Let it “Roll” (for a Little While): DOL Issues Limited Relief Regarding New Fiduciary Exemption

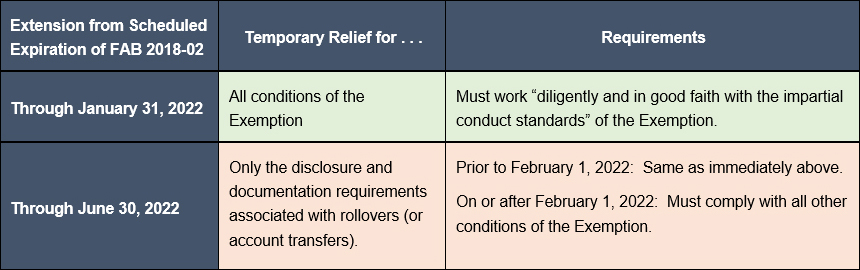

The U.S. Department of Labor (the “DOL”) yesterday, on October 25, 2021, issued Field Advice Bulletin 2021-2 (the “2021 FAB”), along with an explanatory notice, (the “2021 Notice”) in connection with compliance with Prohibited Transaction Class Exemption 2020-2 (the “Exemption”). As discussed below, the FAB and Notice generally (i) extend certain existing transition relief for less than two months (through January 31, 2022), and (ii) provide additional more limited transitional relief for documentation and disclosure conditions of the Exemption concerning rollovers (and transfers of assets among retirement accounts) as to certain matters through June 30, 2022.

Summary Chart

Background

The 1975 regulation regarding the definition of Investment Advice (the “1975 Regulation”), which had stood for approximately 40 years, had been substantially amended in 2016. The 1975 Regulation set forth a five-part test (the “Five-Part Test”) under which one may be considered to be providing Investment Advice and therefore be a Plan fiduciary.

In 2016, the 1975 Regulation was amended, resulting in a dramatically new set of rules. The path to finalization of the 2016 amendment (the “2016 Regulation”) was extremely circuitous, and, ultimately, the 2016 Regulation Rule, together with the associated rulemaking (together with various new exemptions (including, as one notable example, the so-called Best Interest Contract exemption) and amendments of existing exemptions), was vacated in 2018 by the U.S. Court of Appeals for the Fifth Circuit.*

In addition, the DOL essentially recognized that, for those who were concerned that they might be considered fiduciaries under the restored 1975 Regulation (particularly in light of the DOL’s new expansive interpretations thereof, noted below), or might be affirmatively seeking fiduciary status, the elimination of the exemptions issued in connection with the issuance of the 2016 Regulation could adversely affect those financial institutions and other service providers willing to abide by ERISA’s fiduciary standards. Thus, the DOL proposed an exemption, which eventually was finalized in 2020 as the Exemption. In connection with the release of the proposed version of the Exemption leading to the Exemption, the DOL expressly reinstated the 1975 Regulation (and also reinstated Interpretative Bulletin 96-1, which relates to what is considered investment education (as opposed to “investment advice”)).

Furthermore, the preamble to the Exemption sets forth the DOL’s most recent official published views regarding various aspects of what makes one an “investment advice” fiduciary, with significant expansion of the scope of “investment advice” for ERISA purposes, particularly in the case of rollover solicitations. These new expansive interpretations drove up the stakes surrounding the timetable for complying with the Exemption and made the availability of transition relief all the more important. Our discussion of the Exemption can be found here.

In FAB 2018-02 (the “2018 FAB”), the DOL stated that, through December 20, 2021, it would not pursue prohibited-transaction claims against “investment advice” fiduciaries (or treat such fiduciaries as violating the applicable prohibited-transaction rules) where those persons worked diligently and in good faith to comply with applicable “impartial conduct standards” for those transactions that otherwise would be exempt under the Exemption. In finalizing the Exemption, the Department announced that the temporary enforcement policy set forth in the 2018 FAB would remain in place until (and only until) December 20, 2021.

The 2021 FAB and the 2021 Notice

Many institutions seeking to operate under the Exemption have been facing challenges trying to conform to the Exemption’s requirements. The 2021 Notice states, among other justifications for relief contained in the 2021 FAB, that the DOL “understands that the December 20, 2021 expiration date of the temporary enforcement policy poses practical difficulties for financial institutions that are in the process of complying with the exemption conditions,” and in particular, in the 2021 FAB that institutions “are in the process of developing tools to comply with the rollover documentation and disclosure [requirements of the Exemption].” The 2021 Notice goes on to say: “Financial institutions maintain that they face significant challenges in implementing the rollover documentation and disclosure requirements in a sufficiently automated and systematic manner by the Dec. 20 deadline, and that these challenges and concerns may delay their ability to rely on the exemption as the Department intended.” The DOL also noted that timing issues were at play stating that “financial institutions have expressed concern that they would incur significant additional distribution costs, because the December 20, 2021, expiration date does not align with their regular distribution cycle for disclosures. The expiration date also complicates the [Exemption’s] retrospective review requirement for financial institutions that want to perform their review on a calendar year basis.”

Thus, the 2021 FAB:

- Extends full nonenforcement relief for less than two months.

The 2021 FAB provides a two-month extension, to January 31, 2022, of the relief under the 2018 FAB for financial institutions and other persons seeking reliance on the Exemption to comply with the Exemption (provided that, as was the case under the 2018 FAB, they are working “diligently and in good faith with the impartial conduct standards for transactions of the Exemption”). One effect of the relatively short general extension is that, even with the longer extension for certain matters noted in the next bullet point below, financial institutions who seek to comply with the Exemption will still need to provide written notice acknowledging fiduciary status prior to February 1, 2022. - Provides additional nonenforcement relief through June 30, 2022 for (and only for) the Exemption’s documentation and disclosure requirements relating to rollovers.

The 2021 FAB provides that the DOL will not enforce the specific documentation and disclosure conditions for rollovers in the Exemption through June 30, 2022 where the failure to satisfy those conditions is “based solely on [the] failure to comply with the [Exemption’s] disclosure and documentation requirements.” It is noted that, because a condition for relief under the 2018 FAB was good-faith compliance with the Exemption’s impartial conduct standards, that requirement continues to apply to rollovers (and account transfers) even though the documentation and disclosure requirements of the Exemption have been delayed until July 1, 2022. In addition, it would seem that institutions would need to comply with the Exemption’s requirements to disclose conflicts of interest and the services for transactions on or after February 1, 2022.

As noted above, the Notice states that the previous December 20, 2021 expiration date “complicate[d] the retrospective review requirement for financial institutions that want to perform their review on a calendar year basis.” In this regard, to the extent that financial institutions had planned to complete their required retrospective reviews on or before the previous December 20, 2021 deadline on a special (e.g., non-calendar) schedule, they may wish to reconsider that choice in light of the 2021 FAB, which, by providing general transition relief through January 31, 2021, now extends the relief to beyond the end of calendar-year 2021.

* * *

If you have any questions regarding the 2021 FAB or the 2021 Notice, or any other aspects of the Exemption or ERISA’s fiduciary rules generally, please contact the Dechert attorneys listed below or any Dechert attorney with whom you regularly work.

* Chamber of Commerce v. US Dep’t of Labor, 885 F.3d 360 (5th Cir. 2018).