DAMITT Q2 2023: When Avoiding Settlements, Does Merger Enforcement Settle for Less?

Key Facts

United States

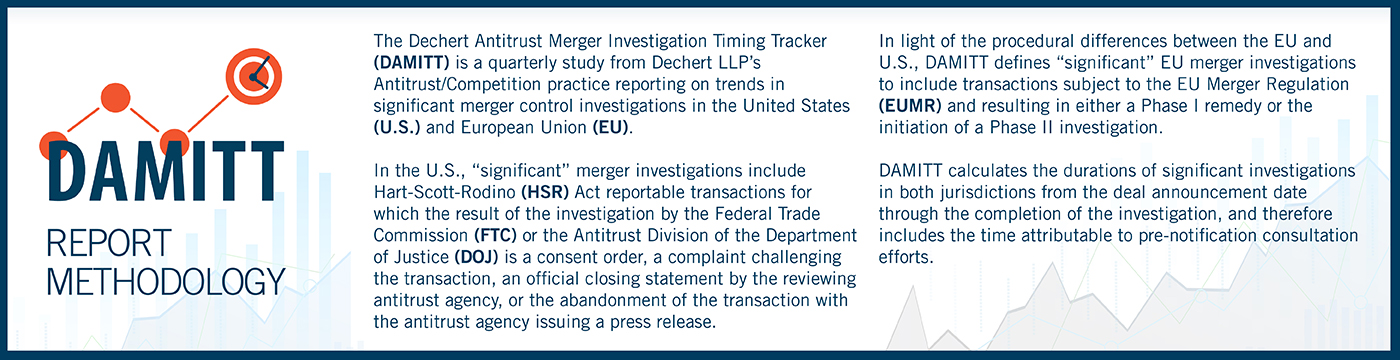

- All significant U.S. merger investigations concluded in either a complaint or an abandoned transaction. Three of four quarters over the last year have now concluded without any consent agreements, demonstrating the agencies’ continued hostility to remedies and settlements short of litigation. With more than 90 percent of significant investigations ending in a complaint or an abandonment, these are uncharted waters from a settlement perspective.

