DAMITT: How Long Does it Take to Conduct Significant Antitrust Merger Investigations?

DAMITT, the Dechert Antitrust Merger Investigation Timing Tracker, is the leading source of analysis for significant U.S. and EU antitrust merger investigation and litigation trends.

The creator of DAMITT, Dechert's antitrust and competition practice group, is recognized as a global leader for sophisticated advocacy and antitrust solutions. Clients around the world turn to the team for their most critical matters, including merger control, litigation, cartel investigations, and counseling and compliance.

Recognized as the definitive authority on merger enforcement data, leading publications rely on DAMITT data when writing about the antitrust merger review process, including The Wall Street Journal, The Financial Times, DealLawyers.com, Bloomberg Law, The Street, The Street TV, Handelsblatt, Time, Fortune, Law360, FTC Watch, PaRR, Global Competition Review, mLex, American Lawyer, Le Monde du Droit – Lexcase, and Dechert's very own Crunched Credit, as have other law firms.

Beyond the newsroom, DAMITT is frequently cited by top consultants like McKinsey and FTI. In addition, DAMITT has been referenced by former U.S. DOJ and FTC leaders in their policy announcements.

The latest DAMITT report is here! See how significant merger investigations in 2025 compare across the U.S. and EU, and read the report for key trends and insights.

Facts and Figures at a Glance

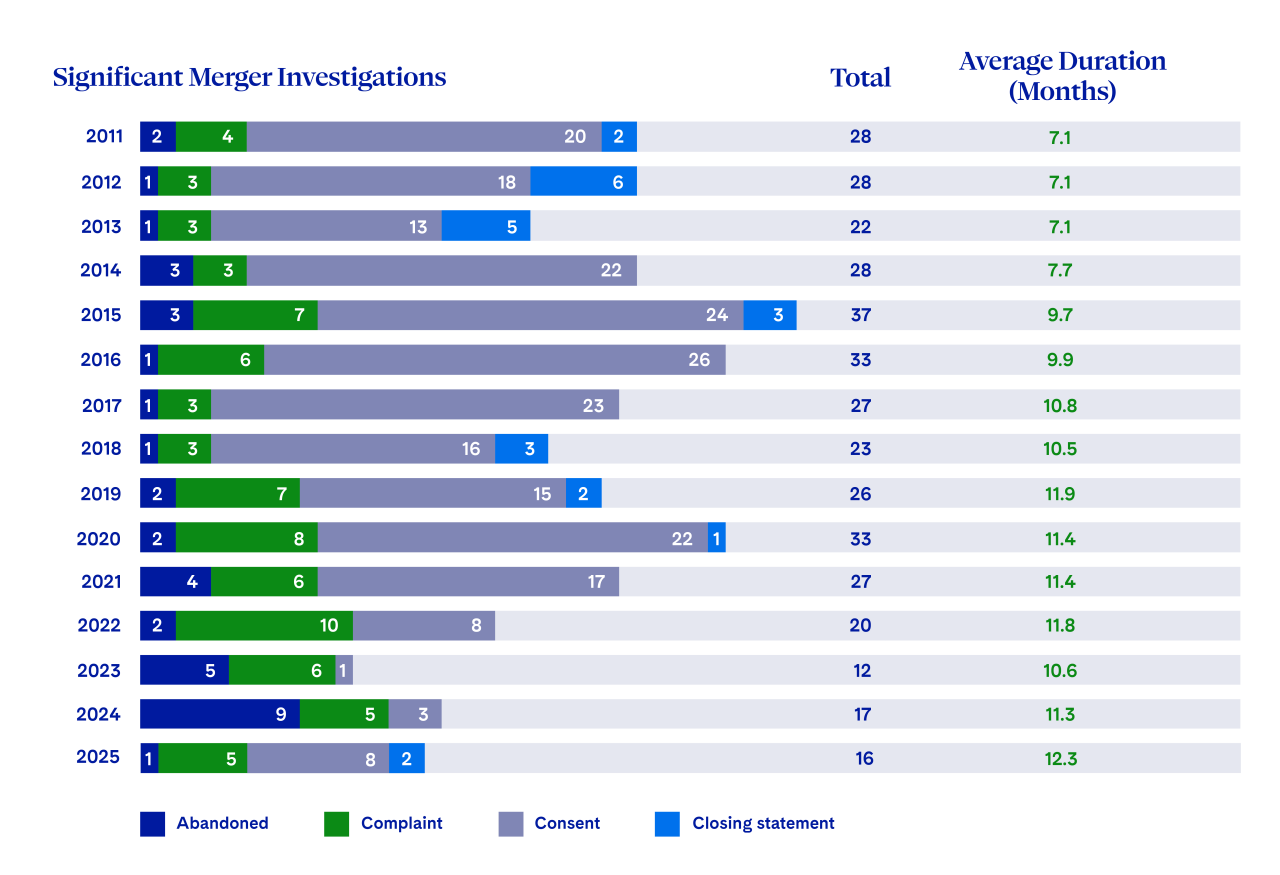

Significant U.S. Antitrust Merger Investigations (2011 – 2025)

