DAMITT Q3 2020: Trump/Biden U.S. Election Antitrust Preview; End of Brexit Transition Period in Sight

Fast Facts

United States

- Trump-era merger enforcement levels have been roughly similar to the Obama/Biden administration’s second term, though the U.S. agencies have been taking longer to review mergers.

- If Biden were to win the election, DAMITT data show that a return to the Obama/Biden era would be unlikely to result in a substantial increase in the number of merger enforcement actions absent new legislation or substantially higher agency funding. Policy changes are likely to materialize first at the DOJ, where the leadership can be replaced quickly, in comparison to the FTC, where Republican majority control will continue until 2023 absent resignations. If Trump were to win re-election, current enforcement levels likely will continue through his second term.

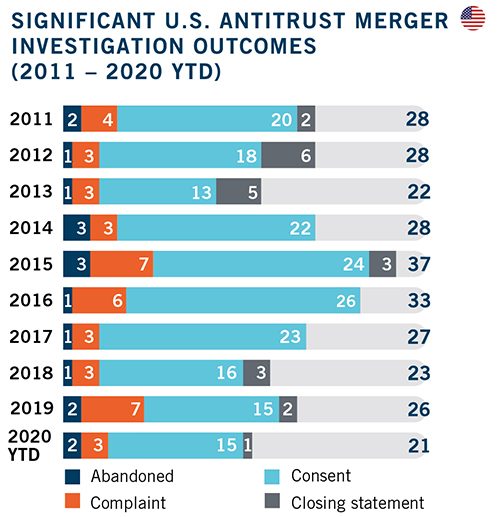

- Activity declined in Q3 2020 with only four significant merger investigations completed during the quarter, but the 2020 total through the first three quarters is the third-highest observed by DAMITT since 2011.

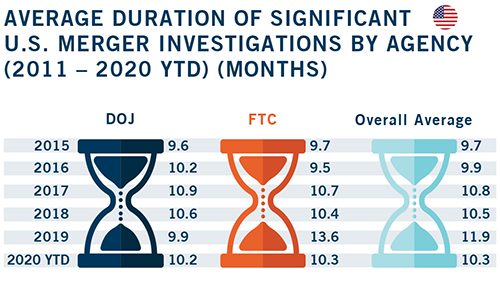

- The U.S. agencies are completing significant investigations faster in 2020 with an average duration of 10.3 months, an improvement from the 11.9-month average for CY 2019. Increased speed for FTC significant investigations has been a key contributor to the improved overall pace.

- For the first time since Q2 2019 and the release of the new Vertical Merger Guidelines, one significant investigation with vertical aspects concluded during the quarter, although it did not result in an enforcement action.

Europe

- The drop in M&A volume in H1 2020 due to the impact of COVID-19 has contributed to a decrease in the EU Commission’s caseload, with the number of deals notified per month to the EU Commission down 21 percent from the same period in 2019.

- Four significant investigations were resolved in Q3 2020 with remedies, which is in line with 2019 levels.

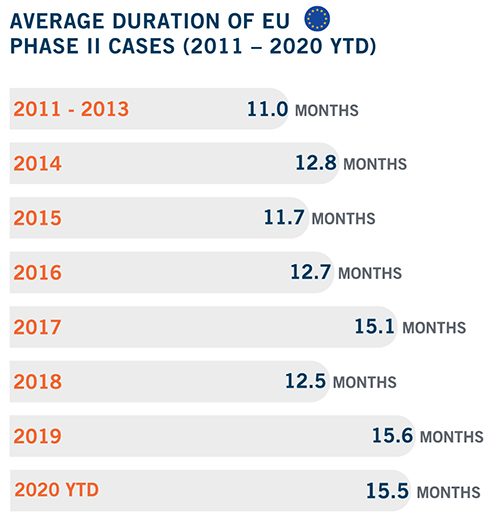

- The 15.5-month average duration of Phase II investigations concluded in 2020 YTD is a fraction lower than the annual record of 15.6 months during the 2011-2020 period tracked by DAMITT. There are eight pending Phase II investigations, three of which having been described as very complex by Commission officials, which may push up the average duration. The average duration of significant Phase I investigations is also trending upward, with cases resolved in 2020 YTD averaging 8.8 months.

