DAMITT Q1 2018 Update: Trend Toward Longer Antitrust Merger Investigations Slowing or Reversing, But Activity Levels Similar to Recent Years

Fast Facts

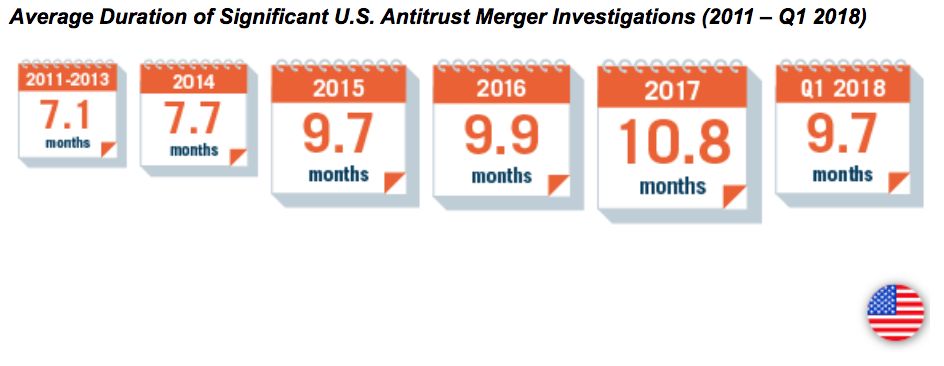

- There are signs that the six-year trend toward longer significant investigations may be slowing or reversing.

- Significant U.S. merger investigations lasted an average of 9.7 months in Q1 2018, the second quarter in a row the average was under 10 months.

- The number of significant U.S. merger investigations over the last 12 months — 31 — was similar to the level in the prior three years.

- The three U.S. agency complaints in Q1 2018 matched the number from all of 2017.

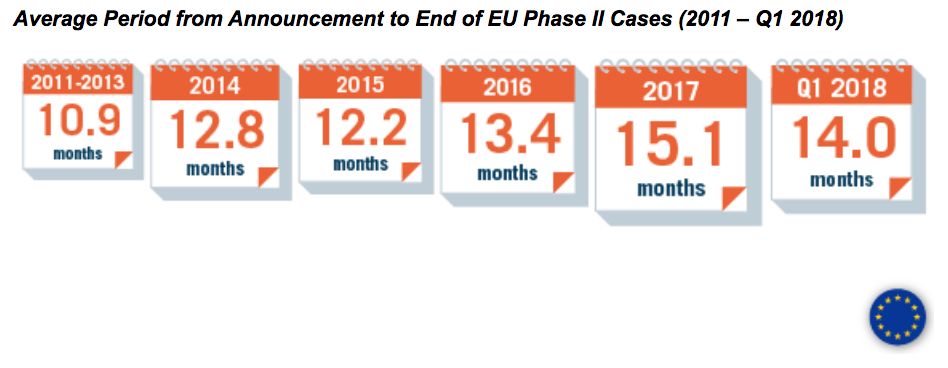

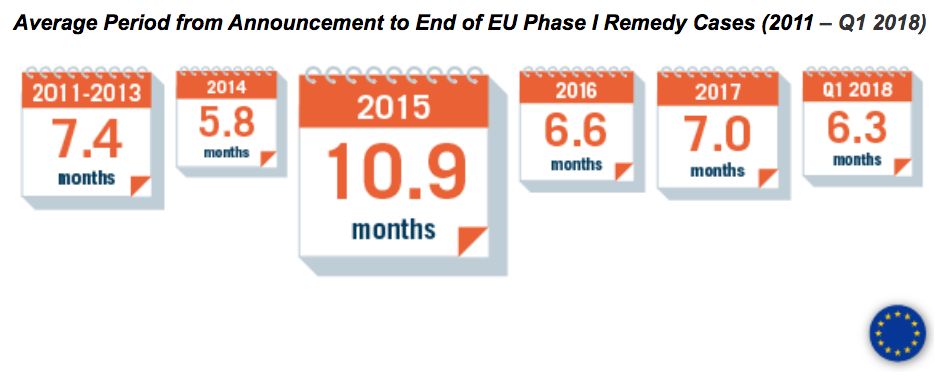

- EU Phase I (with remedies) and Phase II proceedings in Q1 2018 averaged 6.3 and 14.0 months, respectively, both down from the Q4 2017 and 2017 averages.

