DAMITT Q3 2022: Merger Enforcement Remains Aggressive Despite U.S. Court Losses

Key Facts

United States

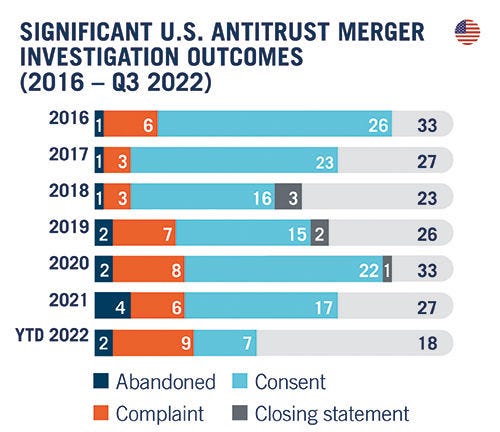

- Only three significant merger investigations concluded in Q3 2022. All three investigations ended with a complaint or an abandoned transaction. For the first time in more than a decade, there were no settlements or closing statements

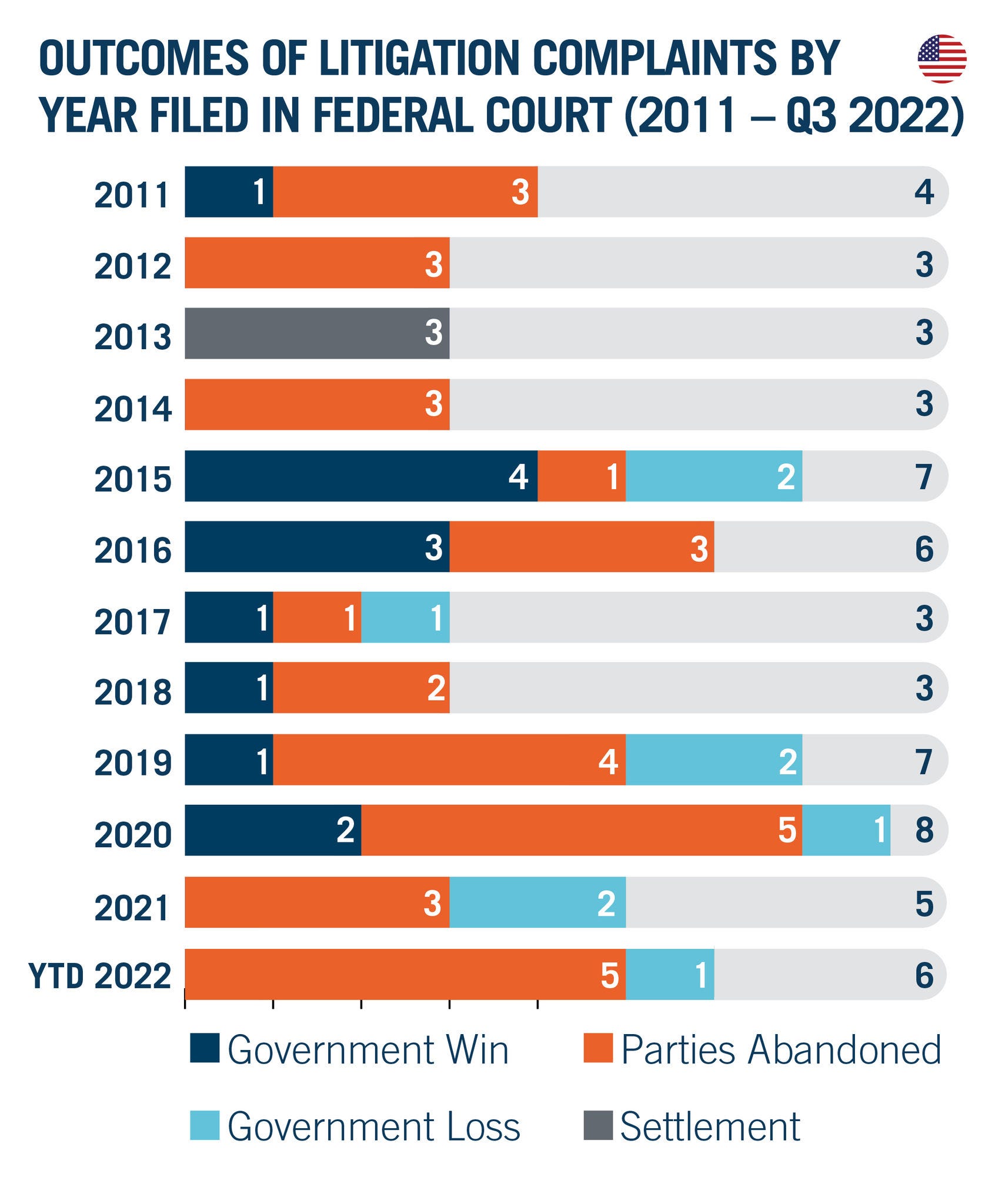

- The DOJ and FTC stacked up back-to-back merger trial losses in September. Meanwhile, no complaint filed by the Biden administration has resulted in a government win in court as of Q3.

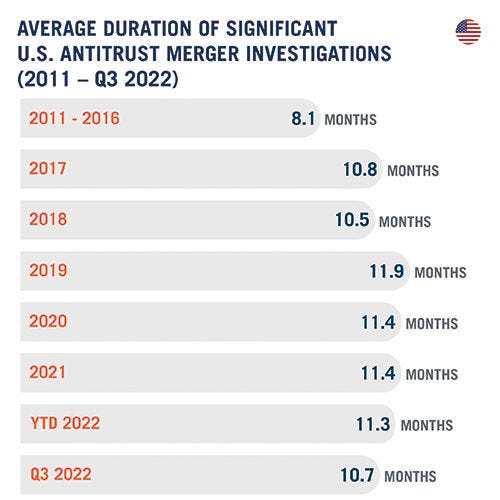

