Clemens Graf York von Wartenburg

Brussels +32 2 535 5411

Munich +49 89 21 21 63 50

For the second time, our antitrust/competition practice has expanded the Dechert Antitrust Merger Investigation Timing Tracker (DAMITT) to include Germany and France. This supplements DAMITT’s U.S. and EU coverage with comprehensive analysis of key merger control indicators before the German Federal Cartel Office (FCO) and the French Competition Authority (FCA), including the duration of merger control reviews in both jurisdictions and the outcome of the competition authorities’ reviews.

Both the French and German authorities are particularly active in merger control at the Member State level within the EU. Companies should keep these jurisdictions on their radar in planning their next transaction, using DAMITT data as a guidepost.

Germany

France

The DAMITT Supplement for Germany and France is a yearly study from Dechert LLP’s Antitrust/Competition practice reporting on trends in significant merger control investigations in major EU jurisdictions.

In Germany, “significant” merger investigations cover all Phase II investigations by the German Federal Cartel Office.

In France, DAMITT defines “significant” EU merger investigations as reportable mergers under the French merger control regime which either (i) were cleared in Phase I with commitments, or (ii) went through a Phase II investigation, irrespective of the outcome of the review.

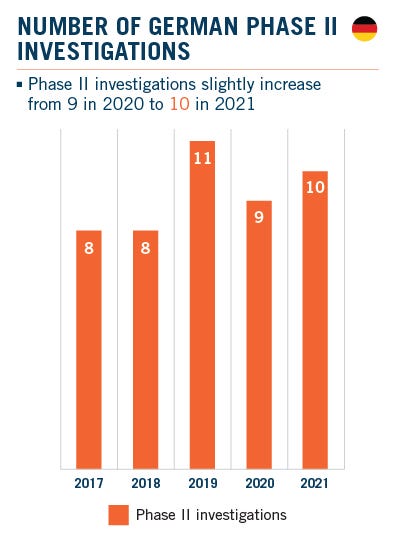

Looking Back In 2021 the total number of notifications to the German Federal Cartel Office (FCO) declined by around 16.7 percent (from about 1,200 in 2020 to about 1,000 in 2021) on an annual basis. However, the decline was far less substantial than many had expected in light of a major overhaul of the German Act against Restraints of Competition (ARC) in early 2021 which was, in part, designed to free up resources at the FCO by reducing the number of reportable transactions.

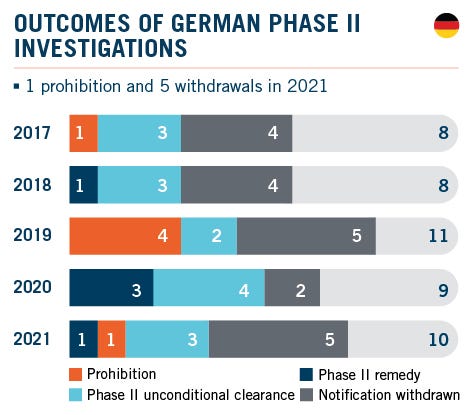

In 2021, ten cases in which the FCO conducted a Phase II investigation were concluded. Three of those cases were unconditionally cleared while one was cleared with remedies. Five notifications were withdrawn by the companies involved in the course of the FCO’s Phase II review. One merger was prohibited.

It is noteworthy that two of the five withdrawals concerned the same transaction, which involved the acquisition of the thermal systems business for light commercial vehicles of a U.S. company by another U.S. company (Dana Inc./Modine Manufacturing). In that case the notification was pulled and refiled on the basis of an amended structure following negative feedback from the FCO and eventually withdrawn again as it became clear that the new structure would not alleviate the FCO's concerns. Companies often abandon deals in advance of an official decision if the FCO indicates to them that it is preparing to block their transaction.

As in previous years, last year’s Phase II cases related to a number of different industry sectors: the FCO opened in-depth investigations in respect of deals in the mobile heaters, refrigerated containers, daily newspapers, petroleum, waste management, subscription dailies, construction and food processing industries.

In 2021 the average duration of merger investigations that proceeded to Phase II decreased from to 7.3 months to 5.5 months. This is consistent with the average durations seen over the years preceding 2020, and confirms that the longer average duration recorded in 2020 was mostly due to one investigation that had a particularly long duration of approximately 10 months, while the other investigations remained more or less within the usual range. In line with previous years, less than one percent of transactions notified in Germany were subject to an in-depth Phase II investigation.

It remains to be seen whether the unexpectedly high number of merger notifications in 2021 was only the result of catch-up effects in global M&A following the slump at the beginning of the pandemic in 2020 or whether the recent ARC reform will fail to meaningfully reduce the number of notifications in the medium to long term.