- The four EU Phase II proceedings concluded during Q1 2018 were one shy of the total number of Phase II cases during all of 2017.

After a six-year trend of increasingly longer antitrust merger investigations, DAMITT, the Dechert Antitrust Merger Investigation Timing Tracker, is finding signs that the trend might be slowing or even reversing, both in the United States and the EU, despite stable or increasing levels of enforcement activity.

Significant U.S. antitrust merger investigations resolved in Q1 2018 lasted an average of 9.7 months—about a month faster than the record high of 10.8 months in 2017. This is the second quarter in a row for which the average duration has been under 10 months, after six consecutive quarters in which the duration exceeded 10 months. The Trump administration appears to be moving faster on more recently announced transactions. On a rolling twelve-month (RTM) basis, investigations of these more recently announced transactions took an average of only 8.1 months. Importantly, investigations of more recently announced transactions comprised 42% of all significant U.S. antitrust merger investigations resolved, up from 28% in the RTM ending Q1 2017, as the backlog of older investigations continues to be drawn down under the new administration. The seven significant U.S. antitrust merger investigations resolved in Q1 2018 represent the second highest level of Q1 enforcement on record with DAMITT while the 31 significant U.S. antitrust merger investigations resolved in the last 12 months is on par with the average of 32 resolved in the same period in each of the three prior years.

EU Phase II investigations concluded in Q1 2018 lasted an average of 14.0 months from announcement to decision, down slightly from the record-high 15.1 months in 2017. As in the United States, this was the second consecutive quarter of quicker investigations, after four of the previous five quarters recorded average durations in excess of 14.0 months. However, the number of cases proceeding to Phase II proceedings was up significantly, with four Phase II investigations resolved in Q1 2018 compared to five in the entirety of 2017. The duration of the single investigation cleared with Phase I remedies during Q1 2018 was 6.3 months, slightly faster than the averages for 2016 and 2017. In light of the often extensive pre-filing discussions with staff of DG Competition, the average duration of significant EU merger investigations still lasts significantly longer than the theoretically fixed schedule for EU investigations.

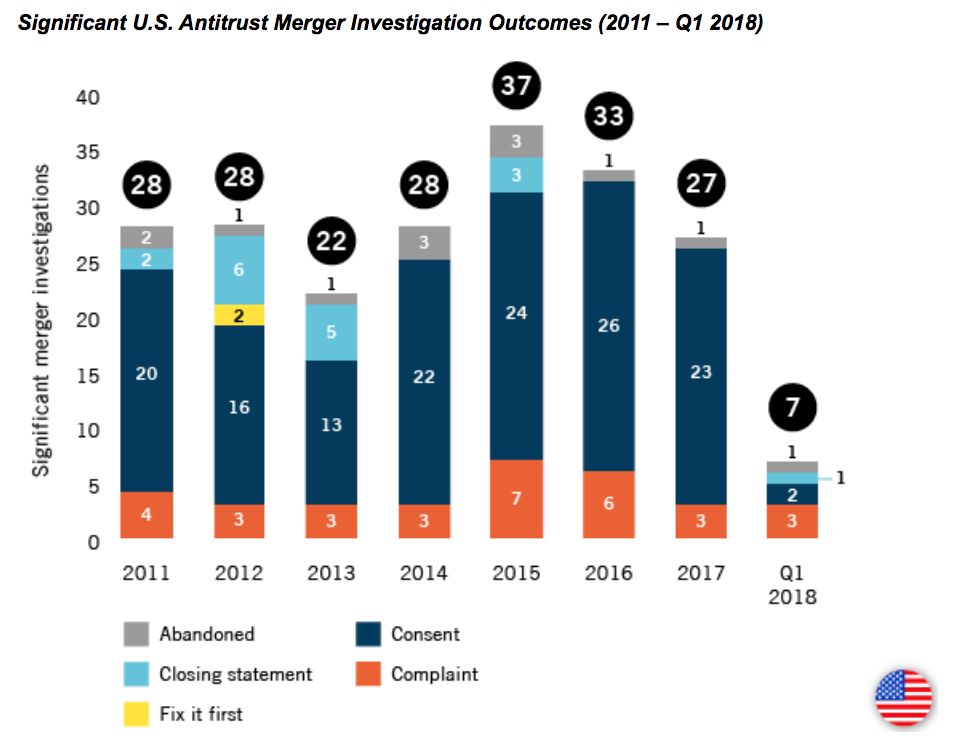

Number of Significant U.S. Merger Investigations Similar to Prior Year, But the Number of Complaints Filed in Q1 2018 Equaled All of 2017

There were 31 significant U.S. merger investigations concluded by the Department of Justice (DOJ) and Federal Trade Commission (FTC) over the RTM ending Q1 2018, similar to the 32 in the same period in the prior year but on pace to exceed the 27 that concluded during calendar year 2017.