- The Brexit transition period is due to expire at the end of the year, and the UK will at once become a new standalone jurisdiction. While there will likely be a slight drop in the number of cases that qualify for review by the EU Commission, the caseload of the UK Competition & Markets Authority is expected to increase by more than 50 percent. Cases in EU pre-notification at the year-end face particular issues.

The Dechert Antitrust Merger Investigation Timing Tracker (DAMITT) is a quarterly release from Dechert LLP reporting on trends in significant merger control investigations in the United States (U.S.) and European Union (EU).

In the U.S., “significant” merger investigations include Hart-Scott-Rodino (HSR) Act reportable transactions for which the result of the investigation by the Federal Trade Commission (FTC) or the Antitrust Division of the Department of Justice (DOJ) is a consent order, a complaint challenging the transaction, an official closing statement by the reviewing antitrust agency or the abandonment of the transaction with the antitrust agency issuing a press release.

In light of the procedural differences between the EU and U.S., DAMITT defines “significant” EU merger investigations to include transactions subject to the EU Merger Regulation and resulting in either Phase I remedies or the initiation of a Phase II investigation.

DAMITT calculates the durations of significant investigations in both jurisdictions from the date of deal announcement to the completion of the investigation, which therefore includes the time attributable to pre-notification consultation efforts.

U.S. Significant Investigations Down in Q3 2020, but 2020 YTD Still One of the Busiest of Past Decade

Significant investigation activity slowed down in Q3 2020. Four significant U.S. merger investigations concluded during the quarter, a marked decline from 10 in Q1 2020 and seven in Q2 2020.

Even with a quieter third quarter, the first three quarters of 2020 were the third busiest of any year since DAMITT began tracking significant merger investigations in 2011. The DOJ and FTC concluded 21 significant merger investigations in the first three quarters of 2020, outpacing the totals at the same point in 2019 (20 significant investigations), 2018 (15 significant investigations), and 2017 (18 significant investigations), despite the pandemic. However, nearly all of the significant investigations concluded in 2020 involved deals announced in 2019 or earlier. A decline in the number of significant investigations due to the pandemic therefore may show up in the data for future quarters.

After three significant investigations resulted in complaints seeking to block mergers in Q1 2020, there have been zero in Q2 and Q3. Compared to the prior decade of data, however, these three complaints in 2020 YTD equal the total number filed in each of the full calendar years for 2012, 2013, 2014, 2017, and 2018.

For the first time since UnitedHealth/DaVita concluded in Q2 2019, one significant investigation in Q3 2020 involved vertical aspects (i.e., at least one vertical allegation identified in the complaint, one vertical remedy included in the consent decree, or one vertical issue mentioned in the closing statement). The DOJ issued a closing statement in the London Stock Exchange/Refinitiv merger explaining why it had concluded the merger did not raise vertical concerns under the new Vertical Merger Guidelines, though the merger remains in limbo in the EU.

The FTC recently proposed HSR filing rule changes that, if adopted, would substantially increase the number of transactions subject to HSR reporting requirements, especially for asset managers and private equity funds. The increase in transactions subject to review, however, is unlikely to markedly increase the number of significant investigations in future quarters.

Number of Significant EU Investigations on Pace With 2019; COVID-19 Impacts Number of Cases Notified to EU Commission

