Fast Facts

United States

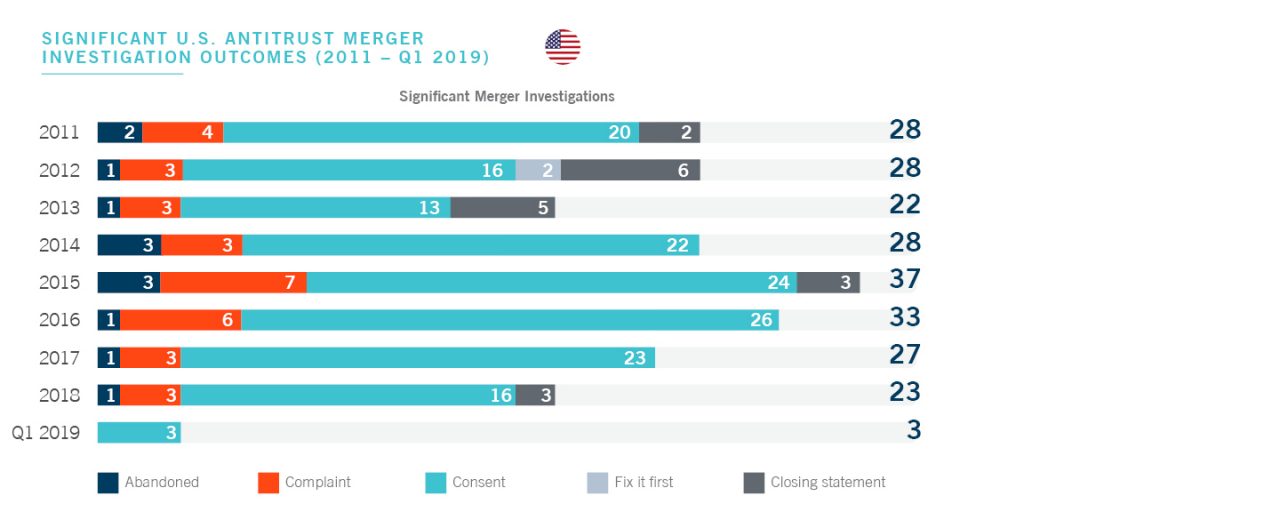

- The number of significant U.S. antitrust merger investigations declined almost 40% during the 12 months ending in Q1 2019 compared to the prior rolling 12 months (RTM).

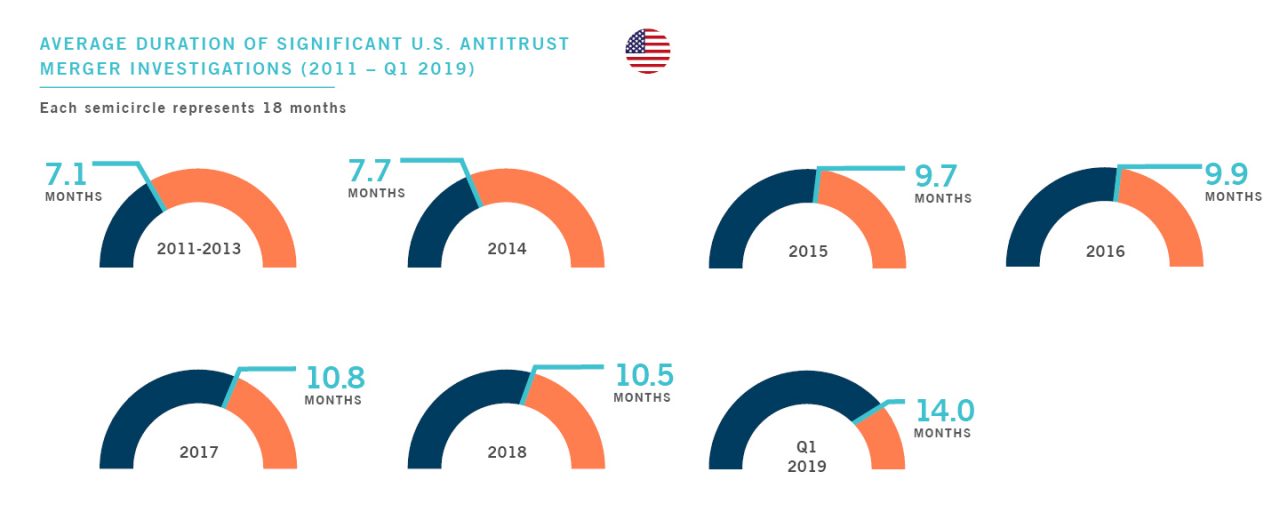

- The average duration of these investigations increased almost a month from the prior RTM, due in part to the 35-day U.S. government shutdown.

