DAMITT 2022 Year in Review: Merger Control Trends in Germany and France

Since 2020, our antitrust/competition practice has expanded the Dechert Antitrust Merger Investigation Timing Tracker (DAMITT) to include Germany and France. This supplements DAMITT’s U.S. and EU coverage with comprehensive analysis of key merger control indicators before the German Federal Cartel Office (FCO) and the French Competition Authority (FCA), including the duration of merger control reviews in both jurisdictions and the outcome of the competition authorities’ reviews.

Both the French and German authorities are particularly active in merger control at the Member State level within the EU. Companies should keep these jurisdictions on their radar in planning their next transaction, using DAMITT data as a guidepost.

Fast Facts

Germany

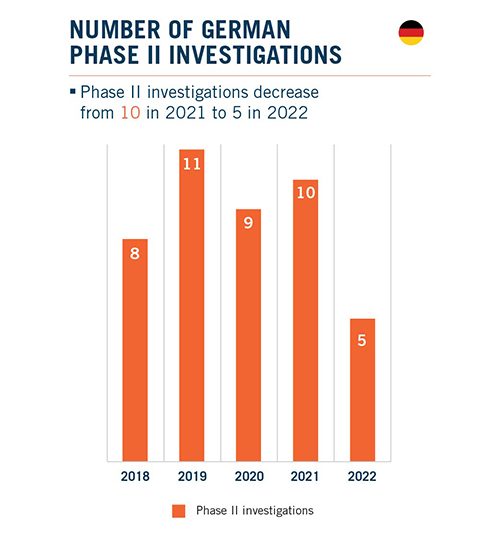

- In 2022 there was a stark decline in the number of filings following the recent reform of the German Act against Restraints of Competition. Only five significant investigations were concluded, a 50 percent drop compared to 2021.