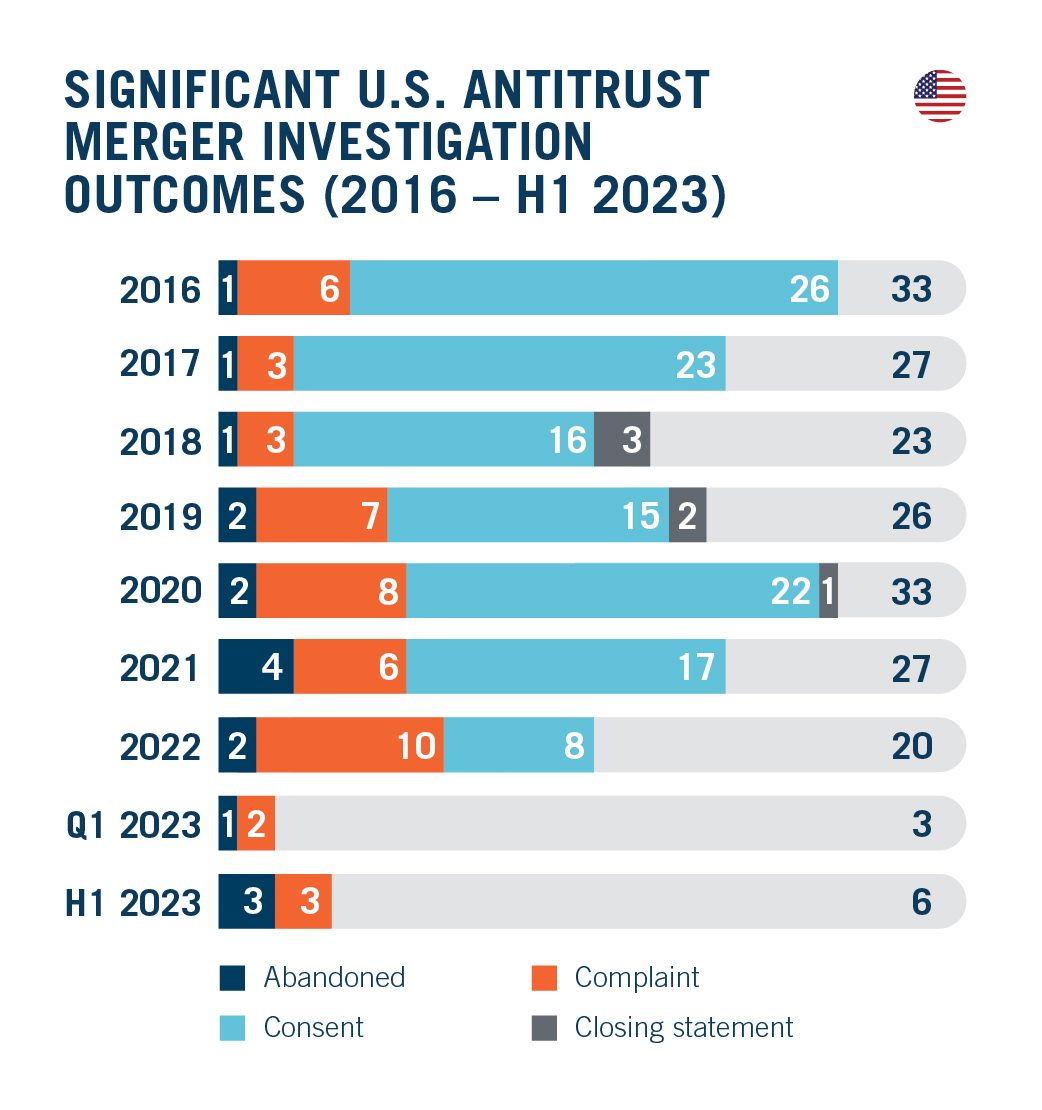

- The number of concluded investigations has fallen precipitously along with the disappearance of consent decrees. The three significant investigations concluded in Q2 2023 are 67 percent fewer than Q2 2022 and follow three quarters of unusually light enforcement activity. The total of 11 significant investigations concluded over the last 12 months is more than 60 percent lower than the annual average between 2011 and 2022.