- Vertical mergers drew significant attention from the U.S. antitrust agencies, with two of the three significant investigations concluding in Q1 2019 having vertical aspects.

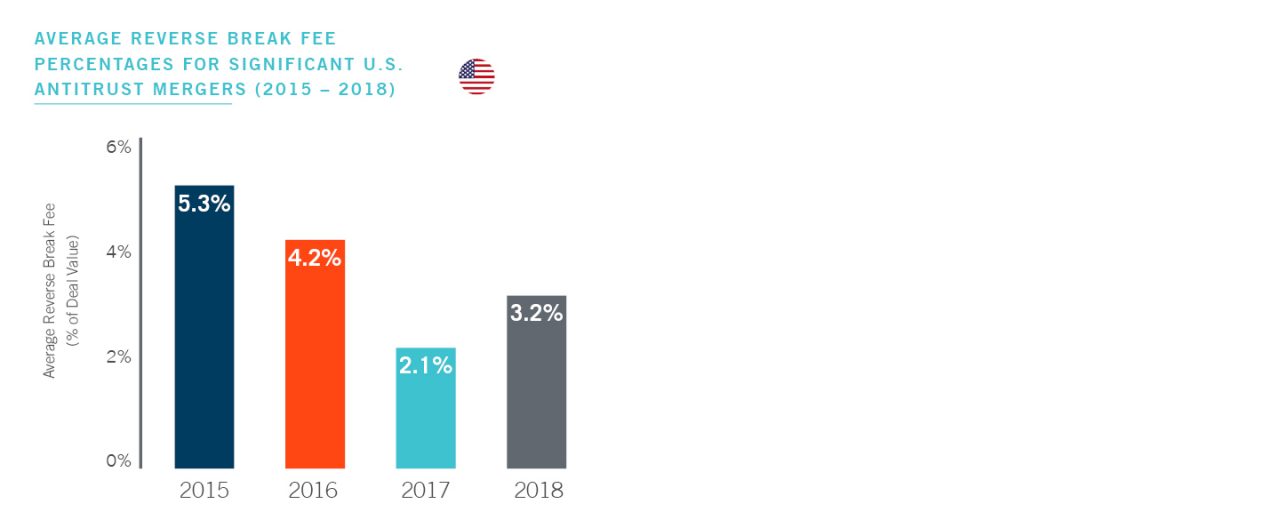

- DAMITT’s analysis of merging companies’ transaction agreements shows a trend towards longer termination periods, but smaller antitrust-related reverse break fees.