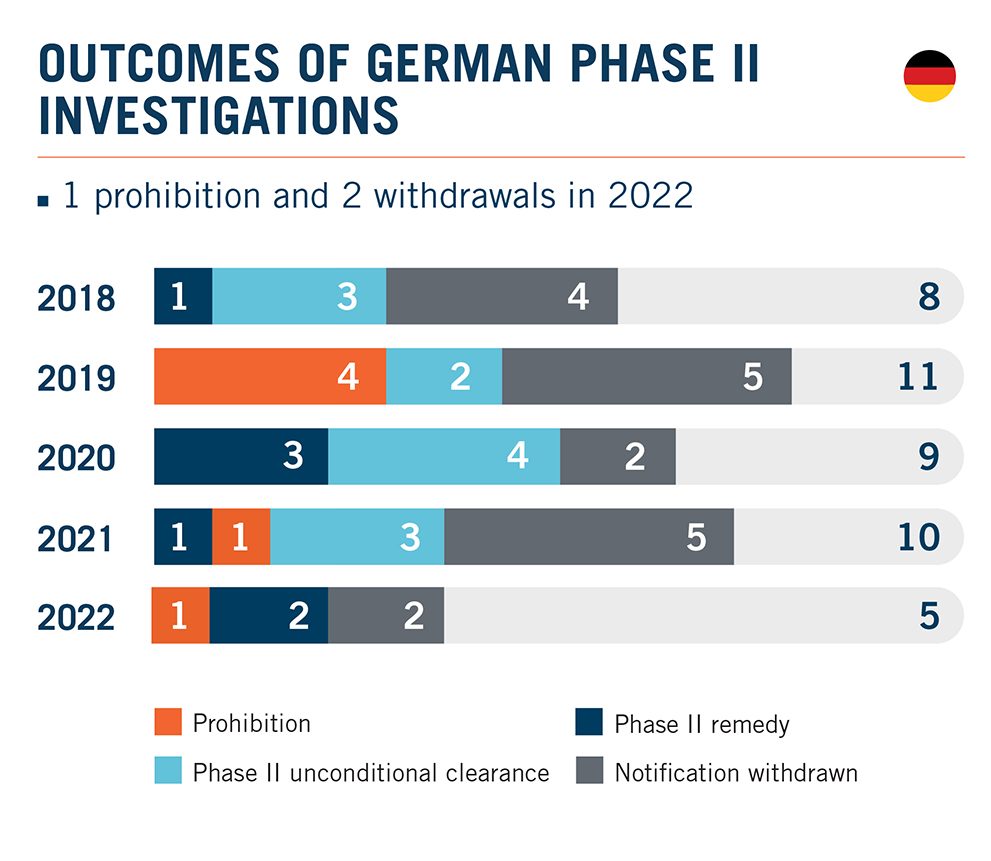

- In line with 2021 statistics, 60 percent of the Phase II merger investigations concluded in 2022 did not result in a clearance of the transaction by the FCO.

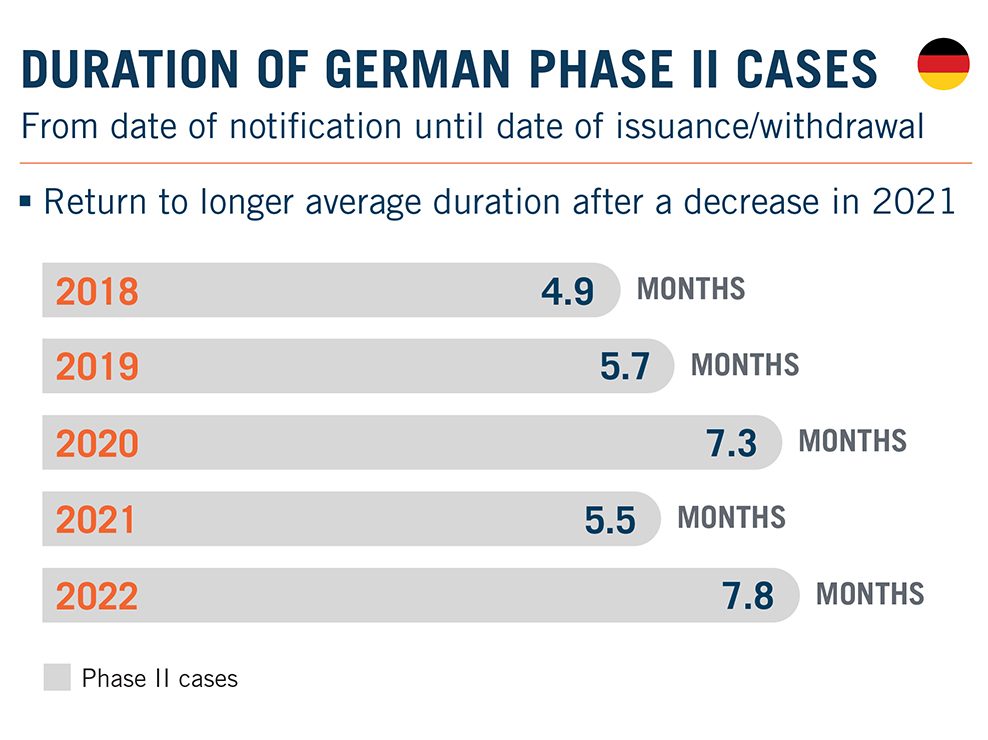

- The average duration of Phase II investigations reached a peak of 7.8 months in 2022 that exceeds the previous high of 7.3 months in 2020.