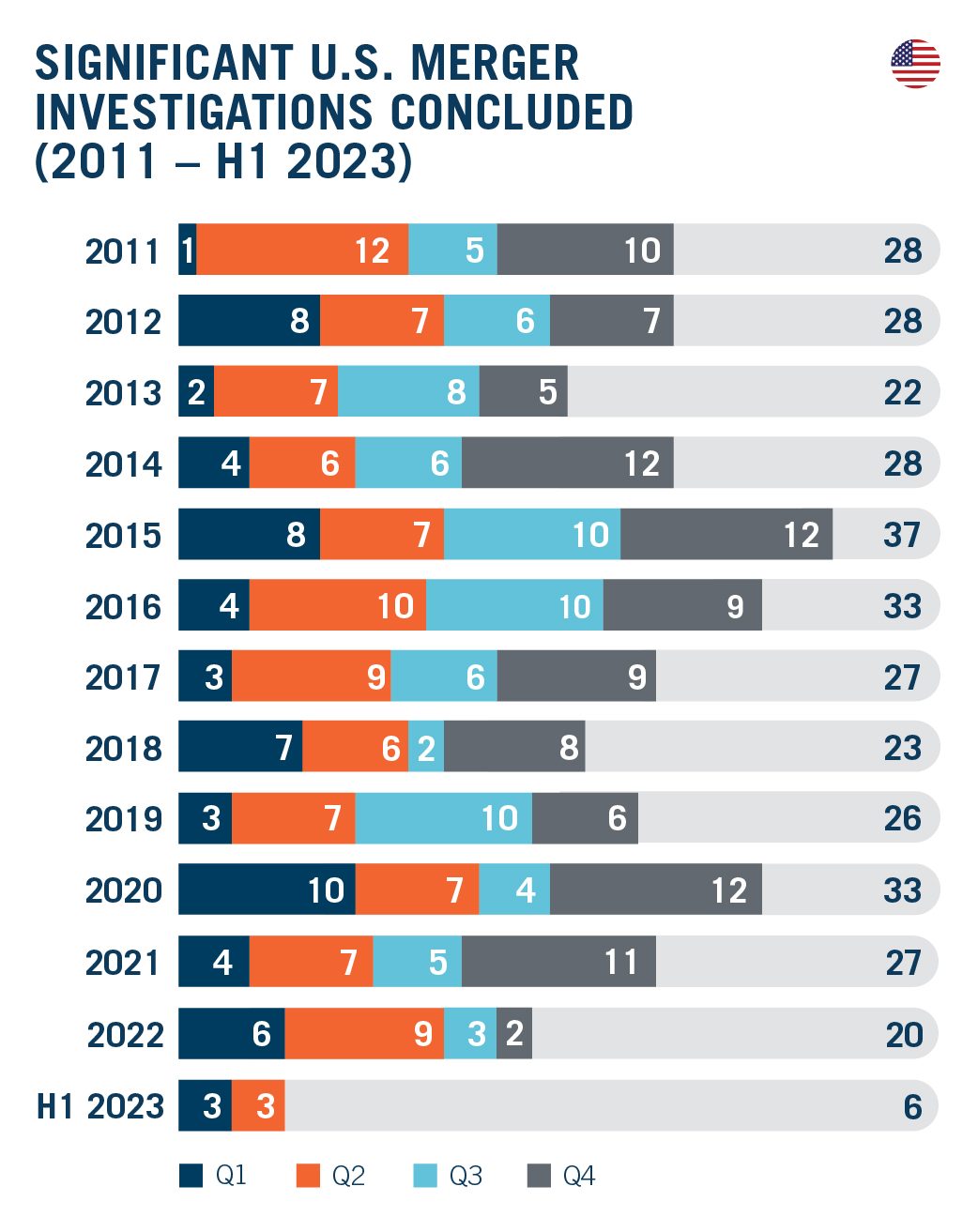

- The average duration of significant investigations for Q1 2023 dropped to 8.3 months for the last quarter. For the last 12 months, the average declined to 10.4 months. Some caution is warranted when interpreting these figures, which largely reflect abandoned or challenged deals. These durations may not reflect the time necessary to get a transaction successfully through an investigation without an enforcement action.

- The only consent approved by the agencies short of litigation over the last 12 months followed a 20-month investigation — far above the average. Keep in mind: these durations were measured before the proposed changes to the U.S. merger review process that are expected to further delay transactions.

European Union

- In stark contrast with the U.S., all significant EU investigations concluded so far this year were cleared by the EC, mostly subject to remedies — although the merging parties are more likely than ever to need to go to Phase II to get that result.

- Deals cleared in Phase II with remedies also show an increased reliance on behavioral remedies, adding a second layer to this new Atlantic schism. Similar behavioral remedies fell out of favor several years ago in the U.S.

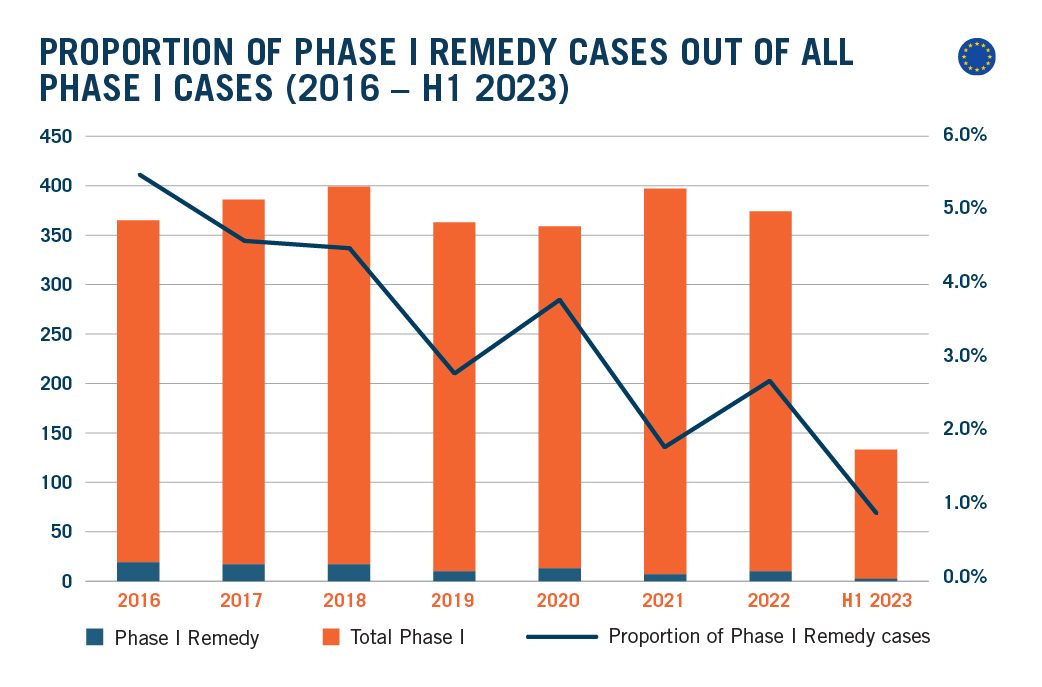

- The EC concluded four Phase II investigations in Q2 2023, but did not conclude any Phase I remedy cases — which now represent only 0.7 percent of all Phase I cases thus far in 2023. Phase I remedy cases increasingly appear headed towards extinction.