“Significant U.S. merger investigations” include investigations of proposed Hart-Scott-Rodino (HSR)-reportable transactions that result in a closing statement, consent order, complaint challenging a transaction, or transaction abandonment for which the antitrust agency issues a press release during the year in question. A total of 34 significant U.S. investigations concluded during the 14 months after President Trump's inauguration, down slightly from the 41 significant investigations during the 14-month period prior to inauguration. However, Q1 2018 proved to be busier than usual with 7 total significant investigations, well above the average of 4.3 significant investigations concluding during Q1s from 2011-2017. If this pace continues, the antitrust agencies’ activity levels in 2018 could be similar to the record-setting levels observed near the end of the Obama administration.

Significant U.S. investigations concluding during Q1 2018 produced some unusual outcomes:

- Three resulted in the filing of a complaint, already matching the number recorded in all of 2017.

- More resulted in complaints (3) than consents (2) during the quarter for the first time in the last five years and for only the second time since 2011.

- For the first time since Q3 2015, the “closing statement” outcome returned. The FTC issued an explanation of its decision to clear the Essilor/Luxottica transaction. Closing statements provide companies and antitrust counsel with better guidance for conducting antitrust risk assessments. It remains to be seen whether this closing statement is a sign of increased efforts for transparency by the agencies.

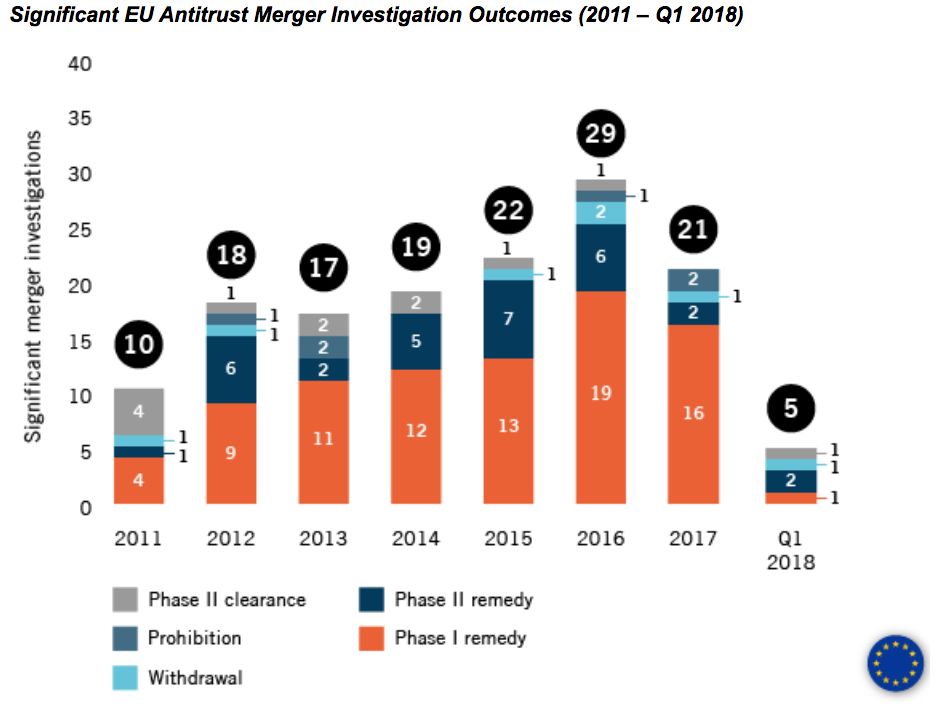

Number of Significant EU Merger Investigations Is on Pace with 2017, But Q1 2018 Has Already Seen Nearly as Many Phase II Proceedings as All of 2017

There were five significant EU merger investigations in Q1 2018, on pace with the 21 significant EU merger investigations that concluded in 2017. In light of the procedural differences between the EU and the United States, DAMITT defines “significant” EU merger investigations to include transactions subject to the EU Merger Regulation and resulting in either Phase I remedies or the initiation of a Phase II investigation.