France

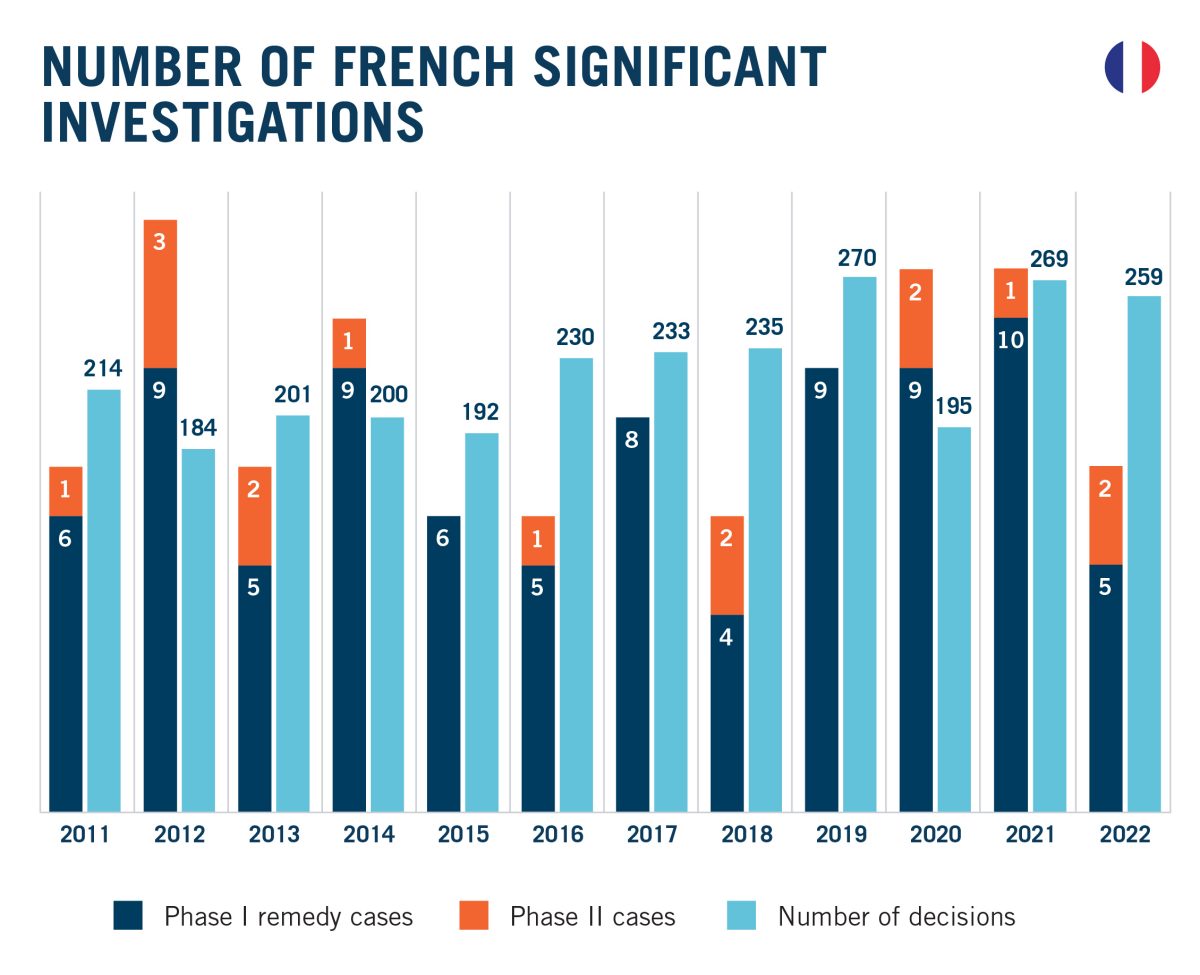

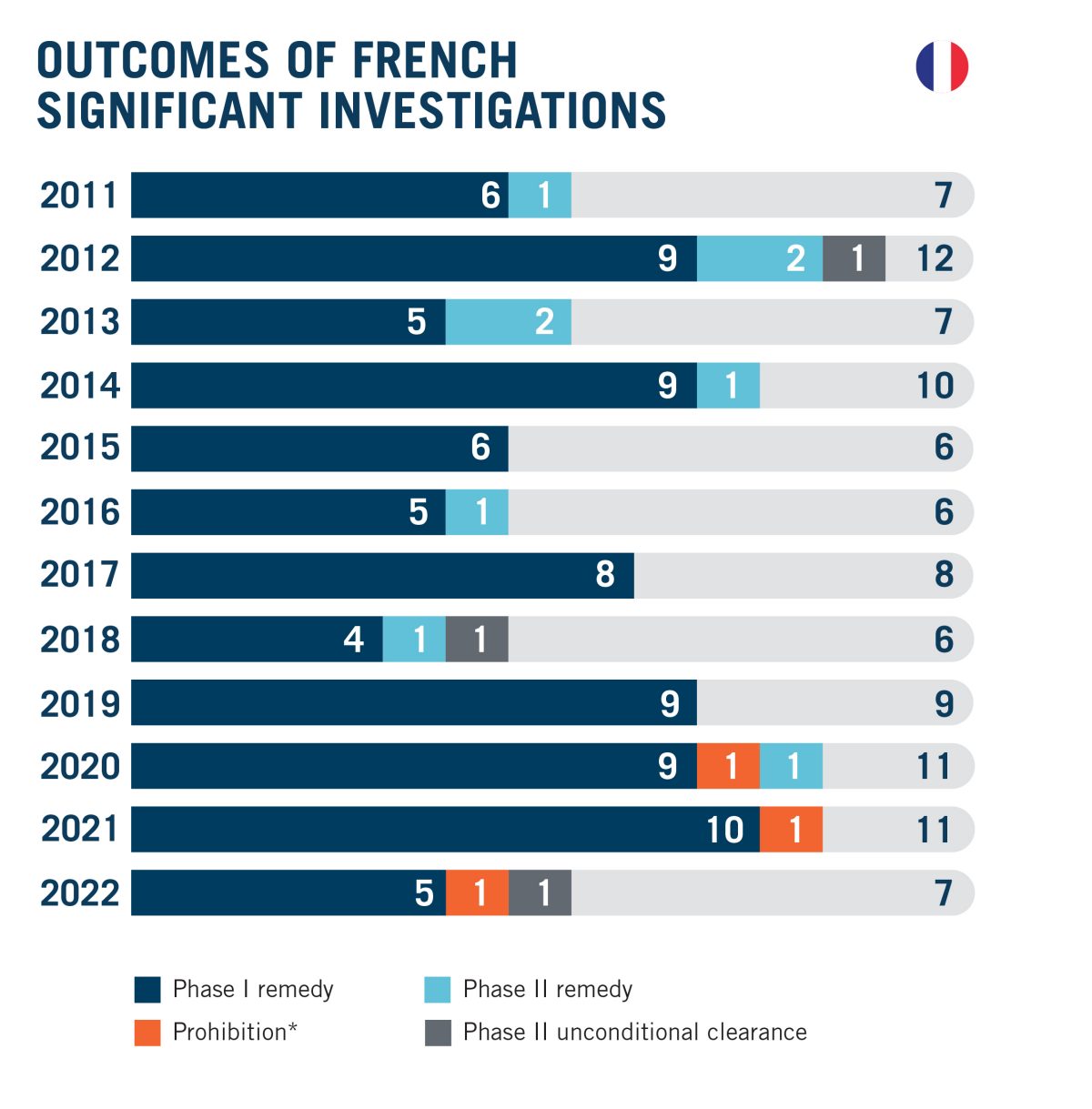

- The number of merger control decisions issued by the FCA slightly decreased by 3.7 percent in 2022 compared to 2021. Meanwhile, the number of significant investigations drastically decreased by 36.4 percent compared to 2021, with only 7 significant investigations completed in 2022.

- Although the FCA did not issue any “formal” prohibition decision in 2022, the agency’s in-depth investigation of the high-profile TF1/M6 resulted in the deal being abandoned by the merging parties.

