UK Qualifying Asset Holding Companies: How Will The Proposals Impact Debt Funds?

The UK government recently published a response paper and draft legislation following a second consultation exercise with respect to what is now termed Qualifying Asset Holding Companies (QAHCs). This is aimed at the introduction of a new tax-advantaged UK intermediate company that could be used by investment funds as a means of investing in underlying assets. It is designed to be competitive with existing regimes in the EU such as Luxembourg. See our previous OnPoint for further details in relation to the first consultation exercise and first response paper here. The intention is for the new QAHC regime to come into effect from April 2022. Whilst this initiative is proposed to have application to a wide range of investment funds, this OnPoint is designed to focus on the potential impact of the proposed rules for alternative credit/debt funds.

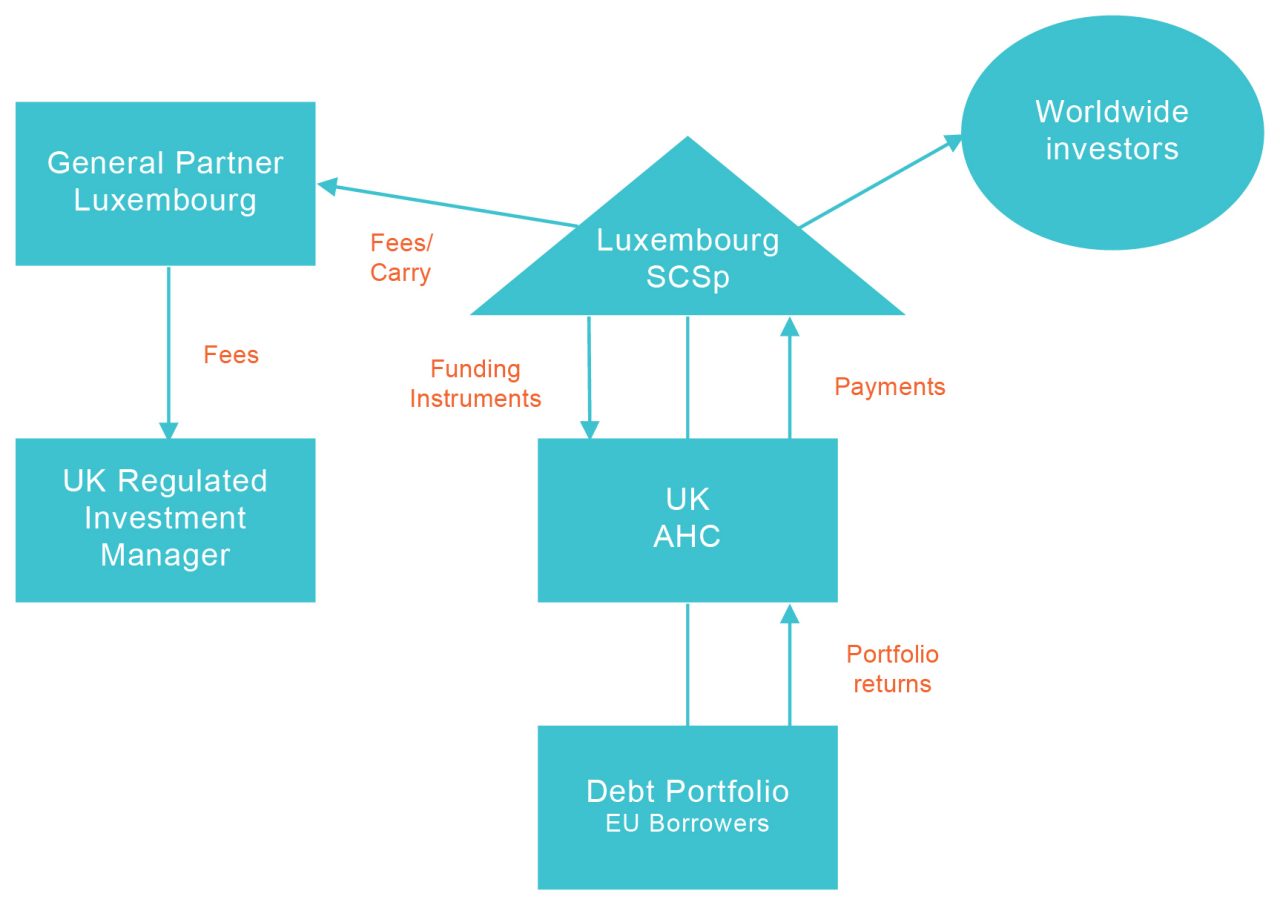

It may be helpful to illustrate the new proposals and outstanding issues via a strawman credit fund structure.