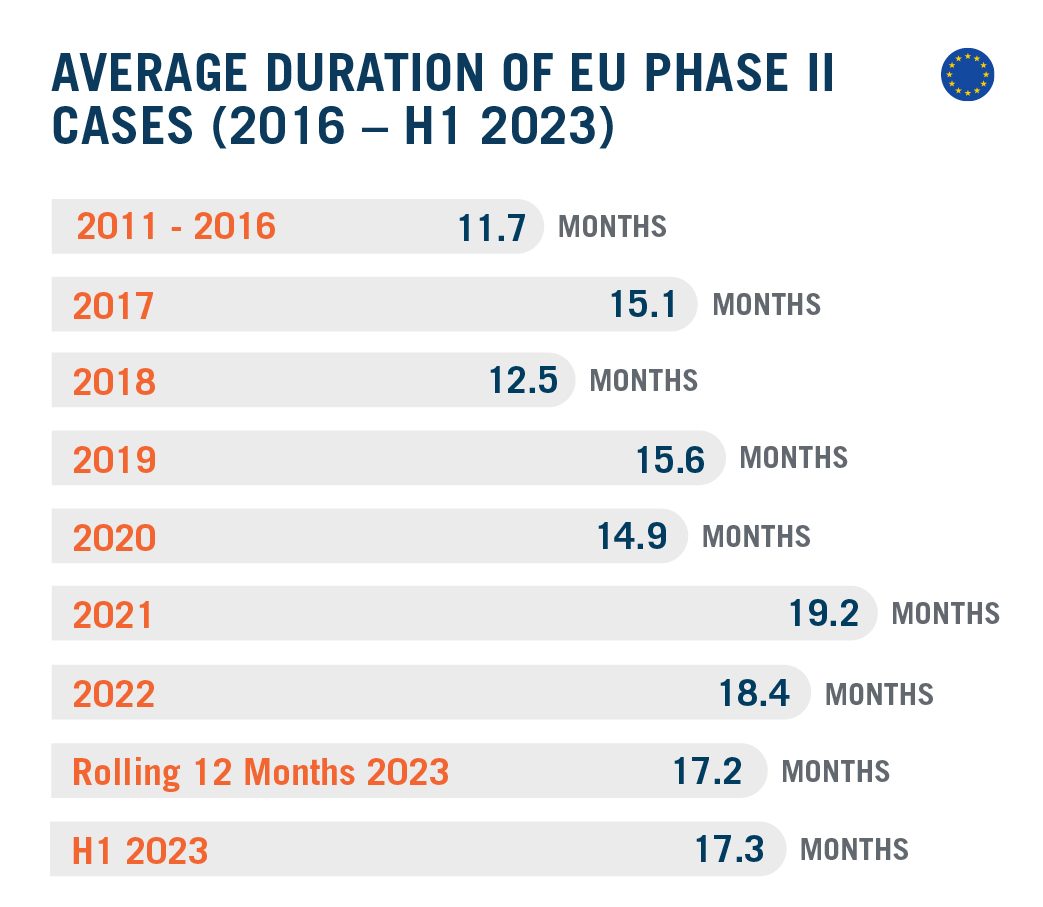

- The average duration of Phase II investigations continues a slow decline after record highs reached in previous years, averaging at 17.2 months for the last 12 months. Still, parties should remain cautious as the duration of these investigations remains very significant.

The U.S. Agencies Avoid Settlements, but Also Achieve Less

U.S. Agencies Only Approve One Settlement Short of Litigation Over the Last 12 Months

