Russia Sanctions: Where Are We Now and What Could Be Next?

Key Takeaways

- Since February 2022, the United States, United Kingdom, and European Union have imposed unprecedented economic sanctions on Russia and various Russian entities and individuals in response to the war in Ukraine.

- Actions have included targeted blocking sanctions and asset freezes, a ban on new investment in Russia by US and UK persons, restrictions on acquiring new debt and equity in certain Russian companies, bans on the export of certain services and goods, and bans on the importation of Russian-origin items including crude oil and gold.

- The Group of Seven (“G7”) countries, the EU, and Australia are now implementing a price cap on Russian oil and petroleum products that will have far-reaching effects around the globe.

- Key issues to monitor in the near future include asset freezes against additional Russian persons, prohibitions on additional services being provided in Russia, clarifications on the handling of sanctioned Russian securities, and the significant potential for increased enforcement measures taken against violators. Indeed, US officials have gone as far as describing sanctions as “the new FCPA” (referring to the Foreign Corrupt Practices Act), signaling an expected “sea change” in the intensity with which sanctions violations will be prosecuted.

Background

It has been nearly ten months since Russia recognized the so-called Donetsk and Luhansk Peoples’ Republics as independent states on February 21, 2022, triggering unprecedented and highly coordinated sanctions against Russia by the United States, the UK, and the EU, Canada, Australia, Japan, and others. As the war has escalated, sanctions measures have only increased in severity.

This OnPoint summarizes the most significant Russia-related sanctions developments that have been implemented this year, the main takeaways for the recently implemented price cap policy for services related to the maritime transport of Russian-origin oil products, and key sanctions issues to watch for in the upcoming months.