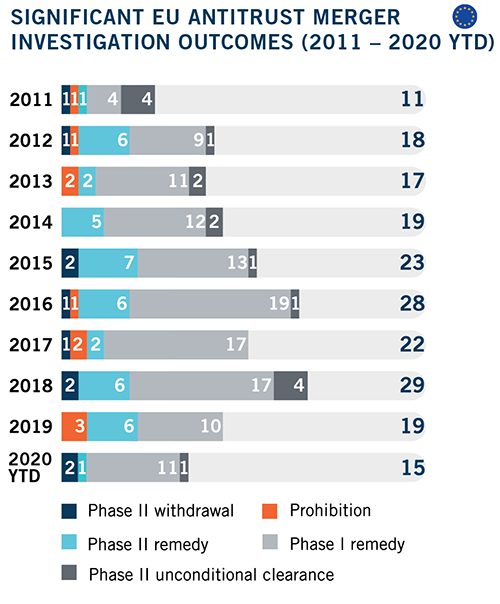

The EU Commission concluded four significant merger investigations in Q3 2020, in line with the quarterly average during the 2011-2020 period tracked by DAMITT.

These new investigations bring the total number of significant EU merger investigations concluded through 2020 YTD to 15. This is broadly in line with the corresponding period in 2019. But the number of significant investigations concluded during the 12 months ended Q3 2020 is down 70 percent from the 12-month period ended Q3 2019.

This is consistent with the drop in the number of resolutions observed in previous DAMITT reports: in 2019, the EU Commission concluded the lowest number of significant investigations during the past five calendar years. The pattern of fewer significant investigations in 2019 and continuing in 2020 does not appear to be due to any slackening of enforcement intent; instead, it may be a reversion to the mean after a few years of exceptionally high levels of significant investigations.

All significant EU merger investigations resolved in Q3 2020 were cleared with remedies, including three transactions in Phase I and one transaction in Phase II. The proportion of significant EU investigations resolved with remedies in 2020 YTD stands at 80 percent, slightly below the 86 percent figure that has been observed since 2014, which coincides with changes to the notification process.

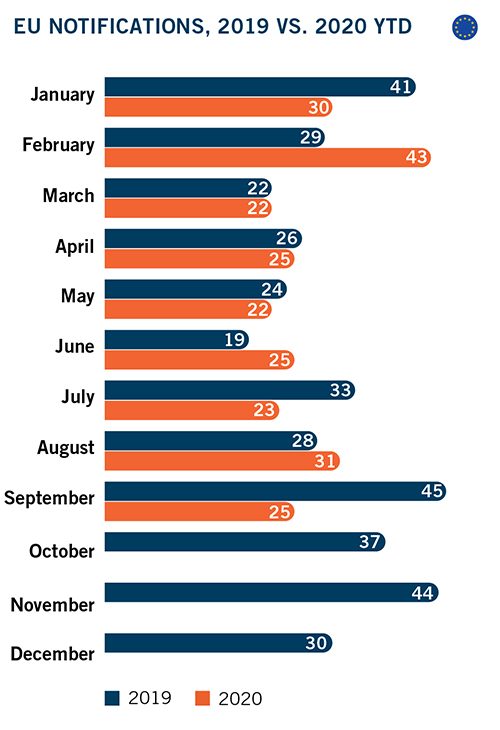

In the DAMITT Q2 2020 report we noted that the impact of the pandemic on EU merger notifications and decisions would likely be delayed due to the time lag between announcement and notification. DAMITT Q3 data show that the EU has witnessed a drop in the number of filings and resolutions. The number of merger investigations resolved by the EU Commission in 2020 YTD corresponds to only 65 percent of the number of decisions adopted in CY 2019. Although the number of deals notified per month to the EU Commission in H1 2020 was broadly in line with the same period in 2019, the number of notifications in Q3 2020 is down 21 percent from Q3 2019. Early signs point to a continuation of this trend with a 44 percent drop in the number of notifications submitted in September 2020 relative to the corresponding period in 2019.

Duration of Significant U.S. Investigations Decreases

Although some expected the pandemic to slow down significant investigations, the data thus far show that the average duration of significant U.S. merger investigations has declined in 2020. Significant investigations concluded in the first three quarters of 2020 averaged 10.3 months, more than a month faster than the 11.9-month average in CY 2019. The current 10.3-month average falls roughly between the averages in CY 2016 at 9.9 months, and CY 2017 at 10.8 months. However, because nearly all of the significant investigations concluded in 2020 involved deals announced in 2019 or earlier, the full impact of the pandemic on pending investigations will not be known until future quarters.

