Germany's Amended Investment Ordinance

The Investment Ordinance (Anlageverordnung – “Investment Ordinance” or “AnlV”), as recently amended and as discussed in more detail below, applies to the investments and the asset allocation of insurance companies and pension funds (Pensionskassen), as well as to professional pension funds (Versorgungswerke), that are either subject to the investment restrictions of the Investment Ordinance under federal state legislation, or have affirmatively chosen to comply with the Investment Ordinance (hereinafter together the “VAG-Investors”). Church pension funds and charitable foundations also regularly comply with the Investment Ordinance.

1. Introduction

Since the implementation of the AIFM Directive (“AIFMD”) into German law in July 2013, the revision of the Investment Ordinance, lastly modified in 2011, was overdue, as it did not reflect the new regulatory framework.

On 25 February 2015, the German Federal Cabinet (Bundeskabinett) adopted the revised Investment Ordinance (the “New Investment Ordinance”). The New Investment Ordinance entered into force on

7 March 2015 following its publication in the Federal Law Gazette (Bundesgesetzblatt) on the previous day.

This OnPoint summarizes the amendments made to the Investment Ordinance and reflected in the New Investment Ordinance, with a focus on the implications for fund investments.1

Further guidance is expected in connection with the revision of the BaFin circular 4/2011 that supplements and interprets the provisions of the Investment Ordinance (the “Revised Circular”). It is not yet known when BaFin will publish the Revised Circular.

2. Investment in Investment Funds

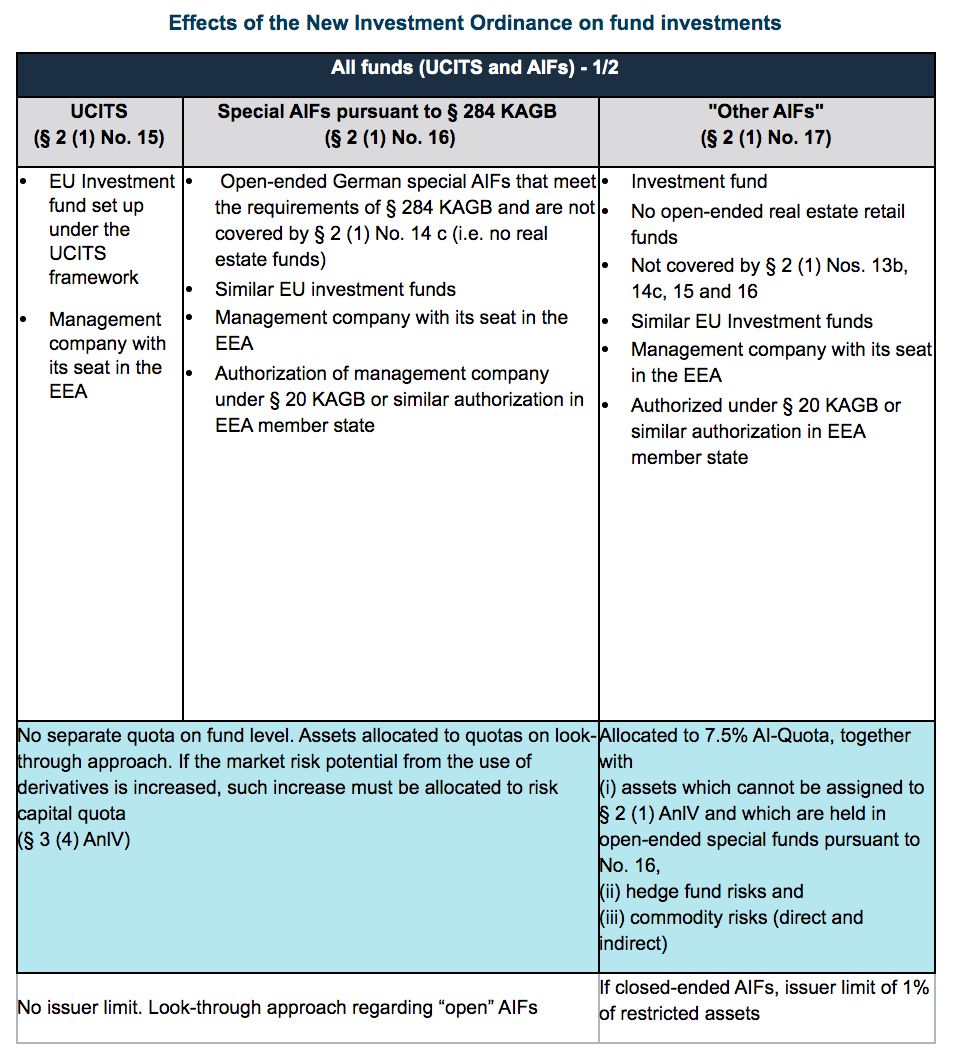

Pursuant to AnlVUnder the New Investment Ordinance, investments in funds will need to qualify as one of the five asset classes described in the following diagram.

a. UCITS (§ 2 (1) No. 15 AnlV)

UCITS domiciled in the EU and managed by a management company with its seat in the EEA are generally eligible for VAG-Investors.