Summary of Current Measures

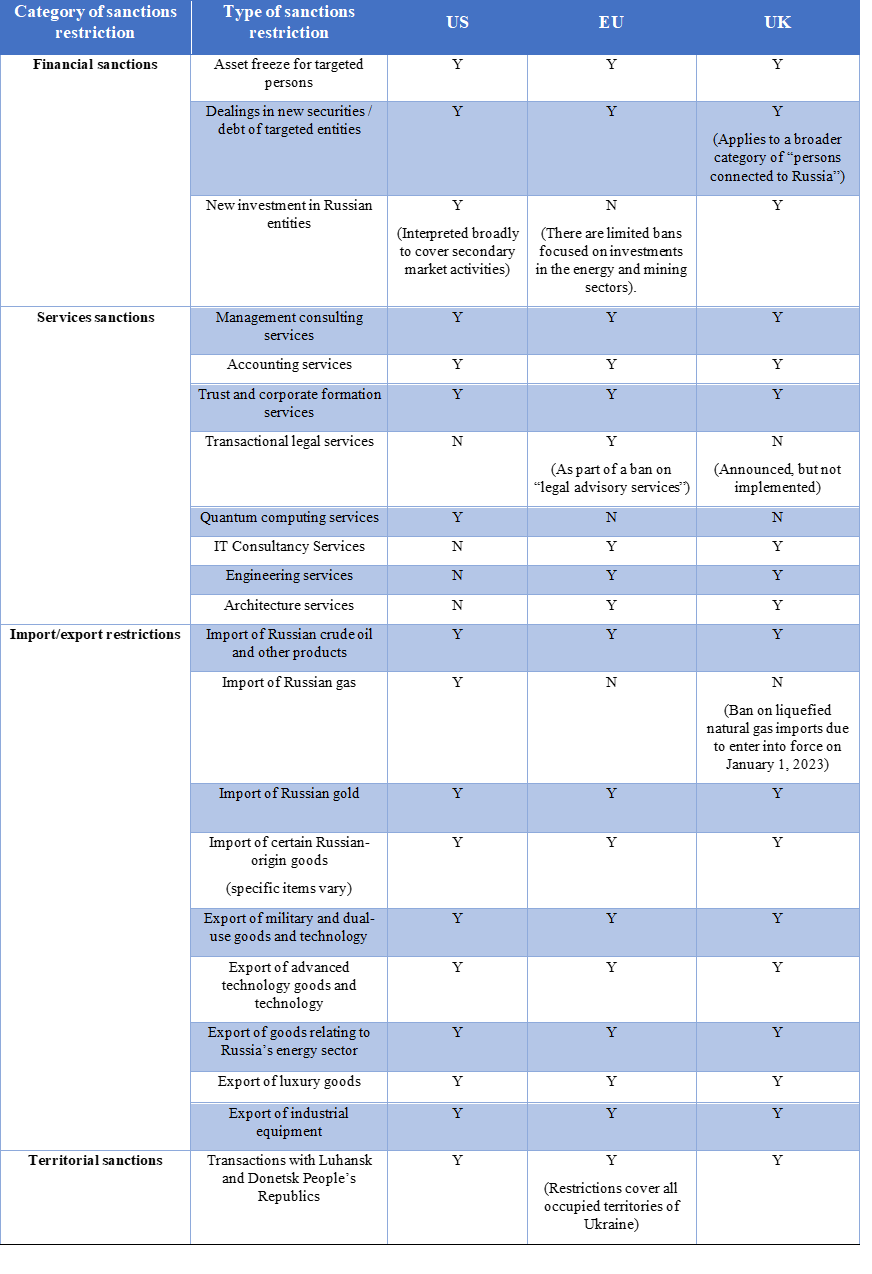

The table below provides a comparison of the key measures taken by each of the United States, the UK, and the EU (please note that this is not a comprehensive summary of all the measures imposed by these jurisdictions and that complex assessments should be made regarding the application of one or more sanctions regimes to potential dealings):

A Coordinated Effort – Russian Oil Price Cap

This autumn, in a continued show of unprecedented coordination, the G7 countries, the EU, and Australia announced a policy to prohibit a wide range of services related to the maritime transport of Russian crude oil and petroleum products unless such products are purchased at or below a set price cap. It is one of the most significant and novel steps yet taken by countries aiming to limit Russia’s ability to finance military actions in Russia through oil revenues while, at the same time, ensuring that Russian oil remains on the global market to avoid disruptive effects.

OFAC issued Preliminary Guidance in September 2022 followed by a formal Determination and Additional Guidance in November 2022 regarding the scope of the price cap policy. The UK and the EU also have published detailed guidance on the implementation of the price cap policy. Key takeaways regarding the price cap policy are below:

- The policy became effective on December 5, 2022, with respect to the maritime transport of Russian crude oil and will become effective on February 5, 2023, with respect to the maritime transport of petroleum products. These dates coincide with the implementation of EU restrictions on imports of seaborne Russian-origin crude oil and petroleum products.

- Under the price cap policy, US, UK, and EU persons generally are prohibited from providing the following services related to the maritime transportation of Russian-origin crude oil and petroleum products unless such products are purchased at or below a price cap:

- Trading/commodities brokering;

- Financing;

- Shipping;

- Insurance, including reinsurance and protection and indemnity;

- Flagging; and

- Customs brokering.

- US, UK, and EU persons are permitted to provide these services in connection with the maritime transportation of Russian-origin crude oil or petroleum products purchased at or below the relevant price cap. As of the date of this publication, the price cap for Russian-origin crude oil is set at US$60 per barrel. A separate price cap for petroleum products and additional guidance are expected before the February 5, 2023, implementation of the price cap policy for petroleum products.

- Actors are expected to conduct due diligence concerning the price at which Russian-origin crude oil was purchased or, if they do not have direct access to such information, to seek attestations from their counterparties concerning the purchase price.

- Under guidance from the US, UK, and EU, the level of expected due diligence varies depending on the type of actor and their ability to access price information. For example, commodities brokers who typically have direct access to price information are expected to collect invoices, contracts, or other documents regarding the price of the purchased oil and provide such documents to other actors as needed. In contrast, actors who typically do not have direct access to price information, such as insurers and shipping carriers, are expected to seek attestations from their customers or should include sanctions exclusion clauses in their contracts.

- Significantly, OFAC established a safe harbor for US persons who conduct good faith due diligence in connection with providing covered services. Distinct from most strict liability regimes administered by OFAC, the safe harbor is intended to shield service providers from strict liability.

- In the UK, actors may be required to report price information to enforcement authorities or the counterparties’ refusal to provide such information or relevant attestation.

- OFAC issued three general licenses related to the maritime transport of Russian-origin crude oil that permit US persons to engage in transactions related to addressing vessel emergencies and certain imports of Russian oil into Japan, Bulgaria, Croatia, and certain landlocked EU Member States.

