Preparing for the Replacement of LIBOR

What We Can Do For You | Useful Links | More on LIBOR

The anticipated replacement of the London Interbank Offered Rate (LIBOR) as benchmark interest rates for loans, debt and derivatives will be a dauntingly complex and time-consuming undertaking.

Our US and European LIBOR teams have been deeply involved in this process. Members of our US team have commented repeatedly and participated in meetings of the Alternative Reference Rate Committee (ARRC) convened by the Federal Reserve Bank of New York and in the LIBOR replacement working groups of all the major trade organizations.

Members of our European team have been involved in consultations by the UK and European regulatory authorities, as well as with initiatives undertaken by industry bodies representing asset managers and other financial intermediaries.

Our Latest Analyses on LIBOR

A Conversation with Adam Schneider from Oliver Wyman — November 2021

Demystifying the Trust Instruction Proceeding with Wells Fargo’s Mike Johnson — July 2021

The Lowdown on LIBOR — July 2021

Dechert LIBOR Update Webinar: The Latest From the LIBOR Front With Special Guests — May 2021

Dechert LIBOR Update Webinar: The Latest From the LIBOR Front — March 2021

Dechert on LIBOR - Officially the Beginning of the End — March 2021

Dechert LIBOR Update Series: The Latest From the LIBOR Front — February 2021

Dechert on LIBOR - A New Year Special — January 2021

It’s Time to Initiate a SOFR Loan…Or Maybe Not (from Richard Jones' Crunched Credit blog) — November 2020

LIBOR Transition - The Moment the Market Has Been Waiting For — October 2020

Dechert LIBOR Update Series — October 2020

Dechert LIBOR Update Series: The Latest From the LIBOR Front — September 2020

LIBOR is out, but SOFR isn't quite in (a podcast episode that includes insight from Dechert's Richard Jones) — August 2020

LIBOR: Time to put your foot down — July 2020

— Advise on the implementation of LIBOR’s replacements in the various currencies and markets affected by the transition from LIBOR

— Advise on and assist you with the challenges created by LIBOR transition for your legacy LIBOR assets and liabilities, including how to address credit spread adjustments

— Assist you on your new transactions to ensure that the documentation adopts the latest market-accepted proposals for LIBOR transition mechanics

— Assist and advise you on the implications for your business of adhering, or not adhering, to the ISDA Protocol which was launched on October 23, 2020 and is effective from January 25, 2021, which implemented amendments to the ISDA 2006 Definitions required in order to address the consequences for various existing derivatives products of the transition from LIBOR, as well as general advice on the ISDA amendments for trades going forward

— Prepare you for the litigation and antitrust risks associated with the transition from LIBOR to a successor interest rate

-

LIBOR (sometimes referred to as ICE LIBOR) is a benchmark for short-term interest rates, currently calculated for five currencies (USD, GBP, CHF, EUR and JPY) and seven tenors for each of these currencies. It is intended to be a measure, for each currency and tenor, of the average rate at which leading internationally-active banks are willing to borrow wholesale, unsecured funds in the London interbank market.

The methodologies used to determine LIBOR for a particular currency and tenor are based on submissions made by panel banks to the LIBOR benchmark administrator, ICE Benchmark Administration Limited (IBA), each London business day. The methodologies and panel banks per currency and tenor used are disclosed on IBA’s webpage.

IBA is the “benchmark administrator” for all LIBORs for the purposes of the EU Benchmarks Regulation, and, as a UK-based benchmark administrator, is regulated in the UK by the Financial Conduct Authority (FCA).

LIBOR rates are categorized as a critical benchmark for the purposes of the EU Benchmarks Regulation, and as with all benchmarks used in the financial markets (and pursuant to post-financial crisis legislation such as the EU Benchmarks Regulation), LIBOR for any particular currency or tenor must be demonstrated to be determined using robust methodologies and sufficient and reliable market-based data. The robustness and reliability of LIBOR as a benchmark depends, therefore, on the submissions made by the panel banks, and on an active interbank unsecured lending market.

-

More than $350 trillion in derivatives and other financial products are tied to LIBOR, including a significant percentage of floating rate notes and floating rate loans denominated in a currency for which LIBOR is quoted. It is particularly prevalent in the USD and GBP syndicated and bilateral loan markets, including commercial real estate loans.