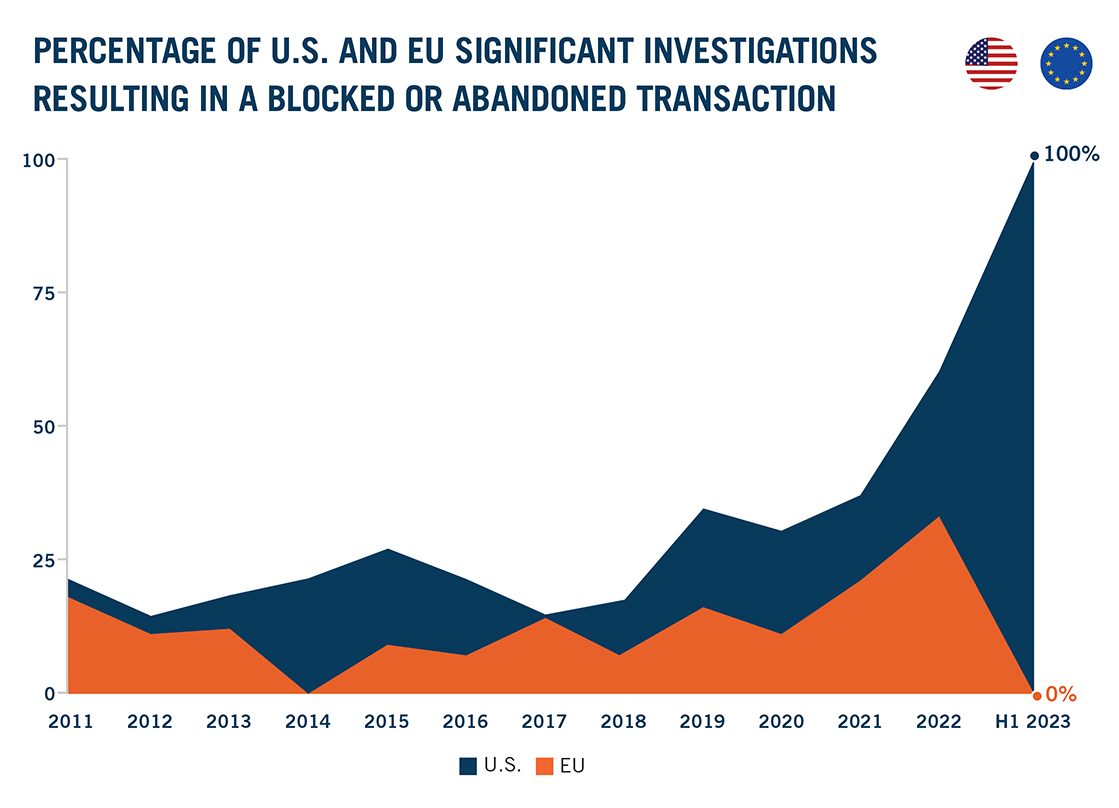

Since our DAMITT 2021 Report, we have warned that transactions subject to significant merger investigations were more likely to be abandoned or blocked. Indeed, a full 60 percent of investigations concluded in 2022 resulted in either a complaint or an abandoned transaction.

In the first half of 2023, the situation has turned from bad to worse. All significant investigations that concluded in H1 2023 resulted in either a complaint or an abandoned transaction. This matches a pattern observed in Q3 2022. Three of the last four quarters have had no consent decrees from either agency. In other words, over the last 12 months more than 90 percent of significant investigations resulted in either a complaint or an abandoned transaction. This puts the then-high of 37 percent recorded in 2021 to shame. And with two quarters down, neither agency has entered a single consent in 2023 short of litigation (and even then, just one matter). These are uncharted waters from a settlement perspective.

These developments began at the DOJ, which has not entered into a single settlement to resolve a significant investigation short of litigation since DOJ Assistant Attorney General Jonathan Kanter began warning, shortly after taking office in November 2021, that investigations resolved with merger remedies should be the “exception, not the rule.” But it has since spread to the FTC.

As the outgoing FTC Director of the Bureau of Competition warned in February 2023, “parties should expect the agency to be skeptical and risk averse when considering offers to settle in our merger investigations.”

The proportion of significant investigations resulting in a complaint or abandonment, however, does not tell the full story.

Number of Investigations Hits Historic Lows

The U.S. agencies only concluded 11 significant investigations over the last 12 months, with the number of concluded investigations never rising above three per quarter. To put these numbers in context, the Trump administration concluded more significant merger investigations in Q4 2020 — its last quarter —than the Biden administration has concluded in the last four quarters combined.

In our DAMITT Q1 2023 Report, we asked what three quarters of such low activity said about the health of merger enforcement. The picture continues to look bleak adding the most recent quarter.

These numbers demonstrate the extent to which the agencies’ avoidance of settlements has reduced overall enforcement activity. Historically, most enforcement actions by the U.S. agencies resulted in consent decrees. The decline in these settlements, however, has not been matched by a corresponding bump in complaints or abandoned transactions. As a result, the total number of investigations concluded in the rolling-twelve-month (RTM) period ending Q2 2023 was dramatically lower than the same period the prior year, as shown below.

Indeed, not only is the number of settlements down over 12 months, but the number of complaints also has fallen by 40 percent.

As a result, it is hard to see what the U.S. agencies have gained through their new approach to settlements, especially as the agencies have struggled to defend the complaints that have been filed in court. As of the end of Q2 2023, the agencies have only successfully blocked one transaction through a complaint filed under the Biden administration.

DOJ did end up settling its Assa Abloy/Spectrum Holdings challenge in Q2 2023 midway through trial after a complaint was originally filed in Q3 2022. In that case, the settlement followed direct criticism from the court of DOJ’s settlement approach: “I think that you all saw a problem a mile away, in your view, and instead of giving the defense an opportunity to fully explain to you the divestiture, to fully set out the divestiture, to find a buyer, to get this done, you all cut off the talks and initiated a lawsuit.” DOJ’s subsequent decision to negotiate a settlement in that case may raise questions about whether it will reconsider its anti-settlement approach looking forward. DOJ did not conclude any investigations in Q2 2023, so it is not possible to evaluate the impact of that settlement at this time.

While the number of complaints is down over the last 12 months, the agencies have reported an increasing number of abandoned transactions. In Q2 2023, two of three significant investigations ended in an abandoned transaction. While some of these abandonments may relate to anticipated complaints, another culprit may also be responsible: deal timing. When CalPortland/Martin Marietta Materials was abandoned in April 2023, for example, Martin Marietta explained that the deal was terminated “in light of the parties being unable to timely obtain the necessary approval by the U.S. Federal Trade Commission.” The investigation for that transaction lasted just over eight months from deal announcement, highlighting the importance of planning for enough time to successfully get a deal through.

The Average Duration Declines, but Beware of Averages Given Changing Outcomes and Process

The publicly observable duration of concluded significant merger investigations dropped to 8.3 months in Q2 2023, nearly returning to lows last seen in 2016. The average duration for the rolling-twelve-months ending Q2 2023 similarly fell to 10.4 months.

