Fast Facts

United States

- The COVID-19 pandemic has yet to slow U.S. merger enforcement, with deal reviews for Q1 2020 averaging 11.1 months in length, slightly below the 11.9 month average for CY 2019.

- The U.S. antitrust agencies concluded 10 significant merger investigations in Q1 2020, their fourth-busiest quarter since 2011 and more than double the 4.4 average number of investigations concluded in each first quarter from 2011-2019. Two investigations were concluded after the U.S. agencies began working remotely due to COVID-19 in late March 2020, signaling that the agencies’ work is continuing.

- The median time from deal announcement to final termination date in transaction agreements for deals subject to significant U.S. investigations that concluded in Q1 2020 was 18.2 months, up from the 15-month medians observed from 2015-2019 and the 12-month medians observed from 2011-2014.

- Although contractual deal termination periods have increased in recent years, the median reverse break fee, expressed as a percentage of deal value declined 10 percent from its 2011-2015 median of 4.0 percent to 3.6 percent from 2016 to Q1 2020.

- The FTC’s challenge to Evonik/PeroxyChem and the DOJ’s challenge to Sabre/Farelogix reached decisions in an average of 204 days after the filing of the complaint, consistent with average litigation lengths observed in recent years, but slightly longer than the 188-day duration in the first-ever U.S. merger arbitration.

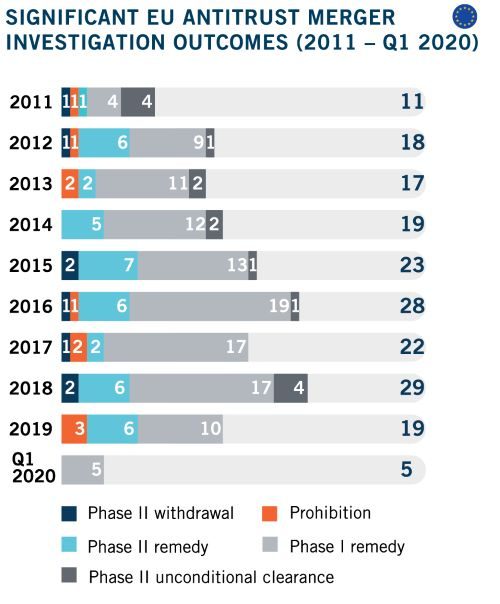

- The number of significant EU antitrust merger investigations concluded in the 12 months ending in Q1 2020 is down by 50 percent from the rolling twelve months (RTM) ended Q1 2019.

- No Phase II decision was adopted in Q1 2020 but there are six ongoing Phase II investigations.

- Investigations cleared in Phase I with remedies in Q1 2020 lasted an average of 9.4 months, 25 percent longer than the 2011-2019 DAMITT average.

- The EU Commission received only five full form notifications since March 16 when it asked parties to delay non-essential filings, compared to an average of nearly two per week in 2019.

The Dechert Antitrust Merger Investigation Timing Tracker (DAMITT) is a quarterly release from Dechert LLP’s Antitrust/Competition practice reporting on trends in significant merger control investigations in the United States (U.S.) and European Union (EU).

In the U.S., “significant” merger investigations include Hart-Scott-Rodino (HSR) Act reportable transactions for which the result of the investigation by the Federal Trade Commission (FTC) or the Antitrust Division of the Department of Justice (DOJ) is a consent order, a complaint challenging the transaction, an official investigation closing statement by the reviewing antitrust agency, or the abandonment of the transaction with the antitrust agency issuing a press release.

In light of the procedural differences between the EU and U.S., DAMITT defines “significant” EU merger investigations to include transactions subject to the EU Merger Regulation and resulting in either a Phase I remedy or the initiation of a Phase II investigation.

DAMITT calculates the durations of significant investigations in both jurisdictions from the deal announcement date until the completion of the investigation, and therefore includes the time attributable to pre-notification consultation efforts.

