Financing the Economy: The Future of Private Credit

The retrenchment of the banking sector, the increasing importance of private markets for investors, and the enduring appeal of direct lender relationships for borrowers are some of the key drivers underpinning the continued expansion of private credit, according to Financing the Economy.

Dechert collaborated with the Alternative Credit Council (ACC), the private credit affiliate of the Alternative Investment Management Association (AIMA), to produce the fifth edition of the report.

Key Findings

Drivers of long-term structural growth are intact

The factors supporting the growth of private credit – increasing attraction of private markets to investors, retrenchment of the banking sector and the appeal of direct lender relationships to borrowers – will fuel further expansion of the asset class over the next decade. Capital allocations to the asset class will be driven by private credit managers’ ability to offer differentiated growth and income opportunities, especially in a low-yield environment, as well as the potential downside protection in times of market turbulence. This will see a greater diversity of markets and strategies evolve within the broader private credit label.

Cyclical concerns are top of the agenda

The credit and economic cycle is a primary consideration for nearly all private credit managers, influencing their approach to underwriting practices, and the way they price risk and structure deals. Capacity to deal with stressed loans is now a key point of differentiation for investors when assessing private credit managers, as they look to identify managers with resilient business models. When it comes to human capital, the industry is experiencing a growing demand for skilled individuals and continues to compete with the private equity world for skilled labour.

Harvesting the complexity premium is key

Flexibility towards their client’s needs remains a recognised strength of private credit, but one which comes at a price in the form of ever-increasing demands on operational infrastructure. The unique regulatory barriers faced by private credit managers in some markets continues to be the single biggest determinant of growth for private credit in those jurisdictions. Private credit managers are addressing this by investing heavily in staff with the necessary skills and experience, introducing greater efficiencies into the lending process with the help of new technology and engaging with policymakers to reduce regulatory barriers.

Institutional capital pulls parts of the market towards homogenisation

Private credit has always been an institutional asset class and the influence of institutional investors will continue to have a significant bearing on its development. Their expectations around risk management, portfolio monitoring and reporting are already driving investment by private credit managers in their operating infrastructure, and we expect this trend to continue.

ESG considerations shaping the market

A structural shift in the attitudes of investors towards ESG considerations in private credit has taken place. Inconsistency in how ESG elements are reflected in investment choices and the absence of standardised data formats is hindering the incorporation of ESG into broad market practices. However, the industry continues in its effort to establish a consensus on what constitutes relevant ESG metrics or approaches and support investors’ understanding and demands.

Transparency is key to sustainability

The need for the industry to support investor and policymaker understanding of private credit remains paramount. Establishing better sources of market data and appropriate performance and risk metrics is just one way the market will demonstrate the value of private credit to these stakeholders. It will be essential for private credit managers to support an evidence-led policy approach to the sector at a time whenconcerns around late cycle dynamics increasingly colour perceptions of the market.

