2021 Global Private Equity Outlook

A Report from Dechert and Mergermarket

Despite the tumultuous events of 2020, the private equity industry has proven that it can roll with the punches, according to 2021 Global Private Equity Outlook, an annual report co-published by Dechert LLP and Mergermarket. This year’s report discusses how the sector fared amid the ongoing global pandemic, economic upset, and geopolitical pressures that marked this year as well as what the future may hold for this robust and creative industry.

The report includes insights from a survey of 100 senior PE executives in Asia, Europe and the U.S., including the following key findings:

PE Industry Resilience

While the COVID-19 pandemic has caused widespread disruption across the global economy, the effect of the first wave on the private equity industry proved short-lived. After a short, sharp shock going into Q2 and many auction processes knocked off course, the sector rebounded impressively with total buyout activity in Q3 reaching US$148 billion, exceeding levels in 2019 by 10 percent. The industry’s resilience and ability to bounce back so rapidly should be a cause for optimism through the current wave of the pandemic alongside record sums of dry powder.

Private Credit

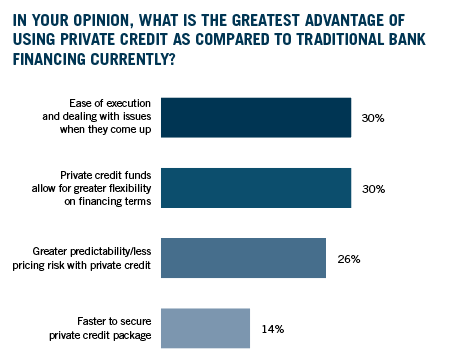

Private credit continues to grow in popularity, with 35 percent of firms having increased their use of these loans in the past three years, and almost half (49 percent) now using private credit as much as traditional bank financing in their buyouts. Greater flexibility on financing terms and ease of execution were cited as top benefits of this type of deal financing.

U.S. Election

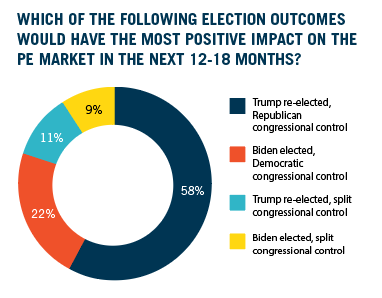

While 58 percent of respondents believed a would-be second term for President Trump combined with Republican congressional control would have the most positive impact on the PE market, a clear electoral result for President Elect Joe Biden also is a relief for dealmakers.

Carve-outs

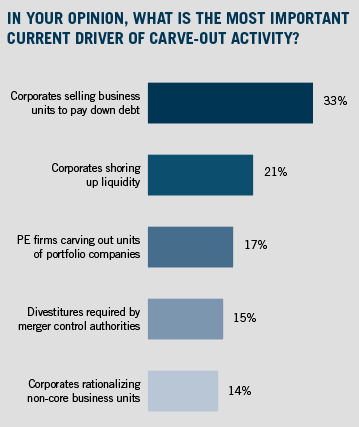

Carve-out activity looks set to spike, with 60 percent of respondents forecasting an increase in the number of carve-outs targeted by their firm. With current economic headwinds putting earnings under pressure, 33 percent of General Partners (GPs) cited corporates’ need to pay down debt as the primary driver of this trend, with 21 percent pointing to a desire to conserve liquidity. Carve-outs are also a useful strategy for PE houses themselves — with 17 percent planning on carving out units of portfolio companies.

Trade

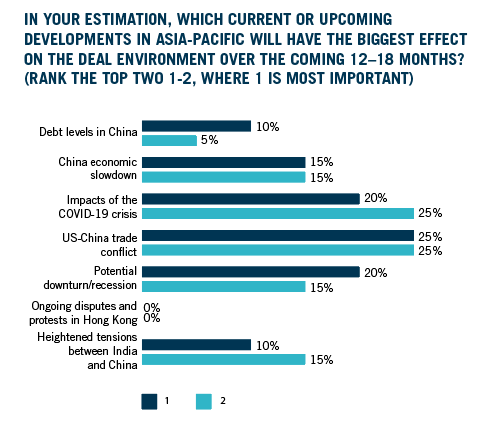

Geopolitical concerns loom large for firms, particularly in Asia-Pacific (APAC). A quarter of APAC respondents cited the US-China trade conflict as the single greatest issue for the deal environment over the next 12-18 months, greater even than the COVID-19 pandemic. Beyond the trade war, new foreign investment rules set by countries including India, Japan and Australia look set to add new dimensions to trade considerations in the APAC region. Notwithstanding, Asia-Pacific saw an impressive 13 percent increase in buyouts compared to 2019.

Getting Creative

2020’s challenging conditions have seen firms get creative across a range of deal types, with many options set to remain popular heading into 2021. 98 percent of respondents were likely to consider partnerships with strategic buyers, whereas distressed deals were being weighed up by 87 percent of firms. Structured equity investments also remain attractive, offering GPs flexibility, greater security and limiting downside risk.

Translate page to German.