Parties should keep in mind, however, that the DAMITT average for the last 12 months only includes one consent. As a result, it is largely measuring the time from deal announcement for transactions that received a complaint or were abandoned.

CalPortland/Martin Marietta Materials should serve as a prime example. Planning for just over eight months in line with the Q2 2023 average is unlikely to be enough to successfully defend a transaction subject to a significant U.S. merger investigation. The only consent approved by the agencies over the last year took a full 20 months from deal announcement to approval. The shorter duration averages recorded by DAMITT may appear welcome at first, but it is important to consider the changing mix of outcomes when evaluating this average. Successfully getting a deal through is likely to require more time — and that is before taking into account any of the onerous proposed updates to the U.S. merger review process that may go into effect later this year or early next year.

In addition, it is important to keep in mind that the durations tracked by DAMITT only measure the time from the deal announcement to a settlement, abandoned transaction, closing statement, or complaint. Parties also may need to plan for time to litigate a potential complaint, which can add an extra 9–12 months.

The EC Remains Open to Remedies in Phase II, but Takes Its Time Reviewing

EC Data Confirms Move Away From Accepting Remedies in Phase I

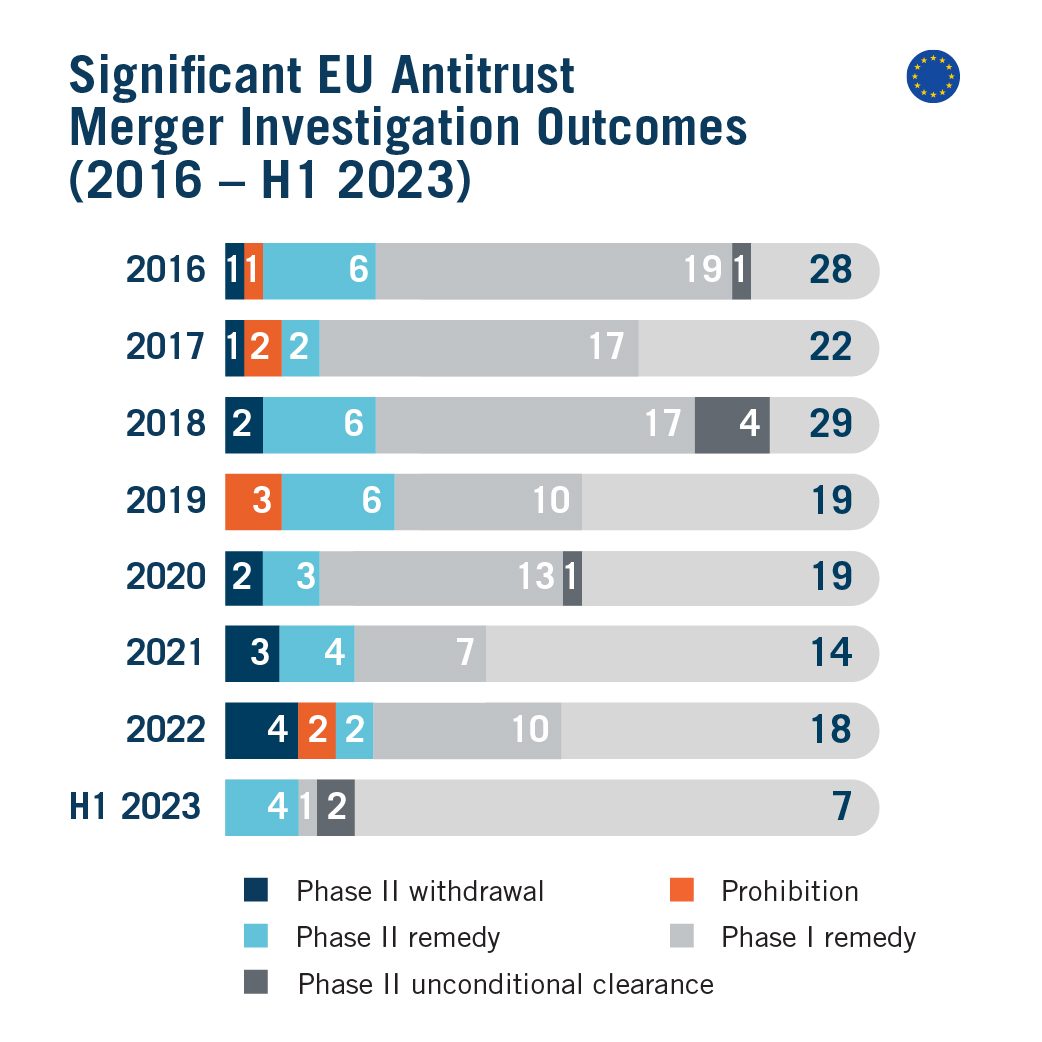

Overall, the total number of significant investigations concluded by the EC in Q2 2023 is in line with previous years. Four significant merger investigations concluded in Q2 2023, just slightly below the quarterly average of 4.9 investigations observed since 2011.