Significant U.S. Investigation Durations Ticked Down Slightly in Q1 2020 as Agencies Continue Merger Enforcement Amid COVID-19

Despite the emergence of the COVID-19 pandemic late in Q1 2020, the average length of significant U.S. antitrust merger investigations was slightly shorter in Q1 2020 than in Q1 2019.

Significant investigations concluded in Q1 2020 lasted an average of 11.1 months from deal announcement to the completion of the investigation, down from 14.0 months in Q1 2019 and 11.9 months in calendar year (CY) 2019. This result was driven in part by the fact that only 10 percent of significant investigations in Q1 2020 exceeded 13 months, compared to 67 percent in Q1 2019 and 38 percent in CY 2019. For the RTM ended Q1 2020, the average significant investigation duration was 11.4 months, approximately even with the 11.3-month average observed for the RTM ended Q1 2019.

The “typical” significant investigation — as measured by the median — lasted 10.8 months for Q1 2020, compared to medians of 14.6 months for Q1 2019 and 9.8 months for CY 2019. Over the RTM ended Q1 2020, the median duration was 9.8 months, up from 9.3 months for the RTM ended Q1 2019. Thus, although the average duration fell due in part to having fewer outliers at the top end of the range, the duration of the typical significant investigation is trending upward.

Two significant investigations – one by the DOJ and one by the FTC – concluded in the second half of March 2020, after the U.S. antitrust agencies had announced they would work remotely in response to COVID-19. These two matters lasted an average of 11.3 months and indicate that, as of now, the agencies continue to execute their merger enforcement efforts amidst the pandemic.

Although significant investigation lengths have held relatively steady thus far in 2020, COVID-19 and its aftershocks could begin to show a measurable impact on the length of merger reviews in Q2 2020.

U.S. Antitrust Agencies Recorded the Fourth-Busiest Quarter for Significant Investigations in the Past 9+ Years, but Significant Investigations With Vertical Aspects Continued Recent Decline

A flurry of significant investigations concluded in Q1 2020. The U.S. antitrust agencies completed 10 significant investigations this quarter, compared to only three in Q1 2019. A total of 33 significant investigations concluded during the RTM ended Q1 2020, a 74 percent increase over the 19 significant investigations that concluded in the RTM ended Q1 2019.

The surge in significant investigations this quarter bucked historical trends. Between 2011-2019, the first quarter of each year had been relatively inactive, with an average of only 4.4 completed significant investigations compared to an average of 7.9 in the second quarter, 7.0 in the third quarter, and 8.7 in the fourth quarter’s year-end rush. This quarter’s total surpassed all of these averages and ranked behind only three other quarters in the prior nine years tracked by DAMITT, signaling a bustling period for the U.S. antitrust agencies.

Despite increased attention on vertical mergers and the agencies’ release of the draft Vertical Merger Guidelines in January 2020, no significant investigations with vertical aspects have concluded thus far in 2020. Only one significant merger investigation with vertical aspects concluded during the RTM ended Q1 2020, compared to six in the RTM ended Q1 2019. The last such matter concluded in Q2 2019. Historically, between 2011 and 2019, significant investigations with vertical aspects had accounted for about 11 percent of the total significant investigations each year, with a record annual high of 22 percent in 2018. But this trend toward more significant investigations with vertical aspects appears to now be in decline.

The antitrust agencies continue to actively file complaints seeking to block mergers outright. After a record-tying year for complaints in 2019, there were three complaints filed in Q1 2020 – all by the FTC – against the Peabody Energy/Arch Coal (coal mining), Jefferson/Einstein (hospitals), and Edgewell Personal Care/Harry’s (razors) mergers. Six other significant investigations that concluded in Q1 2020 resulted in a consent order. And one investigation resulted in the transaction being abandoned by the merging companies, presumably in response to obstacles in obtaining antitrust clearance.

The three complaints accounted for 30 percent of this quarter’s total significant investigations, which is on pace to surpass the DAMITT record of 27 percent set in CY 2019. This recent trend toward a high percentage of complaints may be a sign that merger remedies are becoming more difficult to work out with the U.S. antitrust agencies than in the past.