However, since UCITS are transparent (i.e., a look-through must be applied to the assets held), the general investment principles under the Investment Ordinance apply on a look-through basis (in particular the principle of “security” (Grundsatz der Anlagesicherheit) or the prohibition to engage in speculative activities (Spekulationsverbot)). This has consequences on required minimum ratings for certain types of instruments and the overruling of external ratings by internal ratings, as well as on the eligibility of certain types of speculative instruments (such as Cat-Bonds, which may not be purchased by VAG-Investors).

Although this is not a consequence of the revision of the Investment Ordinance, the new framework regarding ratings and the requirement to not rely solely on external ratings has to be complied with by foreign managers.

We do not expect that the Revised Circular will bring changes in the field of UCITS investments. However, these developments should be closely followed (e.g., by portfolio managers who have confirmed to German KVGs that they will manage their funds in line with the requirements for VAG-Investors).

There is no specific quota for UCITS on the level of the fund. It follows from the look-through approach that the underlying assets of a UCITS must be allocated to the relevant quota.

b. Open-ended Special Funds with fixed investment restrictions (§ 2 (1) No. 16 AnlV)

Investments in open-ended special funds with fixed investment restrictions (Spezial-AIF mit festen Anlagebedingungen) pursuant to § 284 KAGB and comparable EU funds (“Fixed Special Funds”) are eligible for VAG-Investors. These funds must be managed by a management company authorized under the AIFMD with its seat in the EEA. An AIF qualifies as a special AIF if it admits only professional and semi-professional investors.

The asset class of Fixed Special Funds is not available for open-ended real estate special AIFs which fall under the special asset class of real estate funds (see below under 2.d)).

This asset class is particularly relevant for VAG-Investors who have pooled their assets in special funds under the former investment law regime. Since the asset class of Fixed Special Funds essentially mirrors the former provisions, these VAG-Investors can continue their current practice.

A special fund under § 284 KAGB may generally invest in a broad range of asset classes/types, including precious metals, unsecuritized loans and participations. However, investments in unlisted equities are limited to 20%. In the past, BaFin has required further investment restrictions for such special funds in order to be eligible for VAG-Investors (such as a 30% limitation for unsecuritized loan receivables). It remains to be seen whether BaFin will set up similar limitations in the Revised Circular.

Fixed Special Funds must be transparent in order to be eligible for VAG-Investors. There is no specific fund related quota applying to these funds. Rather, the underlying assets must be allocated to the relevant quota where applicable. All assets held in such funds that cannot be allocated to one of the eligible assets types under § 2 (1) of the Investment Ordinance must be allocated to the new quota for alternative investments amounting to 7.5% of the restricted assets (“AI-Quota” pursuant to § 3 (2) No. 2 AnlV; see also below under 2.c)).

If a Fixed Special Fund invests in target funds, such funds must also qualify as eligible investments for VAG-Investors.

c. “Other AIFs” (§ 2 (1) 1 No. 17 AnlV)

§ 2 (1) No. 17 AnlV expands the range of eligible types of investment funds substantially: pursuant to the New Investment Ordinance, all EU AIFs (other than open-ended retail real estate funds) managed by an AIFM with its seat in the EEA (“Other AIFs”) are eligible for VAG-Investors, but must be allocated to the new 7.5% AI-Quota unless the special provisions for other funds (see table above) apply.

For Other AIFs, it is generally sufficient that the management company is authorized under § 20 KAGB (i.e. an AIFM authorization) or has a comparable authorization under the law of another EEA member state. There are no further requirements for this fund type, so that basically, subject to the general investment principles applying to VAG-Investors and further restrictions that may be required under the Revised Circular, all types of assets and investment strategies are eligible for Other AIFs within the AIF quota (e.g. hedge fund strategies, commodities, debt fund strategies, including funds pursuing a direct lending strategy). However, funds that may be distributed in Germany (by way of registration or passporting), but are not managed in the EEA, are not directly eligible as Other AIFs.

For purposes of calculating diversification quotas, no look-through is required in the case of Other AIFs, as they are already subject to the (narrow) AI-Quota.

The maximum AI-Quota of 7.5% includes direct and indirect investments in Other AIFs, assets held in a Fixed Special Fund that cannot be qualified as eligible investments pursuant to the Investment Ordinance and all other direct and indirect investments in instruments whose performance is linked to hedge fund or commodity risks. The AI-Quota is part of the larger risk capital quota of 35% of the restricted assets.