Breaking down the number of investigations between Phase I and Phase II cases, however, reveals significant evolutions. Of note, the four significant investigations concluded in Q2 2023 all underwent an in-depth investigation with no deal being cleared in Phase I with remedies. That continues a sea change we first noted in our DAMITT Q1 2023 Report.

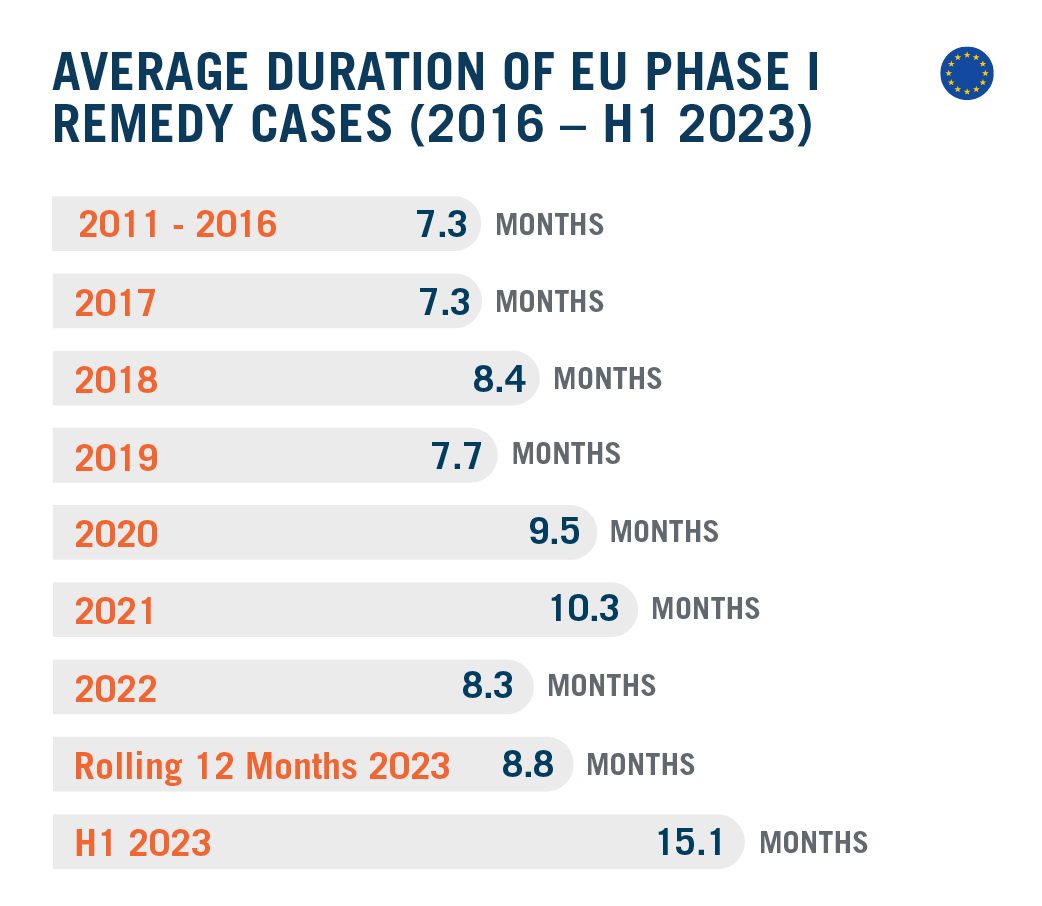

Indeed, Q2 2023 marks the first quarter the EC did not conclude a single Phase I investigation since 2013. This places the total number of Phase I remedy cases for the first half of 2023 far below the annual average of 11 observed since DAMITT started tracking. The proportion of deals cleared in Phase I with remedies dropped below one percent in the first half of 2023, a first since 2011.

This trend may be a function of the fixed EUMR timeline. While the EUMR provides the EC with significant flexibility to extend the duration of a Phase II investigation, the duration of a formal Phase I review is capped at 35 working days, which leaves little time to fully assess remedies. The EC may still be open to remedies, but parties should expect that the EC will want sufficient time to do its due diligence. Rome was not built in a day, and it increasingly looks like 35 working days is not sufficient to get approval for EC remedy proposals, either.

That is not to say that Phase I remedies are completely beyond reach, though, as one case has already been cleared in Phase I with remedies right at the beginning of Q3 2023. That case only seems to confirm, however, that 35 working days may not be enough to get a deal with remedies through in Phase I. Instead, the parties in that case added nearly one and a half months to the clock by pulling and refiling the deal with the EC. We also understand that the parties worked out a significant structural remedy package before refiling the deal.