While the number of total proceedings is on a pace similar to 2017, the distribution between Phase I transactions resulting in remedies and Phase II proceedings shifted significantly. In 2017, 16 of the 21 significant EU merger investigations (76%) were resolved with Phase I remedies, compared to only one of five (20%) in Q1 2018. The four Phase II proceedings that concluded during Q1 2018 were just shy of the five Phase II proceedings that concluded during all of 2017. In addition, while two of the five Phase II proceedings in 2017 led to the transaction being blocked, none of the four Phase II proceedings was blocked in Q1 2018.

The Average Duration of Significant U.S. Investigations Was Similar to the Prior Year, But Investigations of Transactions Post-Dating President Trump’s Inauguration Have Moved More Quickly

The average duration of significant U.S. merger investigations was 10.4 months during the RTM ending Q1 2018, the same average duration as in the prior 12 months. However, the average duration of significant U.S. investigations concluding during Q1 2018 was only 9.7 months, which was faster than the 10.8 month average for 2017.

As noted in the DAMITT 2017 year-in-review, recent remarks by a senior official in the Department of Justice’s Antitrust Division, citing DAMITT’s findings, suggested that the current DOJ administration may be taking steps to shorten U.S. merger investigations. There is some evidence that the Trump administration might be cleaning up the backlog and speeding up the review of more recently announced transactions, as investigations of transactions announced prior to the Presidential election took disproportionately longer than investigations of later transactions. Thirteen of the 31 significant U.S. antitrust merger investigations resolved in the last 12 months (42%) related to transactions announced after Inauguration Day, January 20, 2017. By comparison, only nine of the 32 significant U.S. antitrust merger investigations resolved in the prior 12 months (28%), related to transactions announced after January 20, 2016. In both periods, the investigation of the more recently announced transactions took an average of only 8.1 months. As the backlog of older investigations burns off, the average duration of significant U.S. antitrust merger investigations could continue to fall.

The Average Duration of Significant EU Merger Investigations Was Down Slightly in Q1 2018 Compared to 2017 But Significantly Longer Than the “Fixed” Timetable

The four Phase II EU proceedings that concluded in Q1 2018 lasted an average of 14.0 months from announcement, about double the theoretical duration of the fixed timetable under the EU Merger Regulation. The single Phase I remedy case that ended in Q1 2018 lasted 6.3 months, more than triple the theoretical period under the EU Merger Regulation. While both figures have declined compared to 2017, they continue to reflect the significant duration of pre-filing talks and the frequent use of timetable extensions in Phase II.

Phase II Proceedings

The 14.0 month average duration for Q1 2018 EU Phase II proceedings represented about a 7% decrease from the 15.1 month average in 2017 but a slight uptick from the 13.4 month average in 2016. The average duration of Phase II investigations had been climbing steadily since 2011 when it was 9.4 months. This average compares to a theoretical formal timetable of six to seven months counting from the moment of notification. DAMITT data thus show that the average EU case proceeding to Phase II is taking about four months longer than the average duration of significant U.S. merger investigations.

The stand-out case in Q1 2018 in terms of duration was Bayer/Monsanto, which ran for 9.6 months from announcement until notification and a total of 18.4 months until clearance.

The time between announcement and notification of Phase II transactions that were concluded in Q1 2018 was 6.5 months, almost two months shorter than the 8.3 month average during 2017 but well above the 2011-16 average of 4.9 months. Merging parties invariably institute pre-filing talks with DG Competition staff very shortly after transaction announcement, if not before, and the growth of the period between announcement and notification is mostly explained by the intensity of staff demands for the inclusion of materials in the filing, before the formal timetable is triggered.

Three of the four Q1 2018 Phase II investigations (75%) entailed the use of “voluntary” extensions of time under Article 10(3) of the EU Merger Regulation. These Article 10(3) extensions are common practice in Phase II investigations, occurring in 88% of all Phase II investigations during the 2011-17 period analyzed by DAMITT and typically consuming the entire three weeks permitted. These extensions may be at the behest of the parties (for example, to create space for a remedy discussion), but are often conceded at the instigation of staff.