Number of Significant EU Investigations Continues to Decrease

Five significant EU merger investigations concluded in Q1 2020. This is slightly above the quarterly average of four decisions over the 2011-2019 period tracked by DAMITT, but the number of significant investigations concluded over the RTM ended Q1 2020 is down 50 percent from the prior RTM ended Q1 2019. This is consistent with the drop in the number of resolutions observed in the DAMITT 2019 annual report: in 2019, the EU Commission concluded the lowest number of significant investigations over the past five calendar years.

The COVID-19 pandemic is also likely to have an impact on the number of significant investigations resolved by the EU Commission in 2020. On March 16, the EU Commission issued a statement asking merging companies to delay all non-essential filings, citing anticipated difficulties in collecting information from third parties for market testing purposes and in staff accessing information and databases due to remote working arrangements. This impact is reflected in the DAMITT data gathered since the statement was issued, with the Commission accepting only five long-form notifications, compared to an average of nearly two per week in 2019. These long-form notifications are required in cases that give rise to “affected markets,” i.e., where the parties’ combined share exceeds 20 percent as a result of a horizontal overlap, or where one of the parties has a share that exceeds 30 percent in a market that gives rise to a vertical relationship.

All significant EU merger investigations involve long-form notifications, and the EU Commission is required to conduct a full market investigation by sending questionnaires to market participants including customers, competitors, and suppliers. This process will be challenging in present circumstances, and the EU Commission may thus be hesitant to accept such notifications. In particular, the strict Phase I time limit – i.e., 25 working days extended by 10 working days where remedies are offered – remains in place.

It follows that case teams would be hard-pressed to keep reviews on track in complex transactions that require extensive information gathering.

The five significant EU merger investigations resolved in Q1 2020 were all Phase I remedy cases. This is in line with the number of Phase I remedy investigations resolved in Q1 2019, but above the Phase I remedy quarterly average over the prior nine years tracked by DAMITT. However, the number of Phase I remedy cases resolved in the RTM ended Q1 2020 is down 52 percent from the RTM ended Q1 2019.

Q1 2020 marks only the fourth time the EU Commission has not resolved a single Phase II investigation in a quarter over the 37 quarters tracked by DAMITT since 2011. This has had a corresponding impact on the number of Phase II cases resolved in the RTM ended Q1 2020, which is down by 45 percent from the RTM ended Q1 2019. At the time of publication, however, there are six ongoing Phase II investigations.

Duration of EU Phase I Remedy Cases Keeps Getting Longer; Duration of EU Phase II Cases on Course to Increase in 2020

EU Phase I remedy cases resolved in Q1 2020 lasted on average 9.4 months, 18 percent above the Q1 2019 8.0-month average, up 22 percent from the CY 2019 7.7-month average and up 25 percent from the 7.5-month average over the 2011-2019 period tracked by DAMITT. This upward trend is also reflected in the 8.4-month average duration of Phase I remedy cases resolved in the RTM ended Q1 2020. Although the average duration remains unchanged from the previous RTM ended Q1 2019, the average markedly exceeds the prior RTM periods: 6.8 months on average for the RTM ended Q1 2018, 6.7 months for RTM ended Q1 2017, and 6.3 months for the RTM ended Q1 2016. Phase I investigations resolved with remedies now require on average more than five times the theoretical duration of the fixed timetable under the EU Merger Regulation.

The lengthier average duration is mirrored in the length of pre-filing talks. The average duration from announcement to notification in Phase I remedy cases was 7.6 months in Q1 2020, which was one month longer than in Q1 2019, up 28 percent from the CY 2019 5.9-month average, and up 32 percent from the 2011-2019 average of 5.8 months. As explained in more depth in the DAMITT Q3 2019 report, pre-notification contacts have been a longstanding feature of EU merger reviews: merging parties invariably institute pre-filing talks with EU Commission staff very shortly after the transaction announcement, if not before.

