DAMITT Q3 2016 Update: No Let Up in Antitrust Merger Investigation Activity or the Duration of Merger Investigations; Antitrust Merger Litigation Stretching Out

Fast Facts

- In the first three quarters of 2016, there were 24 significant merger investigations, which is on pace to challenge the record of 37 set in CY2015.

- Significant merger investigations through Q3 2016 lasted 9.7 months on average—on par with CY2015, but more than one-third longer than from 2011 to 2013.

- The antitrust agencies filed three complaints in the third quarter for a total of five complaints YTD, also on pace to challenge the record level of CY2015 when seven complaints were filed.

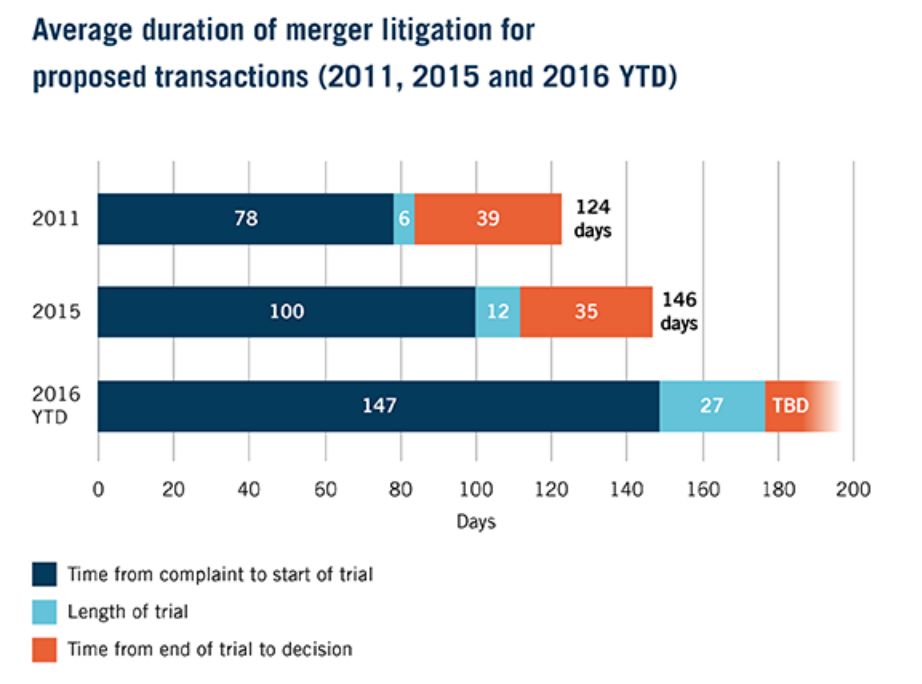

- Scheduling orders related to the complaints filed in 2016 indicate that antitrust merger litigation is taking even longer with 147 days between complaint and the start of trial and 27 days for trial, up 47% and 125%, respectively, from cases filed in CY2015.

Lengthier Significant Investigations Are a Steady State

According to the Dechert Antitrust Merger Investigation Timing Tracker (DAMITT), significant merger investigations concluded by the Department of Justice (DOJ) and Federal Trade Commission (FTC) during the first three quarters of 2016 lasted an average of 9.7 months, identical to those concluded during CY2015. Significant merger investigations include Hart-Scott-Rodino (HSR) Act reportable transactions resulting in a closing statement, consent order, complaint challenging a transaction, or transaction abandonment for which the agencies take credit.

Although the duration of significant investigations appears to have stabilized, the 9.7 month average recorded during the first three quarters of 2016 is more than one-third longer than the 7.1 month average recorded by DAMITT in each of the 2011, 2012, and 2013 calendar years. Quarterly data suggest that investigations of nine or more months have been the norm for the last eight quarters. The trend toward lengthier significant merger investigations first identified by DAMITT in 2015 is now a steady state.

The Number of Significant Merger Investigations in 2016 Continues to be On Pace to Challenge the 2015 Record

Through the first three quarters of 2016, the number of significant merger investigations is on pace to challenge the record set in CY2015 for the most significant merger investigations in any of the five full years during which DAMITT has tracked the data. There were 24 significant investigations that concluded in the first three quarters of 2016, compared to 25 in the same period in 2015.

There are at least six second request investigations in the pipeline that have been ongoing more than the DAMITT 2016 average of 9.7 months since deal announcement. Many of these investigations could result in enforcement actions, closing statements, or abandonment before the end of 2016, challenging the records set in 2015 for the number and duration of significant investigations.

Merger Litigation Continues to String Out the Time to Closing

The agencies filed three antitrust merger complaints in Q3 2016, Aetna/Humana, Anthem/Cigna, and Deere/Monsanto (Precision Planting). Scheduling orders in these cases suggest that merger litigation continues to string out the time to closing. The average time between the complaint and the first day of trial for these cases is 147 days, and trial time has stretched to an average of 27 days. The Q2 2016 DAMITT Report noted that for cases filed in 2015, it took an average of 100 days to get to trial and an average of 12 days to try the case, both figures representing sharp increases from the last batch of litigated merger cases which were brought in 2011. The 2016 cases have added two months to the timeline for litigated merger cases as compared to cases brought in 2015 and three months as compared to cases brought in 2011. While the length of significant merger investigations may have reached a steady state, the duration of merger litigation continues to increase.

Conclusion

The antitrust agencies have not let up on merger enforcement but continue to be active in pursuing significant merger investigations in 2016 at a similar pace to 2015, which was a record-setting year. The duration of antitrust merger investigations appears to have reached a steady state, albeit one much longer than historical norms. But the duration of antitrust merger litigation continues to increase, adding cost and deal risk to antitrust-sensitive transactions. DAMITT shows that significant merger investigations are lasting an average of 9.7 months in 2016 and that merger litigation (including the time waiting for a decision) could take another 7.0 months. Circumstances of individual transactions may lead to results above or below the mean, but parties to the hypothetical average deal now have to plan on 17 months if they intend to fight for the right to combine, and perhaps longer if the trend toward longer litigation continues.