European Union

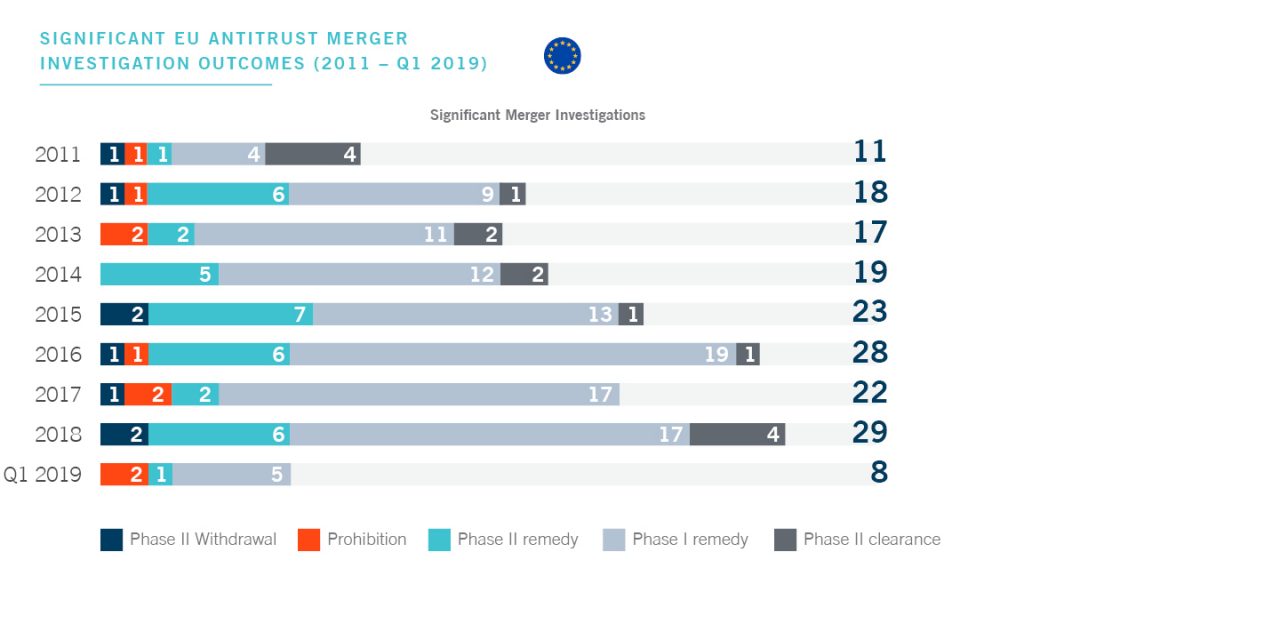

- The number of significant EU antitrust merger investigations concluded in the 12 months ending in Q1 2019 increased 28% from the prior RTM.

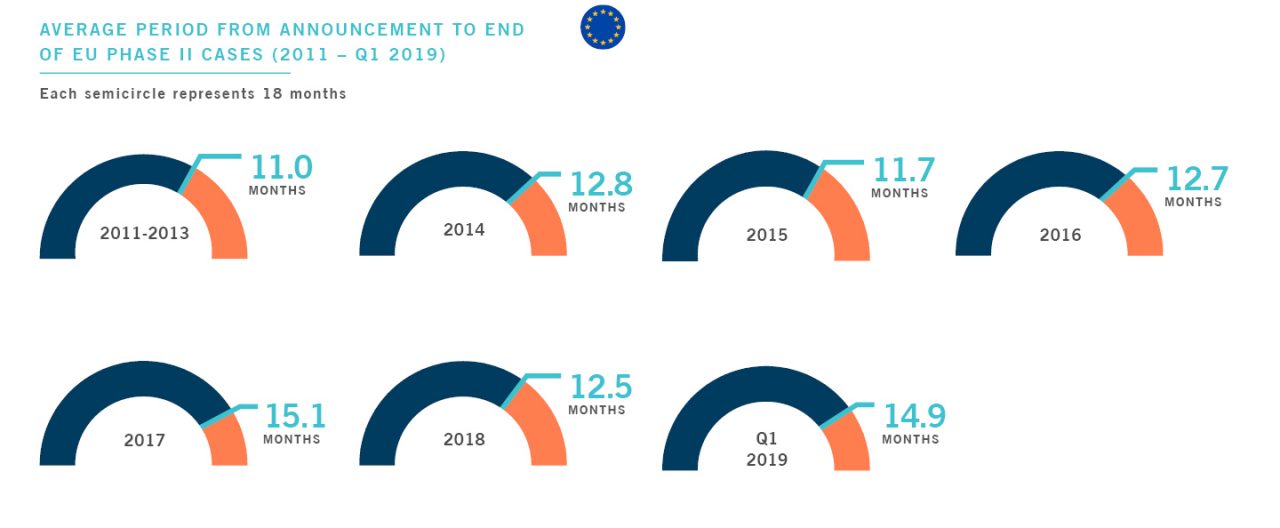

- Phase II investigations resolved in Q1 2019 lasted an average of 14.9 months. Phase II investigations resolved in the RTM through Q1 2019 averaged 12.6 months, lower than the prior RTM average.

- Two transactions resolved in Q1 2019 were blocked following Phase II proceedings, which already matches the highest number of prohibitions in any year over the 2011-2018 period tracked by DAMITT.