Other AIFs can be closed-ended, which is required to cover certain illiquid alternative strategies. However, issuer limitations that apply to closed-ended Other AIFs are different from those for open-ended Other AIFs. For closed-ended Other AIFs, the limitation per issuer of 1% of the restricted assets of the investing VAG-Investor applies. For open-ended Other AIFs, this limit is not applicable. Other AIFs are“open-ended” if they redeem units at least once a year.

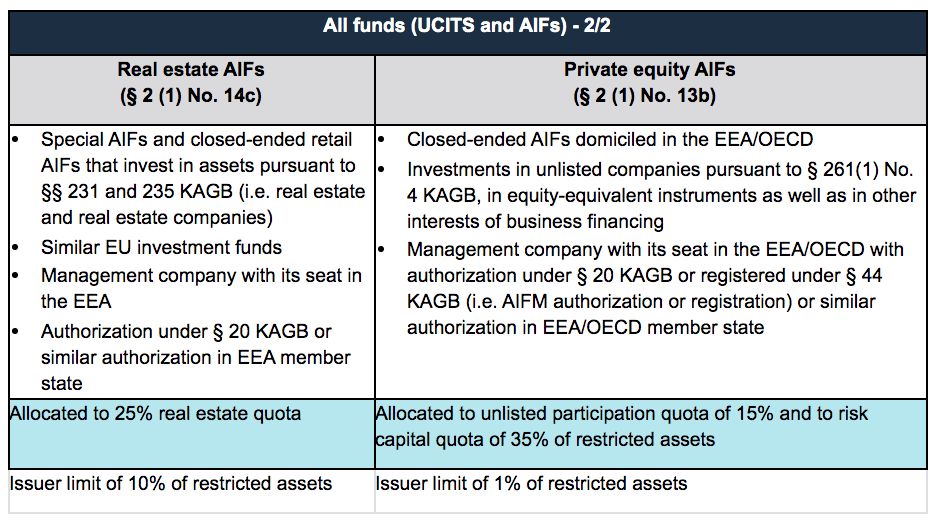

d. Real Estate Funds (§ 2 (1) No. 14c AnlV)

Investments in open-ended and closed-ended special EU real estate AIFs (“Real Estate AIFs”) are eligible for VAG-Investors. An AIF qualifies as a special AIF if it admits only professional and semi-professional investors. Retail EU AIFs are only eligible if they are closed-ended.

Real Estate AIFs must be managed by a German management company authorized under § 20 (1) KAGB (i.e. an AIFM authorization) or an EEA management company with an equivalent authorization (i.e., AIFMD or equivalent standard).

Further, Real Estate AIFs must, directly or indirectly, invest in real estate and/or in real estate companies (as defined in § 231 KAGB and § 235 KAGB). It is not yet clear whether and to what extent Real Estate AIFs can make other investments such as liquidity investments. Clarification is expected to be provided in the Revised Circular.

Real Estate AIFs are allocated to the 25% real estate quota (together with other direct and indirect real estate investments) and are subject to an issuer limit of 10% of the restricted assets.

In the case of real estate funds of funds, the target funds must also meet the requirements for Real Estate AIFs.

It is helpful that under the new regime closed-ended real estate funds also qualify for the real estate quota. In the past, such funds had to be open-ended in order to qualify for the real estate quota. These requirements were often difficult to achieve given the lack of liquidity of the underlying assets. However, BaFin will most likely introduce further restrictions on these fund types in order to be eligible investments in the real estate quota (e.g. limitation of leverage as has been the case under the old regulatory framework).

It should be noted that according to a guidance note from BaFin on the concept of an “investment fund” within the meaning of the German Capital Investment Code (Kapitalanlagegesetzbuch or “KAGB”), any active real estate management activity falls outside the scope of the KAGB. Such funds should however be eligible under the new § 2 (1) No. 13 a) AnlV as participations in enterprises provided they have a so-called business model associated with entrepreneurial risks and fulfil the further requirements under this provision.

e. Private Equity Funds (§ 2 (1) No. 13b AnlV)

aa. Introduction

Investments in enterprises (such as private equity funds and other entities that have a business model associated with entrepreneurial risks) under the former § 2 (1) No. 13 AnlV remain eligible. However, the New Investment Ordinance takes into account that under the new investment law regime implementing the AIFMD, private equity funds and their managers are generally subject to regulation with the consequence that these funds must be managed by a fully authorized AIFM or at least by managers registered under the AIFMD. The New Investment Ordinance now differentiates between two alternatives: unregulated participations in enterprises (see below under bb.) and participations qualifying as AIF (see below under cc.).

bb. Unregulated participations in enterprises (§ 2 (1) No. 13 a) AnlV)

Pursuant to the new § 2 (1) No. 13 a), which is identical to the former § 2 (1) No. 13, participations in enterprises are investments in fully paid-up shares or interests in certain types of German corporations or partnerships. Investments in another type of company must be materially comparable with these types of investments.