The Average Duration of Phase II Investigations Declines, but Remains Stubbornly High

The average duration of significant EU investigations concluded in 2023 continues the trend observed in 2022. In particular, the average duration for the rolling-twelve-months ending in Q2 2023 fell to 17.2 months, more than two months faster than the 19.5-month duration observed in the previous 12-month period.

These “shorter” average durations should, however, be taken with caution, considering that all significant investigations concluded in 2023 resulted in a clearance. Between 2017 to 2022, significant investigations resulting in an unconditional clearance have been shorter on average—at 11.3 months—than investigations resulting in a prohibition, which averaged at 20.9 months over the same period. Similarly, deals cleared with remedies following a Phase II investigation underwent a 15.4-month investigation before the EC reached a decision. Comparing duration of investigations concluded so far in 2023 with averages for investigations with similar outcomes, investigations in 2023 have lasted significantly longer than previous averages: 15.6 months for 2023 unconditional clearances and 18.2 months for Phase II clearances with remedies.

Another departure from previous practice is a decreased use by the EC of its statutory powers under the EU Merger Regulation, which allow case teams to agree to “voluntary” extensions with the merging parties and issue “stop the clock” orders. The EC only stopped the clock in half of the significant EU investigations concluded in 2023, whereas it had relied on this possibility in 62 percent of cases between 2017 and 2022. Even more striking, the proportion of significant EU investigations subject to an extension dropped from 92 percent over the same period to only 67 percent in 2023. Significant EU investigations concluded thus far in 2023 are however marked by lengthy pre-notification periods, averaging 9.1 months, the second highest recorded by DAMITT, and 45 percent above the 2011-2022 average.

Because there were no Phase I remedy decisions in Q2 2023, there is not much new to say on the average duration of Phase I remedy investigations. The first Phase I remedy decision adopted in Q3 2023 this July, however, clocked in at a bit less than 10 months, confirming that the extreme 15.1-month duration observed in Q1 was likely an outlier.

The Big Transatlantic Divide on Remedies?

With the first half of 2023 down, some differences between the U.S. and the EC have become quite stark regarding the agencies’ approach to remedies. While the U.S. antitrust agencies dug in their heels on merger settlements in H1 2023 — accepting no settlements at all short of litigation — no merger subject to a significant Phase II investigation in the EU was either blocked or abandoned. For the EC, this is a significant change compared to the past year which saw 33 percent of significant EU investigations ending either with a prohibition of a withdrawal. The divergence between the agencies here could not be more apparent, as shown below.

Even more striking is the fact that 29 percent of Phase II investigations concluded with an unconditional clearance thus far in 2023, the highest since 2012. In terms of remedies, the EC also departs from the other authorities — and the UK’s CMA in particular, which has expressed strong skepticisms towards behavioral remedies — and accepted behavioral remedies in 29 percent of cases so far in in 2023. This is the highest-ever recorded since DAMITT started tracking. Meanwhile, the U.S. agencies accepted remedies (of any type) in 0 percent of cases in H1 2023, marking a new, and unsurpassable, record of its own.

When it comes to a shift in the EC, the data is supported by recent statements from EVP Vestager noting the following: “[S]ome people think that agencies should either block or clear mergers. Nothing in between. So if you block you are a ‘tough’ enforcer. If you clear, well, let's just say you are not perceived as tough.

That is not our policy.” Vestager acknowledges, of course, that this is not just a matter of preference. Instead, she explained: “The European Courts have held that we cannot, as a matter of principle, dismiss remedy proposals. We have to investigate the merits of every solution offered.” If comments from the bench in Assa Abloy/Spectrum are any guide, U.S. and EU courts at least appear to agree on this principle.

It is unclear how long this divergence may continue. At least in the short term, though, understanding the different approaches to settlement currently in favor in the U.S. and the EC may be critical to parties seeking to their deal done on both sides of the Atlantic.

Conclusion

Parties to transactions subject to significant merger investigations continue to face an elevated risk of seeing their deal blocked or abandoned on both sides of the Atlantic, even if the intervention rate shows relatively few deals may receive this level of scrutiny. To ensure the ability to defend their deals through a potential investigation, parties to the average “significant” deal in the U.S. should plan on at least 12 months for the agencies to investigate their transaction and may want to add on additional time to address the continuing uncertainty at the agencies. Parties should also plan for another 9–12 months if they want to preserve their right to litigate an adverse agency decision. On the EU side, parties to transactions likely to proceed to Phase II investigations should allow for at least 18 months from announcement to clearance and should not rely on the theoretical deadlines provided for in the EU Merger Regulation, even after a deal has been formally notified. Parties should be aware that the EU Commission is less and less likely to accept remedies without an in-depth investigation; in any case, if parties still plan on obtaining a Phase I clearance with commitments, they should plan on around nine months from announcement to a decision, with significant time set aside for pre-notification talks with the Commission.