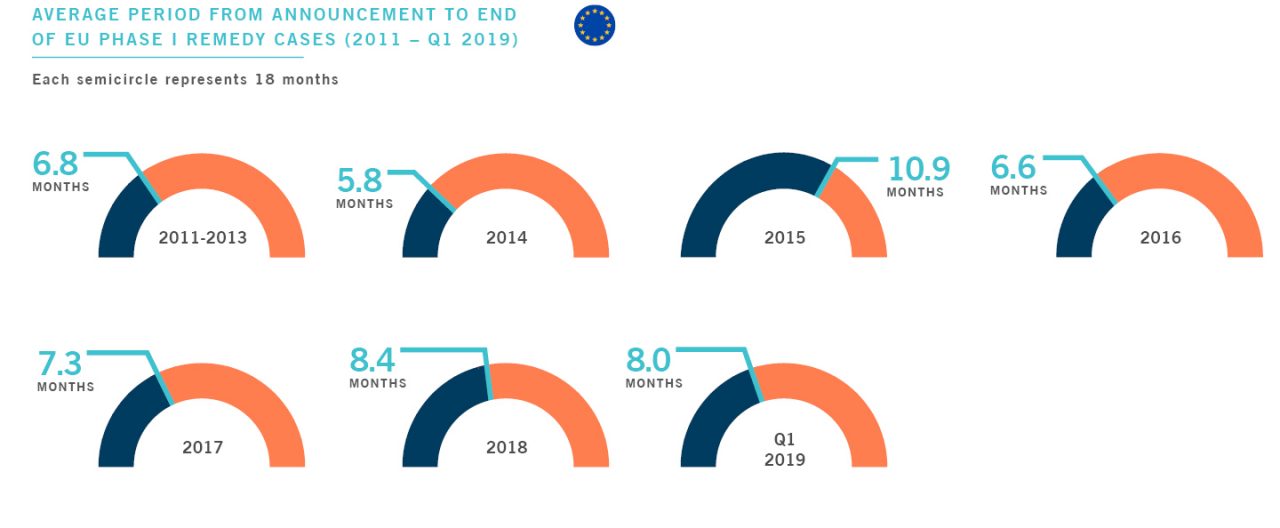

- Investigations cleared in Phase I with remedies during the RTM ending in Q1 2019 lasted an average of 8.4 months, consistent with the uptrend observed since 2016.

- Pull-and-refiles – a tool known well to U.S. practitioners – are gaining steam in Europe, with the two pull-and-refiles in Q1 2019 already matching the annual totals for 2017 and 2018.

Significant antitrust merger investigations in the United States and Phase I remedy cases in the European Union are trending longer, according to the Dechert Antitrust Merger Investigation Timing Tracker (DAMITT). The number of significant investigations is trending down in the United States and up in Europe.

In the United States, perhaps due to the 35-day government shutdown, significant investigations concluding in the RTM ended Q1 2019 averaged 11.3 months, up from 10.4 months in the same period in the prior year. At the same time, the number of significant U.S. merger investigations is decreasing, with only 19 concluding during the RTM ended Q1 2019, down 40% from the prior comparable period.

Vertical mergers continue to garner attention from the U.S. antitrust agencies, with two of the three significant U.S. investigations concluding during Q1 2019 having vertical aspects. In addition, DAMITT’s analysis of the transaction agreements for significant U.S. investigations finds that termination periods are getting longer (averaging almost 17 months for 2018) but with smaller antitrust-related reverse break fees (averaging 3.2% of deal value for 2018).

In Europe, although the average duration of Phase II proceedings was down to 12.6 months on an RTM basis, investigations concluding during Q1 2019 averaged 14.9 months, nearly matching the 15.1-month DAMITT record in 2017. Meanwhile, the average duration of Phase I cases with remedies increased to 8.4 months for the RTM ended Q1 2019, up 20% from the prior RTM. Overall, 32 significant EU investigations were concluded over the RTM ended Q1 2019, up 28% from the prior RTM period.

With the U.S. antitrust agencies working on streamlining merger reviews, the trailing impact of the U.S. government shutdown, and the delay and uncertainty created by Brexit, antitrust merger trends in the United States and Europe are likely to continue to show volatility in 2019.

Number of Significant U.S. Merger Investigations Continues Decline

The number of significant U.S. investigations has continued to decline. There were 19 significant U.S. merger investigations concluded by the Department of Justice (DOJ) and Federal Trade Commission (FTC) over the RTM ending in Q1 2019, down nearly 40% from the 31 that concluded during the RTM ending in Q1 2018. In total, 50 significant investigations have concluded over the 8 quarters since President Trump’s inauguration, down from 65 over the final 8 quarters of President Obama’s term.

Consistent with past years in which the first quarter has tended to have the least activity, only 3 significant investigations concluded during Q1 2019. This trend may have been exacerbated by the 35-day U.S. government shutdown, during which zero significant investigations concluded. Other significant investigations that were ongoing during the shutdown may have also been delayed.

All three Q1 2019 significant investigations resulted in consent orders, with two of the three – Fresenius Medical Care/NxStage and Staples/Essendant – involving vertical aspects. This high percentage of significant investigations with vertical aspects continues the trend observed in DAMITT’s 2018 Year in Review.