Another aspect of German merger control that has garnered attention over the last few years is the attempt to capture high-value acquisitions of targets that have insignificant German revenues by way of a transaction value threshold. The FCO has recently published updated guidelines which provide (limited) additional clarifications on how it will apply the transaction value test in practice.

The guidelines now provide that the FCO will presume that a target company does not have substantial domestic activities if its sales in Germany remain below €17.5 million (instead of the previous €5 million) assuming that those sales adequately reflect its market position and competitive potential. While this change may lead to fewer transactions being notified on the basis of the transaction value test, a number of questions and scenarios remained unaddressed in the updated guidance. It is therefore likely that the FCO will continue to receive precautionary notifications of deals that are not meant to be captured by the transaction value threshold.

Another open question is how the FCO will ultimately position itself in relation to the EU Commission’s new Article 22 EUMR guidance. Last year the FCO announced that it would not join a referral by other Member States pursuant to Article 22 EUMR in respect of the Meta/Kustomer transaction because its policy is to refer cases only if they are reportable under national competition law – which in that case still needed to be assessed. This constituted an apparent departure from the EU Commission’s new guidance in which it encourages Member States to refer certain types of transactions that do not meet the EUMR thresholds to the Commission under Article 22 EUMR even if the referring Member States themselves have no jurisdiction. The FCO has since announced that it has jurisdiction over Meta/Kustomer and will be reviewing the deal in parallel.

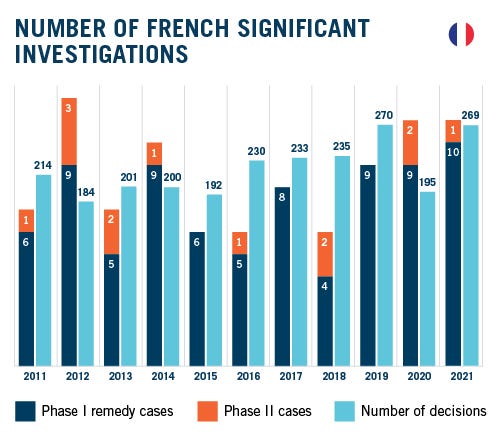

If 2020 was marked by a decrease in the merger control activity in France, due in large part to the Covid-19 pandemic, 2021 showed the FCA resuming business almost as usual. This is reflected by the considerable increase in the number of decisions issued over the past twelve months and by the high number of significant investigations concluded over the past three years, including the first two prohibition decisions ever issued by the FCA.

The FCA's merger control activity has resumed at a sustained pace in 2021. The pandemic had led to a significant decrease in the number of decisions issued in 2020 (28 percent less than in 2019), correlated with a significant increase in review times: +1.2 months for Phase I with commitment and + 0.5 months in Phase II compared to previous years.

After the blip observed in 2020, however, 2021 reaches back again to the levels of 2011-2019, with a total of 269 decisions issued by the FCA, 74 more than in 2020 and just one less than in 2019, the year during which the FCA’s activity peaked (270 decisions issued).

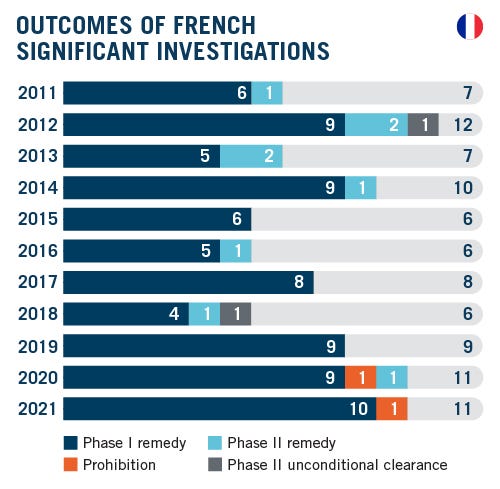

The increased number of transactions reviewed is not reflected in the number of significant investigations completed, however, which remains similar to 2020. 11 significant investigations were reviewed in 2021, the same as in 2020 and an increase of 22 percent compared to 2019.

While the number of significant investigations remains stable, these figures must be put in perspective with respect to the total number of decisions issued. In 2021, significant investigations only accounted for 4 percent of the FCA’s activity (against 5.6% in 2020). In parallel, simplified procedures accounted for 86 percent of the FCA’s activity (74% in 2020).

While the percentage of deals that give rise to a significant investigation decreased, the outcome of these investigations reflects stricter enforcement. Of the two Phase II investigations concluded in 2021, one resulted in the deal being withdrawn by the parties (Transaction No. 19-319)1 while the other led to the second prohibition decision ever issued by the FCA (Decision No. 21-DCC-79). It should be noted that for these two transactions, the companies proposed behavioral commitments that were deemed insufficient to address the competition concerns raised by the FCA.