- The average duration of significant investigations in Q3 2022 was 10.7 months, matching the prior quarter. The average duration for 2022 has now fallen to 11.3 months.

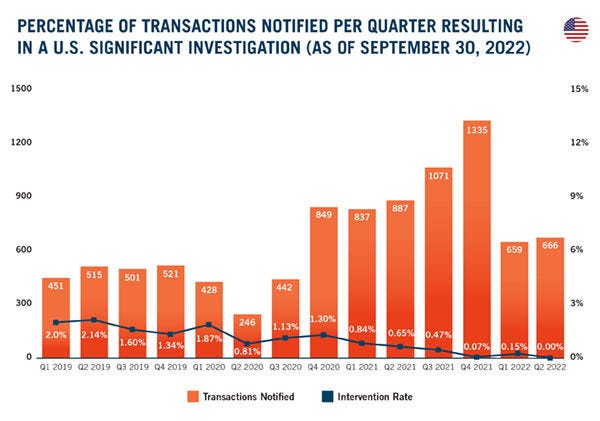

- The number of HSR filings fell 31 percent compared to the first three quarters of 2021 and the percentage of HSR filings resulting in concluded significant investigations continues to plummet.

- By the end of Q3, the FTC and DOJ had only concluded 21 significant investigations into the more than 6,000 HSR filings made since January 2021.

European Union

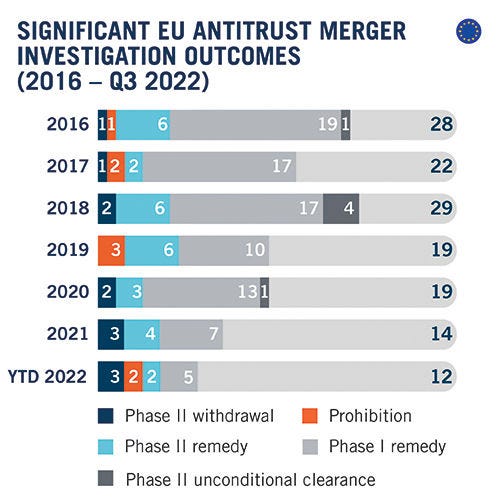

- Once again, the EC only concluded three significant merger investigations this quarter. This brings total concluded investigations year-to-date to a near-record low of 12.