The LIBOR rate determined for a particular currency and tenor can influence the amount of interest you pay on a wide range of financial products, including mortgage loans, credit cards and (in the US) private student loans.

When the transition away from LIBOR to a replacement benchmark interest rate occurs for a particular currency and tenor, you will likely have a significant portfolio of financial assets and hedge products which will require transition.

-

LIBOR is predicated on an assumption that there is an interbank unsecured term lending market for the currencies and tenors for which a LIBOR is published.

Regulatory investigations in Europe and the US following the global financial crisis revealed that for some years preceding the financial crisis, as well as during the financial crisis, the volume of transactions in the interbank markets of the relevant currencies had decreased significantly, to the point that the panel banks that contribute to the production of LIBOR were relying on their expert judgment, rather than observable market rates, for some of their submissions, and in many cases were manipulating their submissions to the benchmark administrator and, thus, manipulating LIBOR for certain tenors and currencies.

These investigations led to millions of dollars in fines and undermined public confidence in LIBOR.

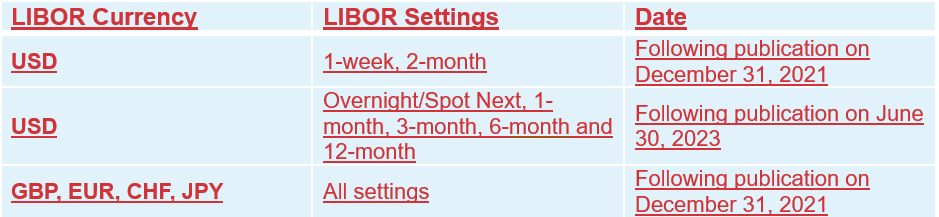

On March 5, 2021, IBA and the FCA each made announcements indicating that IBA would have to cease publication of all 35 LIBOR settings immediately after the following dates:

As a result, it is anticipated that the panel banks for the various LIBOR currencies will cease making their rate submissions to IBA from the above dates. The FCA and IBA have also signaled that they may declare that a LIBOR is unrepresentative if even a single panel bank for the relevant currency ceases its submissions for that currency.

A particular LIBOR is unlikely to continue to function as a benchmark interest rate if it ceases to be representative, and market participants in the EU may be prohibited from using it as a benchmark rate if it ceases to comply with the criteria for a critical benchmark under the Benchmarks Regulation.

-

It is widely expected that four of the six USD LIBOR tenors (one month, three month, sixth month and one year) as well as overnight USD LIBOR will continue to be produced through June 30, 2023. The proposed cessation date for all other LIBOR currencies (GBP, CHF, EUR and JPY), as well the one week and two-month tenors of USD LIBOR is December 31, 2021.

U.S. banking regulators have indicated that market participants should end use of LIBOR in new financial and other contracts as soon as is practicable and generally speaking by December 31, 2021. Other markets and regions have set shorter timeframes. In the UK, for example, market participants were expected to cease initiation of new GBP LIBOR-linked loans, bonds, securitizations and most non-linear derivatives that expire expiring after the end of 2021 by the end of Q1 2021.

-

The replacement benchmark rate will differ from currency to currency. The majority of LIBOR replacements will be derived from risk-free overnight rates. Here is a brief summary of these risk-free rates.

USD LIBOR TO BE REPLACED BY SOFR (Secured Overnight Financing Rate)

SOFR was launched as a new interest rate benchmark in April 2018 and is based on the cost of overnight loans, using repurchase agreements secured by US government securities (so looks at a larger section of transactions than is used to derive the Fed Funds rate). SOFR is published by the Federal Reserve Bank of New York. On July 29, 2021, the ARRC recommended the CME Group’s forward-looking SOFR term rates.

EUR LIBOR TO BE REPLACED BY €STER (Euro Short-Term Rate)

€STER is based on the wholesale euro unsecured borrowing costs of euro-area banks and is replacing EONIA (euro overnight index average). The ECB publishes €STER on every TARGET 2 business day by reference to the transaction data reported to it on the previous business day. Note that the current intention is that EURIBOR (which is determined by reference to different methodologies from EUR LIBOR – see below) will continue to be published for various tenors.

GBP LIBOR TO BE REPLACED BY SONIA (Sterling Overnight Index Average)

SONIA has been published since 1997 (albeit the methodology for determining it was revised in 2018) and is administered by the Bank of England. It is based on actual transactions and reflects the average of the interest rates that banks pay to borrow sterling overnight from other financial institutions.

