Dechert Survey: Developments in U.S. Securities Fraud Class Actions Against Life Sciences Companies

Life sciences companies were popular targets of class action securities lawsuits in 2018.

In the most recent edition of our annual survey, Dechert litigators David H. Kistenbroker, Joni S. Jacobsen and Angela M. Liu examine these trends as well as why life sciences companies have remained attractive targets for class action securities fraud claims. They also offer best practices for life sciences companies to reduce their risk of being targeted.

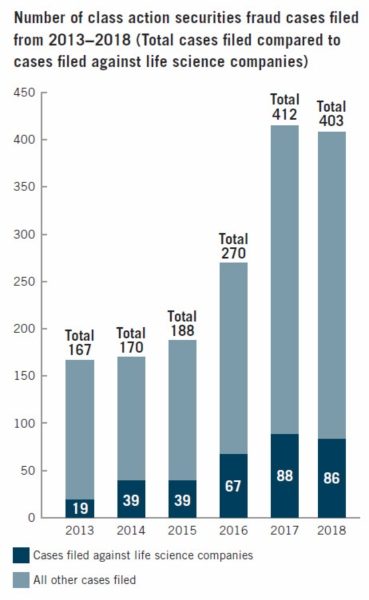

How Many Class Action Securities Lawsuits Were Filed Against Life Sciences Companies Last Year

Plaintiffs filed a total of 86 class action securities lawsuits against life sciences companies last year. While the filings represented a slight decrease from the previous year, the number was still much higher than it was five years prior.

The number of securities fraud class action lawsuits in general has been increasing steadily over the last few years, but it seems to have reached a plateau in 2018. It took a slight downturn, topping out at 403 – nine less than the 412 securities fraud suits filed by the end of 2017.

A new filing trend that emerged in 2018 was the rise in claims against large cap companies. About 60 percent of the life sciences companies named in class action securities fraud complaints had a market capitalization of US$500 million or over. Most notably, almost half of the total cases filed were against life sciences companies with a market cap of US$1 billion or more.

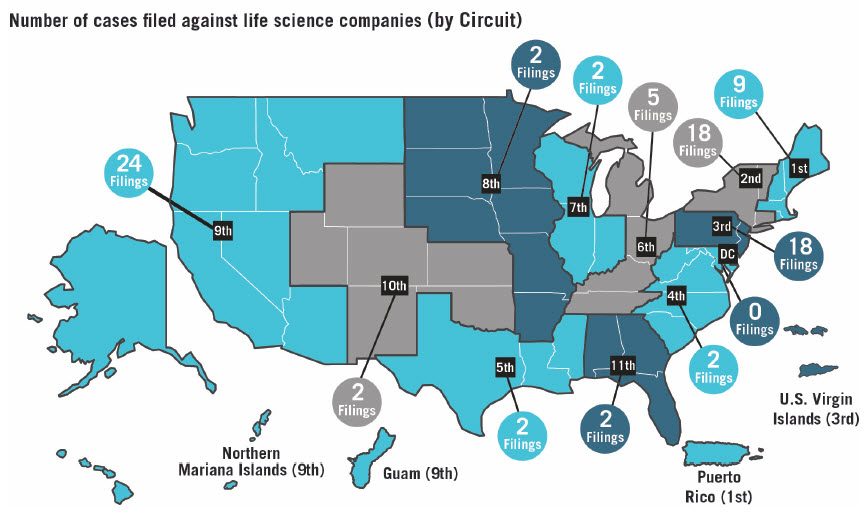

Where Lawsuits Against Life Science Companies Were Filed

Consistent with historic trends, the majority of the 86 class action securities fraud suits brought against life sciences companies were filed in three federal circuits: the Ninth Circuit with 24, the Third Circuit with 18, and the Second Circuit also with 18.

District courts in California had the most filings, with 21 overall and 15 in the Northern District of California alone. New York was once again the second most popular state with 18 total filings, 11 of which were in the Southern District of New York. While nearly half of all cases were brought in the federal district courts in these two states (an increase from 2017), this is still a notable decrease from 2016. The Third Circuit, while accounting for the second most filings against life sciences companies in 2018, saw a shift in the distribution of filings among its federal district courts: New Jersey with eight, and Delaware with seven.

Three law firms were associated with more than half of filings against life sciences companies.

- Glancy Prongay & Murray LLP

- Pomerantz LLP

- Rosen Law Firm

How You Can Minimize Securities Fraud Litigation Risks

Here are some practices that life sciences companies should consider in order to reduce their risk of being targeted in a class action securities fraud claim:

- Be alert to events that may negatively impact the drug product lifecycle and be diligent regarding disclosure obligations. Some potentially troubling issues are obvious, e.g., clinical trial failures and FDA rejection.

- Review internal processes relating to communications and disclosure about products, including those that are in the developmental stage.

- Ensure that public statements and filings contain appropriate “cautionary language” or “risk factors” that are specific and meaningful, and cover the gamut of risks throughout the entire drug product life cycle – from development to production to commercialization.

- Be aware that while remaining silent on an issue does not in and of itself create liability, such omissions must not make the actual statements made misleading in any way.

For more tips, read the full Dechert Survey: Developments in U.S. Securities Fraud Class Actions Against Life Sciences Companies.