The average duration of pre-notification will likely continue to increase in 2020 due to the COVID-19 pandemic. Parties should expect longer periods of pre-filing consultation in view of the likely difficulties in conducting market testing once the formal timetable starts. In addition, EU Commission officials have hinted at an increased use of pull-and-refile: although this U.S. technique is not familiar in the EU, the practice is gathering steam, with four such cases in 2019 (including two Phase I remedy cases). In addition, the EU Commission may have to resort to using its powers under the EU Merger Regulation to “stop the clock.” Although the EU Commission is reluctant to exercise these powers in Phase I investigations and has not done so in any recent cases, the current crisis may force a rethinking of this policy.

Although the statutory time limits have not been suspended, it will be challenging for the EU Commission to adhere to those limits in on-going Phase II investigations due to the disruption caused by the COVID-19 pandemic. At the time of this report, there are six such investigations, of which three are currently suspended (EssilorLuxottica/Grandvision; Fincantieri/Chantiers de l'Atlantique; Hyundai Heavy Industries Holdings/Daewoo Shipbuilding & Marine Engineering) due to stop-the-clock orders. These six Phase II investigations have already lasted an average of 18.5 months, which is higher than the 2019 average of 15.6 months. The exclusion of the Fincantieri/Chantiers de l’Atlantique merger, which had an exceptionally long pre-notification period of 33 months, brings the average down to 14.1 months.

Emerging U.S. and EU Trends in Negotiating Termination Periods and Reverse Break Fees in Transaction Agreements

Companies expecting significant merger investigations will often negotiate two key antitrust provisions in their merger agreements: the amount of time after signing in which antitrust clearance must be obtained and the amount of any antitrust-related reverse termination fee. This DAMITT report analyzes key trends observed in these two provisions over time using publicly available transaction agreements for deals subject to U.S. and EU significant investigations.

Transaction agreement termination dates are critical because, if a merger investigation extends beyond the contract’s termination date, one or both parties will have the right to walk away. For example, if the value of a seller’s business has declined by the termination date and antitrust clearance has not been obtained, the buyer may decide to terminate the transaction agreement. And in the U.S., a company may not have time to litigate a merger challenge if not enough time is allotted in the transaction agreement. On the other hand, some companies may opt for shorter termination periods to avoid hanging their businesses in limbo for too long of a period. Thus, companies must carefully consider the appropriate termination period for their transactions in light of the expected duration of the antitrust process and their unique strategic considerations.

Antitrust-related reverse break provisions play a related and important role in negotiating antitrust merger risks. These provisions state the negotiated amount (if any) that a buyer would be required to pay to the seller if antitrust clearance is not obtained prior to the termination date. Ostensibly, the amounts are designed to reasonably compensate the seller for at least a portion of any damages suffered as a result of the failed transaction, such as the loss of customers or employees due to uncertainty while the deal is pending, or the time and resources expended by the seller to try to obtain clearance.

U.S.: Companies Are Allotting Substantial Time for Significant Merger Investigations While Reverse Break Fees Percentages Have Drifted Downward Since 2011

DAMITT’s analysis of publicly available transaction agreements for deals involved in significant U.S. merger investigations shows that in recent years companies have allotted more time in their merger agreements, but with relatively smaller antitrust-related reverse termination fees.

The median time from deal announcement to the final termination date in transaction agreements for deals involved in significant U.S. merger investigations that concluded in Q1 2020 was 18.2 months. This represented an increase from the remarkably steady 15-month medians observed in each of the years from 2015-2019 and the 12-month medians observed in each of the years from 2011-2014. This stepwise increase observed since 2011 may reflect merging parties’ response to the growing duration of significant investigations, as well as growing marketplace awareness of the actual duration of significant investigations.

The average time from deal announcement to the final termination date in transaction agreements for deals involved in significant U.S. merger investigations has been more volatile in recent years but also trending upward over the longer term. For significant investigations concluded in Q1 2020, the average period from announcement to the drop-dead date was 16.6 months, well ahead of the 14.5-month average in CY 2019 but slightly behind the 16.9-month average in 2018. Nevertheless, the averages observed from 2015 through Q1 2020 (14.2, 15.7, 14.1, 16.9, 14.5, and 16.6 months, respectively) have consistently exceeded the average of only 12 months observed in each year from 2011-2014 (12.1, 12.3, 11.8, and 11.5 months, respectively).