CHF LIBOR TO BE REPLACED BY SARON (Swiss Average Rate Overnight)

SARON was developed in 2009 and represents the average overnight interest rate for secured money market borrowings in Swiss francs; it is based on transactions and quotes posted in the Swiss repo market. It is administered and published by an affiliate of SIX Group Ltd.

JPY LIBOR TO BE REPLACED BY TONA (Tokyo Overnight Average Rate)

TONA is based on unsecured money market rates and is published and administered by the Bank of Japan.

-

The London Interbank Offered Rate is only one example of floating interest rate benchmarks based on interbank borrowing markets. The issues which have caused the transition away from LIBOR have affected most of these other interest rate benchmarks, or IBORs. There are proposals to replace the following interest rate benchmark rates with benchmarks based on overnight risk-free rates:

- HIBOR - Hong Kong interbank offered rate, applicable to Hong Kong dollars

- SIBOR – Singapore interbank offered rate, applicable to Singapore dollars

- TIBOR – Tokyo interbank offered rate, applicable to Japanese Yen (with the rate being set in Tokyo rather than (as with JPY LIBOR) London).

The methodologies for determining EURIBOR were revised in 2019, and there is currently no proposal to discontinue publication of EURIBOR rates. EURIBOR is, nonetheless, dependent on the existence of an observable and reliable interbank borrowing market for euros and the published tenors, so it is essential to ensure that adequate fallback mechanisms are included in documentation referencing EURIBOR, should it meet the same fate as other IBORs.

-

For each LIBOR and other IBOR, one of the most critical, commercial consequences of the transition to a risk-free benchmark rate arises from the fact that LIBOR and other IBORs are unsecured term borrowing rates with an in-built credit spread, whereas risk-free rates (whether secured or unsecured) are overnight rates only and contain a minimal credit spread. The transition of the interest rate applicable to a financial contract from an IBOR to a risk-free rate will require, therefore, a credit spread adjustment.

There have been a number of industry consultations for each IBOR currency on how to address the credit spread adjustment. In addition, several private market participants are developing dynamic credit spread adjustments.

ISDA adopted spread adjustments for derivatives based on the median difference over a five-year period between LIBOR for a particular tenor and the overnight risk-free rate for a particular currency. The spread adjustments were set on March 5, 2021 as a result of the announcements by IBA and FCA.

The ARRC has recommended that cash products use the ISDA spread adjustment for the transition from USD LIBOR to any SOFR-based rate of the corresponding tenor.

-

The vast majority of LIBOR exposure lies in derivatives products and ISDA is widely acknowledged as leading work on benchmark reform. Following a request from the Official Sector Steering Group (OSSG) in 2016, ISDA has undertaken work to improve contractual robustness of derivatives contracts that reference LIBOR and other key IBORs. This means updating ISDA documentation to include references to the alternative RFRs instead of the existing family of IBORs.

Current standard ISDA documentation includes references to those IBORs and certain fallbacks. Those fallbacks were however only ever intended to accommodate a temporary cessation of those rates. ISDA's updates have therefore been focused on including triggers that will switch in-scope derivatives from the current reference rates to the new rates and developing fallbacks with relevant adjustments.

Starting in the summer of 2018, ISDA launched several public consultations most of which focused on identifying the term and credit spread adjustment to convert each of the identified alternative RFRs into rates that would have similar characteristics to the IBORs.

The result of those consultations indicated that the market favored the “compounded setting in arrears rate” for the term adjustment with the “historical median approach” (a five year look-back comparison calculation between the relevant “compounded in arrears” RFR and relevant IBOR) for the credit spread adjustment.

Working groups beyond ISDA, including the ARRC, have and continue to consider using methodologies consistent with ISDA's recommended methodology in the context of addressing the credit spread adjustment required for cash products. On October 23, 2020, ISDA launched the IBOR Fallbacks Supplement (Supplement) to the 2006 ISDA Definitions and the ISDA 2020 IBOR Fallbacks Protocol (Protocol). The Supplement and Protocol implement the results of ISDA’s aforementioned consultations, for both existing trades (via parties adhering to the Protocol) and new trades (via new trades incorporating the Supplement).