While the average length of significant investigations has fallen in 2020, the median continues to increase. The median in the first three quarters of 2020 was 10.4 months, higher than in any year from 2011-2019. A falling average and a rising median could indicate that while the duration ceiling is lowering, the floor for the length of significant investigations is rising. For example, nine significant investigations concluded in the first three quarters of 2019 lasted 13 months or longer, compared to only one so far in 2020.

Improved speed at the FTC, which has narrowed the timing gap with the DOJ, helped spur the overall decrease in the average duration of significant investigations. The average FTC significant investigation averaged 10.3 months in the first three quarters of 2020, down from 13.6 months for CY 2019. DOJ significant investigations averaged 10.2 months in the first three quarters of 2020, a slight increase from the 9.9-month average in CY 2019. While the FTC took more than three months longer than DOJ to review transactions in CY 2019, the two agencies have achieved near parity in 2020.

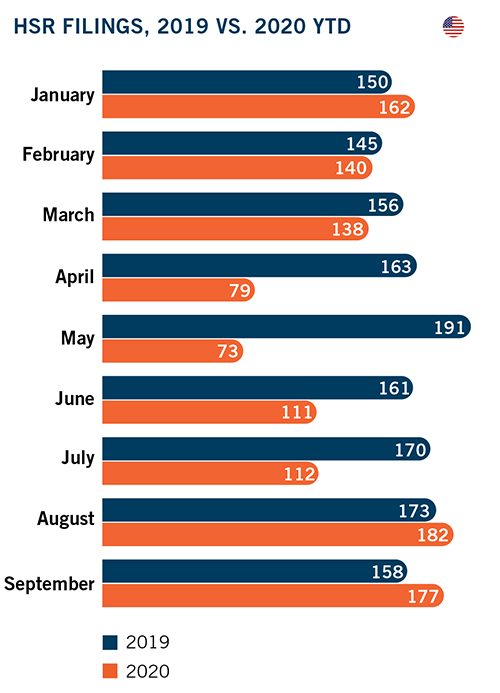

This increased speed at the FTC could be due to policy initiatives to improve the pace of investigations as well as the decline in Hart-Scott-Rodino pre-merger filings during the pandemic. HSR filings declined sharply year-over-year in 2020, particularly from April through July. In August and September, however, the number of filings increased from the prior year.

Duration of Phase I and Phase II Significant EU Investigations Trending Upward

The average duration of Phase I remedy cases concluded in the 12 months ended Q3 2020 averaged 8.6 months, broadly in line with the average duration of 8.7 months during the prior 12-month period but up from the 7.7-month average observed in 2019.

The average duration of Phase II proceedings continues to trend upward. Phase II investigations concluded during the 12 months ended Q3 2020 averaged 15.4 months, up 11 percent from the 13.9-month average observed during the prior 12-month period.

EU Phase II Proceedings

The 15.5-month average duration for Phase II proceedings resolved in 2020 YTD is in line with the 2019 average of 15.6 months.

As noted in the DAMITT Q2 2020 report, this high figure is largely attributable to the Boeing/Embraer investigation which had already run for 22.4 months at the time it was abandoned, making it the third-longest EU investigation since 2011. The average duration was also pushed higher by the PKN Orlen/Grupa Lotos investigation, which concluded in Q3 and lasted 16.8 months.

The average duration of Phase II investigations may continue to trend upward in Q4 2020 and into 2021. The eight pending Phase II investigations have already lasted an average of 18.2 months (14.2 months excluding the Fincantieri/Chantiers de l’Atlantique transaction which has already clocked 46.2 months from announcement). Three of these pending transactions – Google/Fitbit, LSEG/Refinitiv Business and Air Canada/Transat have been described as “very complex” by Olivier Guersent, Director General of DG Competition.

