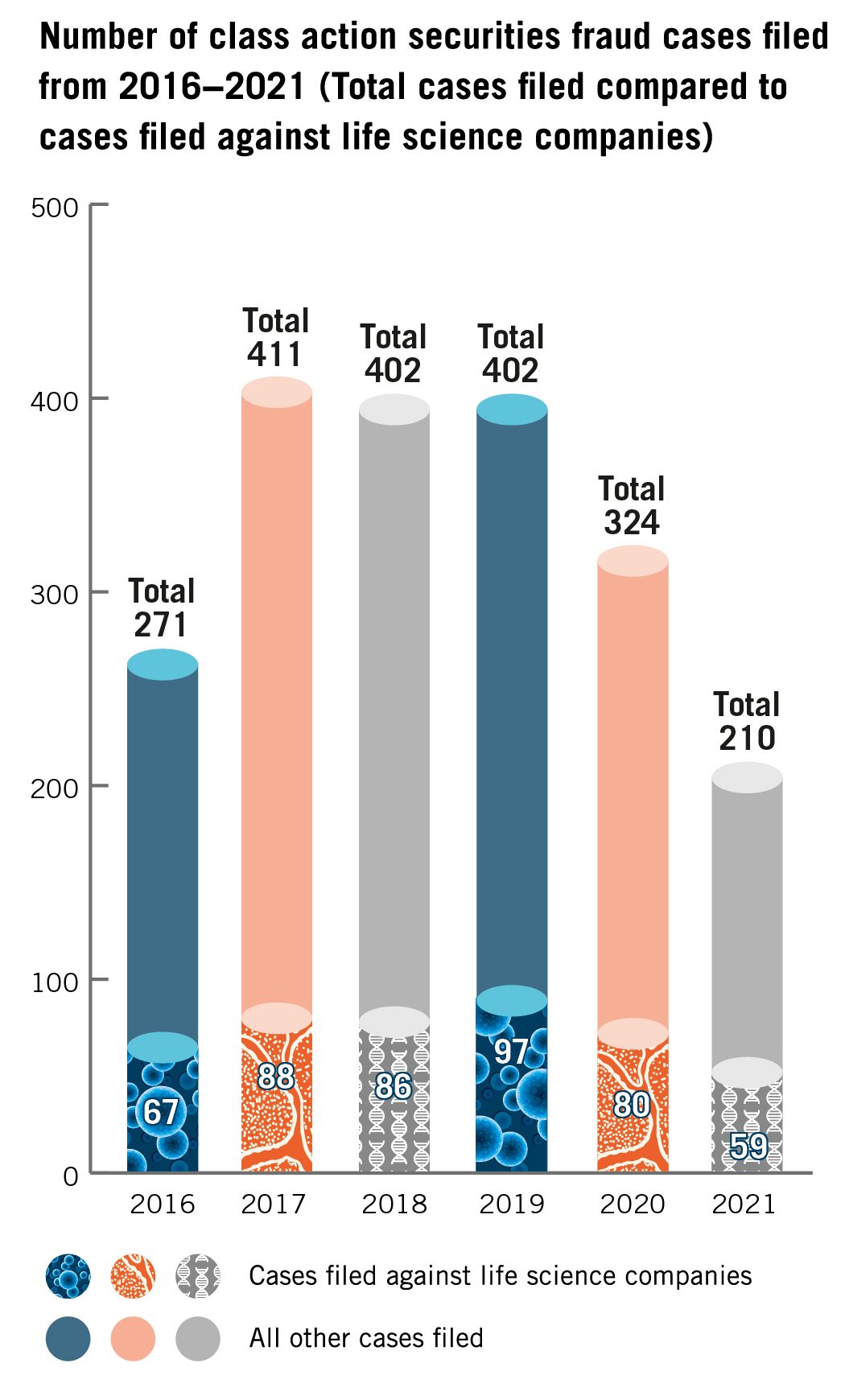

In 2021, securities class action litigation on the whole remained at a steady high, and life sciences companies were, once again, popular targets of such lawsuits1. In this whitepaper, we analyze and discuss trends identified in last year’s filings and decisions so that prudent life sciences companies can continue to take heed of the results.

