DAMITT H1 2023: A Look at German and French Merger Control Trends

This special report has been published in collaboration with Law360 and is also available here.

This article provides an overview of merger control statistics and trends in Germany and France in the first half of 2023, focusing on trends in significant merger control investigations in these two major European Union jurisdictions.

In Germany, significant merger investigations cover all Phase 2 investigations by the German Federal Cartel Office, or FCO.

In France, significant merger investigations are defined as all reportable mergers reviewed by the French Competition Authority, or FCA, under the French merger control regime which were either:

- Cleared in Phase 1 with commitments; or

- Went through a Phase 2 investigation, irrespective of the outcome of the in-depth review.

Germany

- In the first half of 2023, there was a decline in notifications received by the FCO — 379 compared to 416 in the first half of 2022.

- The FCO concluded five Phase 2 investigations during this period, 40 percent of which were unconditionally cleared.

- Phase 2 investigation durations dropped to 4.8 months in the first half of 2023, slightly below the averages of prior years.

- The 11th German Act Against Restraints of Competition amendment, or GWB, enacted in July, further bolsters the FCO's merger enforcement powers.

France

- In the first half of 2023, the FCA issued 135 decisions, marking a 20.5 percent increase compared to the previous year.

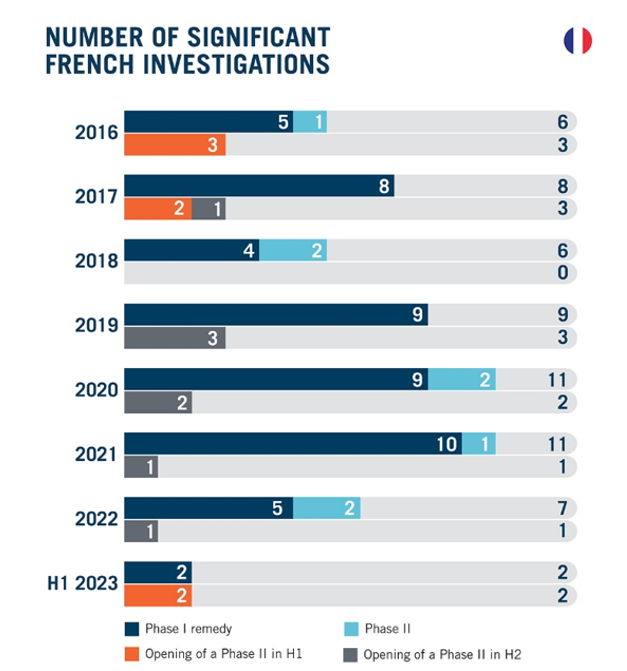

- There has been, however, a significant year-on-year decrease in significant investigations, with only two Phase 1 cases involving commitments concluded in the first half of the year.

- While no Phase 2 decisions have yet been issued by the FCA in 2023, the authority opened two in-depth investigations in the first six months of the year— a first since 2017.

- The duration of significant investigations has decreased significantly in Phase 2 to 5.3 months from the date of announcement to the clearance.

A Decline in Notification Count, but an Increase in Significant Investigations

In the first half of 2023, the number of notifications to the FCO declined to approximately 379 compared to approximately 416 in the first half of 2022.