“Significant U.S. merger investigations” include investigations of proposed Hart-Scott-Rodino (HSR)-reportable transactions that result in a closing statement, consent order, complaint challenging a transaction, or transaction abandonment for which the antitrust agency issues a press release.

... But the Duration of U.S. Investigations Has Increased

After steadying in 2018, the average duration of significant U.S. investigations is returning to its uptrend. The three significant investigations that concluded in Q1 2019 averaged 14.0 months in duration. During the RTM ended Q1 2019, the average was 11.3 months – up from 10.4 months in the prior RTM period and longer than 2017’s record of 10.8 months. As noted, the 35-day government shutdown may have caused a delay in the significant investigations resolved in Q1, as well as those that were in progress at the time.

Citing DAMITT findings, the U.S. antitrust agencies announced planned reforms to the merger review process late in 2018. Whether these reforms actually lead to the expected streamlined investigations in 2019 remains to be seen, however, and the countervailing impact of the government shutdown could cause overall durations to rise.

While prior DAMITT analyses found that antitrust merger litigation added an additional 5-7 months to the merger process, no new litigation duration data are available for this update, as no new merger cases were filed in Q1 2019.

Number of Significant EU Investigations on Pace with 2018

The number of significant EU merger investigations thus far in 2019 is similar to the pace observed in 2018. Eight significant EU merger investigations concluded in Q1 2019, slightly above the quarterly average for the eight years of data tracked by DAMITT; and 32 significant investigations were concluded over the RTM ended Q1 2019, up 28% from the prior RTM.

In light of the procedural differences between the EU and the United States, DAMITT defines “significant” EU merger investigations to include transactions subject to the EU Merger Regulation and resulting in either Phase I remedies or the initiation of a Phase II investigation.

Six of the eight significant EU merger investigations resolved in Q1 2019 were cleared with remedies, including five transactions in Phase I and one transaction in Phase II. Two transactions were blocked following Phase II proceedings, already matching the highest number of prohibitions in any year since DAMITT began tracking the data in 2011. By contrast, in 2018, four Phase II investigations were resolved with an unconditional clearance, and there were zero prohibitions.

Diverging Trends Between Phase II (Shorter) and Phase I Remedy Cases (Longer)

The duration of significant Phase I remedy cases keeps getting longer: the average duration of investigations resolved over the RTM ended Q1 2019 – 8.4 months – is up 20% from the prior RTM.

The average duration of Phase II proceedings concluded in the RTM ended Q1 2019 was 12.6 months – approximately two months shorter than the average over the prior two RTM periods, although there was a sharp increase in the average duration of Phase II investigations resolved in Q1 2019.

Phase II Proceedings

The 14.9-month average duration for Q1 2019 EU Phase II proceedings represented a 40% increase compared to Q4 2018. This gap is likely related to the complexity of the cases resolved in Q1 2019. The two prohibited transactions – Siemens/Alstom and Wieland/Aurubis – involved allegedly close competitors in highly concentrated markets.

Siemens/Alstom was notable also for the political controversy it generated, but the timetabling constraints of the EU process proved robust, even after a particularly long pre-notification exercise. BASF/Solvay also allegedly raised significant input foreclosure concerns because Solvay was found to be the only supplier of a key input in Europe.

While the RTM average of 12.6 months was approximately two months shorter than the average duration over the same period in the prior two years, even this lower RTM average duration is nearly double the theoretical duration of the fixed timetable under the EU Merger Regulation. The difference is nearly all attributable to the pre-notification period.

The time between announcement and notification of Phase II transactions that concluded in the RTM ended Q1 2019 was 5.8 months, 36% shorter than the 7.9-month average for the same period in the prior year. Merging parties invariably institute pre-filing talks with DG Competition staff very shortly after transaction announcement, if not before.

Phase I Cases

During Q1 2019, five significant EU investigations were resolved in Phase I with remedies. These investigations lasted 8.0 months on average, slightly below the 8.4-month average for 2018. However, the RTM average duration of 8.4 months shows that the trend of year-on-year increases observed since 2016 has not reversed. Phase I investigations resolved with remedies now require more than five times the theoretical duration of the fixed timetable under the EU Merger Regulation.

The time between announcement and notification for Phase I remedies cases that were resolved during the RTM ended Q1 2019 was 6.6 months, longer than the 5.1 and 5.0-month average for the prior two RTM periods. Two of those cases involved maneuvers similar to what is referred to as a “pull-and-refile” in the United States, which remain a rare occurrence in the EU. In the U.S., parties may withdraw their HSR notification and refile within two business days without paying a new filing fee.

