The Hong Kong Professional Investor Regime

Similar to the situation in many other jurisdictions, fund managers, banks and other market participants in Hong Kong were, until recently, not required to apply the same regulations to high net worth, corporate or institutional investors as were applied to retail investors. Licensed intermediaries in Hong Kong were exempt from applying various regulatory requirements under the Hong Kong Securities and Futures Commission’s Code of Conduct1 (Code of Conduct) when dealing with professional investors (PIs). However, with effect from 25 March 2016, the following changes to the PI regime in Hong Kong are now in place:

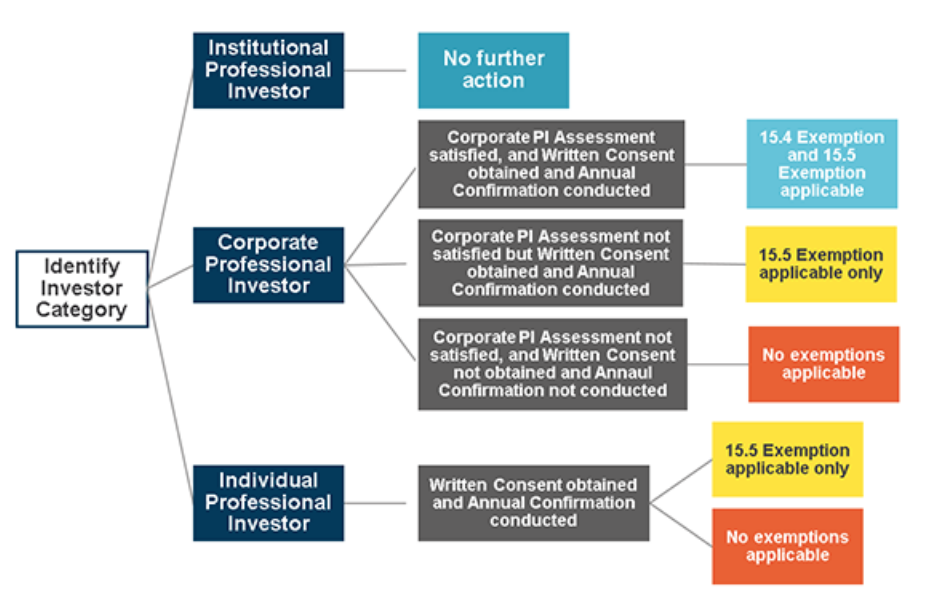

- There are now three distinct categories of PIs – Institutional PIs, Corporate PIs and Individual PIs – instead of the previous, informal two-category PI classification;

- Most (but not all) of the exemptions previously available to licensed intermediaries when dealing with Individual PIs and certain Corporate PIs have been removed; and

- An assessment of Corporate PIs has been introduced to determine whether they can be treated in the same way as Institutional PIs in terms of the exemptions that the licensed intermediary can apply to them.

Background

The term “professional investors” includes: financial institutions, government departments, intermediaries, collective investment schemes and similar investors as defined under the Securities and Futures Ordinance (SFO)2 (which came to be referred to as “Category A” PIs); and, essentially, high net worth individuals and corporate investors as defined under the Securities and Futures (Professional Investor) Rules (PI Rules)3 (which came to be referred to as “Category B” PIs).

Previously, a licensed intermediary was not required to apply various rules to any type of PI client (Client), including not being required to:

(i) Establish the Client’s financial situation, investment experience and investment objectives;

(ii) Ensure the suitability of a recommendation or solicitation made to the Client;

(iii) Assess the Client’s knowledge of derivatives or characterize the Client based on its knowledge of derivatives;

(iv) Enter into a client agreement (Client Agreement) and provide the relevant risk disclosure statements;

(v) Disclose transaction-related information; and

(vi) Obtain the Client’s Written Consent and conduct an Annual Confirmation (each as described below) with respect to discretionary accounts.

Exemptions (i) to (vi) above are collectively referred to as the 15.4 Exemptions;

(vii) Inform the Client about the licensed intermediary and the identity and status of its employees and others acting on its behalf;

(viii) Confirm promptly with the Client the essential features of a transaction after effecting a transaction for the Client; and

(ix) Provide the Client with documentation on the Nasdaq-Amex Pilot Program.