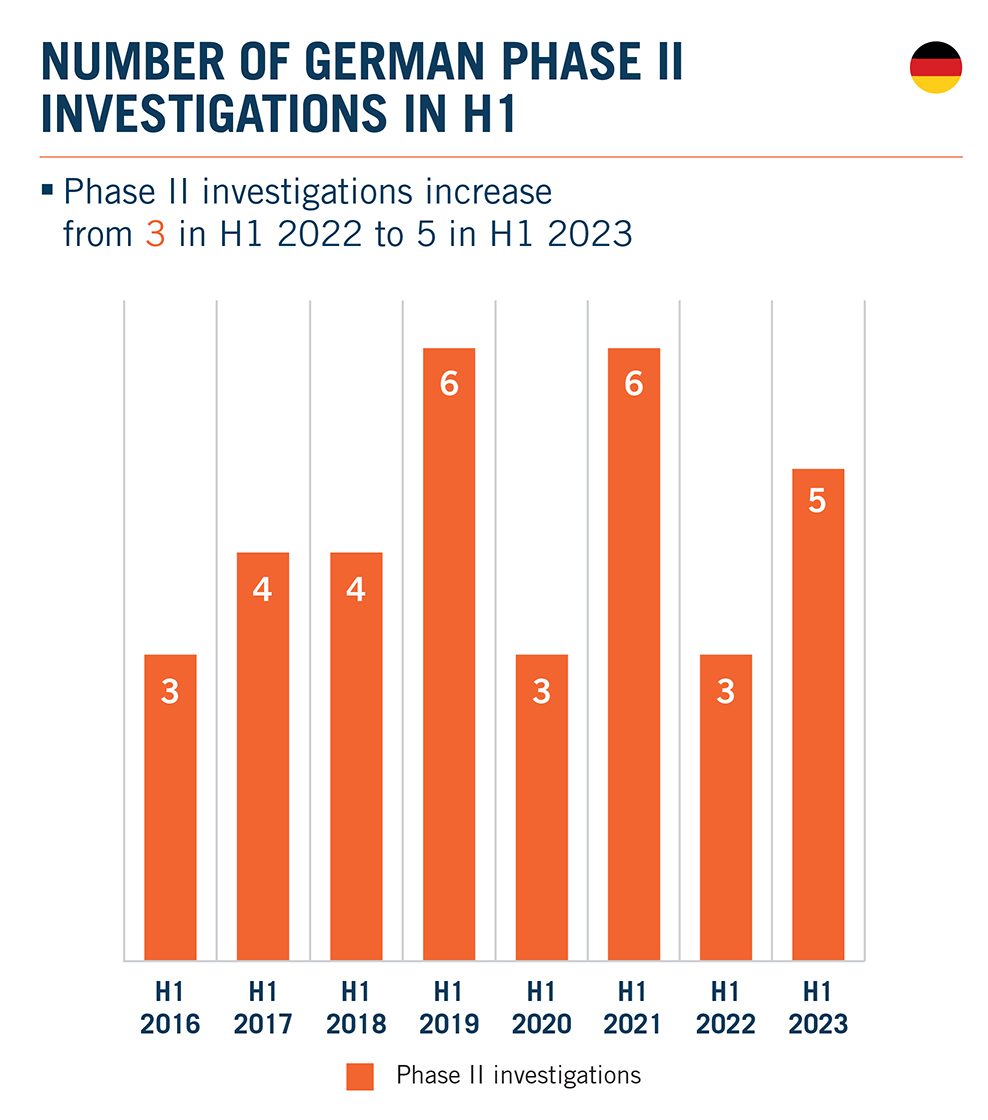

Conversely, while the first half of 2022 saw the conclusion of three Phase 2 investigations, this number increased to five during the same period of 2023, which was the same for the entire year in 2022, showing no sign of a decrease in the FCO's enforcement activities.

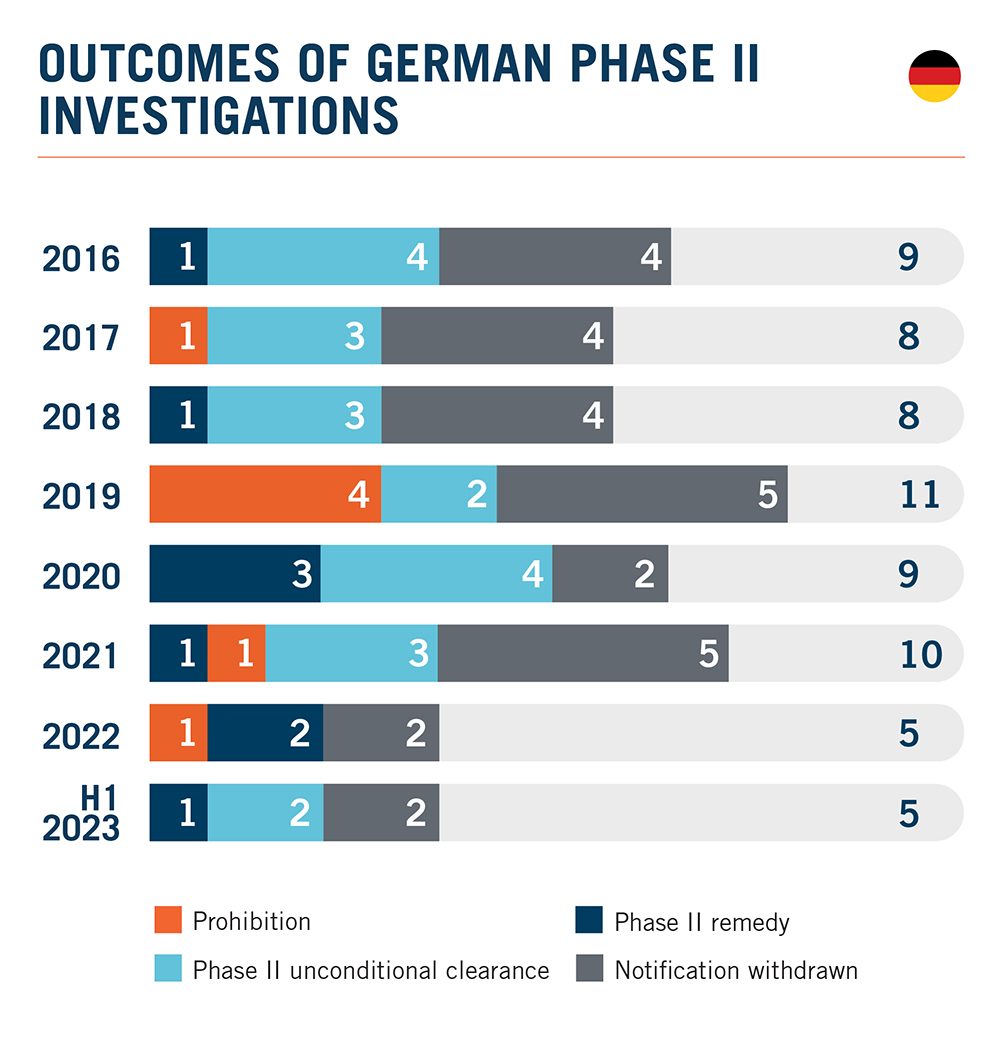

Two of the five transactions that underwent Phase 2 investigations in the first half of 2023 were unconditionally cleared, one was cleared with remedies and two were withdrawn by the parties in the course of the FCO's Phase 2 review.

