Non-Reportable ≠ Non-Reviewable: Antitrust Insights for Smaller US Mergers

Acquisitions of U.S. companies that fall below the $80.8 million Hart-Scott-Rodino (HSR) reporting threshold may pose unique risks to buyers. Unlike HSR reportable transactions, non-reportable transactions typically do not allow for contractual allocation of antitrust risk. The buyer is left shouldering the risk. A recent Federal Trade Commission (FTC) enforcement action confirms that the risk taken by buyers includes not only the possibility that the acquired assets will have to be divested, but also the possibility that the buyer will be forced to disgorge profits earned after the acquisition. For Mallinckrodt, the subject of the most recent consummated merger challenge, the disgorgement remedy was $100 million, on top of divestiture of part of the acquired assets.

Disgorgement as a remedy remains controversial and relatively infrequent, and may become even less frequent in the new administration. Nonetheless, antitrust investigations and challenges to consummated mergers are likely to continue at a steady pace. These investigations may increase if the volume of reportable transactions declines and agency staff in turn gains more capacity to investigate consummated mergers.

A study by Dechert shows that the FTC and Department of Justice (DOJ) have brought consummated merger challenges in each of the last five years, thirteen in total. Two of these challenges were litigated to a decision on the merits, with the remainder settled by consent; all resulted in remedies being imposed. Dechert is aware of other consummated merger investigations that the agencies closed without challenge, but has no way to systematically measure them. This study suggests a number of implications for companies considering competitively-sensitive non-reportable deals in the U.S.

Merger / Deal Value / Agency / Enforcement Date / Time after Close / Market Structure Allegations / Competitive Effects Allegations / Remedy / Litigated to Decision?

- Mallinckrodt/Questcor/Novartis / $135 million / FTC / 1/18/2017 / 42 months / 100% / Price already raised to monopoly level; acquired likely entrant / Disgorgement of $100 million; divestiture of assets / No

- Valeant /Paragon / $69.1 million / FTC / 11/7/2016 / 17 months / 70% / Price increase implemented / Divestiture of assets / No

- Keystone Orthopedic/Orthopedic Associates / Not specified/ FTC / 10/15/2015 / 57 months / 76% / Price increase implemented / Behavioral / No

- Heraeus/Minco / $42 million / DOJ / 1/2/2014 / 15 months / 95% / Service deterioration occurred / Divestiture of assets / No

- Solera/Actual Systems / $8.7 million / FTC / 7/22/2013 / 13 months / 3 to 2 / Increased ability to raise prices / Divestiture of assets / No

- Graco/Gusmer/GlasCraft / $65 million; $35 million / FTC / 4/18/2013 / 97 months; 61 months / 93% / Price increase implemented / Divestiture of assets / No

- Charlotte Pipe/Star Pipe / $19 million / FTC/ 4/2/20133 / 2 months / Highly concentrated / Increased ability to raise prices/ Behavioral / No

- St. Luke's/Saltzer Medical / $28 million / FTC / 3/12/2013 / 2 months / 60% / Increased ability to raise prices / Divestiture of assets / Yes

- Oltrin Solutions/JCI / $5.5 million / FTC / 1/18/2013 / 33 months / Highly concentrated / Increased ability to raise prices / Divestiture of assets / No

- Bazaarvoice/PowerReviews / $168.2 million / DOJ / 1/10/2013 / 6 months / 70% / Increased ability to raise prices / Divestiture of assets / Yes

- Twin America/Coach/City Sights / Not specified / DOJ / 12/11/2012 / 44 months / 99% / Price increased 10% / Disgorgement of $7.5 million; divestiture of assets / No

- Magnesium Elektron/Revere Graphics / $15 million / FTC / 10/12/2012 / 60 months / 100% / Increased ability to raise prices / Divestiture of assets / No

- Renown Health/SNCA/RHP / $3.4 million;$4 million / FTC / 8/6/2012 / 19 months; 16 months / 97% / Increased ability to raise prices / Behavioral / No

Horizontal Mergers with High Combined Market Share Are Targets. All of the consummated merger challenges in the last five years involved horizontal mergers. While the same Merger Guidelines apply to review of reportable and non-reportable deals alike, consummated merger challenges have focused disproportionately on deals with high combined market shares—often 2-to-1 mergers. Dechert’s analysis shows that the average combined firm market share for consummated merger challenges, for which share information is available, is 86%.