Plaintiffs filed a total of 59 securities class action lawsuits against life sciences companies in 2021. Filings against life sciences companies in 2021 represented a 17.5 percent decrease from the previous year, but a 19.4 percent increase from five years prior. Of these cases, the following trends emerged:

- Consistent with historic trends, the majority of suits were filed in the Second, Third and Ninth Circuits, with a 19.3 percent increase in suits filed in the Ninth Circuit. The Third Circuit, on the other hand, saw a 57.9 percent decrease in filings from the previous year — from 29 in 2020 to nine in 2020. Within these circuits, the Northern District of California had the most filings, with 13 overall.

- A few plaintiff law firms were associated with about three-fourths of the filings against life sciences companies: Pomerantz LLP (27 complaints), Glancy Prongay & Murray LLP (11 complaints) and Bronstein, Gewirtz & Grossman, LLC (8 complaints).

- Slightly more claims were filed in the second half of 2021 than in the first half, with 29 complaints filed in the first and second quarters, and 30 complaints filed in the third and fourth quarters.

- 6 cases were filed against companies with COVID-19-related products.

An examination of the types of cases filed in 2021 reveals continuing trends from previous years.

- About 40.7 percent of claims involved alleged misrepresentations regarding product efficacy and safety, with many of these cases involving alleged misrepresentations regarding negative side effects related to leading product candidates, which could at times impact the likelihood of Food and Drug Administration (FDA) approval.

- About 32.2 percent of the claims arose from alleged misrepresentations regarding regulatory hurdles, the timing of FDA approval or the sufficiency of applications submitted to the FDA.

- Approximately 22 percent of the claims alleged misrepresentations regarding purported unlawful conduct in both the United States and abroad, including (but not limited to) illegal kickback schemes, anticompetitive conduct, tax issues and inadequate internal controls in financial reporting.

- About 25.4 percent of the claims involved alleged misrepresentations of material information made in connection with proposed mergers, sales, IPOs, offerings and other transactions.2

Courts throughout the country issued decisions in 2021 involving securities fraud actions against life sciences companies, including:

- Claims that arose in the development phase, such as cases involving products failing clinical trials that are required for FDA approval, or products not approved by the FDA, where courts were more likely to grant motions to dismiss in full than to deny them, either in whole or in part.

- Claims that were independent of or arose after the development process, where courts were more likely to grant motions to dismiss in full than to deny them, either in whole or in part.

- Claims based on the financial management of life sciences companies, which generally split between plaintiff and defendant-friendly outcomes.

Given the numbers from this and recent years’ filings, and accounting for the COVID-19 pandemic, there is no indication that the filings of securities claims against life sciences companies is going to slow down any time soon. The decisions this year resulted in mixed outcomes, with 19 opinions decided in favor of defendants,3 10 opinions denying motions to dismiss (including one reversal of dismissal on appeal), and eight opinions in which only partial dismissal was achieved.4 In addition, appellate courts also rendered opinions. There was only one appellate court decision rendered, and in that case the Court of Appeals affirmed in part, vacated in part, and remanded for further proceedings. These numbers illustrate how life sciences companies remain attractive targets for class action securities fraud claims. Therefore, companies should continue to stay abreast of recent developments and implement best practices to reduce their risk of being sued.

_____________

1 2017 saw a record increase of class action securities litigation overall with 411 cases, up from the 271 securities class actions filed in 2016. In 2020, 324 securities class actions were filed while 210 were filed in 2021.

2 It should be noted that 21 of all 2021 filings fell in more than one category.

3 Throughout this whitepaper, the terms “company” or “defendants” may be used to also include individual officers or directors.

4 The cases were compiled through Westlaw searches of dispositive orders involving the Private Securities Litigation Reform Act (PSLRA) between January 1 and December 31, 2021, and cross-referencing them against filters in the Securities Class Action Clearinghouse filings by “Healthcare.” In many cases, the court dismissed the operative complaint without prejudice and amended complaints are anticipated.

Previous Survey Results

See the results from previous surveys