The FCO demonstrated its usual versatility in its Phase 2 cases, investigating mergers from a wide range of sectors, including dairy, scrap and metal trading, marketing of media products, pool and water treatment equipment, and thermal packaging systems.

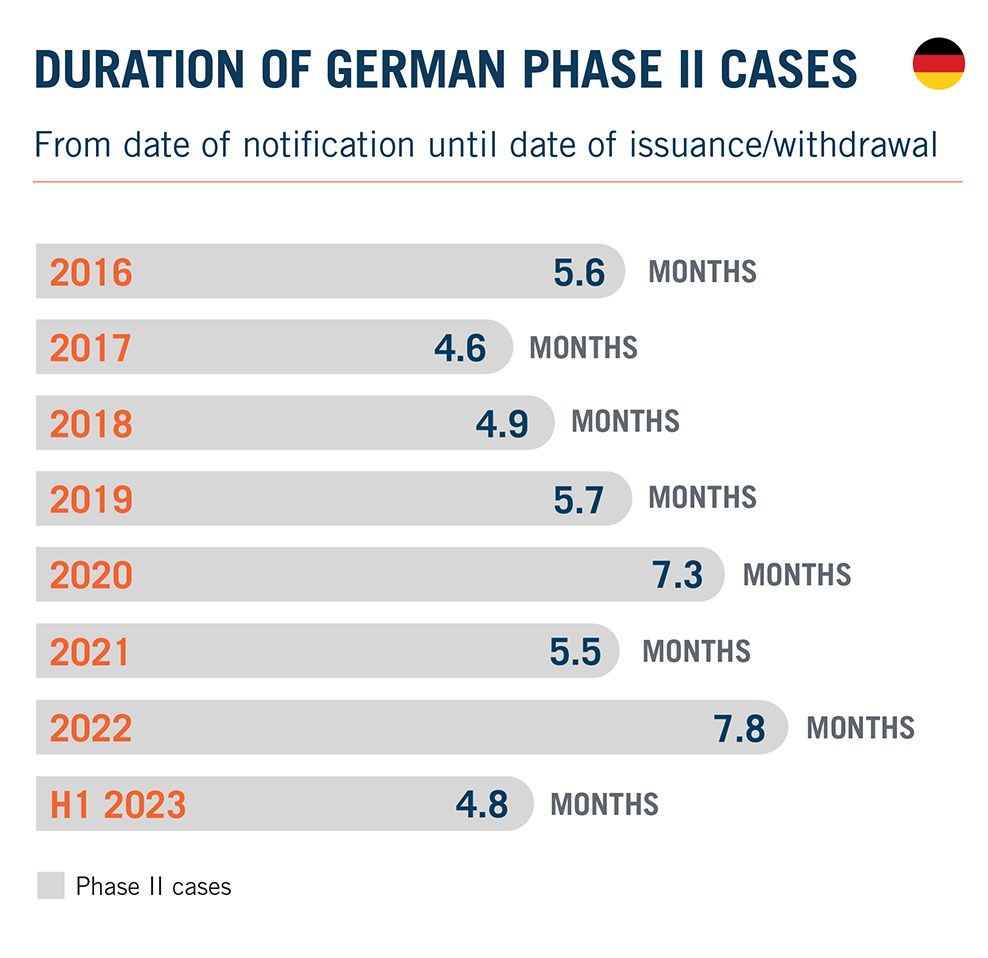

In H1 2023, the average duration of merger investigations that proceeded to Phase II declined from an overall average duration of 7.8 months in 2022, as shown in the graph — or 6.8 months in H1 2022 — to approximately 4.8 months.

This number is slightly below the average durations seen in prior years and brings the FCO's timing back in line with pre-pandemic years — although it remains to be seen if that trend will continue in the second semester.