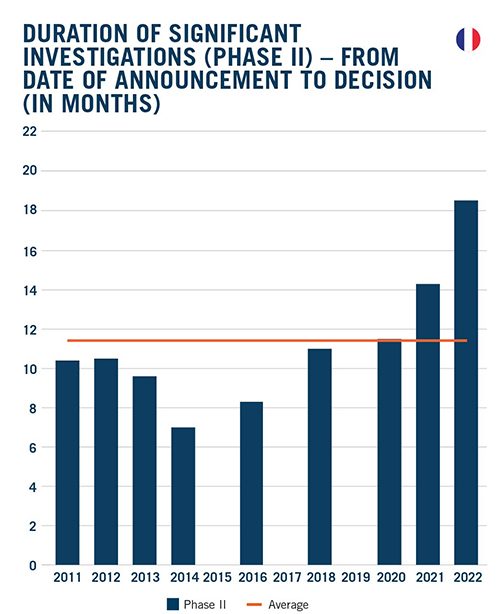

- The average duration of Phase II investigations hit a record of 18.5 months. The duration of Phase I proceedings followed the same trend, reaching an average of 9.9 months – a 59.7 percent increase compared to 2021.

The DAMITT Supplement for Germany and France is a yearly study from Dechert LLP’s antitrust/competition practice reporting on trends in significant merger control investigations in major EU jurisdictions.

In Germany, “significant” merger investigations cover all Phase II investigations by the German Federal Cartel Office.

In France, DAMITT defines “significant” merger investigations along the line of our EU report, including all reportable mergers under the French merger control regime which either (i) were cleared in Phase I with commitments, or (ii) went through a Phase II investigation, irrespective of the outcome of the review.

In 2022, the total number of notifications to the German Federal Cartel Office (“FCO”) declined by around 20 percent on an annual basis (from around 1,000 in 2021 to around 800 in 2022).

Five significant investigations were concluded by the FCO in 2022. Two of those cases were cleared with remedies. Two notifications were withdrawn by the companies involved in the course of the FCO’s Phase II review. One merger was prohibited.

The FCO demonstrated its usual versatility in its Phase II cases, investigating mergers from a wide range of sectors, including energy, construction, metal trading, advertising marketing of media products and food processing.

In 2022, the average duration of merger investigations that proceeded to Phase II increased from 5.5 months to 7.8 months. This number is significantly higher than the average durations seen in prior years which ranged between 4.6 and 5.7 months.

Number of Notifications Declines Further

However, the longer average duration recorded in 2022 was mostly due to one investigation that lasted for almost 10 months, and another one that lasted approximately 9 months. The ten-month investigation involved China International Marine Containers Group’s (CIMC) envisaged acquisition of Maersk Container Industry (MCI). The notification was ultimately withdrawn after the FCO raised concerns that the transaction would leave CIMC with a global market share of 60-70%. The nine-month investigation concerned the strategic merger between E.ON’s subsidiary Westenergie, on the one hand, and Rheinenergie, on the other hand. It was cleared on the condition that substantial parts of Rheinenergie’s heating electricity business be transferred to a third party.

The other three investigations exceeded the previous average durations as well, as they ranged between approximately 6.5 and 7.5 months. They concerned the planned acquisition of the business operations of Nassauische Neue Presse by VRM Holding GmbH & Co. KG, which was ultimately withdrawn, the clearance of the takeover of the OMV petrol station network by EG Group (Esso) on the condition that 48 sites be sold to third parties, and the prohibition of the merger between family-owned Birco GmbH and Ahlmann SE & Co. KG in order to avert a dominant position in line drainage. In line with previous years, less than one percent of the transactions notified in Germany were subject to an in-depth Phase II investigation.

Looking Ahead

While the number of merger investigations conducted by the FCO remains considerable, a downward trend can be seen which can be attributed, to a large extent, to the new merger control thresholds introduced in 2021. In combination with the significant decline in M&A activity compared to 2021 levels, this could mean another record low in 2023.

