Establishing a new fund management business using an LLP is no longer the “no-brainer” default option it once was.

While advantages remain, it's important to evaluate many factors when considering whether to use an LLP or a limited company for the management vehicle.

LLP advantages have eroded

Following its introduction in 2001, the LLP quickly became the vehicle of choice for those looking to start an asset management business. Offering the protection of limited liability, along with the flexibility and tax-planning possibilities of a partnership, the LLP was often a clear choice.

But many of the historic advantages of the LLP have eroded in recent years, leaving many of today’s new managers with a genuine dilemma.

The specific advantages and disadvantages range across various areas.

NICs Savings

The principal benefit of using an LLP is often the ability to treat highly remunerated individuals as self-employed for tax purposes. The resulting absence of employer National Insurance Contributions (NICs) on allocations of LLP profit shares, as compared to payments of salary or bonus to an employee, offers a significant saving of 13.8 percent on remuneration costs (or 14.3 percent where the Apprenticeship Levy applies).

In addition, a marginal personal National Insurance saving can arise when comparing members’ total Class 2 and Class 4 liabilities to employee Class 1 contributions. As a result, there is often an immediate and obvious tax saving available with an LLP.

While this advantage remains, the “salaried member” rules, introduced in April 2014, significantly curtail the ability to take advantage of self-employed status for a large proportion of LLP members. In some cases, only the most influential or highly remunerated members of an asset management business may be respected by HM Revenue & Customs (HMRC) as self-employed.

The salaried member rules generally provide that a member will only be respected as self-employed if the member fails one or more of three conditions:

- It is reasonable to expect that at least 80 percent of the member’s remuneration from the LLP will be “disguised salary” (broadly, remuneration that is fixed or which does not vary by reference to the profits of the LLP as a whole).

- The member does not have “significant influence” over the affairs of the LLP

- The member’s capital contribution to the LLP is less than 25 percent of the total amount of the member’s disguised salary.

Planning Possibilities

Prior to the introduction of the salaried member rules, as well as the “mixed member” rules that also became effective in April 2014, many asset management businesses took advantage of the partnership structure offered by an LLP to implement a variety of tax planning measures.

The introduction of the mixed member rules largely eliminated planning designed to take advantage of the lower tax rate paid by corporate members. Contributing factors to the significant decline in the use of LLPs for tax planning purposes include

- A proliferation of other anti-avoidance provisions

- Some notable HMRC successes in challenging tax avoidance structures in the courts

- A strengthening of public sentiment against tax avoidance

- Many managers’ unwelcome experience of the time, expense and distress involved in responding to HMRC enquiries

Reduced Overall Tax Cost

An LLP potentially offers a small overall tax saving, though much will depend on personal circumstances.

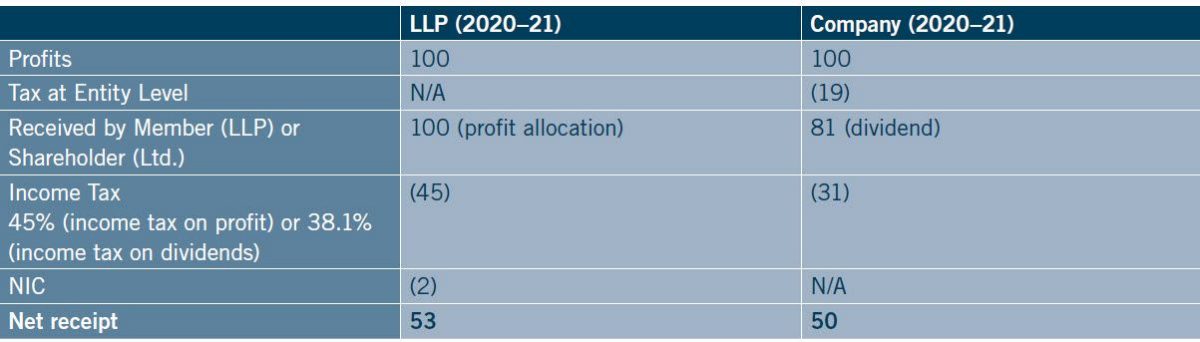

In the example below, all profits are distributed by a company in the form of dividends (as opposed to salary or bonus, which are taxed at higher rates); and all taxes are paid on dividends/profit share at the highest rates (disregarding any lower marginal rates of tax).