Phase II investigations concluded in the first half of 2023 included:

- Theo Muller Group's acquisition of Royal Friesland Campina NV's dairy brands. After a six-month-long investigation, the FCO cleared the acquisition subject to the sale of the "Tuffi" business and to the granting of "Landliebe" licenses to third parties.[1]

- The FCO cleared the merger in the scrap and metal trading sector between Schrott-und Metallhandel Kaatsch GmbH and Prometall GmbH in 4.2 months. The parties withdrew the initial notification during Phase 2 and resubmitted the filing in its original form.[2]

- After a five-month-long investigation, the FCO cleared Funke Mediengruppe's acquisition of a stake in BCN Brand Community Network GmbH, a transaction pertaining to the marketing of media products.[3]

- The FCO cleared Fluidra SA's acquisition of Meranus Group, Meranus Haan GmbH, Meranus Lauchhammer GmbH and Aquacontrol GmbH, all active in the space of swimming pool equipment, after a five-month-long investigation.[4]

- Following a four-month-long investigation, including withdrawal and refiling, the FCO cleared EQT Private Equity's acquisition of va-Q-tec AG, a company active in thermal insulation and cold chain logistics.[5]

In the first half of 2023, less than 2 percent of transactions notified in Germany were subject to an in-depth Phase 2 investigation, which is a slight increase compared to the first half of 2022.

This reflects the fact that, despite recent changes to merger control thresholds, the German system still catches a high number of unproblematic transactions.

Looking Ahead

On July 6, the German Federal Parliament passed the 11th amendment to the GWB, aiming to enhance the FCO's enforcement tools and expand its powers following sector inquiries.

In relation to merger control, the amendment allows the FCO to require companies to notify certain mergers, even if they do not meet the specific turnover thresholds outlined in the GWB, provided there are indications that future mergers in the investigated sector could significantly impede competition.

The 11th GWB amendment also lowers the thresholds for the special merger control regime, which aims to better monitor and control concentration tendencies in smaller regional markets.

These legislative changes reflect a more interventionist approach to merger control in Germany, with the FCO gaining broader powers to intervene in transactions and address potential competition concerns at an earlier stage.

Steady Activity for the First Semester of 2023, but a Decrease in Significant Investigations

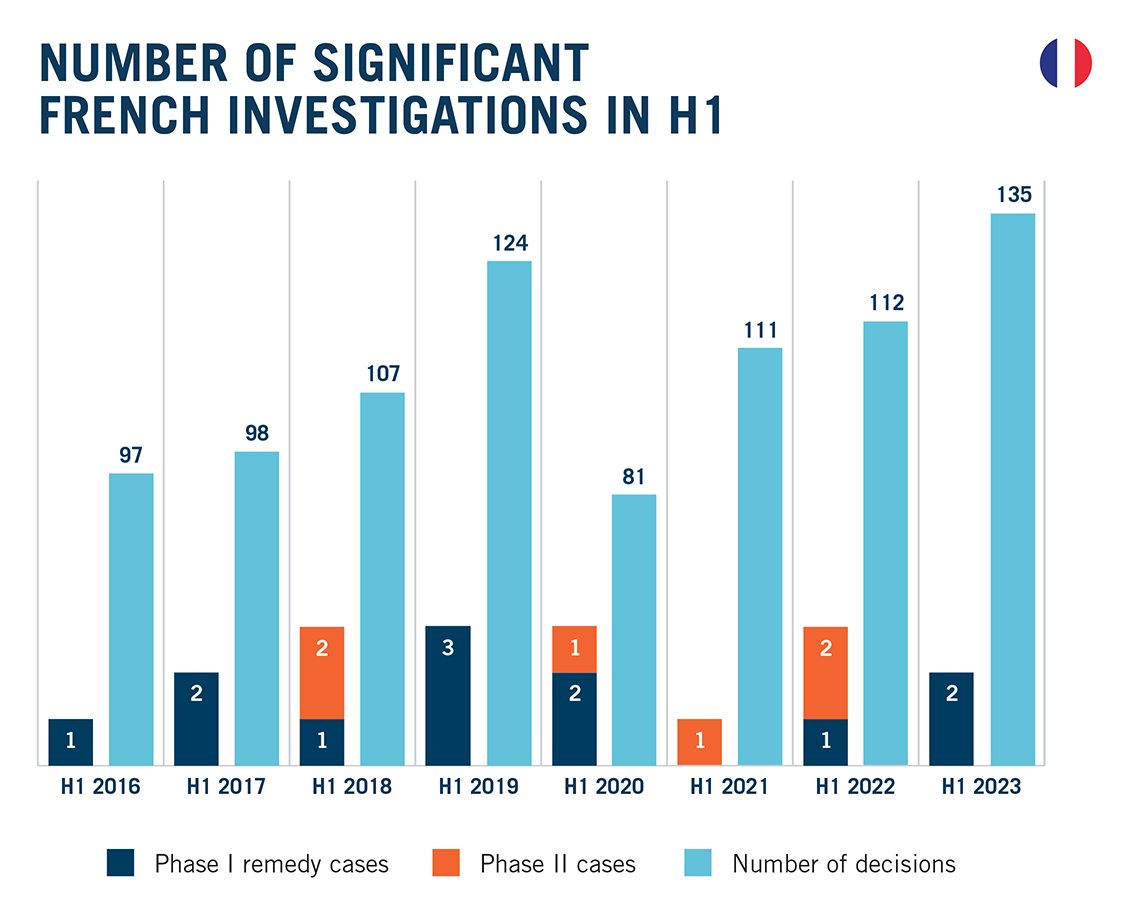

During the first six months of 2023, the FCA issued 135 decisions, a 20.5 percent growth compared to the same period last year, which saw 112 decisions.