The Commission also used its powers under Article 10(4) of the EU Merger Regulation to “stop the clock” in three of the four Q1 2018 Phase II investigations. This power relates to parties missing deadlines to respond to information requests, and its use added an average 0.8 months to each of these investigations. By comparison, only 40% of 2017 Phase II investigations and 30% of 2011-16 Phase II investigations were hit with “stop the clock” orders, also adding an average of 0.8 months.

The overall duration of cases going to Phase II reflects the increased intensity of the examination. This may be defensive lawyering on the Commission’s part: the Bayer/Monsanto decision runs to more than 1,300 pages. But it also reflects an increased focus on internal documents, with EU proceedings in that sense aligning with U.S. “second request” practice. The pros and cons of this tendency may be debated, but on any basis it contributes to the reason why the average duration of cases that proceeded to Phase II is greatly exceeding the EU timetabling system.

Phase I Proceedings

Only one significant EU investigation was resolved in Phase I with remedies during Q1 2018. This investigation lasted 6.3 months, which was below the 7.0 month average duration for 2017 and the 6.6 month average for 2016. However, this Phase I investigation still required more than triple the formal EU timetable of about seven weeks.

The time between announcement and notification for this Phase I remedy case was 4.3 months, which was slightly faster than the 5.2 month average in 2017 and the 4.9 month average in 2016. During the pre-filing period, companies typically engage in extensive discussions with DG Competition staff over the scope and detail of the parties’ filing, which adds time to the formal schedule.

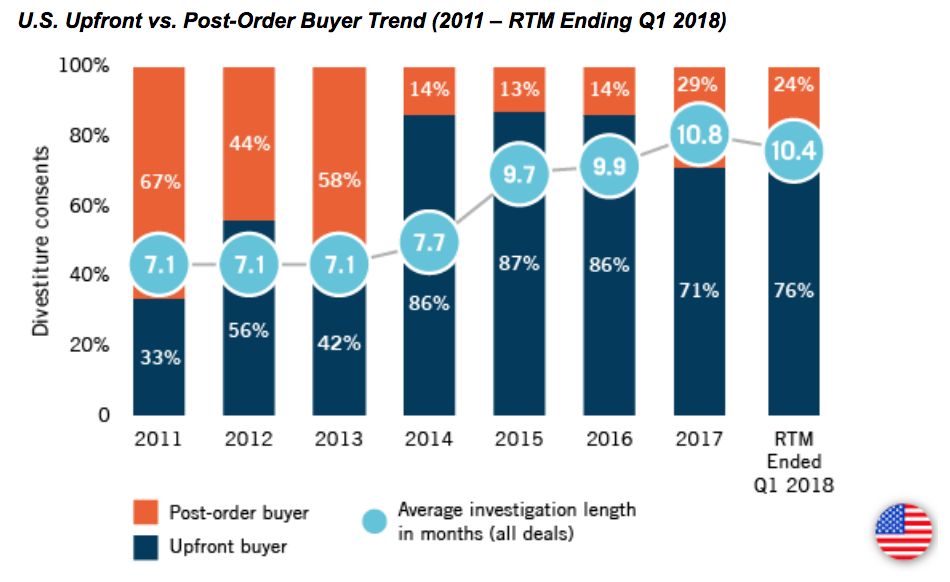

Percentage of U.S. Divestiture Consents Requiring Upfront Buyers Is Down Slightly But Consistent with Recent Years

The U.S. agencies’ consent orders generally continued to require upfront buyers. The percentage of divestiture consent orders requiring upfront buyers was 76% over the RTM ending Q1 2018 (including both of the divestiture consents during Q1 2018), down slightly from 84% in the same period in the prior year. The 76% statistic is still well above the 43% average during the 2011-13 period during which post-order buyer consents were more common, showing a continuation of the recent trend toward the agencies including upfront buyer requirements.

When an upfront buyer is required, before the merging parties can consummate their transaction, they must find a willing and able buyer, negotiate a purchase agreement with that buyer for the divested assets, and present that purchase agreement, the buyer’s business plan, and other information to the agency as part of the approval process. This process can add significant time to the investigation. Between 2011 and Q1 2018, DAMITT has observed that investigations ending with consents requiring upfront buyers lasted about two months longer than those with consents permitting the merging parties to find and negotiate with divestiture buyers after consummating their transaction.