- The EC blocked a second merger this year, after two years without any formal prohibition – bringing the percentage of blocked deals among significant investigations to a staggering 17 percent so far in 2022.

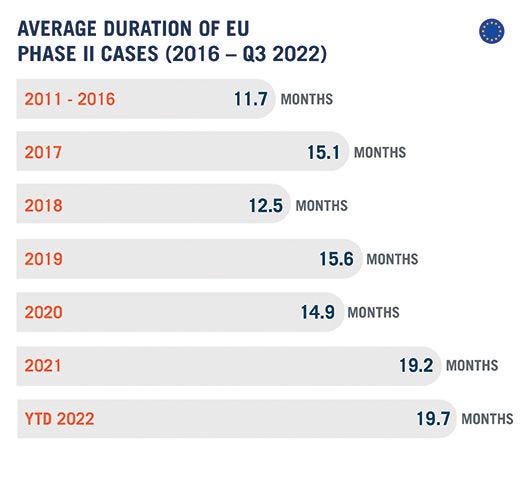

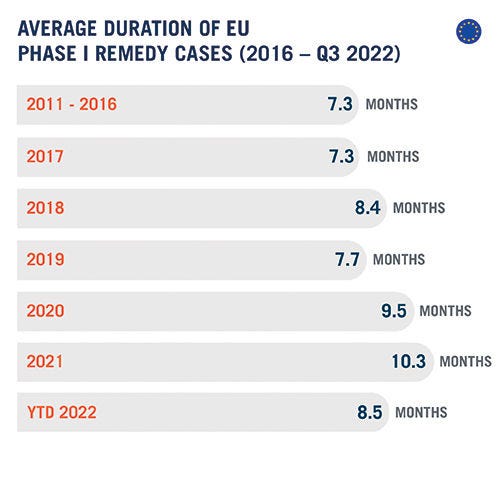

- The average duration of Phase I remedy investigations decreased to a closer-to-average 8.5 months, whereas the average duration of Phase II investigations sky-rocketed to 19.7 months.

- Deal notifications finally slowed down; the number of deals notified so far in 2022 is down 14 percent compared to the same period last year.

The Biden Administration Refuses to Settle Significant U.S. Merger Investigations, Faces Mounting Losses in Court

In both our DAMITT 2021 Report and our Q1 2022 Report, we warned that parties to transactions subject to significant merger investigations were more likely to see the FTC or DOJ sue to block their deal or push them to abandon it prior to being sued. Despite a temporary reprieve last quarter—when just under 50 percent of significant investigations resulted in a settlement—the Biden administration’s aversion to settlements returned in Q3, when all concluded significant U.S. merger investigations resulted in either a complaint or an abandoned transaction.

That is not to say that the agencies will not accept any settlements. For the first three quarters of 2022, nearly 40 percent of significant investigations resulted in a settlement. Of note, however, the DOJ has not entered into a single settlement to resolve a significant investigation since DOJ Assistant Attorney General Jonathan Kanter began warning, shortly after taking office in November 2021, that investigations resolved with merger remedies should be the “exception, not the rule.” The FTC is responsible for all merger settlements since that time.

The nine litigation complaints filed in the first three quarters of 2022 are already the most observed in a single year since DAMITT started tracking in 2011, and there is still one quarter left to go.

While the U.S. antitrust agencies today increasingly favor litigation, the data show that litigation increasingly does not favor the antitrust agencies. By the end of Q3, neither the DOJ nor the FTC had yet secured a win based on a complaint filed by the Biden administration in federal district court.

Instead, in September 2022 alone, DOJ lost its challenge to two transactions—UnitedHealth / Change Healthcare and U.S. Sugar / Imperial Sugar—in the span of a week. If the pending case against Penguin Random House / Simon & Schuster also results in a loss, the current administration will have overseen the longest period without a successful litigation complaint since 2014. At this point, DOJ’s litigation stance seems poorly aligned with its court record.