On the other hand, few significant investigations have been concluded: The FCA has only issued two Phase 1 decisions with remedies since January 2023, and no Phase 2 investigations have been concluded so far this year.

If the FCA wants to stay on track with previous years, it will therefore need to conclude between four and nine additional significant investigations by the end of the year.

It may well be their intention to do so: Although no Phase 2 decisions have been issued since January, the FCA has opened two in-depth investigations in the first half of the year, a situation not seen since 2017.

This points to a steady level of enforcement action, despite a modest start to 2023.

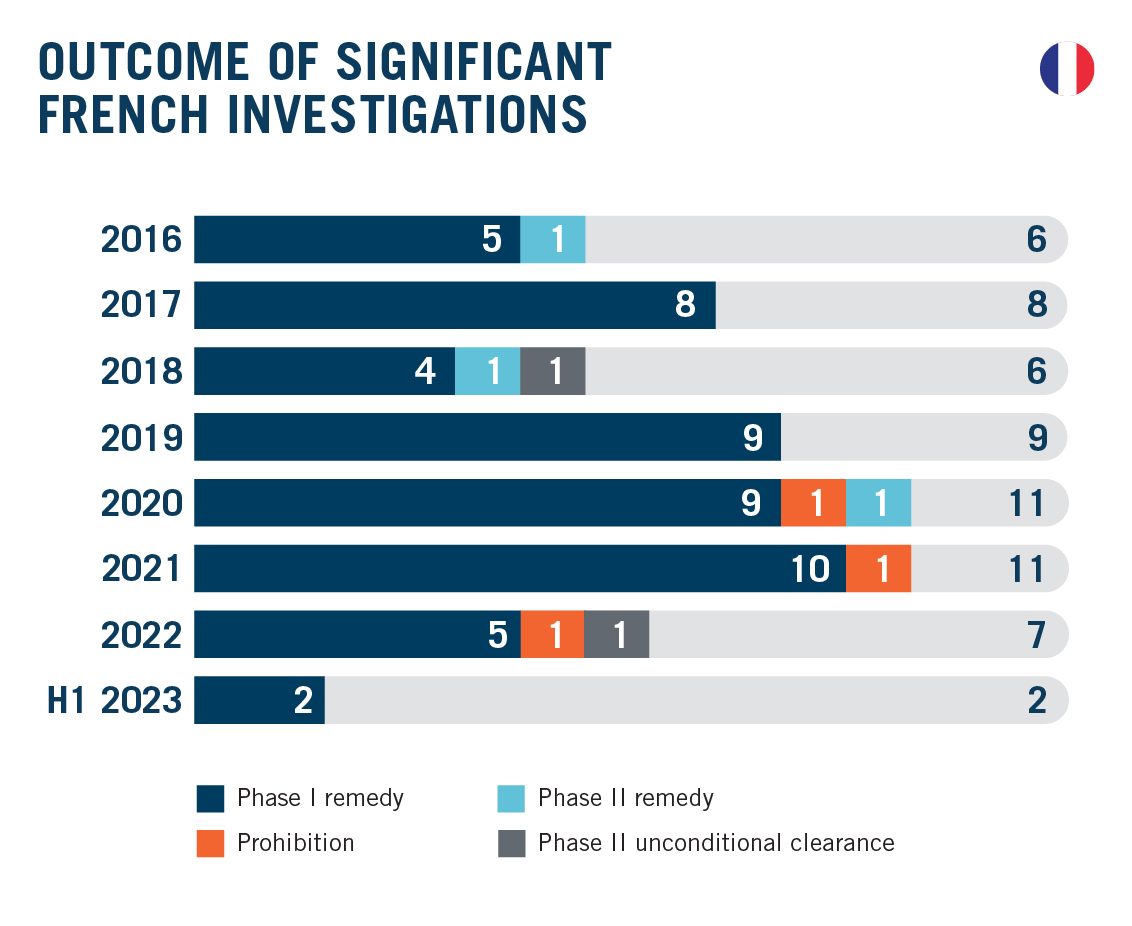

Will the FCA Maintain its Recent Trend of Stricter Enforcement?

The remedies approved by the FCA in the two significant investigations concluded this semester confirm that, although the authority relies mainly on structural commitments, it remains more open to behavioral commitments than other agencies, especially the European Commission — a commitment to delegate the management of a specific activity site to an independent third party was approved by Vacanceselect Group and European Camping Group.

In terms of priorities for the FCA, it is worth noting that the two decisions to open an in-depth investigation and the one Phase 1 with remedies case concluded since January relate to the tourism and hospitality industry. [6]

Even though this sector is not included in the FCA's roadmap for 2023-2024, it seems that the consolidation of the industry in the aftermath of the coronavirus pandemic is still an area of focus for the authority.[7]

Finally, with three Phase 2 investigations still ongoing, it remains to be seen whether the FCA will maintain its pattern blocking a deal per year, observed since 2020. While, for the first decade of its merger review responsibilities, the FCA never blocked a transaction, it can now be considered as one of the strictest agencies in Europe.