Some significant U.S. investigations took longer than the allotted termination period and were renegotiated or abandoned, but on average the termination periods for significant U.S. investigations exceeded the average duration of those significant investigations by about 4.7 months for each year from 2011 through Q1 2020. Although on average these termination periods provided merging companies with time sufficient to cover the investigation phase, in most years absent a renegotiation this cushion was not sufficient to allow time for litigation, which typically lasts 5-7 months, as detailed in the next section. As a result, many litigations filed by the U.S. antitrust agencies result in companies abandoning deals without a court battle.

While termination periods have increased since 2011, antitrust-related reverse break fee amounts as a percentage of deal value have drifted slightly downward over the same period. This inverse movement is surprising given that a seller’s expected losses are likely to be greater over the course of a longer investigation than a shorter one. Thus, one would have expected reverse termination fees to trend in the same direction as the duration of termination period, all else equal.

Instead, over the five-year period from 2011-2015, the average reverse break fee percentage was 5.3 percent, about 36 percent higher than the average of 3.9 percent from 2016 to Q1 2020. The median for 2011-2015 was 4.0 percent, about 11 percent higher than the 3.6 percent from 2016 to Q1 2020.

Antitrust-related reverse break fee provisions were included in about 55 percent of all publicly available transaction agreements for significant U.S. investigations since 2011. The chart to the left provides year-by-year breakdowns of the reverse break fee averages and medians, showing a downward trend over the full 2011-2020 period, but with some fluctuations along the way.

A further breakdown of reverse break fees by the outcome of U.S. significant investigation yields interesting results. For all significant investigations for which reverse break fee information is available from 2011 through Q1 2020, the average was 4.8 percent. At the low end of the spectrum, deals abandoned during significant investigations averaged a reverse break fee of only 2.7 percent, suggesting that companies may be more willing to walk away from an investigation if the cost is low. The averages for significant investigations ending in complaints (4.7 percent) and those ending in consents (4.3 percent) were closer to, but slightly below, the overall DAMITT average. And at the top end of the spectrum, significant investigations resulting in a closing statement without any enforcement action averaged 9.7 percent. Together, these results suggest that on average merging companies negotiated relatively larger reverse break fees in mergers where the actual risk is low (i.e., mergers that do not result in an enforcement action) and relatively smaller reverse break fees in mergers where the actual risk is high (i.e., mergers that result in an enforcement action or deal abandonment).

EU: Average Allotted Time for Significant Merger Investigations Remains Above the Observed Average Duration of Merger Reviews; Antitrust Reverse Break Fees Relative to Deal Value are Higher for Phase II than Phase I transactions

DAMITT’s analysis of publicly available transaction agreements for deals that were the subject of significant EU merger investigations between 2015 and 2020 shows companies have on average allotted sufficient time in their merger agreements to allow for the length of merger reviews. As observed in significant U.S. investigations, antitrust-related reverse termination fees since 2015 have fluctuated but trended downward. In addition, these fees have consistently been lower for Phase I remedy cases than for transactions that proceed to Phase II.

The average time from deal announcement to the final termination date in transaction agreements for significant EU merger investigations fluctuated between 13.8 months and 21.4 months over the 2015-2020 period. For significant investigations concluded in Q1 2020, the average period from announcement to the drop-dead date was 15 months, well below the 19-month average in CY 2019; and also below the 17.1-month average observed over the 2015-2019 period. This is the first decrease in average allotted time since 2017, but this may be linked to the small sample size available for Q1 2020.