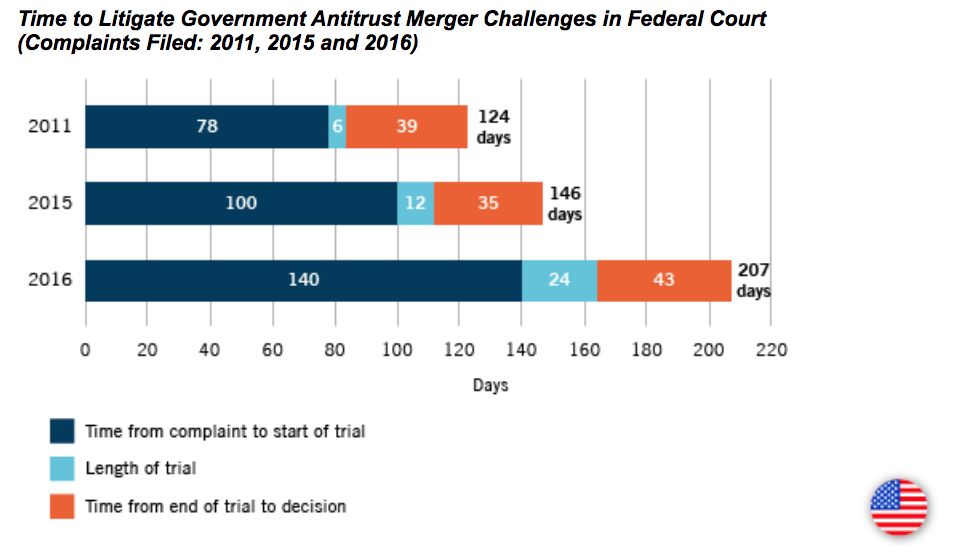

AT&T/Time Warner Trial Reaches Start of Trial Faster Than Past Cases But Is Scheduled to Last More Than Twice as Long as Trials in Recent Years

Prior DAMITT analyses found that U.S. antitrust merger litigation in federal court was trending longer, too. In 2016, an average of seven months passed from the filing of the complaint to the judge’s decision. Although three significant U.S. investigations ended in 2017 with the agencies filing a complaint, only one of these litigations—AT&T/Time Warner—has a scheduling order available and has proceeded to trial in federal court. Of the two other complaints in Q1 2018, one was abandoned by the companies after the FTC filed an administrative complaint and the other has only proceeded in the FTC’s administrative court thus far, not in federal court.

As an update to DAMITT’s prior coverage of the AT&T/Time Warner trial, which is currently in progress, the trial started only 122 days after the agency filed its complaint, nearly three weeks faster than the average of 140 days in 2016. However, the trial is scheduled to last up to 8 calendar weeks, which would be significantly longer than the average trial length of 24 calendar days recorded in 2016. This difference is partially explained by the facts that each trial day in this case is expected to be shorter than in past merger trials and there are only four trial days scheduled per week. In addition, AT&T and Time Warner amended their transaction agreement to extend the drop-dead date from April 22, 2018 to June 21, 2018 at the strong urging of the judge, which allowed for a lengthier trial than usual.

The time between the end of the AT&T/Time Warner trial and the issuance of the judge’s decision remains to be determined. In the most recent 2016 merger trials, judges issued their merger decisions an average of 43 days after the end of trial. If the AT&T/Time Warner judge matches this pace, an opinion would be rendered in early to mid-June, just ahead of the companies’ termination date

Conclusion

The duration of significant investigations declined during Q1 2018 in both the United States and the EU and may signal a reversal in the trend observed by DAMITT over the past few years. While the circumstances of future antitrust-sensitive transactions may lead to results above or below DAMITT averages, the latest statistics suggest that parties to the hypothetical average “significant” deal subject to review only in the United States would have to plan on approximately 10-11 months for the agencies to investigate a transaction and another seven months if they want to preserve their right to litigate an adverse agency decision. Deal timetables for cases likely to go to a European Phase II need to account for an average lapse of about 15 months from announcement to clearance. After slight declines in the number of significant investigations during 2017, the initial data suggest that 2018 may be a busy year for antitrust enforcers in both the United States and the EU.