FTC and DOJ Need Not Prove Price Effects. The agencies take the position that the absence of price effects or other anticompetitive effects is not a defense to a consummated merger and the courts have adopted that view. In the majority of their consummated merger challenges in the last five years, the FTC and the DOJ alleged that the buyer had gained an enhanced ability to raise price, rather than that it had actually implemented a price increase.

Merger Remedies May Extend Beyond Divestiture. Remedies in consummated merger challenges over the last five years include disgorgement and behavioral relief, as well as divestiture. By a large margin, the preferred remedy has been divestiture: 77% of the matters studied ended with divestiture as a remedy. Disgorgement and behavioral remedies arise in a comparatively small portion of consummated merger challenges.

In the most recent matter, Commissioner Ohlhausen, a Republican recently appointed as Acting Chair, opposed the use of disgorgement and in a later speech reiterated her concerns about the lack of clear standards for when to apply disgorgement as a remedy. Under her leadership, the FTC may yet develop new disgorgement standards. While this might suggest that disgorgement remedies would be imposed less frequently, companies engaging in competitively-sensitive, non-reportable acquisitions should not be overly comforted. Because the FTC believes divestiture remedies are less likely to succeed when businesses are integrated, the new standards may retain disgorgement as a credible deterrent to truly anticompetitive, non-reportable deals.

There is No De Minimis Exemption. Dechert’s analysis of consummated merger challenges over the past five years shows that the agencies will challenge small deals. 55% of the consummated merger challenges for which valuation information is available involved deals valued at below $30 million. There is No Statute of Limitations.

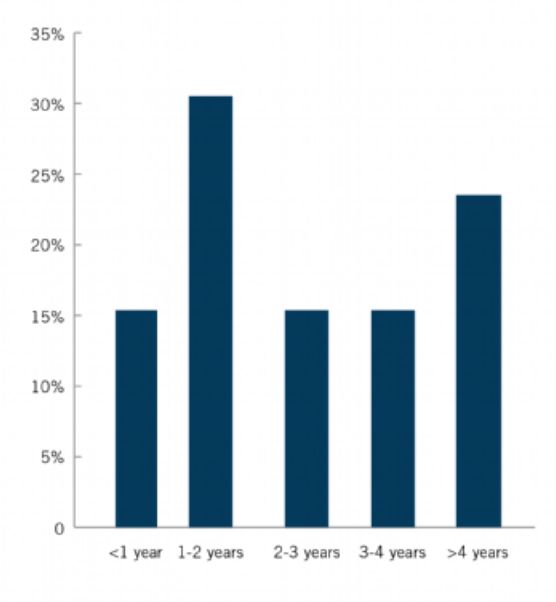

There is no statute of limitations barring antitrust challenges to consummated mergers. Although Dechert’s analysis shows that most enforcement actions occur less than three years after deal closing, the agencies have shown a willingness to challenge some relatively old mergers: 38% of challenges were more than 3 years after consummation and 23% were more than 4 years later.

When Reportable Transactions Drop, Consummated Merger Investigations May Rise. The agencies brought consummated merger challenges in each of the last five years, but more than a third of those challenges were brought in 2013—the year that had the lowest level of significant reportable transactions as reported by the Dechert Antitrust Merger Investigation Timing Tracker (DAMITT). A slow-down in reportable merger investigation activity could result in increased scrutiny of consummated deals.

Conclusion. Whether a transaction is HSR reportable has an important impact on procedure and timing. But non-reportable deals continue to be investigated and challenged, as shown recently by the FTC. Mergers leading to very high market shares, including ones that are relatively small in value, may be at risk of an FTC or DOJ challenge and a resulting cumbersome divestiture remedy for the buyer. Caveat emptor.