As important, the government losses referenced in the data above are understated for two reasons. First, because the data only lists results in federal district court, the data do not include the FTC’s unusual loss before its own administrative law judge in Illumina / Grail, which also occurred in September. The FTC typically wins in this forum, however it also lost a challenge before the same administrative law judge in Altria / JUUL back in February. (That earlier loss also is absent from our data, both because of the forum and because it was challenged after the merger was consummated.)

Second, the data do not include the DOJ’s failure to obtain a preliminary injunction in Booz Allen Hamilton / Everwatch, which occurred shortly after the quarter concluded in October. As previously reported in our Q2 2022 Report, that transaction was the only merger challenge filed by DOJ in Q2 2022. In that matter, DOJ rushed to court before the parties had complied with second requests alleging a time-sensitive violation of the Section 1 of the Sherman Act, which rarely occurs in merger challenges. The case aligned with comments from the DOJ Principal Deputy Assistant Attorney General that DOJ may seek “faster access to courts” and does not have “to wait one or two years” for parties to comply with a second request before filing a complaint. While DOJ felt the need to rush in Booz Allen Hamilton / Everwatch, however, a district court judge disagreed, rebuffing DOJ’s request for a preliminary injunction.

While complaints are up at the agencies, the number of concluded investigations is down over the last quarter. In Q3 2022, the number of concluded investigations in Q3 dropped to three, bringing the total number of significant investigations concluded in the first three quarters to 18. This number falls right in line with the historical average for the same period between 2011 and 2021, but that alone should be surprising given prior FTC statements about being hit by a tidal wave of merger filings in 2021. We have yet to see any increase in concluded investigations corresponding to that increase in notifications.

The FTC first reported an unprecedented volume of HSR filings beginning in late 2020 to justify “temporarily” suspending grants of early termination in February 2021. That left us wondering where the expected wave of concluded significant investigations was as early as our Q3 2021 Report. A year later, we are still waiting for the wave. We are also left wondering whether early termination will return any time soon now that the number of merger filings has returned to more manageable levels.

The average duration of significant investigations remained 10.7 months in Q3 2022, matching the prior quarter. When combined with the 12.6-month average for Q1 2022, the average for the first three quarters is 11.3 months. While well above the average of 8.1 months between 2011 and 2016, the progression downwards should be welcome news for parties considering transactions.

At the same time, the average duration of a significant investigation only measures the time from the initial merger filing to a settlement, abandoned transaction, closing statement, or complaint. For cases concluded so far in 2022, litigation in federal court has lasted an average of just under nine months between the complaint and decision. This is in line with litigation averages over the last three years, which have slowly ticked upwards. The average duration of litigation for 2022 is likely to increase, however, after Penguin Random House / Simon & Schuster is decided.

EC Blocks Second Deal This Year; The Duration of Phase II Investigations Skyrockets and Phase I Investigations Falls

The EC followed on the same path as the previous quarter and once again concluded only three significant investigations this quarter. While slightly higher than the number of significant investigations concluded over the same period in 2021, this is nearly 25 percent less than the average number of significant investigations concluded in the first three quarters of a year since 2016. The total significant investigations concluded in 2022 will, however, exceed the 2021 total – the EC having already concluded three more significant investigations in October 2022 – and could come closer to the total in 2019 and 2020.

The EC concluded only one significant investigation following a Phase II investigation this quarter, Illumina / Grail, but this resulted in the second prohibition of the year. The parties tried convincing the EC to clear the deal with commitments, but the remedies offered were deemed insufficient to address the concerns. The emphasis the EC put on circumvention risks in its press release may suggest growing difficulties for parties aiming to convince the EC to approve a merger based on behavioral commitments. Data however show that behavioral remedies are more likely to be accepted following an in-depth investigation than in Phase I. Since 2016, purely behavioral remedies have been accepted in only 13 percent of cases cleared with remedies in Phase I, whereas they account for nearly 25 percent of the cases cleared with remedies following a Phase II.

This new decision brings the total of Phase II investigations concluded thus far in 2022 close to the average of eight Phase II decisions per year over the 2016-2021 period. And it takes the proportion of significant investigations concluded so far in 2022 and resulting in a prohibited or an abandoned deal to 42 percent, nearly 30 points above the 2016-2021 average.