The undertaking must be domiciled in a country of the EEA or OECD. The undertaking must pursue a business model and assume entrepreneurial risks, i.e. it essentially must be an operating company. Under certain conditions, a look-through applies for holding companies.

In the past, foreign closed-ended funds that were subject to an investment regulation and invested in equity interests or infrastructure could also be allocated to the restricted assets via § 2 (1) No. 13 AnlV (old version) without considering the legal form. Such vehicles will now be subject to § 2 (1) No 13b (see below under cc.)

cc. Private Equity Funds (§ 2 (1) No. 13 b) AnlV)

“Private Equity Funds” are closed-ended AIFs domiciled in the EEA/OECD provided that they

- invest directly or indirectly in assets covered by § 261(1) No. 4 KAGB (i.e., investments in unlisted companies), in equity-equivalent instruments and in other instruments of corporate financing (andere Instrumente der Unternehmensfinanzierung); and

- are managed by an investment management company based in the EEA/OECD with AIFM authorization or registration or a comparable supervision. This also entails fund managers registered as EuVECA2 or EuSEF3 managers.

It is unclear which “de-minimis rule” for other investments is applicable. However, ancillary investments in liquid instruments and in derivatives (for hedging purposes) are allowed.

With the concept of “other instruments of corporate finance”, the legislator has expanded the range of permissible assets to include senior debts instruments. In particular, debt funds focusing on senior debt should now also be covered without an additional requirement of a business model associated with entrepreneurial risks at the level of the fund (as was required in the past). In our view, this criterion should not apply at the level of the Private Equity Fund, because the wording of the Investment Ordinance does not require it for funds falling under § 2 (1) No. 13 b) (other than with regard to § 2 (1) No. 13 a)). However, the issuers of instruments in which the Private Equity Fund invests should, in our view, have a business model associated with entrepreneurial risks. It remains to be seen how the Revised Circular will deal with this.

The target funds of Private Equity Funds do not need to comply with the requirements of § 2 (1) No. 13b) AnlV. However, it should be noted that the reasoning of the New Investment Ordinance specifically notes that the Revised Circular will specify further requirements that address the issue of circumvention of the provisions of the New Investment Ordinance by means of repackaging into Private Equity Funds.

Investments under § 2 (1) No. 13 a) and 13b) are allocated to the unlisted participation quota of 15% which is part of the risk capital quota of 35% of the restricted assets. There is an issuer limit of 1% of the restricted assets. This may be applied on a look-through basis in case the Private Equity Fund qualifies as holding (see § 4 (4) sentence 2 AnlV).

3. Transitional Regulations

Retail open-ended real estate funds acquired before 8 April 2008 may remain part of the restricted assets and may be allocated to the real estate quota through § 2(1) No. 14c) AnlV.

The new requirements for Private Equity Funds pursuant to § 2 (1) No. 13b) have entered into force on 7 March 2015. Investments that have already been made prior to that date are to be allocated to the participation quota in accordance with § 2 (1) No. 13b) and may be held to maturity. Additional investments in existing grandfathered funds are not permitted. However, further investments based on capital calls in relation to capital commitments signed before the entry into force of the New Investment Ordinance are in our view permitted.

4. Critical Appreciation and Outlook

The New Investment Ordinance should constitute a reasonably feasible legal framework for the capital investments of VAG-Investors. Calls for even more flexible investment restrictions and a higher quota for alternative investments have been turned down, as VAG-Investors have not historically made full use – at least on statistical average – of the permitted scope for alternative investments under the former Investment Ordinance.

To remove the remaining legal uncertainties, a prompt publication of the Revised Circular is essential.

For insurance companies falling within the scope of the Solvency II Directive, the Investment Ordinance will cease to apply upon the implementation of “Solvency II” into German law on 1 January 2016. However, we assume that the requirements of the New Investment Ordinance and of the supervisory practice will continue to be of significance for VAG-Investors in relation to the internal (quantitative) directives which are to be specified with a view to implementing the qualitative requirements for capital investments.

Footnotes

1) The changes to the Investment Ordinance in principle apply mutatis mutandis to the Pension Fund Capital Investment Ordinance which has also been changed by the same act that implements the New Investment Ordinance, but which is not as restrictive as the New Investment Ordinance in some areas (such as issuer limits).

2) Funds established pursuant to Regulation (EU) No. 345/2013 of the European Parliament and of the Council on European venture capital funds.

3) Funds established pursuant to Regulation (EU) No. 346/2013 of the Euroepan Parliament and of the Council on European social entrepreneurship funds.