Further Trends

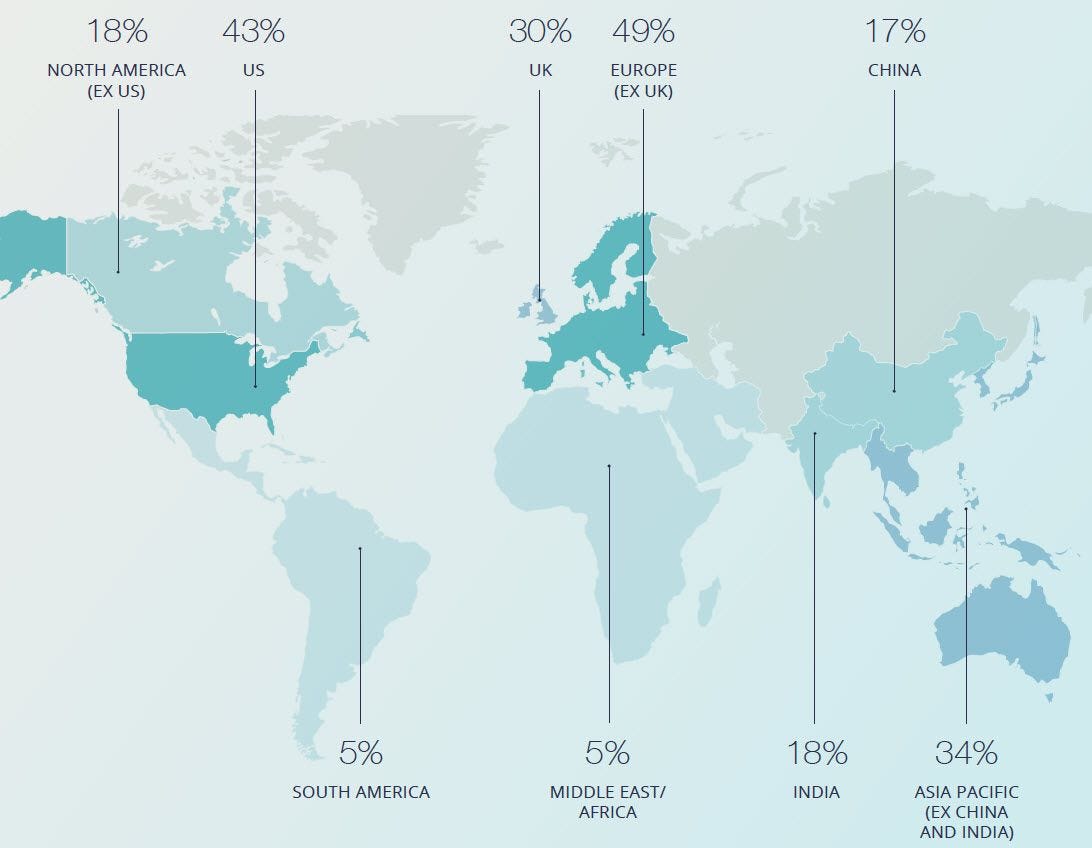

Private credit managers expect to increase their investment in almost every region in the next three years

Our data show the percentage of respondents who expect to invest more in these markets during that time period.

In Europe, private credit continues to build on the footholds it has established, with countries such as France and Germany now seen as tested propositions in a similar manner to the UK. There is also evidence that capital is being allocated to borrowers in less-developed European markets as private credit managers continue to expand their businesses throughout the wider region.In jurisdictions outside the US and Europe, investors are also becoming more comfortable with private credit strategies . The process of familiarisation can take some time, especially where markets are less efficient than those in the US or Europe, or are seen to lack the infrastructure needed to service large, institutional investors.

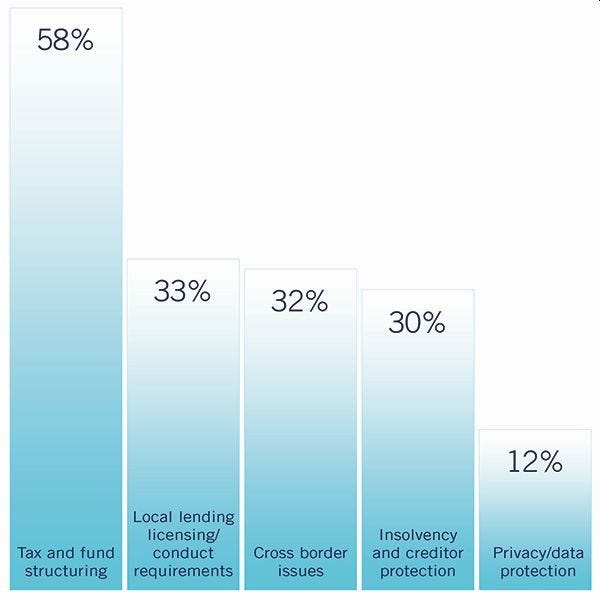

The biggest regulatory challenge facing private credit managers is tax and fund structuring

Fifty-eight percent of respondents cited that as the biggest challenge, followed by local lending licensing/conduct requirements, which 33 percent of respondents cited.

Balancing business, legal, tax and regulatory requirements, while developing products that support the alignment of interests between private credit managers and their investors, is a core competency for private credit managers.

The variety of strategies that currently sit within private credit means there are few areas within a typical fund checklist that can be addressed in a systematic way. Flexibility to clients' needs is a recognised strength, but one which comes at a price in the form of ever-increasing demands on operational infrastructure to deliver.

Private credit also faces unique regulatory barriers when seeking to lend in markets that place restrictions on the granting of credit by non-banks. This requires private credit managers to have a thorough understanding of the precise legal and regulatory requirements in each country of operation.

Inevitable challenges lie ahead for private credit. Risks continue to build up in many credit markets, and the resilience of business models will be tested over the next five years in different ways. The success of the asset class during this period will come from private credit managers continuing to be a valuable and trusted partner to their borrowers and investors in good and bad times. This research showcases how private credit managers are preparing to meet this challenge and ensure their stakeholders continue to prosper, whatever the economic weather.