Turning to duration, the only Phase II investigation concluded in Q3 2022 took 28.8 months, bringing the average length of Phase II cases concluded so far in 2022 to 19.7 months, a record high since DAMITT started tracking. This extreme length of 2022 Phase II investigations may be explained by the peculiarities of two of the cases concluded this year: the nearly 30-month long investigation in Illumina / Grail may be due – at least in part – to the fact that it was the first case referred to the EC under the new approach to Article 22 EUMR and the 36-month long investigation in the Hyundai Heavy Industries Holdings/Daewoo Shipbuilding & Marine Engineering transaction, ultimately abandoned in Q1 2022, was heavily disrupted by the Covid-19 pandemic following an initial notification in November 2019. Excluding these two transactions, the average falls to 15.6 months, which is more in line with average durations in 2019 and 2020.

Looking at Phase I remedy cases, the average duration seems to be coming down from the peak 10.3-month duration observed in 2021. Phase I investigations concluded with remedies so far in 2022 averaged at 8.5 months, the shortest duration observed in the past two years. Looking to the future, the three Phase I remedy cases concluded by the EC thus far in October continue this downward trend.

Intervention Rates Remain Low, But May Be Impacted by Falling Notification Levels

For the last year, we have highlighted that the proportion of total notified transactions that undergo significant investigations (the “intervention rate”) has fallen in recent years. Estimating the exact intervention rate can be difficult because the length of concluded significant investigations varies. The best we can do is look at the significant investigations that have been concluded, when those transactions were filed, and the number of transactions that were notified over the same period.

In the U.S., the intervention rate has continued to fall, even as the number of merger filings for the first three quarters declined 31 percent from last year’s record highs.

Some caution is warranted when interpreting these figures, which only reflect investigations concluded as of September 30, 2022. Given the average durations reported above, there are likely deals that were notified (for 2021 and 2022 in particular) that are still subject to significant investigations that have not yet concluded.

