FTC Requires Divestitures in Ahold/Delhaize of 81 Stores and Gives Upfront Buyers More Time to Complete Acquisitions; Continues Focus on "Traditional Supermarket" Competition

Key Points:

- The FTC required divestitures in many local markets in Ahold/Delhaize despite the fact that there were between three and six remaining competitors (i.e., 4-to-3, 5-to-4, 6-to-5, and 7-to-6 markets)—in fact, most of the divestiture markets had at least this many remaining competitors. In requiring divestitures in these markets, the FTC was influenced by the close proximity of the parties’ stores, their similarity in formats, and the moderate to high concentration levels.

- The FTC continues to limit its product market to "traditional supermarkets," including supermarkets located within Walmart and Target supercenters and excluding non-traditional supermarkets such as Whole Foods, Aldi, and Trader Joe's.

- The consent order provides some upfront buyers with significantly more time to acquire the divested stores compared to prior retail consent orders, apparently balancing the buyers' interest in having extra time to prepare for a successful transition against the risk of the divestiture assets deteriorating.

After an investigation setting a longevity record for supermarket deals,1 on July 22, 2016, the FTC accepted for public comment a consent order requiring Ahold, which operates Stop & Shop, Giant, and Martin's supermarkets, to divest 81 stores in 46 local markets to seven "upfront buyers" in order to obtain clearance to acquire Delhaize, which operates Food Lion and Hannaford supermarkets. The post-merger Herfindahl-Hirschman Index (HHI) in the 46 local markets ranged from as low as 2,268 points, which is "moderately concentrated" under the 2010 Horizontal Merger Guidelines, to 10,000 points—a merger to monopoly.

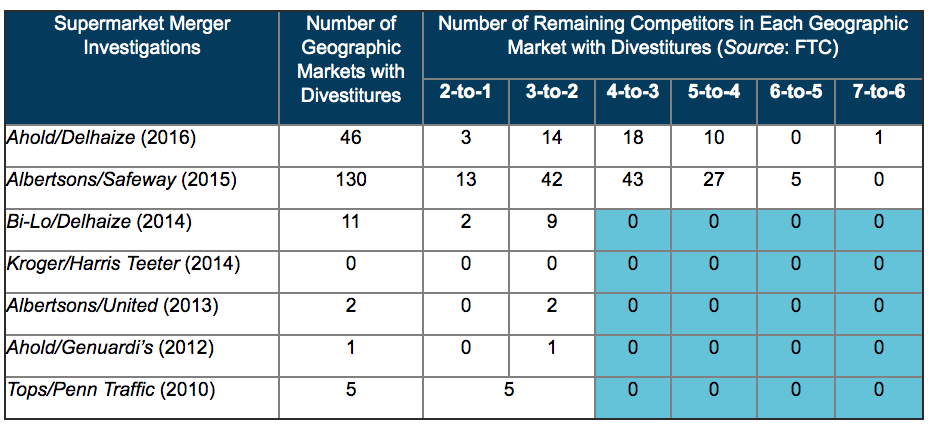

In both Ahold/Delhaize and the FTC's 2015 Albertsons/Safeway consent order, approximately 60% of the divestiture markets in each transaction had from three to six remaining supermarket competitors (i.e., 4-to-3, 5-to-4, 6-to-5, and 7-to-6 markets). As shown in the chart below of supermarket merger investigations during the Obama administration, prior to Albertsons/Safeway the FTC had not brought an enforcement action in any local areas with three or more remaining supermarkets.

In recent years, mergers resulting in at least three remaining competitors often have not required divestitures in many industries. Going forward, merging parties need to be aware that the FTC may bring challenges even in markets with as many as six remaining competitors.

The FTC did not provide detailed insights into the likely competitive effects of the proposed merger, offering instead generalized allegations that Ahold's and Delhaize's supermarket chains are "close and vigorous competitors in terms of price, format, service, product offerings, promotional activity, and location" in each of the 46 local markets. The FTC believes the proposed merger would increase the ability of Ahold-Delhaize to raise prices and decrease incentives to compete on service, convenience, and quality. All 46 of the geographic markets in Ahold/Delhaize are localized, ranging from as small as one-tenth of a mile to a ten-mile radius around the merging companies' supermarkets. In the Dollar Tree/Family Dollar matter in 2015, the FTC similarly alleged markets narrower than a half-mile radius. These highly localized geographic markets in recent retail mergers show that overlapping stores in close geographic proximity are at risk for enforcement even if there may be several other competing stores within only a mile or two.

In calculating market shares and concentration, the FTC continues to limit its product market to "traditional supermarkets," including supermarkets located within Walmart and Target supercenters and excluding prominent non-traditional supermarkets such as Whole Foods, Aldi, and Trader Joe's, as well as club stores such as Costco and Sam's Club. This product market definition has not changed in many years even though there has been rapid growth by non-traditional supermarkets. According to the FTC, "the critical difference" between traditional supermarkets and other food stores is the "ability to offer consumers one-stop shopping," although the complaint does not provide details on the extent to which Ahold, Delhaize, and other competitors' shoppers engage in one-stop shopping. The FTC further alleges that other food stores "do not, individually or collectively, provide sufficient competition to effectively constrain prices at supermarkets."

The Ahold/Delhaize consent order is noteworthy also for the additional time provided to approved divestiture buyers to complete their acquisitions of the divested stores. Unlike the Albertsons/Safeway consent order, where the upfront buyer with the longest time period had 150 days to complete the acquisition of 146 stores, two of the upfront buyers in this matter will have significantly more time to acquire significantly fewer stores. Weis Markets has 230 days to complete the acquisition of 38 stores located in Delaware, Maryland, and Virginia, and Publix has 360 days to complete the acquisition of 10 stores in Virginia. None of the seven buyers is obligated to complete the purchase of all of their stores in fewer than 60 days. Accordingly, Ahold-Delhaize will be subject to an order to maintain the viability, marketability, and competitiveness of the divestiture stores under the supervision of a monitor that is lengthier than in past supermarket enforcement actions. Although upfront buyer requirements and shorter divestiture time periods are intended to help decrease the risk of the divestiture assets deteriorating during the divestiture period, the FTC appears to be willing to accept divestiture buyers' requests for more time to help ensure they have sufficient time to prepare for a successful transition.

The Ahold/Delhaize and Albertsons/Safeway consent orders show that the FTC has intensified its enforcement efforts in supermarket merger matters compared to recent years, seeking divestitures in areas with as many as six remaining traditional supermarket competitors. The FTC continues to view traditional supermarkets as the relevant product market in highly localized geographies. In addition, given the length of FTC retail investigations, companies considering a significant transaction need to plan adequate time to resolve any substantive merger issues, present viable divestiture buyers to the FTC for approval, and fulfill post-order compliance obligations pending divestitures to upfront buyers.

Footnotes

1) The FTC's 13-month Ahold/Delhaize investigation was the longest for a Hart-Scott-Rodino reportable supermarket transaction in at least the past 25 years. According to DAMITT, the Dechert Antitrust Merger Investigation Timing Tracker, the investigation was also the longest reportable retail merger investigation since at least 2011.