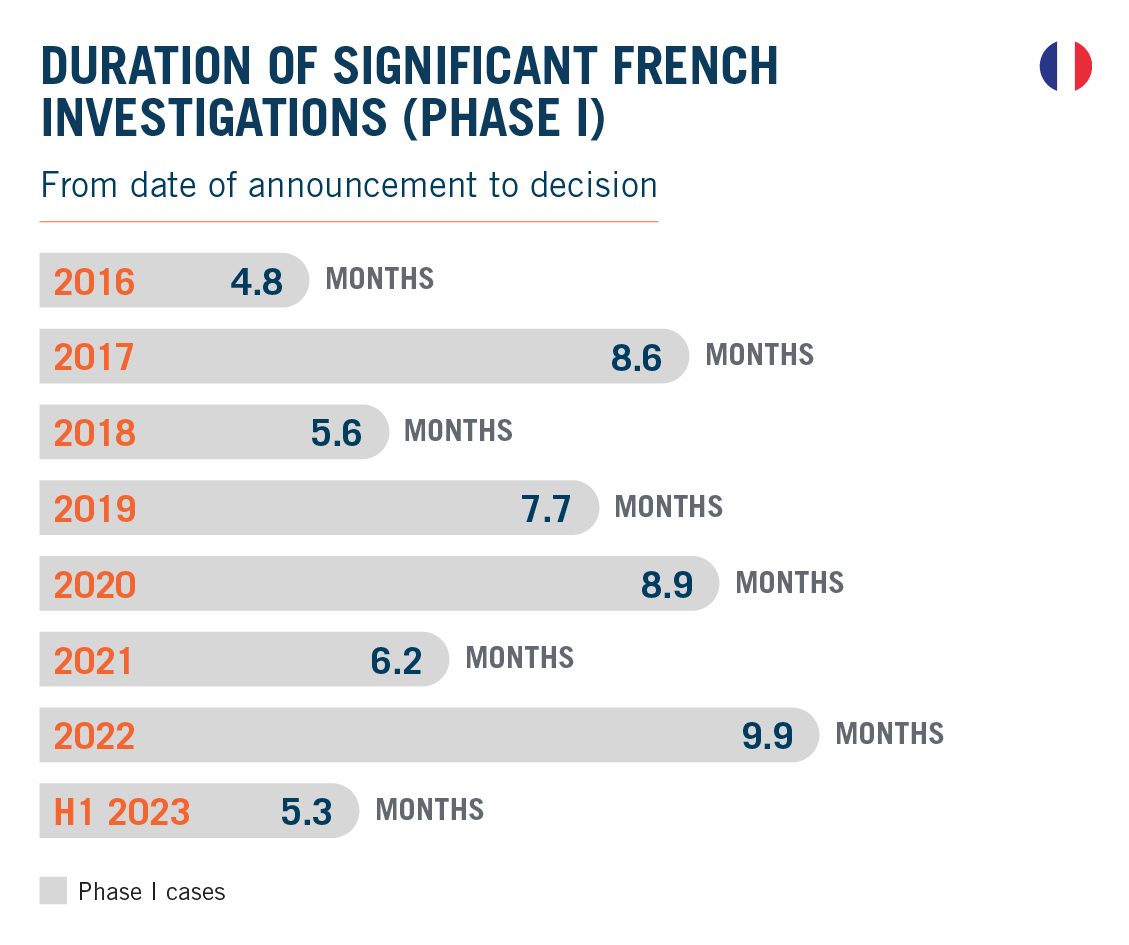

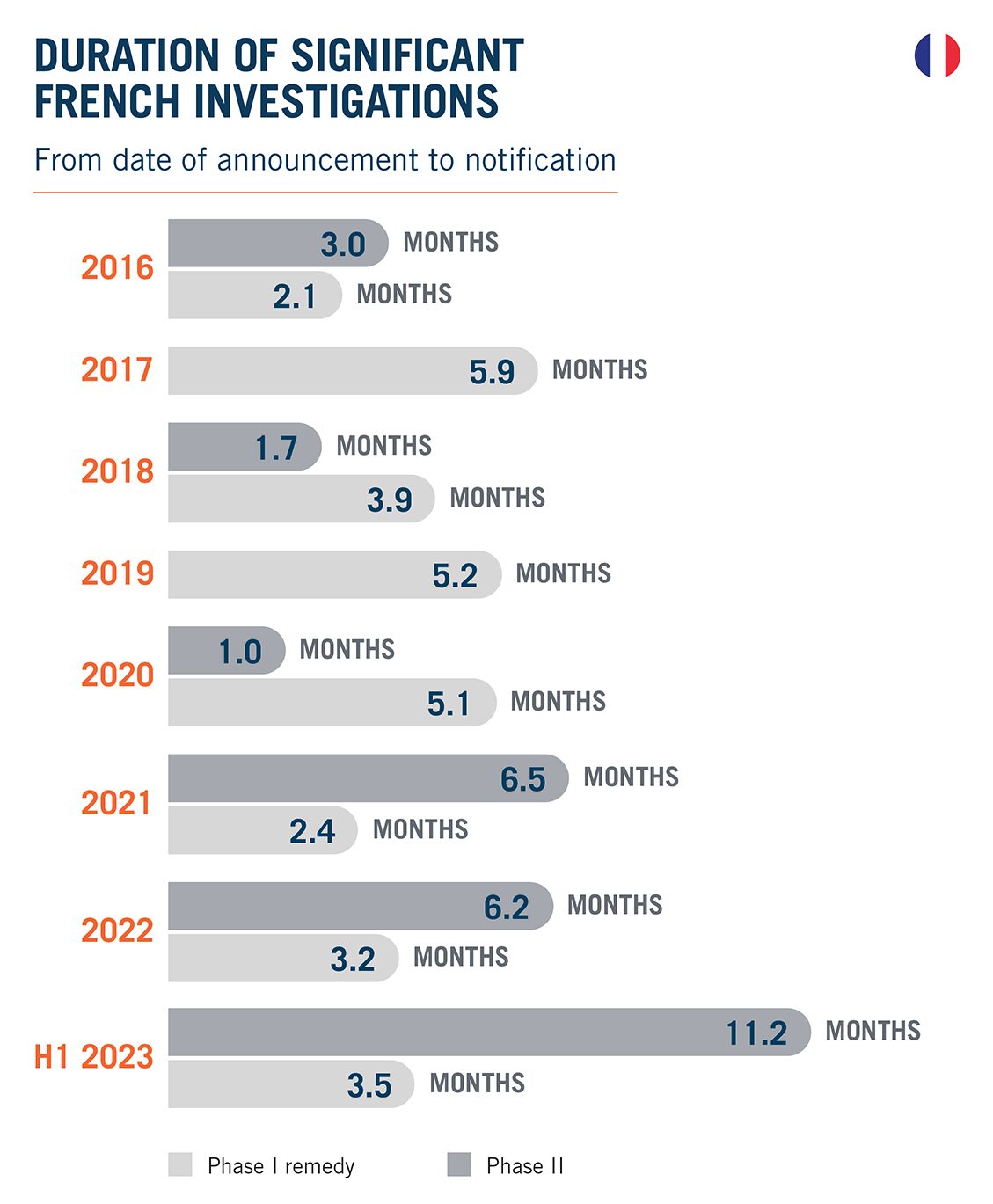

Average Duration of Significant Investigations

The duration of Phase 1 investigations significantly decreased in the first half of 2023, from an average of 9.9 months in 2022 to 5.3 months — a level not seen since 2018. This sharp decrease is at odds with the average levels observed in recent years, and it may not be reasonable for merging parties to expect it to remain at that level for the rest of the year.