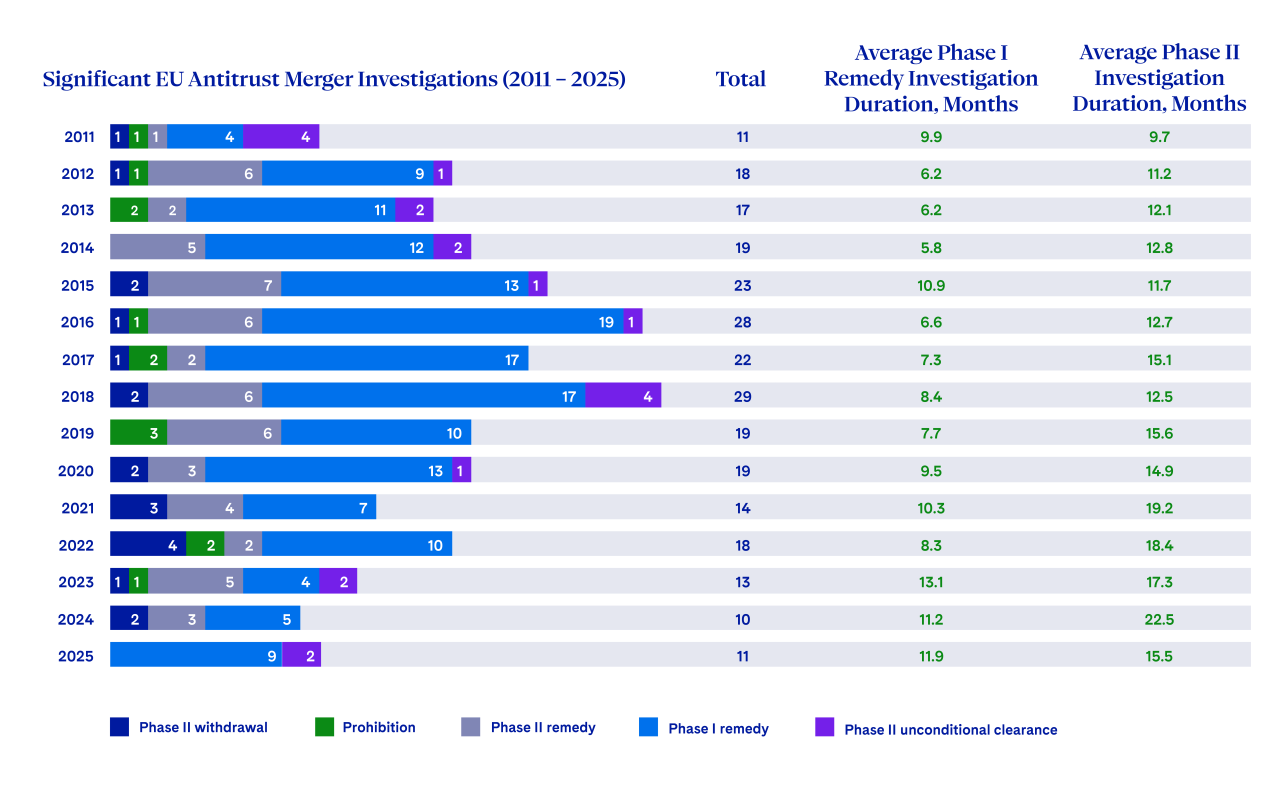

Significant EU Antitrust Merger Investigations (2011 – 2025)

Prior Reports and Webinars

-

-

-

-

DAMITT 2022 Year in Review: Merger Control Trends in Germany and France

DAMITT Q3 2022: Merger Enforcement Remains Aggressive Despite U.S. Court Losses

DAMITT Q2 2022: Is Merger Enforcement Taking a Conservative Turn?

DAMITT Q1 2022: Significant Merger Investigations Face Steeper Hurdles to Settlement

-

DAMITT 2021 Report: Merger Investigation Activity Sinks More Deals

DAMITT 2021 Year in Review: Merger control trends in Germany and France

DAMITT Q3 2021: Where’s the Wave? No Uptick Yet in Significant Merger Enforcement Activity

DAMITT Q2 2021: Move Over Big Tech – Traditional Industries See More Merger Investigation Activity