Exemptions (vii) to (ix) above are collectively referred to as the 15.5 Exemptions.

After a public consultation that began in 20144, with effect from 25 March 2016, the three key results of the change in the PI regime are as follows:

- Three formal PI categories have replaced the informal Category A and Category B PI classifications;

- Licensed intermediaries are no longer entitled to rely on most of the exemptions previously available to them when dealing with Individual PIs; and

- Licensed intermediaries must now assess Corporate PIs to determine how they may be treated.

New Categories of Professional Investors

The revised Code of Conduct refers to three categories of PIs:

- Institutional PIs (defined in Part 1 of Schedule 1 of the SFO) – previously, the Category A PIs;

- Corporate PIs (defined in Section 3 of the PI Rules); and

- Individual PIs (defined in Section 3 of the PI Rules) – previously, together with the Corporate PIs, the Category B PIs.

There has been no change in the definitions contained in the SFO and the PI Rules. Consequently, the private placement rules in Hong Kong have not changed.5

Both the 15.4 Exemptions and 15.5 Exemptions may be claimed by a licensed intermediary in respect of Institutional PIs, and this category of PI remains unaffected by the changes.

Limited Exemptions Available to Licensed Intermediaries in respect of Corporate PIs and Individual PIs

Individual PIs will now largely be treated like retail investors under the Code of Conduct, although licensed intermediaries are still entitled to apply the 15.5 Exemptions to Individual PIs as well as non-exempt Corporate PIs, provided that: (i) a Written Consent has been obtained; and (ii) an Annual Confirmation is conducted.

Written Consents must include:

- A written and signed declaration by the Client that it has given its consent to be treated as a PI;

- An acknowledgment that a full explanation has been given to the Client regarding the consequences of being treated as a PI and that the Client has the right to withdraw from being treated as such; and

- Disclosure that the Client is treated as a PI in a specific product and/or market and that it has the right to withdraw from being treated as a PI in respect of any and all products and markets.

The Annual Confirmation must be in writing and remind the Client of:

- The risks and consequences of being treated as a PI; and

- The Client’s right to withdraw from being treated as a PI in respect of any and all products and markets.

Corporate PI Assessment

A new, three-pronged, principles-based assessment requirement has been introduced for Corporate PIs. If a Corporate PI satisfies the following criteria, licensed intermediaries would not need to extend certain protections under the Code of Conduct to the Corporate PI (Corporate PI Assessment):

(i) The Corporate PI has an “appropriate” corporate structure and investment process and controls a specialized in-house treasury or investment decision making function (e.g., a designated investment committee or external investment advisory team that is independent and subject to any locally required regulatory oversight). This team must consist of competent and suitably qualified professionals responsible for the investment strategies and investment process of the Corporate PI. Either this team makes investment decisions on behalf of the Corporate PI or the Corporate PI makes informed investment decisions taking into account the advice or recommendation of the team);

(ii) The decision-maker has a “sufficient” investment background; and

(iii) The Corporate PI is aware of the risks involved in making the investment.

To assess whether the decision maker of a Corporate PI has a sufficient investment background, and whether a person is competent and suitably qualified to make determinations regarding a Client’s investment strategies and investment process, the SFC has indicated that the licensed intermediary should take the following into account as part of its assessment of the Corporate PI’s decision maker:

(i) His/her investment experience and history (including personal investments and investments for the account of others);

(ii) His/her work experience in the financial sector (including investment management, investment research, recommending or selling investment products); and

(iii) His/her academic or professional qualifications.

All three of these criteria should be directly relevant and relate to the products and markets in which the Corporate PI will invest. Further, the assessment should also take into account the individual’s level of responsibility, as well as the period of time during which, and when, such experience was acquired.

Licensed intermediaries should retain written records of the Corporate PI Assessments conducted (including the basis of the assessment and conclusions), as well as supporting documents (e.g., director resumes, charts explaining the corporate structure of the Corporate PI).

