COVID-19 Coronavirus: Historically Low Interest Rates are Ideal for Estate Planning

Interest rates that are used for loans to family members, loans to trusts and to value gifts to certain trusts have been further reduced as a result of market conditions driven by the COVID-19 pandemic. These historically low interest rates present time-sensitive estate planning opportunities that could produce significant transfer tax savings.

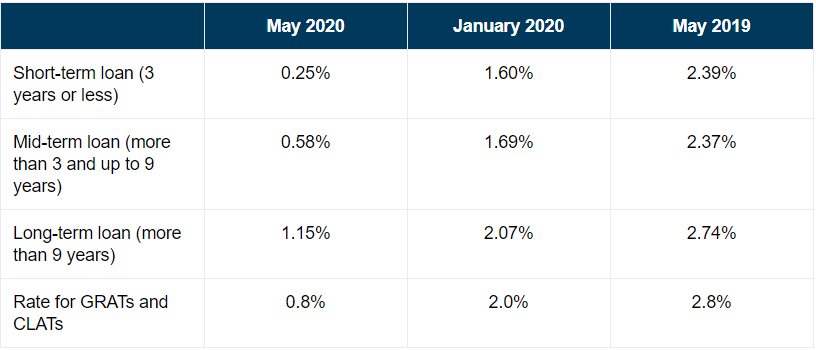

The relevant interest rates affecting estate planning techniques change monthly. The rates applicable to transactions in May, along with some historical rates for comparison purposes, are as follows:

There are several ways you can capitalize on these low interest rates.

1. Family Loans. Consider making new loans to family members or trusts for their benefit. The loans can be made with annual interest rates as low as 0.25% and can be structured to allow for a balloon principal payment at maturity, all with no gift tax consequences. If the family member or trust is able to earn a rate of return (on the loaned funds) greater than the interest rate, the excess may be kept without any gift taxes being paid. For example, in May, you can make a $1,000,000 loan for a term of three years to a grantor trust for the benefit of your child that provides for an interest rate of just 0.25%. If the grantor trust invests those funds and earns a 5% annual rate of return, you will have effectively transferred almost $150,000 to your child at the end of three years with no gift tax consequences.

2. Refinance Existing Loans. If you have already made loans to family members or trusts for their benefit, consider refinancing those loans at the current lower interest rates. If refinancing is possible, this is an easy way to transfer more assets out of your estate with no gift tax consequences.

3. Installment Sales to a Grantor Trust. Consider selling assets to an irrevocable trust in exchange for a promissory note. The interest rate on the note may be between 0.25% and 1.15% in May (depending on the term of the note) and because the irrevocable trust is established as a grantor trust, the sale does not trigger federal capital gains tax or federal income tax on the interest payments. The effect of the sale is that any appreciation over the applicable interest rate is equivalent to a tax-free gift to the irrevocable trust.

4. GRATs. Consider funding a grantor retained annuity trust (“GRAT”). A GRAT is an estate planning technique used to make gifts to family members without using lifetime gift tax exemption or paying gift tax. The effectiveness of this technique increases as interest rates decrease. A GRAT is an irrevocable trust in which the individual who creates the trust retains the right to receive annuity payments for a selected term of years equal to the amount contributed to the GRAT plus an amount equal to a hurdle rate. At the end of the annuity term, the appreciation on the trust property in excess of the hurdle rate of return (0.8% for May 2020) passes tax free to that individual’s family members or trusts for their benefit. Assets expected to increase in value significantly over a short period of time are ideal assets to contribute to a GRAT. However, because the hurdle rate of return is so low, even moderate asset appreciation may result in significant tax savings. As an example, a GRAT funded in May with $5,000,000 for a three year term whose assets appreciate 5% a year for the 3 years would produce a tax-free remainder of nearly $500,000. If the same assets appreciate at a rate of 10% per year the tax-free remainder would be over $1,100,000.

5. CLATs. For those charitably inclined, consider a charitable lead annuity trust (“CLAT”), which is similar to a GRAT except that a charity receives the annuity payments instead of the individual who created the trust. Your family members or trusts for their benefit still benefit tax free from any asset appreciation in excess of the hurdle rate.

You should consult with one of the members of Dechert’s Private Client team to help you determine if any of these techniques or other estate planning opportunities are appropriate for your situation. Dechert’s Private Client team is always ready to help you make the most of these and other opportunities available to you.