The ABCs of Fund Finance: Credit Facilities for Secondaries Funds and Funds of Funds

Private equity funds raised the second-highest level of capital for investments in secondary private equity interests in 2016. According to Preqin, 19 funds secured $23 billion in investor capital. This level was surpassed only in 2014, when 27 secondaries funds raised $26 billion. Sponsors, having raised record amounts of equity capital, are increasingly entering into credit facilities secured by secondary limited partnership (LP) interests. In addition to amplifying returns on the secondaries portfolio, these facilities can provide sponsors with a limited degree of liquidity and the ability to monetize a portion of the portfolio. While hedge funds of funds have not experienced similar equity raises in recent years, hedge fund managers continue to use leverage secured by underlying hedge fund LP interests to boost returns, and to assist with investor subscription and redemption cash management issues.

This OnPoint provides a brief overview of key structural considerations lenders and borrowers encounter when negotiating credit facilities secured by LP interests.

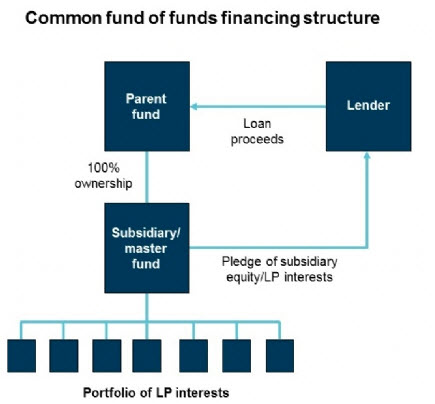

Overview of Structure

In a PE or hedge fund of funds structure, a domestic or offshore fund invests in a portfolio of LP interests. Fund structures may also include tax-blocker entities and Irish- or Luxembourg-based entities to address investor-specific demands. A lender will extend credit to the parent fund entity, which will hold the LP interests directly or through a subsidiary. The parent fund will then pledge as collateral all or part of its portfolio of LP interests.

PE and Hedge Fund Collateral Issues

General partners (GPs) of underlying funds typically place restrictions on the ability of limited partners to transfer, assign or pledge their equity interests in the fund. The following is a standard example of terms in LP agreements pertaining to restriction of pledges:

A Limited Partner may not sell, assign, pledge or otherwise transfer in any manner whatsoever all or any part of its Interest in the Partnership without the prior consent of the General Partner.

Borrowers generally will address this limitation in one of three ways: by consent; through use of a special purpose vehicle (SPV) subsidiary; or through use of a securities account.

Consent

The borrower may simply request the consent of the GP of each of the funds being pledged to the lender. However, some funds of funds may have a large number of underlying funds and the time and expense of negotiating consents with the GPs may be prohibitive. In addition, the issue historically has been sensitive for hedge fund managers, who were often reluctant to allow a bank to foreclose on an LP interest and potentially obtain confidential information about the manager’s trading strategy.

More recently, however, as hedge funds have underperformed and faced increased redemptions, managers have been more willing to consider consent requests from their fund of funds investors. On the PE side, GPs have been increasingly involved with consent discussions given the expanded secondaries market. GP experience and increasing comfort with secondaries funds has helped facilitate the review and negotiation of consents to pledge interests for credit facilities. Some sponsors themselves have turned to credit facilities for their secondaries funds, and understand firsthand the need to obtain consents when pledging LP interests as collateral. Legal counsel to the bank or borrower will typically have form language to include in a LP interest consent or assignment agreement.

Special Purpose Vehicle Subsidiary Structure

In certain cases, the borrower may establish an SPV to hold the LP interests with the intent of eliminating the need for GP consent. Interests held by the secondaries fund may be transferred to the SPV when the related LP agreement allows transfers without GP consent to affiliates of the holder of the LP interest. Provided a sufficient amount of LP interests are held directly by the SPV or can be transferred into the SPV, the secondaries fund will then pledge to the bank the equity the secondaries fund holds in the SPV.

Upon a default, the bank may foreclose on the equity of the SPV and then control the management or disposition of the LP interests without any change in record ownership. The transfer of an LP interest from the SPV to a third party would still likely require GP consent.

Securities Account Structure

For many years in the hedge fund market, another common structure to address transfer restrictions has involved the borrower holding the LP interests in a securities account at a custodian that functions as a securities intermediary. Under Article 8 of the Uniform Commercial Code, the lender obtains a perfected security interest in the securities account and the securities entitlements (that is, the LP interests in the account) by way of an account control agreement. Upon a default by the borrower, the bank delivers a notice of exclusive control and can direct the securities intermediary to dispose of the LP interests. For hedge fund of funds financings, the bank typically will direct the securities intermediary to redeem the underlying hedge fund investments. While this structure is not commonly seen in the PE industry, more often borrowers are now requiring certain smaller PE sponsors, family offices and other similar investors to establish this type of securities account structure.