Following public pressure related to high gas prices in Germany, Robert Habeck, the Federal Minister of Economics, announced in the summer of 2022 that he intends to create an “antitrust law with claws and teeth”. He subsequently presented the draft bill of the 11th amendment to the German Act against Restraints on Competition (“GWB”). On 5 April 2023, the Federal Cabinet passed a slightly softer version of the proposed 11th amendment. According to the draft, the FCO would be allowed to take far-reaching measures to improve the conditions of competition directly after a sector enquiry and irrespective of any concrete antitrust infringements having been identified. Under the proposed rules, the FCO would also be able to investigate possible violations of the Digital Markets Act. The draft also facilitates the FCO's ability to recover economic benefits obtained through antitrust law violations. The proposed 11th amendment must now pass through the legislative process in the Federal Parliament (Bundestag) and the Federal Council (Bundesrat).

In parallel, in fall of 2022, the Working Group on Antitrust Law, a group of economics and law professors as well as judges of the antitrust senates in Germany, discussed a notification requirement for all mergers involving certain large digital groups, so-called gatekeepers, based on, the model of Article 14 of the Digital Markets Act, which entered into force in November 2022. Against this background, it is proposed to introduce a notification requirement for mergers involving undertakings falling under Section 19a (1) GWB, i.e., large digital groups which are of paramount significance for competition across markets, such as Amazon, Alphabet/Google and Meta/Facebook, as found by the FCO. Again, to what extent the discussion will be reflected in practice remains to be seen.

Sustained Activity in 2022 but Drastic Decrease in Number of Significant Investigations

The number of decisions issued by the FCA remains high in 2022, with a total of 259 decisions. For now, the impact of the international context on the FCA's activity seems limited in view of the high number of decisions issued in 2022, down by only 3.7% compared to 2021. Simplified merger procedures, represented 86.5% of the decisions issued in 2022 (stable compared to 2021) and the FCA’s workload is still dominated by the retail sector, which accounted for close to 50% (48.3%) of the FCA's 2022 merger decisions due to the lower thresholds applicable to these transactions, a proportion similar to 2021. Despite a steady activity level, the number of significant investigations dropped by 36.4% compared to 2021, with a total of only 7 significant investigations concluded in 2022. These figures are more in line with the pre-pandemic landscape, confirming that the last three years were particularly exceptional in terms of the FCA's handling of complex cases.

While significant investigations only account for 2.7% of the FCA’s activity, the outcome of these investigations continues to evidence the harder stance taken by the FCA in recent years in merger reviews. Among the two Phase II investigations conducted in 2022, although one resulted in an unconditional clearance (Conforama/Mobilux)1 – something that had not happened since 2018 –the other resulted in the high-profile media transaction between TV groups TF1 and M6 being withdrawn by the parties to avoid a prohibition decision2.

Interestingly, in Conforama/Mobilux, unconditional clearance was granted following the first application by the FCA of the failing firm defense. The case was reviewed by the FCA after being referred by the Commission based on Article 4(4) of the EU Merger Regulation in June 2020.3 A month later, in July 2020, the FCA exceptionally agreed to waive the standstill obligation – given the serious financial difficulties encountered by the target – in order for Mobilux to effectively acquire control over Conforama without waiting for a clearance decision. Following its in-depth investigation,4 the FCA confirmed (1) that without the planned acquisition the target would have shortly exited the market, (2) that there was no less harmful alternative transaction and (3) that Conforama exiting the market would not be less detrimental to consumers than the proposed acquisition.

While the TF1/M6 case did not lead to a “formal” prohibition decision, the FCA issued a press release after the deal was withdrawn, confirming that it was on the verge of blocking the transaction despite the major structural commitments offered by the Parties.5 This is consistent with the FCA activity in the last couple of years, with one blocked deal per year. And with the French Administrative Supreme Court upholding the FCA’s first prohibition decision (originally issued in 2020) in July 2022,6 this trend is unlikely to stop.