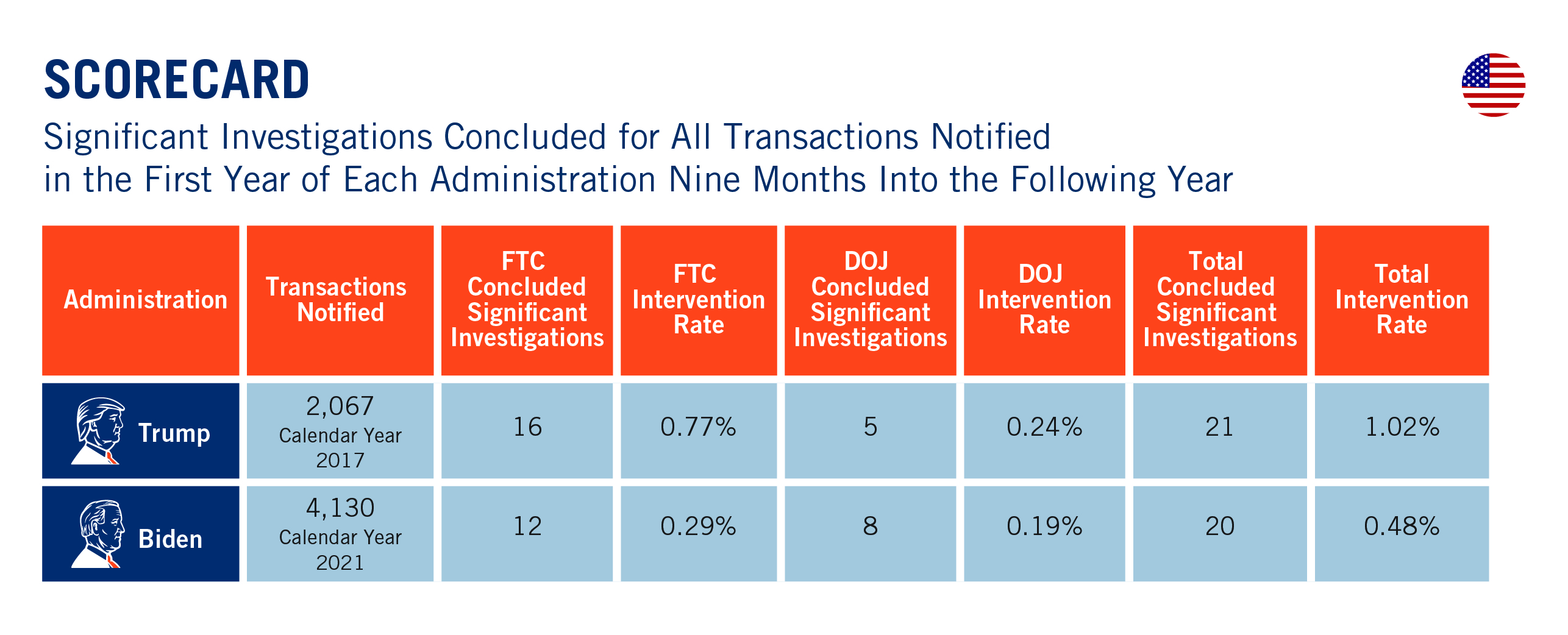

Nevertheless, the data continue to show that the intervention rate for transactions notified in the first year of the Trump administration was more than double the intervention rate for transactions notified in the first year of the Biden administration at the same point in time. While the agencies received less than half of the number of notified transactions in the first year of the Trump administration, they had concluded one more significant investigation related to those transactions within nine months after the year had ended.

Looking beyond Q3 2018, the U.S. antitrust agencies concluded ten more significant investigations of deals that were filed in 2017. Ultimately, the final intervention rate for transactions notified in 2017 was 1.5 percent. For the Biden administration to match that final intervention rate, the U.S. antitrust agencies would need to conclude 42 more significant investigations for deals filed in 2021.

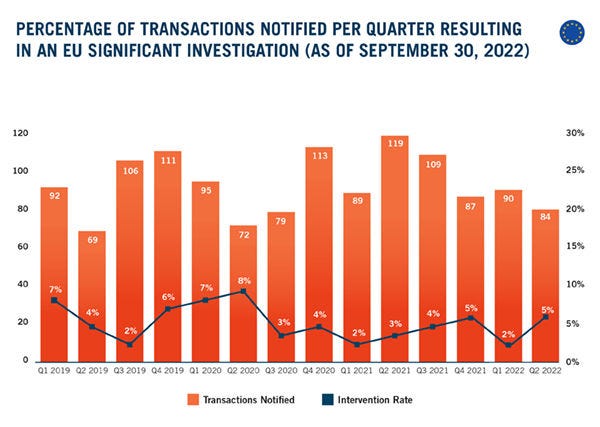

In the EU, the trend looks somewhat different. While the intervention rate fell to two percent in Q1 2022, it rebounded to five percent in Q2 2022 and should reach seven percent once current pending Phase II investigations come to an end. It remains to be seen whether this indicates a reversal of the downward trend observed over the past few years. Preliminary data for Q3 2022 forecasts that the intervention rate will be at least five percent, but it could still go up.

The fact that the number of EU filings also seems to be returning to more usual levels may also push the intervention rate up. Compared to the same period last year, the number of filings is down 14 percent.

Conclusion

Parties to transactions subject to significant merger investigations continue to face an elevated risk of seeing their deal blocked or abandoned, even if the intervention rate shows relatively few deals may receive close scrutiny. To ensure the ability to defend their deals through a potential investigation, parties to the average “significant” deal in the U.S. should plan on at least 12 months for the agencies to investigate their transaction and may want to add on additional time to address the continuing uncertainty at the agencies. Parties should also plan for another eight to ten months if they want to preserve their right to litigate an adverse agency decision. On the EU side, parties to transactions likely to proceed to Phase II investigations should allow for at least 20 months from announcement to clearance and should not rely on the theoretical deadlines provided for in the EU Merger Regulation, even after the deal has been formally notified. If the investigation is likely to be resolved in Phase I with remedies, parties should plan on around nine months from announcement to a decision.