The average duration of pre-notification contacts (i.e., from announcement until notification) of Phase II transactions resolved during the 12 months ended Q3 2020 was 7.9 months, a significant increase from the 6.9-month average in the prior 12-month period. However, excluding the exceptional delay of 14 months in Boeing/Embraer, this average drops to a more typical 6.7 months.

Article 10(3) of the EU Merger Regulation allows merging companies to grant “voluntary” extensions of time. These extensions are commonly conceded by merging parties at the urging of staff. With the exception of the Johnson & Johnson/TachoSil transaction which was withdrawn 11 days after the opening of an in-depth investigation, all Phase II cases concluded in 2020 YTD entailed the use of such extensions, adding the statutory maximum 20 working days to the investigation period in all but one case. This is consistent with the pattern of the maximum possible extension being invoked during the 2011-2019 period tracked by DAMITT.

EU Phase I Remedy Cases

On average, Phase I remedy cases that concluded in the first three quarters of 2020 lasted 8.8 months, up from the 7.7-month average observed in 2019. This is the longest average duration observed by DAMITT since 2016.

This longer duration observed in 2020 YTD may suggest that the decrease in duration observed in 2019 was an outlier and that the overall trend to longer reviews in Phase I remedy cases will continue. Phase I investigations resolved with remedies now tend to require more than five times the theoretical duration of the fixed timetable under the EU Merger Regulation.

The longer average duration is mirrored in the length of pre-filing talks. The average duration from announcement to notification in Phase I remedy cases was seven months for the cases concluded in 2020 YTD, more than a month longer than the 5.9-month average observed in 2019. As explained in more depth in the DAMITT Q3 2019 report, pre-notification contacts have been a longstanding feature of EU merger reviews. Merging parties invariably institute pre-filing talks with EU Commission staff very shortly after the transaction announcement, if not before.

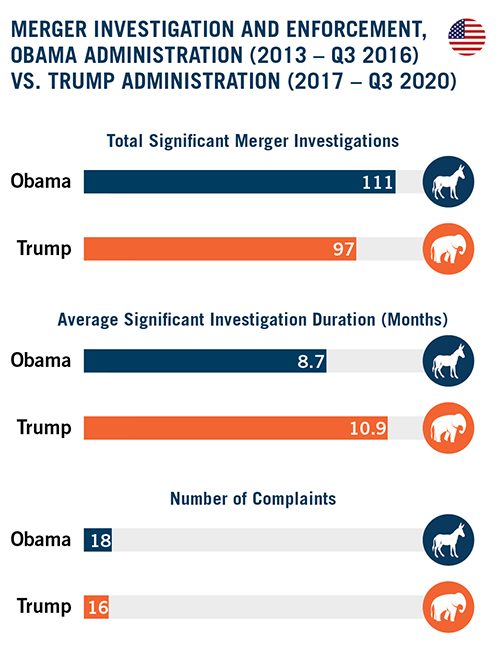

DAMITT Election Preview: Trump Administration’s Merger Enforcement Record Similar to Obama/Biden Administration

With the U.S. presidential election right around the corner, DAMITT has analyzed what a Biden victory might mean for antitrust merger reviews. Although many expected antitrust merger enforcement to become more lax under President Trump’s first term, DAMITT data show that any differences may be more marginal rather than a major change in enforcement policy. Although there have been slightly fewer total significant investigations so far in the Trump era, there have also been a higher number of significant investigations with vertical aspects, and the agencies have taken more time to review mergers.

President Trump-era merger enforcement levels are slightly behind those of the Obama/Biden administration’s second term. Under the Trump administration between Q1 2017 and Q3 2020, 16 significant investigations out of a total of 97 resulted in complaints seeking to block mergers. At the same point in the Obama/Biden administration’s second term (Q1 2013-Q3 2016), the totals were slightly higher at 18 complaints and 111 total significant investigations.

