COVID-19 Coronavirus Business Impact: 10 June Deadline for Placing Employees on Furlough for the First Time

In this OnPoint we report on the recently announced extension of and changes to the Coronavirus Job Retention Scheme (the Scheme) with a reminder that the last date for furloughing staff for the first time for the purposes of the Scheme is next Wednesday, 10 June 2020.

Introduction

On Friday, 29 May 2020, the Government announced further changes to the Scheme confirming its extension to 31 October 2020, when it will close, and various important changes to its operation including obligations on the employer to contribute to the funding of the wages of furloughed employees. Whilst the Government has issued a fact sheet outlining these changes, it is understood that further detailed guidance on the changes to the Scheme will be published on Friday, 12 June 2020.

Deadline – closure of the Scheme to new entrants

Employers should note an important deadline of next Wednesday, 10 June 2020 which is the last day on which they can place employees on furlough for the first time and be eligible to claim the relevant grant payments under the Scheme in respect of furloughed employees. The Scheme will be closed to new entrants from 1 July 2020 and, from that point onwards, employers will only be able to furlough employees who have been furloughed for a full three-week period prior to 30 June 2020. This means that the final date by which an employer can furlough an employee for the first time is 10 June 2020, in order for the required minimum three-week furlough period to be completed by 30 June 2020.

Flexible furloughing

From 1 July 2020, “flexible furloughing” will be permitted under the Scheme. This means that:

- Employers will be able to bring back to work employees who have previously been furloughed, for any amount of time and on any shift pattern, while still being able to claim a grant under the Scheme for normal hours not worked.

- Employers will need to agree any new flexible furlough arrangements with their employees in writing.

- For any hours which an employee works, employers will need to pay full wages, tax and NICs in the usual way. Employers will be able to make a claim under the Scheme for the remainder of the employee’s “usual hours” that they are not required to work and will be required to submit data on the usual hours an employee would be expected to work in the relevant period and the actual hours for which the employee worked.

- Employers will be required to keep detailed records of an employee’s working hours during any period of flexible furloughing for the purposes of any subsequent audit by HMRC.

It is not yet clear whether any workers who are working under flexible furlough arrangements will still be permitted to work for other employers whilst not working.

Employer funding

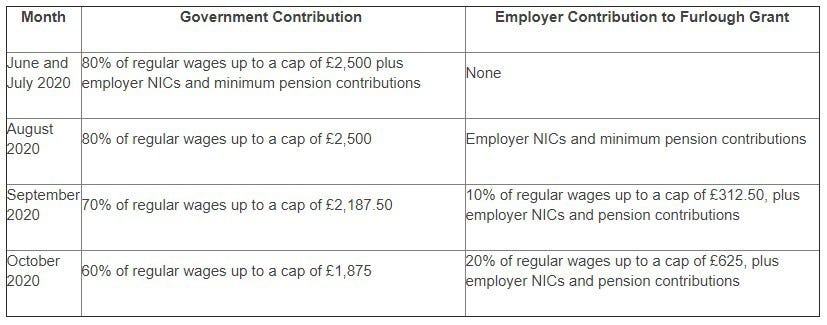

From 1 August 2020, employers will pay employer NICs and pension contributions on what they pay to their employees and from 1 September 2020 the Government’s contributions will taper down as follows:

Employees who are furloughed 100% of the time will continue to receive 80% of regular wages up to the cap of £2,500, contributed by the Government and the employer as above. For employees on flexible furlough, the grant and cap will be reduced in proportion to the hours not worked.

Employers may continue to top up the wages of furloughed employees to 100% if they wish.

Other changes

The minimum period in respect of which a claim may be made under the Scheme will be one week — the reason for this change being that it will enable grants to be calculated accurately across working patterns.

From 1 July 2020, claims will no longer be able to be made in respect of overlapping months. Employers will have until 31 July to make any claims in respect of the period to 30 June.

The overall level of claim an employer can make will be limited — the Government’s factsheet indicates that the number of employees an employer can claim for in any claim period will not be permitted to exceed the maximum number they have claimed for under any previous claim under the Scheme as currently operated.

Actions for employers

Employers will need to:

- ensure they have considered whether any further staff need to be furloughed under the Scheme and that they put the relevant arrangements in place in time for the 10 June deadline.

- consider whether they wish to take advantage of the extension of the Scheme in light of the funding obligations it entails as the Government grant is tapered.

- decide whether to seek to agree with furloughed staff that flexible furloughing can be operated.

- ensure that when flexible furloughing is used to bring staff back to the office they operate those arrangements in a careful and appropriate manner that avoids so far as possible the risks of constructive dismissal or discrimination claims.

- ensure when incorporating flexible furloughing into their return to work plans that arrangements for return to work fully address health and safety and other concerns.

- review the revised guidance on the Scheme once it becomes available and consider what changes need to be made to their existing furlough arrangements as a result.

- consider, if redundancies or other restructuring are likely to be necessary, an appropriate plan for managing the required process, including consideration of whether collective consultation with employee representatives is necessary.