Russian Countermeasures

Russia has adopted a broad range of measures aimed at limiting the impact of sanctions on its economy in response to the US, UK, EU, and other coalition countries’ actions. The key component of the response is the creation of a list of so-called “unfriendly countries” (non-Russian states and territories believed to be committing acts against the Russian Federation and Russian legal entities and individuals), which includes the US, UK, EU Member States and other coalition nations, and the introduction of various restrictions with respect to businesses connected with such countries. Russia has implemented other measures, such as strict capital control rules, as well. Broadly speaking, Russian countermeasures include:

- Severely limiting or restricting foreign currency transfers outside of Russia. This includes restrictions on Russian entities providing foreign exchange loans to any foreign counterparty;

- Requiring special clearance for transactions with securities and real estate involving a Russian person and persons from “unfriendly countries” (or entities controlled by “unfriendly” persons). In practice, this means that any western company wishing to leave Russia must obtain either a special permit from the Russian Government Commission for Control over Foreign Investment (for all limited liability and joint stock companies), or from the Russian president (for those companies listed on the relevant presidential decree, which covers most western banks and financial institutions, companies operating in the oil and gas sector, and several other categories of entities);

- A set of requirements that state that payments of loans, credit, and other financial instruments to “unfriendly” entities and persons be made in rubles (notwithstanding the currency of the underlying credit instrument) and to a special “Type C” account opened with a Russian bank. The funds deposited in such Type C accounts become effectively frozen;

- Mandatory conversion of depository receipts issued by Russian issuers to local Russian shares;

- Payment for Russian gas in rubles;

- A ban on export of certain goods (including commodities and equipment);

- Changes to intellectual property (“IP”) laws and regulations, which affect payments under IP contracts; and

- Targeted sanctions on individuals.

In light of the announced price cap on Russian crude and related products, it is widely expected that the Russian government will soon announce a set of countermeasures that will include a prohibition to sell oil if the contract is with a country (or an entity from a country) that has joined the price cap arrangement and the price cap appears in the contract as a condition, or if a reference price under a contract is equal to the price cap (currently at $60 per barrel), no matter who the contracting party is.

Additional measures may be announced in the coming weeks.

Measures to Watch For

The US, UK, and EU will continue to impose additional sanctions against Russia while the war in Ukraine continues. Below we highlight key issues to monitor in the coming months:

- Additional Sanctions Designations: While hundreds of Russian individuals and entities have been sanctioned by the US, UK, and EU, the specific targets vary across the regimes. For example, the EU and UK have been more aggressive than the United States to date in sanctioning Russian oligarchs, and it is possible that the United States will close the gap through additional designations in the near future. Additional sanctions also could target companies in Russia’s metals and mining sectors which largely have avoided specific asset freeze sanctions to date, although the US, in particular, has been reluctant to target companies that are deeply integrated into the global markets and has instead preferred to target beneficial owners. For example, on December 15, 2022, the US announced another round of sanctions aimed at further constraining the Russian financial services sector, designating dozens of entities and individuals including well-known oligarch Vladimir Potanin (but not Norilsk Nickel, the Russian mining company of which Potanin is the largest shareholder).

- Additional Services Designations: US, UK, and EU persons are prohibited from providing a broad range of services to Russia. The specific services vary depending on the regime but generally include accounting, consulting, and, in some cases, legal advisory services. The United States also prohibits exports of quantum computing services to Russia. These jurisdictions could harmonize the specific services that are prohibited and also could expand restrictions to additional services such as the provision of investment advisory and other financial services to Russia or Russian persons.

- Expansion of New Investment Restrictions: The United States and United Kingdom already prohibit any new investment in Russia regardless of sector with limited exceptions (such as investment to maintain existing operations in Russia). While the EU had previously only banned new investment in Russia’s energy sector, on December 16, 2022, it adopted a ban on new investment in Russia’s mining sector as part of its 9th package of sanctions and could target additional sectors in the future.

- Payments of Taxes and Other Fees in Russia: US persons currently are prohibited from engaging in most transactions involving the Central Bank of Russia, Ministry of Finance, and National Wealth Foundation. Under General License 13 and its successors, however, US persons are permitted to engage in transactions involving these entities in connection with payments for taxes, fees, import duties, permits, licenses, registrations, or certifications related to day-to-day business operations in Russia. This authorization is crucial for US persons required to be involved in making or approving such payments for Russian operations. The current authorization is scheduled to expire on March 7, 2023; while the license has been extended for successive three-month periods in the past, further extensions are not guaranteed. The lack of certainty for future extensions continues to raise significant concerns for US persons involved in supporting day-to-day operations in Russia. EU and UK sanctions targeting the Central Bank of Russia are more limited and do not generally restrict involvement in tax or other official payments to the Government of Russia, though such activities could be targeted in the future.

- Continued voluntary curtailing of foreign business interests in Russia: More than 1,000 companies have stated publicly that they are voluntarily curtailing their Russian operations or leaving the country entirely, according to the Yale School of Management tracking project. As noted above, Russia is taking steps to impose delays and potential penalties regarding such activities.