The structure is a simplified version of how a typical European fund might be established in Luxembourg where currently we would typically use a downstream Luxembourg SARL or securitisation vehicle as the intermediate asset-holding corporate vehicle. The goal of the new UK government proposals is to facilitate the use of a UK QAHC instead. This could be very attractive to UK-based investment managers as it will be easier to demonstrate existing substance in the UK (due to the presence of employees, an office etc.) and thereby should avoid the need to build such substance in Luxembourg. It will also mean all meetings of the QAHC could be held in the UK rather than in Luxembourg, which could simplify life for some of the UK executives who would wish to be on the board of the company. In addition, it would avoid the need to seek a treaty passport or other treaty relief to avoid UK withholding tax in respect of interest payments on underlying UK portfolio debts owned by the company.

It is clear that investment managers are not going to use the new regime unless it is both straightforward and competitive with existing jurisdictions like Luxembourg. So how close are the current QAHC proposals to delivering such a regime? It is fair to say that what we have by way of draft legislation is encouraging – however amendments are required and a number of key areas still need to be addressed or clarified.

How to qualify as a QAHC?

An ownership condition must be met to qualify as a QAHC. The details of the test are complex in some respects, but appear to be workable for most types of alternative credit funds that directly own a QAHC. Essentially, 70% of investors of the QAHC (not the fund itself) must be “good” investors, and this category will include diversely owned funds that are managed by regulated managers. This category will also include institutional investors such as pension funds, sovereign entities and long-term life insurance companies if those investors were to own interests in the QAHC directly. A diversely owned fund for these purposes will include non-close companies (ignoring for these purposes circumstances where it is close only as a result of ownership by certain types of institutional investors). It will also include funds that meet the genuine diversity of ownership requirements.

There is also a need for the QAHC to meet an activities test that currently is worded in an unsatisfactory manner (in that it appears to require the spreading of investment risk and also excludes trading activities). It is essential that the practical meaning of these terms is clarified so that there is no risk that normal credit fund activities are excluded due to possible concerns over what constitutes adequate risk spreading (and whether an active management policy or origination activity might be considered to be a trading activity). However, further dialogue is ongoing with HMRC, and we are optimistic that greater clarity can be achieved around this definition.

There is a proposal that there should be a minimum capital requirement for entry into the QAHC regime of £50 million or £100 million, but this remains to be resolved.

Key Tax Benefits/Requirements

- It is proposed that the QAHC will only be subject to corporation tax on a small transfer priced profit margin. This needs to be sufficiently small to be competitive with other jurisdictions. We are awaiting further guidance on this key point.

- In order to ensure that corporation tax liabilities will be kept to a minimum in the QAHC key anti-avoidance legislation will need to be “switched off.” We understand that this will include aspects of the anti-hybrid rules, the late paid interest rules, the corporate interest restriction rules and the rules that treat profit related interest payments as distribution. Draft legislation is awaited.

- A key confirmation was given in the second response document that an exemption from UK withholding tax will be introduced for payments made to holders of interests in the QAHC (in respect of payments related to those interests). However, there will be no blanket exemption from UK withholding tax on payments by a QAHC. For example, ordinary lenders to the QAHC would need to seek other exemptions from potential UK withholding tax on interest payments made to them.

- Confirmation was given in the second response document that there would be a mechanism to pass underlying gains realised by the QAHC through to investors. Accordingly, a repatriation of such proceeds to a holder of an interest in the QAHC could enable such investor/carried interest holder to obtain capital gains treatment. Unfortunately, this doesn't appear to extend to gains on distressed debt. It may be that such gains can still be returned to such investors through a redemption of funding instruments, but this would appear to require very specific drafting of such instruments as well as a taxable profit margin to be retained by the QAHC in respect of such gains.

- Although of lesser significance for debt funds, confirmation has been given in the second response document that a capital gains exemption will also be introduced for QAHCs.

- It was also announced that a stamp duty exemption would be introduced on transactions in debt instruments that might otherwise not qualify for existing exemptions for debt instruments, such as where the debt is convertible or interest is profit dependent. This could apply to redemptions or transfers of such interests. However, no exemption would be included in respect of dealings in the share capital of the QAHC.

- No further update was given in relation to possible changes to the VAT treatment of investment management fees. This is to be the subject of a separate work stream, and while an important issue to resolve, has greater significance in relation to investment management charges to the fund itself (in the event the fund was also located in the UK).

- It will be necessary to choose to enter into the regime, and special rules will apply on entry into and exit from the regime. In the event that the QAHC undertakes non-qualifying activities, those activities would be ring fenced from the qualifying activities and would not benefit from the special tax advantages of a QAHC.

- HMRC recognises that consideration should be given to the position of UK resident, but non-domiciled investors given that direct investment in a UK entity may be unattractive.

Next Steps

HMRC and HMT have already begun a further series of virtual meetings with interested parties in relation to the draft legislation and the outstanding tax issues. It is very evident that a great deal of effort is being expended to consult widely with a view to making the new QAHC regime a success. If anyone is interested in contributing to this process, please feel free to contact any member of the Dechert tax team.