* The TF1/M6 investigation is considered a completed investigation for the purpose of this report. See FCA’s press release dated 16 September 2022, TF1/M6, in which the FCA “acknowledges the announcement made by Bouygues to withdraw its plan to acquire exclusive control of [M6]” after the case was heard by the College of the FCA.

Average Duration of Significant Investigations Reaches Unprecedented Levels

The average duration of Phase II investigations – taken from the date of announcement of the notification to the date of the decision – has reached a record of 18.5 months in 2022, representing an uptake of 27.6% compared to 2021, and a consistent increase since 2014 onwards. This average takes into account the 15 months investigation in TF1/M6 and the 22 months investigation in Conforama/Mobilux. It is worth noting that in these two cases, the duration of the prenotification talks reached 7.5 months and 4.9 months respectively (representing an average of 6.2 months in 2022 and a slight decrease compared to the 2021 record of 6,5 months).

The duration of significant investigations cleared in Phase I with remedies followed a similar path, with an average duration of 9.9 months in 20227 – a 59.7% increase compared to 2021 and a record based on our DAMITT data (starting in 2011). This exceptional duration is however triggered by the specific circumstances of the Géant Casino La Batelière / Groupe Parfait,8 the notification was pulled in June 2021 by one of the two purchasers and refilled by the other in September 2021. Without this transaction, the average duration of Phase I with remedies investigations would have been closed to 7.8 months (which is closer to the 2011-2021 average of 6.6 months).

Toward Increased Cooperation with European Commission in Significant Investigations?

Almost one-third of the FCA significant investigations in 2022 were referred by the European Commission (2 out 7 decisions). In the first case, the transaction was referred to the FCA at the request of the parties (Conforama/Mobilux), while in the second case, the referral was granted following a request from the FCA (Mckesson/Phoenix) concerning a transaction involving the newly defined market for pharmaceutical distribution. 2022 was a year of particularly intense cooperation between the two institutions, as it also led to the prohibition of the Illumina-Grail transaction after the case was initially referred by the FCA. This level of cooperation has allowed the FCA to play a key role in the merger control scene in Europe without introducing any of the legislative changes that are currently contemplated by Germany – something that merging parties should keep in mind when assessing the areas of risk for their transaction.

Conclusion

In France and Germany, the trend is towards a drastic fall in significant investigations, combined with an exceptional duration of these investigations. Meanwhile, in both jurisdictions the average outcome shows an increasing number of deals being blocked or abandoned in the last few years.

Parties to transactions that are subject to Phase II investigations in Germany should be prepared for a long duration of proceedings and in-depth scrutiny by the FCO. Looking back at the last five years, one may assume that the review period in 2023 will on average also be longer than the statutory review period of five months.

In France, the trend towards an increasingly strict approach already seems to be confirmed for 2023, as the FCA opened two Phases II investigations between December 2022 and early January 2023. This means merger parties involved in transactions likely to proceed to a significant investigation should be prepared to face more hurdles – and longer deadline – than ever before.

Footnotes

1 FCA, Decision No. 22-DCC-78 of 22 April 2022, Conforama/Mobilux.

2 FCA, Press release of 16 September 2022, TF1/M6.

3 European Commission, Decision of 26 June 2020 in Case M.9894, Conforama/Mobilux.

4 FCA, Decision No.21-DEX-01 of 15 September 2021, Conforama/Mobilux.

5 FCA, Press release of 16 September 2022, TF1/M6.

6 French Supreme Administrative Court, Judgment No. 436274 of 22 July 2022, Soditroy/Adlec.

7 In this case, the announcement of Leclerc’s withdrawal in June 2021 was taken as the starting point of the prenotification talks. See FCA press release of 10 June 2021 I, Groupe Parfait / ACDLec / Géant Casino La Batelière.

8 FCA, Decision No. 22-DCC-254 of 22 December 2022, Groupe Parfait /Géant Casino La Batelière.