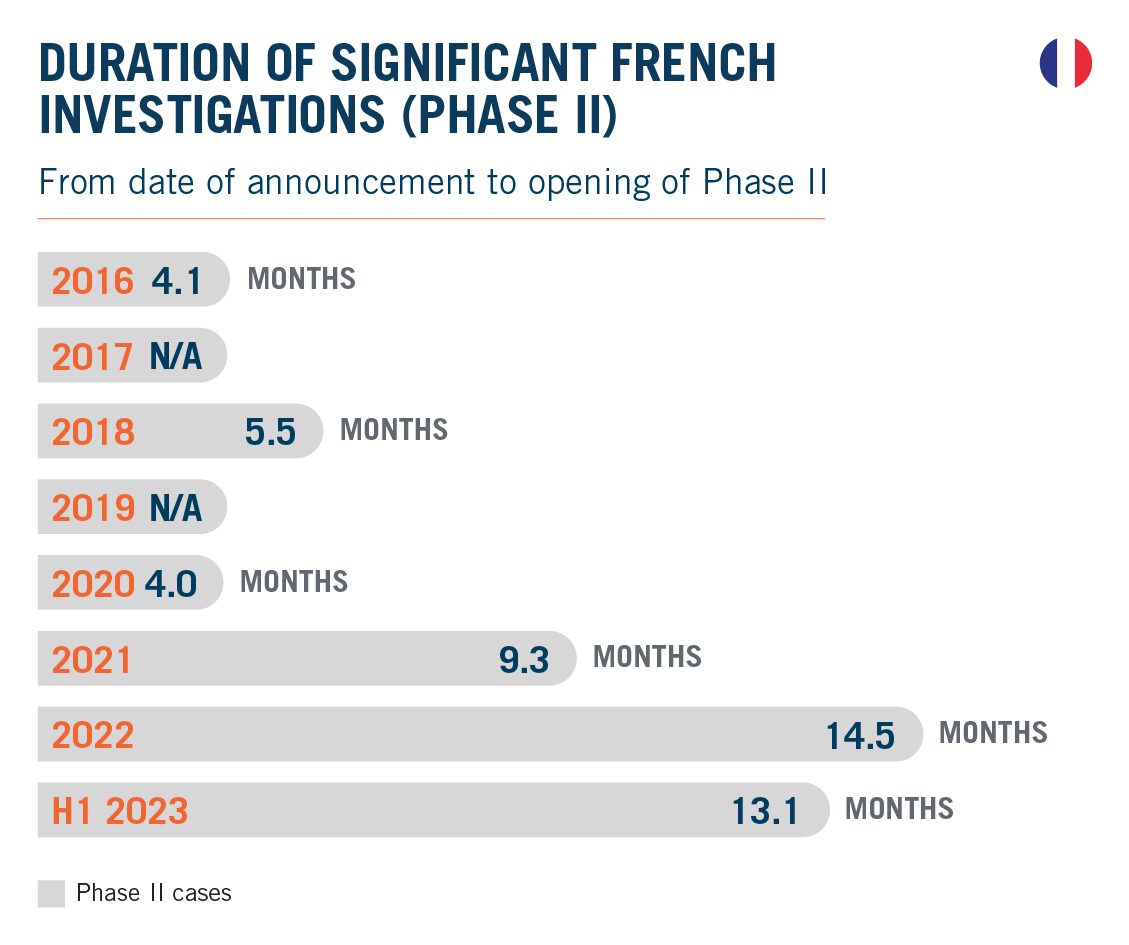

Since no Phase 2 decision was issued since January, no comment can be made at this stage on the overall length of in-depth investigations.

Still, based on the two decisions to open Phase 2 investigations issued in the past six months, there has been a slight decrease in the time between the deal announcement and the opening decision, from a record 14.5 months in 2022 to only 13.1 months.

But this is still well above the average in all years prior, indicating that clearance in Phase 2 is likely to remain as challenging as ever.

2023 H2: Longer Prenotification Talks Are Likely to Result in Increased Durations in the Future

While the total duration of significant investigations is decreasing, time spent on prenotification discussions has increased, up to 3.5 months in Phase 1 and 11.2 months in Phase 2.

This is all the more concerning for merging parties that the length of prenotification talks no longer appears to be a reliable indicator of the successful outcome for the transaction.

In the past two years, the longest prenotification discussions observed have resulted in prohibition decisions — 7.5 months for French broadcasters TF1 and M6 in 2022, and 6.5 months for Transport Storage Energies and Société du Pipeline Méditerranée-Rhône in 2021.[9]

Looking Ahead

The French merger control review process has not recently undergone significant legislative changes, but the evolution in the past few years towards stricter enforcement is still notable. And it is clear that the FCA's scrutiny has not eased.

Going forward, with three Phase 2 investigations still under review, one of which was notified about 15 months ago, it seems that neither the duration of the review nor its outcome is improving for merger parties, especially as recent experience has shown that lengthy discussions with the FCA do not necessarily bode well for the operation's success.

Conclusion

Germany and France are key merger control jurisdictions in Europe, with strict enforcement and sophisticated analysis tools.

While the FCO traditionally handles far more merger notifications than the FCA, the number of filings in Germany has continued to decline following legislative reforms that introduced new merger control thresholds in 2021.

Parties to substantively complex transactions that require merger notifications in Germany and France need to make sure that they factor in sufficient time for filing preparations and review by the authorities.

In cases where authorities in Germany and France are subject to significant investigations, parties should be prepared for a long duration of proceedings and in-depth scrutiny by the authorities.

While the duration of significant investigations declined in both jurisdictions compared to full year 2022 statistics, it remains to be seen whether we are seeing a new trend.

Experience shows that averages may vary significantly between calendar years given the relatively low number of significant investigations in both jurisdictions.

Footnotes

[1] Case B4 — 90/22, decision of February 22, 2023, available in German here.

[2] Case B5-88/22, decision of January 23, 2023, English case summary available here.

[3] Case V-31/22, decision of March 16, 2023, available in German here.

[4] Case B5-27/23, decision of June 22, 2023, English press release available here.

[5] Case B5-36/23 — decision of June 12, 2023, English press release available here.

[6] FCA Decision No. 23-DEX-01 of 9 January 2023, Aéroport de Paris/ Select Service Partner /JV, available in French here. FCA Decision No. 23-DEX-02 of 2 May 2023, Smartbox/Wonderbox, available in French here. FCA Decision No. 23-DCC-32 of 14 February 2023, Vacanceselect/ ECG Grou, available in French here.

[7] See the FCA's Roadmap 2023-2024 published on 3 March 2023, available in English here.

[8] FCA, Decision No. 22-DCC-254 of 22 December 2022, Groupe Parfait /Géant Casino La Batelière, available in French here.

[9] FCA, Decision No. 21-DCC-79 of 12 May 2021, Transport Storage Energies / Société du Pipeline Méditerranée-Rhône, English press release available here.