Over the 2015-2019 period, the average allotted time for significant investigations remained consistently above the average duration of Phase II merger reviews during the same period, which suggests that parties are taking into account the anticipated length of reviews. Although the average allotted time for significant investigations resolved in Q1 2020 falls below the average duration of Phase II investigations resolved in 2019, all of those transactions were cleared in Phase I. Accordingly, the allotted time was well above the 7.7-month average for significant Phase I investigations resolved in 2019.

Over the 2015-2020 period and similar to the U.S. data, 49 percent of significant EU transactions for which information is publicly available included a termination fee linked to antitrust clearance. The amount of these antitrust-related reverse break fees relative to deal value has fluctuated over the 2015-2020 period, but is trending downwards.

The data also show that the antitrust reverse break fees for deals cleared in Phase I with remedies are on average lower than in deals that are resolved in Phase II: 3.9 percent vs 4.8 percent. This result may suggest that sellers expecting a lengthier investigation are seeking larger reverse break fees.

Federal Court Merger Litigations Timelines Similar to Recent Years but Slightly Slower Than DOJ’s Novel Merger Challenge in Arbitration

Companies often abandon transactions in the face of an FTC or DOJ lawsuit seeking to block a deal in federal court, particularly where they run out of time under their transaction agreement, as discussed in the previous section. The DOJ’s recent decision to pursue a merger challenge in arbitration could change that dynamic.

Two merger litigations filed by the U.S. antitrust agencies in federal court in 2019 were litigated to a decision. These litigations – the FTC’s challenge to Evonik/PeroxyChem and the DOJ’s challenge to Sabre/Farelogix – provide additional data on the timeline companies should expect if they decide to fight the lawsuit. Both the FTC and the DOJ were unsuccessful in their attempts to block these mergers, which reached decision an average of 204 days after the filing of the complaint. This average nearly matched the 207- and 205-day averages observed in 2016 and 2017, respectively.

In addition to these federal court litigations, the DOJ for the first time arbitrated a significant portion of a merger challenge in a case filed in 2019 against the Novelis/Aleris transaction. The DOJ and the parties agreed to limit the arbitration to only the issue of product market definition.

Overall, the arbitration lasted 188 days from the filing of the case to the arbitrator’s decision, which was about two weeks faster than the 204-day average for the two most recent federal court litigations. The time from the filing of the DOJ’s complaint to the arbitration hearing was 173 days, about 32 percent longer than the 131-day average length for the two litigations. But the length of the arbitration hearing and the federal court hearings was approximately the same at 10-12 days for all three cases.

The main difference in timing between the arbitration and two federal court proceedings was in the time it took the arbitrator to reach a decision following the end of the hearing. It took only three days for the arbitrator to reach a decision, compared to an average of 63 days for the judges in the federal court proceedings. However, this significant difference was likely due to the fact that the arbitrator’s decision was limited to the issue of product market definition, whereas both federal court proceedings also involved a variety of other merger issues, such as geographic market definition, competitive effects, efficiencies, and the adequacy of a proposed divestiture remedy. Likely for this reason, the Novelis/Aleris decision was only nine pages, compared to the 64-page Evonik/PeroxyChem opinion and the 97-page Sabre/Farelogix opinion.

DAMITT does not yet have enough data on arbitrations to evaluate whether arbitration proceedings may present a new path forward for more efficient and less costly merger challenges. But if the DOJ continues to pursue future merger challenges in arbitration and finds ways to further streamline the process, it may represent an important reform for the business community given that timing constraints often prohibit merging companies from having their day in court after a lawsuit is filed.

Summary

While the circumstances of future antitrust-sensitive transactions may lead to results above or below DAMITT averages, current statistics suggest that parties to the hypothetical average “significant” deal subject to review only in the U.S. would have to plan on approximately 11-12 months for the agencies to investigate their transaction, and another five to seven months if they want to preserve their right to litigate an adverse agency decision. Deal timetables for EU cases where the investigation is likely to proceed to Phase II need to account for an average lapse of 15-16 months from announcement to clearance.

With the COVID-19 pandemic potentially causing disruptions, companies may need to tailor their transaction agreements to allow for further delays in the merger review process above these averages.