- Challenges Related to Blocked Russian Securities: US sanctions prohibit any dealings in securities issued by Specially Designated Nationals (SDNs) such as Sberbank, VTB Bank, and many others unless authorized by a general or specific license. General licenses allowing limited activities for these securities have expired. These securities now cannot be transferred under any circumstances where there is a US nexus which has led to difficulties for activities such as liquidation or mergers of funds or transfers of assets to beneficiaries as part of a decedent’s estate if SDN securities are involved. Due to the US prohibition on new investment in any Russian-related entities, even the transfer to US persons of securities issued by non-sanctioned Russian-related entities is prohibited. Unless OFAC issues guidance or general licenses permitting the transfer of Russian securities in certain circumstances, these challenges will continue to plague the financial services industry. EU sanctions targeting the National Settlement Depository also have caused significant issues in settling trades involving Russian securities even where otherwise permitted by sanctions, and these challenges will continue absent additional guidance or licenses from relevant EU authorities.

- Enforcement: There has been little public enforcement for violations of Russia sanctions to date largely because the measures are new and regulatory authorities appear to be focused on encouraging compliance through outreach and guidance rather than through enforcement actions. This could change soon, however, particularly due to increased resources dedicated to identifying and prosecuting sanctions violations. In particular:

- The US Treasury and Justice Departments have established task forces, called KleptoCapture and REPO (Russian Elites, Proxies and Oligarchs), in order to track down, freeze, and seize the assets of sanctioned Russian elites. Senior Justice Department officials, such as the Attorney General (Merrick Garland) and Deputy Attorney General (Lisa Monaco), have made public statements about their commitment to enforcing sanctions violations and provided notice of an expected “sea change” in enforcement around US sanctions violations. For example, Monaco described the intensity with which the U.S. government will pursue US sanctions violations and drew parallels to enforcement of the U.S. Foreign Corrupt Practices Act (“FCPA”), a law that the U.S. government has enforced actively for several decades, and described sanctions as “the new FCPA.” Export controls, too, seem to be the subject of increased scrutiny; the DOJ recently charged seven defendants with attempting to evade US export laws through a global procurement and money laundering network on behalf of the Russian government.

- Since March 2022, the EU Sanctions Whistleblower Tool has facilitated reporting of sanctions violations or circumvention to the EU Commission, which passes information to relevant national authorities after preliminary investigation. The EU also is stepping up efforts to increase coordination on sanctions-related enforcement, including the introduction of EU-wide criminal penalties (sanctions violations are a criminal offense in 25 out of 27 EU Member States, but the definitions vary). EU officials are also reportedly considering the establishment of a central authority, similar to OFAC, to enable greater oversight of sanctions enforcement across the bloc and improve information flows between the national enforcement authorities.

- In a push to step up UK enforcement efforts, the UK’s Office of Financial Sanctions Implementation (“OFSI”)—responsible for the implementation and enforcement of financial sanctions in the UK—obtained, in June 2022, powers to impose civil monetary penalties for financial sanctions breaches on a strict liability basis. This brings the UK into alignment with the approach taken in the United States, removing the requirement for OFSI to prove that a person had knowledge or reasonable cause to suspect that they were in breach of sanctions before a civil penalty can be imposed. The UK Treasury also has committed to “more than doubling” headcount at OFSI, indicating a clear intention to ramp up enforcement activity.

- The US Treasury and Justice Departments have established task forces, called KleptoCapture and REPO (Russian Elites, Proxies and Oligarchs), in order to track down, freeze, and seize the assets of sanctioned Russian elites. Senior Justice Department officials, such as the Attorney General (Merrick Garland) and Deputy Attorney General (Lisa Monaco), have made public statements about their commitment to enforcing sanctions violations and provided notice of an expected “sea change” in enforcement around US sanctions violations. For example, Monaco described the intensity with which the U.S. government will pursue US sanctions violations and drew parallels to enforcement of the U.S. Foreign Corrupt Practices Act (“FCPA”), a law that the U.S. government has enforced actively for several decades, and described sanctions as “the new FCPA.” Export controls, too, seem to be the subject of increased scrutiny; the DOJ recently charged seven defendants with attempting to evade US export laws through a global procurement and money laundering network on behalf of the Russian government.

***

The business landscape in and involving Russia continues to change rapidly. Companies should continue to keep abreast of legal developments including US, UK, and EU sanctions and export controls laws and how they impact their business. As always, Dechert is available to advise on any measures imposed on or by Russia, in addition to sanctions and export controls more broadly.