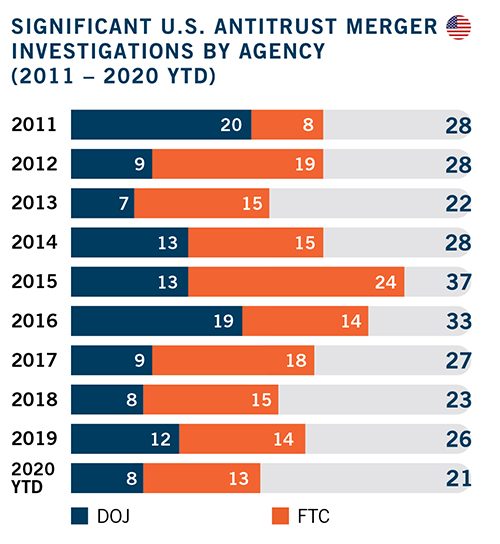

Under both administrations, the FTC concluded more significant investigations than the DOJ. Between Q1 2013-Q3 2016, the FTC concluded 65 significant investigations compared to 60 between Q1 2017-Q2 2020. DOJ’s total significant investigations dropped slightly more, with 46 significant investigations between Q1 2013-Q3 2016 versus 37 significant investigations in Q1 2017-Q2 2020.

Yet, the Trump administration has overseen an increase in significant investigations with vertical aspects. Between Q1 2017-Q3 2020, the Trump administration concluded 12 significant investigations with vertical aspects compared to only eight between Q1 2013-Q3 2016 under the Obama/Biden administration’s second term. This increase coincides with the release of the new Vertical Merger Guidelines this year, which replaced the vertical guidelines last issued in 1984.

In addition, the duration of significant investigations substantially increased during the Trump administration. Significant investigations concluded between Q1 2017-Q3 2020 lasted an average of 10.9 months, about two months longer than the Obama/Biden administration’s 8.7-month average from Q1 2013-Q3 2016.

Going forward, if Biden were to win the election, more continuity is expected at the FTC compared to DOJ. FTC commissioners have seven-year terms and cannot be removed for political or policy reasons by a new administration. Thus, absent a resignation by a Republican commissioner, Republicans would retain majority control of the FTC until 2023. By contrast, DOJ is led by political appointees who can be replaced more rapidly after a new administration takes control. For this reason, policy changes at DOJ can be implemented more quickly under a new administration if the president chooses to do so. But assuming Biden were to appoint DOJ leadership similar to the group that served under the Obama/Biden administration’s second term, these policy differences are not expected to be drastic.

If Trump were to win re-election, significant changes from current enforcement levels are not expected. Although changes in leadership sometimes occur at the FTC or DOJ at the start of a president’s second term, any replacements likely would maintain the status quo.

Another wildcard for future merger enforcement is whether Democrats are able to take control of Congress. Democratic control of Congress would increase the likelihood of new antitrust merger legislation or greater agency funding for merger investigations, both of which could result in more merger enforcement. Without such changes, however, antitrust policy would continue to be constrained by economic theory and modern era case law. These constraints make significant merger enforcement changes unlikely given that agency overreach in challenging mergers would still be subject to judicial review under existing precedents.

Brexit: End of Transition Period in Sight With Potentially Significant Implications

The implementation (i.e., transition) period under the Withdrawal Agreement is due to expire on December 31, 2020. There has been continuity during the transition period, with the UK competition regime remaining de facto part of the EU system. Although the UK is no longer a Member State, it continues until year-end to be treated as one for purposes of the EU Merger Regulation.

In practice this means that the EU Commission continues to hold exclusive jurisdiction over deals meeting the thresholds (including revenue achieved in the UK). For merger reviews where notification has been made prior to the end of the transition period, i.e., December 2020, the EU Commission retains exclusive jurisdiction. Moreover, for all cases where the EU Commission accepts remedies from the parties, either before the end of the transition period or after if the Commission had exclusive jurisdiction, it will continue to be responsible for monitoring and enforcing all aspects (including any UK elements) of those remedies after the end of the transition period.