Tax-Efficient Profit Retention/Reinvestment

Prior to the introduction of the mixed member rules, it was customary for an asset management LLP to be established with a limited company member. The corporate member typically would be owned by the equity-owning individual members, and the corporate member often would act as the managing member of the LLP.

A principal tax advantage of having a corporate member was that it allowed the LLP to allocate profits to the corporate member, on which it would be taxable at corporation tax rates (which historically have been, and remain, significantly lower than income tax rates). This effectively enabled the individual members to retain or reinvest profits in the business much more efficiently than had the profits been allocated to the individual members and reinvested by them after payment of income tax.

The mixed member rules put an end to such planning – broadly, by reattributing the profits allocated to the corporate member, for tax purposes, to the individual members of the LLP who directly or indirectly sit behind the limited company. The net effect of the mixed member rules is that individual members of an LLP who wish to retain their profit in, or reinvest their profits into, the business must do so net of income tax and NICs at up to 47 percent.

In contrast, asset management businesses established as limited companies continue to have the ability to retain and reinvest profit, subject only to 19-percent corporation tax. For start-ups requiring significant ongoing capital investment or those that wish to roll up profits to quickly scale up, this can be a significant disadvantage of an LLP and an advantage of a limited company.

The ability to “roll up” profits in a limited company also offers a potential benefit to those intending to leave the UK in the longer-term. Profits may be accumulated within the company, subject to tax at corporation tax rates, and distributed only when the individual has ceased to be UK tax-resident. If an individual proposes to relocate to a low-tax jurisdiction, such a strategy could result in a significant long-term tax saving.

Investment into the Fund

It is relatively common for new asset managers to reinvest profits of the business into the fund or to use profits to finance co-investment commitments. Any such investment from an LLP would be net of income tax and NICs at up to 47 percent. In contrast, investment by a limited company generally may be achieved after tax at the corporation tax rate of 19 percent.

There remains a degree of uncertainty as to the possible application of the “disguised investment management fee” (DIMF) rules - introduced with effect from April 2015 - to such arrangements. But it appears that the DIMF rules should not apply to investments by a genuine investment management vehicle with substance.

Deferral of Tax on Remuneration Until Profitable

Due to the tax transparency of the LLP vehicle, LLP members pay income tax on their share of the profits of the LLP. If the LLP makes no profit, they pay no tax. This is the case even if they receive drawings from the LLP during loss-making periods.

Employees of limited companies are subject to income tax and NICs on payments of salary or bonus received from a limited company, even if the company is loss-making.

In both cases, the payments to the member/employee reduce the capital available to the business, but the difference in tax treatment is stark. In the longer-term, if the business is profitable, the position will even out. LLP members are taxable on profits allocated to them for tax purposes but not distributed to them (as such profits replace the capital expended on drawings during the loss-making periods). However, in the initial loss-making years, and in the longer-term if the business ultimately is not profitable, an LLP may allow a significant income tax saving.

Flexibility to Admit New Members

Subject to the terms of the LLP agreement, new members generally can be admitted to the partnership free of a tax charge. This allows LLPs to promote employees to partnership status and to recruit new partners laterally, with ease. It also allows such new members to be admitted into the equity of the LLP without an obligation to pay market value for such rights.

For a limited company to grant an equity interest, it must issue new shares or transfer shares from the existing shareholders. Due to the complex “employment-related security” (ERS) rules, such issues or acquisitions of shares will be subject to income tax in the hands of the recipients to the extent they do not pay market value for them. There may also be capital gains consequences for the existing shareholders who give up part of their equity. While this can be mitigated through share options, restricted shares and other routes, such routes generally are more complicated and tax-inefficient on either acquisition or exit.

This additional flexibility afforded by an LLP often makes this structure an attractive option when the intent is to grow the number of equity holders over time. A limited company often is more suitable when the intention is for the founders of the business to hold the equity close and in pre-agreed proportions in the longer-term.

Flexibility to Vary Profit Shares

Subject to the terms of the LLP agreement, members of an LLP are free to vary the basis on which the members share in the LLP’s profits. This allows significant flexibility to adjust members’ profit shares on an annual basis to reflect their contributions to the business.

While limited companies have the flexibility to pay discretionary bonuses to reward personal performance, such payments are subject to employer NICs at 13.8 percent (or 14.3 percent if the Apprenticeship Levy is due).

Profits may be distributed to shareholders free of NICs in the form of dividends. However, dividends generally must be paid to shareholders pro-rata to their shareholdings, and varying the proportions in which equity is held is itself ordinarily taxable.