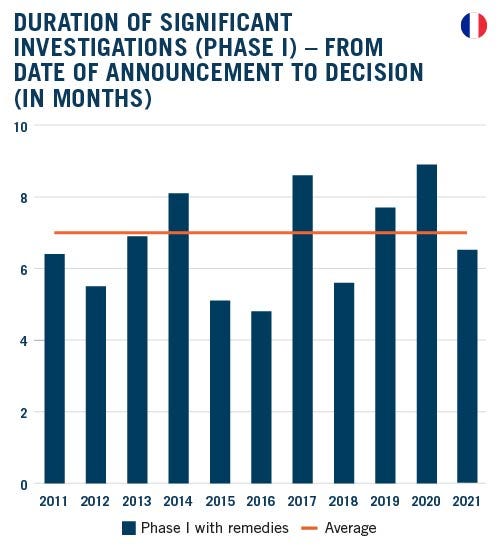

The average duration of Phase I with remedies materially decreased, from 8.9 months in 2020 to 6.2 months in 2021.

As a reminder, under French merger control rules, Phase I with remedies must in theory be completed within seven weeks of the formal notification (25 working days from the filing plus two additional weeks for the discussion of commitments). This deadline however does not take into account prenotification talks, which generally start shortly after the announcement of the deal.2 Despite the significant decrease in the average duration of Phase I cases with commitments, the total review process thus remains significantly higher than the theoretical maximum provided for by the legislation.

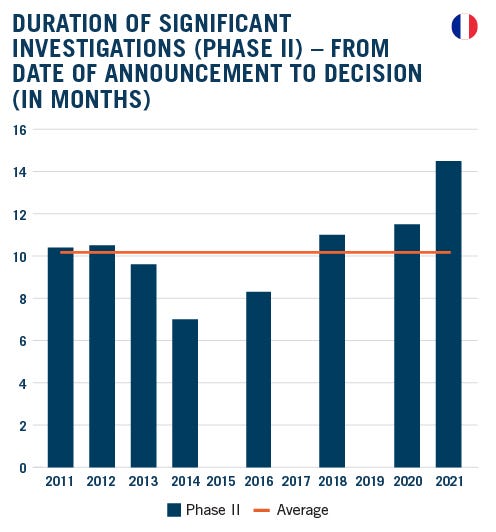

Although the yearly number of Phase II investigations is limited, a clear upward trend in the duration of these investigations can nevertheless be observed. In 2021, the average duration of Phase II cases jumped even further from 11.5 months in 2020 to 14.5 months.

This 26 percent increase reflects the fact that the only transaction that went through the whole Phase II process in 2021 was eventually blocked by the FCA. The duration of that review (14.5 months) is comparable to the duration of the FCA’s investigation for its first prohibition decision in 2020 (13.8 months).

It is worth noting however that this new prohibition sets a new record in terms of duration of the prenotification phase: 6.5 months from the announcement to the filing. By comparison, over the period 2011-2020, the average duration of prenotification talks for Phase II investigations was 2 months. In this case, it indicates that even long pre-notification discussions with the FCA did not alleviate the competition concerns.

Interestingly, the other deal that gave rise to the opening of a Phase II investigation in 2021 also went through a 6-months prenotification phase and eventually led to the withdrawal of the transaction after a 10-months formal investigation. At 16 months total, this would have been the longest Phase II investigation conducted by the FCA over the past ten years if the deal had not been abandoned.

In both France and Germany, the trend is towards a post-Covid recovery in terms of the number of deals reviewed. This is not however reflected in the number of significant investigations completed, which remained stable in both jurisdictions, with a low percentage of deals giving rise to an in-depth investigation by the competition authorities.

For those deals that were subject to a significant investigation, however, the average outcome has been more unfavorable than ever for companies seeking clearance, with an ever-increasing percentage of deals being blocked or abandoned. These trends follow those observed in the US and at the European Commission level, where the percentage of deals leading to a significant investigation is steadily decreasing but leading to more restrictive outcomes: in the US, 37 percent of all significant merger investigations concluded in 2021 ended in either a complaint or an abandoned transaction; in the EU, 21 percent of significant merger investigations similarly resulted in a prohibited or abandoned transaction. See our transatlantic DAMITT report for more data.

Footnotes

1) See FCA Decision No. 20-DEX-02 of 18 December 2020 on the opening of a Phase II and FCA press release of 10 June 2021 on the withdrawal of Leclerc-ACDLec.

2) Please note that date of the formalization of the transaction, as retained in the FCA decision (e.g. signing, firm offer letter), was used as a proxy for the announcement date.