In terms of immediate impact, the UK will at once become a new standalone jurisdiction upon the expiry of the transition period. For deals that are signed next year, the UK will no longer count towards the EU jurisdictional thresholds, which is likely to lead to a slight reduction (up to 15 percent according to the Commission’s estimates) in the number of cases that qualify for review under the EU Merger Regulation. Many of the cases triggering a separate UK review will still need an EU filing; and it is true of course that cases taken out of EU review will then be likely to trigger filings at the Member State level. Conversely, according to the UK Competition and Markets Authority (CMA)’s own estimates, Brexit could increase the merger control caseload of the CMA by 50 percent or more.

The description above leaves a subset of cases where the deals were signed in 2020 but not yet notified to the EU, even if already in pre-notification talks. Such cases may be subject to parallel reviews by the CMA and the EU Commission: the EU Commission considers that jurisdiction under the EU Merger Regulation crystallizes on the date of signing (or as applicable, the announcement of a public bid or the acquisition of a controlling interest or the date of notification). Accordingly, UK revenues will continue to be taken into account in assessing whether those cases trigger EU filing. But in the absence of an EU filing by year-end the EU’s jurisdiction will not exclude the parallel application of UK law.

As the expiry of the transition period fast approaches, the CMA has indicated that it will monitor transactions in the pre-notification phase which may fall under UK jurisdiction at the end of the transition period. Merging parties are being encouraged to engage in pre-notification discussions with the CMA where the merger might not be formally notified to the EU Commission before the end of the transition period.

Parallel EU/UK filings will not only increase the merging parties’ administrative burden, but may potentially cause delays to transaction timelines. This risk is particularly higher in cases that require remedies. In this regard, U.S. merger control practice provides for a somewhat flexible review period, which allows some scope for coordinating the timing of EU-U.S. merger reviews. In contrast, the UK operates under a theoretically fixed statutory timetable, which is not aligned with the EU timetable, and has a remedies process that is entirely separate from the substantive review. Companies should therefore plan accordingly by negotiating appropriate flexibility in their transaction agreements.

In the meantime, the UK is able to invoke the jurisdictional referral mechanisms in the EU Merger Regulation that allow for mergers to be transferred from the Commission to Member State competition authorities where the CMA considers that a notified transaction threatens to affect competition significantly in a distinct market within the UK. This may be a source of tension as the transition period draws to a close and the two regulators find themselves both focused on deals that straddle the transition period. The CMA has reportedly made a referral request for exclusive jurisdiction over the GBP 31 billion planned merger between Virgin Media and mobile telecoms operator O2. It has also been reported that the CMA and EU Commission are locked in discussion over which authority will review the US$30 billion merger between Aon and Willis Towers Watson.

Summary

The U.S. antitrust agencies have increased the pace of their significant merger investigations in 2020, even while faced with COVID-related challenges. In particular, FTC investigations picked up speed. While the circumstances of any individual transaction will vary from the DAMITT averages depending on certain factors (e.g., the complexity of the review), current statistics suggest that parties to the hypothetical average significant investigation subject to review only in the U.S. would have to plan on 10 to 11 months for the agencies to investigate a transaction.

Deal timetables for EU cases where the investigation is likely to proceed to Phase II need to allow for a lapse of around 16 months from announcement to clearance. If the investigation is likely to be resolved in Phase I with remedies, the deal timetable should allow for approximately nine months from announcement to a decision.

DAMITT data show that merger enforcement levels under the Trump administration and the Obama/Biden administration’s second term were similar in terms of the number of complaints and significant investigations. Looking ahead, we therefore expect that if Biden wins the U.S. election, a return to the Obama/Biden administration enforcement levels would be unlikely to result in a substantial increase in the number of merger enforcement actions absent new antitrust legislation or significantly increased agency funding. And if Trump were to win re-election, the status quo will likely be maintained. On the EU side, the upcoming expiry of the Brexit transition period is expected to lead to a further decrease in the EU Commission’s caseload; and a corresponding significant increase in the number of mergers reviewed by the UK CMA. Transactions that are in the pre-notification phase when the transition period ends face the prospect of parallel reviews in the EU and the UK which will add to administrative burden of merging parties and potentially prolong deal timetables.