According to SFC guidelines, a written representation from a Client confirming that it meets the Corporate PI Assessment criteria will not, by itself (in the absence of conducting an assessment or obtaining supporting documents) be acceptable. Further, it will be difficult to show that a Corporate PI has the necessary substantive investment processes and controls in place if it is effectively controlled by one or a small number of individuals (e.g., a married couple or a family), even if such individuals are themselves financially experienced. Such a Corporate PI will, therefore, be unlikely to satisfy the three-pronged Corporate PI criteria.

A licensed intermediary will be exempt from having to extend all of the available protections under the Code of Conduct to a Corporate PI (and thus may rely on both the 15.4 Exemptions and 15.5 Exemptions) provided that (i) the Corporate PI Assessment criteria are met; (ii) the Corporate PI’s Written Consent is obtained; and (iii) an Annual Confirmation is conducted.

A flow chart setting out the actions to be taken by, and exemptions available to, a licensed intermediary with respect to each of the PI categories is set out below:

Client Agreement and Suitability Requirement

Licensed intermediaries are now required to enter into a written Client Agreement and ensure the suitability of a recommendation or solicitation (otherwise known as the Suitability Requirement) with respect to Clients who are (i) Individual PIs; and (ii) Corporate PIs that have not satisfied the Corporate PI Assessment.

It currently appears that the following clause (New Clause) must be included in all Client Agreements no later than 9 June 2017:

If we [the intermediary] solicit the sale of or recommend any financial product to you [the client], the financial product must be reasonably suitable for you having regard to your financial situation, investment experience and investment objectives. No other provision of this agreement or any other document we may ask you to sign and no statement we may ask you to make derogates from this clause.

The SFC expects all licensed intermediaries to include the New Clause in their Client Agreements (ostensibly, including those who do not solicit the sale of or recommend any financial product, such as execution-only brokers), although the SFC has acknowledged that paragraph 6.4 of the Code of Conduct continues to apply6). Nevertheless, if an agreement with a Client is entered into other than to comply with the requirements of the Code of Conduct (e.g., an ISDA Master Agreement), there will be no obligation to include the New Clause in such agreement.

The Suitability Requirement is regarded by the SFC as “the cornerstone of investor protection”. Although the Suitability Requirement was previously only a regulatory obligation, it will become a contractual obligation once licensed intermediaries incorporate the New Clause into their Client Agreements. The SFC has indicated that it is conducting an internal study on the Suitability Requirement, and we look forward to further clarification in this area in due course.

Immediate Next Steps for Licensed Intermediaries

It is appropriate for licensed intermediaries to now:

- Review and update all internal procedures (including internal template documentation such as Client questionnaires, KYC documents and Client Agreements) to incorporate the new regulatory requirements. The SFC expects licensed intermediaries to immediately commence the process of incorporating the New Clause into their Client Agreements, including re-executing Client Agreements with the New Clause with respect to existing Clients, as required.

- Review and amend internal compliance manuals to ensure compliance with the revised Code of Conduct.

- Provide comprehensive training to ensure employee awareness of, and compliance with, the new regulatory requirements.

- Incorporate the new regulatory requirements into Client onboarding procedures in respect of new Clients.

- Re-categorize existing Clients and take necessary steps in order to be compliant with the revised PI regime.

Footnotes

1) Code of Conduct for Persons Licensed By, or Registered with, the Securities and Futures Commission.

2) Cap 571, Laws of Hong Kong.

3) Cap 571D, Law of Hong Kong.

4) The SFC issued the Consultation Conclusions on the Proposed Amendments to the Professional Investor Regime and Further Consultation on the Client Agreement Requirements on 25 September 2014 (2014 Consultation Conclusions), which amended the Code of Conduct. On 8 December 2015, the SFC further issued the Consultation Conclusions on the Client Agreement Requirements, which confirmed that a new clause (as described in this article) must be included in all Client Agreements with respect to all intermediaries, going forward.

5) Changes to the PI regime could, however, have an impact on the usage of certain private placement exemptions. For example, a hedge fund manager may continue offering hedge fund shares to PIs in Hong Kong, but it may be more reluctant to conduct a traditional 49-person private offering to Individual PIs if it is required to apply Code of Conduct requirements to the offering.