The Protocol and Supplement changes are "effective" from January 25, 2021 (the Effective Date). Market participants can adhere, and are being encouraged by regulatory bodies, to adhere ahead of the Effective Date, and will continue to be able to do so following the Effective Date.

By adhering to the Protocol, market participants will agree that their legacy derivative contracts (and certain other listed “Protocol Covered Documents” including market standard repo and securities lending documentation) with other adherents will include the amended floating rate option for the relevant IBOR and will therefore include the fallback. As always, adherence to any ISDA protocol will be completely voluntary and will amend contracts only between two adhering parties (i.e. it will not amend contracts between an adhering party and a non-adhering party or between two non-adhering parties).

In addition to publishing the Supplement, the Protocol and an FAQ, ISDA has also published a series of "bilateral" templates that allow counterparties to tailor the Protocol in a number of ways for example, by enabling them to agree to Protocol amendments with only a limited set of counterparties, or to vary the documents that are to be covered by the Protocol.

In brief, the Supplement introduced a set of "hard-wired" fallbacks that apply to the relevant contracts after certain “index cessation events” and also should there be a temporary cessation of a relevant IBOR. These index cessation events generally occur upon either the discontinuation of the applicable IBOR (a permanent cessation trigger) or, for certain relevant IBORs, a declaration from the regulatory supervisor of the administrator of the IBOR that the IBOR is no longer representative (a pre-cessation trigger).

For example, a pre-cessation fallback for derivatives referenced to LIBOR would be triggered if the FCA, as the supervisor of the benchmark’s administrator, announced that LIBOR is no longer capable of being representative - either immediately or as of a future date - even if it continues to be published (meaning that permanent cessation fallbacks would not be activated).

The point about representativeness is linked to the requirements of the European Benchmarks Regulation. Amongst these requirements, is a clear and unambiguous requirement for not only the administrator, but also for the supervisor of the benchmark administrator, to assess the capability of a critical benchmark to be representative of an underlying market and economic reality. As we note above, in the case of LIBOR, the supervisor is the FCA.

Notwithstanding the launch of the Protocol and Supplement, it is expected that ISDA will continue its wider LIBOR transition work, including in the following areas:

- the use of RFRs in non-linear derivatives and cross-currency swaps and supplemental amendments to IBOR fallbacks for these transactions;

- continued advocacy to seek to ensure there are no regulatory, tax or accounting impediments to fallbacks or amendments to legacy portfolios; and

- continued education on LIBOR

ISDA has published various materials on benchmark reform and transition from LIBOR including the launch of a benchmark reform hub, a link to which can be found below in Useful Links and the resources here are regularly updated with both ISDA material and market materials including from other industry groups.

As you would expect given the extent and complexity of LIBOR transition, there is a wealth of material available on the topic, including specific web pages or websites set up by the ARRC, the Bank of England, the FCA, the ECB, ESMA, ICMA, ISDA, the LSTA, the LMA and other industry bodies. Here are links to some of these websites (some require a subscription).

You can find more of our LIBOR thinking below:

Final IRS Regulations on Transition from LIBOR to Other Reference Rates — January 2022

Term SOFR is Here – The ARRC Recommends CME Group’s Term SOFR Rates for Use — August 2021

SEC Division of Examinations Releases 2021 Examination Priorities — March 2021

LIBOR – The UK Beat Goes On — May 2020

ARRC Recommended Spread Adjustment Announced — April 2020

Quick Note: The NY Fed is Publishing Compounded SOFR Screen Rates — February 2020

It’s Time to Originate a SOFR Loan! Really! — January 2020

Quick Note: The ARRC Spread Adjustment Consultation — January 2020

Proposed Tax Rules on LIBOR Replacements Answer Some (But Not All) Questions — October 2019

Considerations for Proactively Addressing LIBOR Cessation and Transition; SEC Staff Issues Statement on LIBOR Transition — September 2019

Killing LIBOR: A Victory for Irrational Rectitude — August 2019

LIBOR, Again (Sorry!) — March 2019

A Break from the “B” Word – LIBOR and Benchmark Reform – Progress has the Wind in its Sails — October 2018

Night of the Living Dead: LIBOR Playing a Zombie in a Reality Near You! — August 2018

More Fun with LIBOR — April 2018

LIBOR - Where Are We Now? — April 2018

The End of Days (Or At Least LIBOR) — July 2017

What if LIBOR is Disrupted? — July 2012