Partner Status

Although seniority or importance to a business established as a limited company is frequently demonstrated through a wide range of impressive job titles, there remains a certain distinction for many to being a “partner” in a business.

Partnership can help create a greater sense of ownership in the business, as well as a club-like atmosphere among the key individuals. Partner status also may serve as an incentive to lateral recruits. The importance of this factor will vary from business to business but is rarely a critical aspect in decision making.

Restrictive Covenants

It is common for senior executives to be bound by restrictive covenants following an exit from the business. Such covenants typically aim to prevent the disclosure of confidential information, competition with the business and solicitation of clients or employees.

In general, restrictive covenants are at risk of being void as a restraint of trade, unless they protect a legitimate proprietary interest, and the protection sought is reasonable in light of the interests of the parties and the general public.

Though restrictive covenants are highly fact-specific, the courts generally are more inclined to enforce them against partners of an LLP, as compared to employees. This is particularly the case in respect of senior “equity” partners in an LLP as compared to more junior partners.

Establishment as an LLP may offer the founders the ability to impose harsher restrictive covenants on key individuals holding partner status, together with an increased prospect of enforcing those restrictions, than would be possible if the management business were established as a limited company.

Simplicity

Although the degree of complexity is principally a result of the commercial arrangements between the principals and with any co-investors, limited companies generally remain simpler, quicker and less expensive to establish than LLPs.

In many cases, particularly where the principals are from non-UK jurisdictions and unfamiliar with LLPs, limited companies are better understood and perceived to be easier to operate.

Remittance Relief for Non-UK Domiciled Individuals

Investing in a limited company may enable business investment relief to be claimed in order to prevent a taxable remittance if:

- The founders are non-UK domiciled individuals claiming the remittance basis. Broadly, it permits such individuals to elect to be taxed in the UK on non-UK source income and gains, only to the extent such income and gains are remitted to the UK

- Such individuals propose to fund the business establishment from non-UK income or gains

An investment in a UK LLP is not a qualifying investment for business investment relief purposes, and would constitute a taxable remittance if funded with non-UK income or gains. Although the potential extension of business investment relief to investments in partnerships has been mooted on a number of occasions since this relief was introduced in 2012, there currently are no plans for such an extension.

Entrepreneurs’ Relief

Managers looking to the long-term at choice of structure may consider the tax treatment expected in connection with a future sale of the business. While it is difficult to depend on the current tax regime remaining in place at an undetermined future date, there is potential availability of “entrepreneurs’ relief,” based on present rules.

Currently under considerable political scrutiny, entrepreneurs’ relief potentially enables business owners to pay capital gains tax at only 10 percent on their first £10 million of gains arising from a sale of their interest in the business or assets used in the business (providing a potential tax saving of £1 million).

Although relief potentially is available on the sale of either shares in a limited company or a partnership interest in an LLP, the conditions for relief in the case of a sale of shares are significantly more prescriptive than those applicable to a sale of partnership interests. For example, the requirement for a 5-percent shareholding means a founder’s ability to claim relief in respect of a sale of shares may be lost as a consequence of dilution of the initial shareholdings over time. This is due to external investment or increased sharing of equity across the management team.

In contrast, as long as a founder remains a member of the LLP, a reduction in the founder’s interest over time should not limit the ability to claim relief on a future sale of the LLP interests. That’s because there is no minimum holding requirement.

Carried Interest

The UK tax rules applicable to carried interest have changed significantly during the last five years. Although it was never the intention of the legislative changes to favour limited companies over LLPs, in some cases this may be a practical consequence.

A key change to the taxation of carried interest was the introduction of the “income-based carried interest” (IBCI) rules in April 2016. Broadly, these rules look to the weighted average holding period of a fund’s investments in determining whether any carried interest in relation to the fund should be taxed as income or capital gains. An average holding period of at least 40 months is required for carried interest to be taxed fully as capital gain.

However, the IBCI rules do not apply where carried interests are taxed under the ERS regime discussed above, as would be the case where the recipients are employees. For these purposes, the effect of the ERS rules would be to generally allow capital gains tax treatment for a typical carried interest.

As a result, where a significant proportion of the return payable to the senior members of the management team is expected to be derived from carried interest, and where the investment strategy of the fund is such that the 40-month average investment holding period might not be satisfied, employment by a limited company potentially (at least under current law) may offer a more tax-efficient treatment of carried interest, as well as more certainty as to that treatment. It remains to be seen whether this distinction in tax treatment will apply in the longterm.