The two “pull-and-refiles” observed in the EU during Q1 already matches the total number of pull-and-refiles in 2017 and 2018, which suggests that the use of this tool is becoming more commonplace. However, the additional delay in those investigations was limited, because the average pre-notification period of 2.5 months in the pull-and-refile cases resolved in Q1 2019 was shorter than the average of 5.0 months and 8.3 months in 2017 and 2018, respectively.

Unlike in the U.S., where the re-filing must be made promptly in order to avoid a new filing fee, there is no deadline for re-filing in the EU. In Q1 2019, one transaction was re-notified on the same day, and the second transaction was re-notified following a delay of 3.2 months. These intervals are significantly shorter than the average delay in older pull-and-refiles of 6.6 months and 5.0 months in 2017 and 2018, respectively.

Transaction Agreements Trending to Longer Termination Periods and Smaller Reverse Break Fees

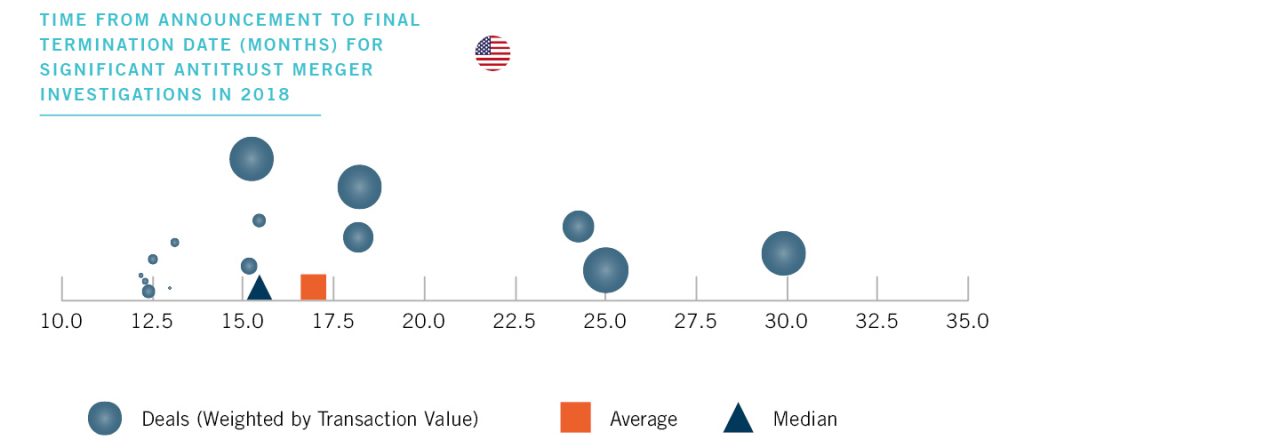

DAMITT’s analysis of publicly available transaction agreements for deals involved in significant U.S. merger investigations suggests that companies are agreeing to longer termination periods but smaller break fees.

The average time from deal announcement to the final termination date in transaction agreements for significant U.S. merger investigations that concluded in 2018 was 16.9 months, up from an average of 14.6 months from 2015-2017.

As shown in the 2018 chart below, DAMITT’s analysis also shows that companies involved in deals with a larger transaction value tended to allot more time in their transaction agreements than companies involved in smaller transactions.

While termination periods have increased, antitrust-related reverse break fees have been trending downward since 2015. Significant U.S. investigations concluding in 2018 had an average reverse break fee of 3.2%, down from an average of 4.4% from 2015-2017.

Summary

While the circumstances of future antitrust-sensitive transactions may lead to results above or below DAMITT averages, current statistics suggest that parties to the hypothetical average “significant” investigation subject to review only in the United States would have to plan on approximately 11 months for the agencies to investigate a transaction, and another five to seven months if they want to preserve their right to litigate an adverse agency decision.

Deal timetables for EU cases where the investigation is likely to proceed to Phase II need to allow for an average lapse of almost 13 months from announcement to clearance. If the investigation is likely to be resolved in Phase I with remedies, the deal timetable should allow for approximately 8 months from announcement to a decision.

Significant U.S. and EU Phase II investigations resolved in Q1 2019 took significantly longer than in 2018 as a whole; while the government shutdown may have contributed to the increase in the U.S., any streamlining effects of the proposed reforms to the review process have yet to materialize in the case of significant transactions.