Borrowing Base and Advance Rates

Eligible Investments

Lenders and borrowers will also negotiate the nature and types of LP interests and other collateral assets that may qualify as “eligible investments.” If certain events have occurred in respect of an LP interest, this interest may no longer qualify as an eligible investment. A lender, for example, will usually exclude an LP interest for which the borrower is in default on a related capital call. Other common reasons for disqualifying LP interests include the existence of conflicting liens, investor lock-ups (e.g., redemption gates and side pocket gates) and material write-downs or write-offs of portfolio investments.

Advance Rates

A lender will assign a certain amount of collateral value for each category of eligible investment. For example, a lender may assign LP interests in a particular PE strategy (such as buy-out funds) a value of 60% of their net asset value. The lender will then only extend credit or “advance” funds in an amount equal to 60% of the value of the buy-out fund collateral. The 40% reduction in collateral value of these LP interests is known as a “haircut.”

The amount of financing a borrower can obtain against different types of collateral depends largely on the liquidity of the collateral and the ability of the lender to quickly foreclose on the asset and generate sufficient proceeds to repay defaulted loan balances. A lower advance rate reflects the illiquidity of the collateral asset, including potential issues with transferring LP interests and the extended time horizon for monetizing the interests if the lender is unable to transfer the position following foreclosure. To illustrate the point further, haircuts on other common types of eligible investments (e.g., U.S Treasury bills and other cash equivalents) may be only 1-3%.

Borrowing Base

The borrowing base is the aggregate amount of value in the collateral portfolio that a lender is willing to finance. The borrowing base is calculated by summing up the advance rates against each eligible investment. Following the example above, if the collateral pool consisted of $100 million in buy-out fund LP interests and $10 million in U.S. Treasury bills with a 2% haircut, the borrowing base would equal:

$100 million in LP interests * 60%, or $60 million

Plus

$10 million in U.S. Treasury bills * 98%, or $9.8 million

Borrowing base is $69.8 million, compared to net asset collateral value of $110 million.

The borrowing base will typically be subject to reductions if the collateral portfolio exceeds certain concentration limits on an aggregate basis. Lenders place these restrictions on the collateral to avoid or mitigate concentration risk in a particular type of asset or strategy. Because fund of funds financings are typically multi-year facilities due to the illiquid nature of the collateral, lenders may become concerned that the fund of funds sponsor could concentrate its portfolio during the term of the credit facility in a specific industry sector or underlying sponsor. Concentration limits allow for some degree of investment management flexibility, while preserving the overall diversified quality of the collateral pool for the lender. Common restrictions include: limitations on the amount of portfolio concentration in particular strategies; geographic limitations on the sponsors (e.g., limitations on sponsors outside the United States or Europe); and hedge fund LP interests with less frequent liquidity than quarterly.

For example, a lender may include a concentration limit that requires LP interests of funds focused on certain strategies (e.g., special situations funds) not to exceed 25% of the aggregate amounts drawn on the facility. If $100 million is outstanding on the credit line and such LP collateral (after any applicable haircuts) equals $30 million (30% of the outstanding amount), the borrowing base would be reduced by the excess above $25 million, or $5 million.

Financial Covenants and Related Events of Default

Lenders will ordinarily include financial covenants that restrict the overall amount of debt the borrower may incur at any one time. A “loan-to-value” (LTV) ratio compares the aggregate outstanding amount borrowed against the value of the eligible investment collateral. The reciprocal of the LTV ratio is sometimes used instead, which is a total assets-to-debt ratio and often referred to as an “asset coverage ratio.” Hedge fund of funds borrowers, in particular, need to be mindful of the mark-to-market nature of credit facilities backed by LP interests. Depreciation in the value of the underlying portfolio of LP interests may result in a breach of the facility’s LTV ratio, even if no additional amounts are borrowed.

Many facilities for hedge funds of funds also include covenants relating to a decline in the borrower’s NAV, or the NAV of the collateral, on a monthly, quarterly and/or yearly basis. Borrowers will often try to negotiate for NAV calculations to be determined net of subscriptions and redemptions, to ensure that the NAV calculation tracks performance only. Some borrowers will also negotiate for a look-back to the year-to-date NAV calculation. If, for example, the credit facility would be in default if the borrower’s NAV were to decline by 30% in a quarter, the default might be avoided if the borrower’s NAV had increased by 10% or more prior to the quarterly NAV decline. Finally, borrowers will strive to include “point-to-point” NAV measurements. Many credit facilities will measure the NAV at a month-end against any day in the prior month. Point-to-point calculations only allow for NAV determinations to be made each month-end against the prior month-end, with similar provisions for quarterly and yearly calculations.

Conclusion

As investors allocate increasing amounts of capital to PE secondaries funds, the demand for credit facilities secured by LP interests will continue to grow. Financing of LP interests, however, can generate complex issues of which sponsors and managers need to be aware. Provided the facilities are properly structured and negotiated, PE and hedge fund of funds borrowers will be able to use these facilities to help meet investment return objectives and address important portfolio management needs.

Footnotes

1) Mega Funds Spur Private Equity Secondaries Fundraising, Preqin (Feb. 9, 2017).