DAMITT Q3 2023: Merger Control Is a Marathon, Not a Sprint

Key Facts

United States

- All significant U.S. merger investigations concluded in either a complaint or an abandoned transaction. Four of the last five quarters have now concluded without any consent agreements, demonstrating the agencies’ continued hostility to remedies and settlements short of litigation.

- At the same time, post-complaint settlements—once a distinct outlier—are a new trend. Forced to defend complaints in court, the agencies have showed a willingness to settle later in the process on three separate transactions over the last two quarters.

- Only 10 significant merger investigations concluded over the last 12 months, nearly 65 percent lower than the annual average between 2011 and 2022 and 50 percent lower than the average just last year.

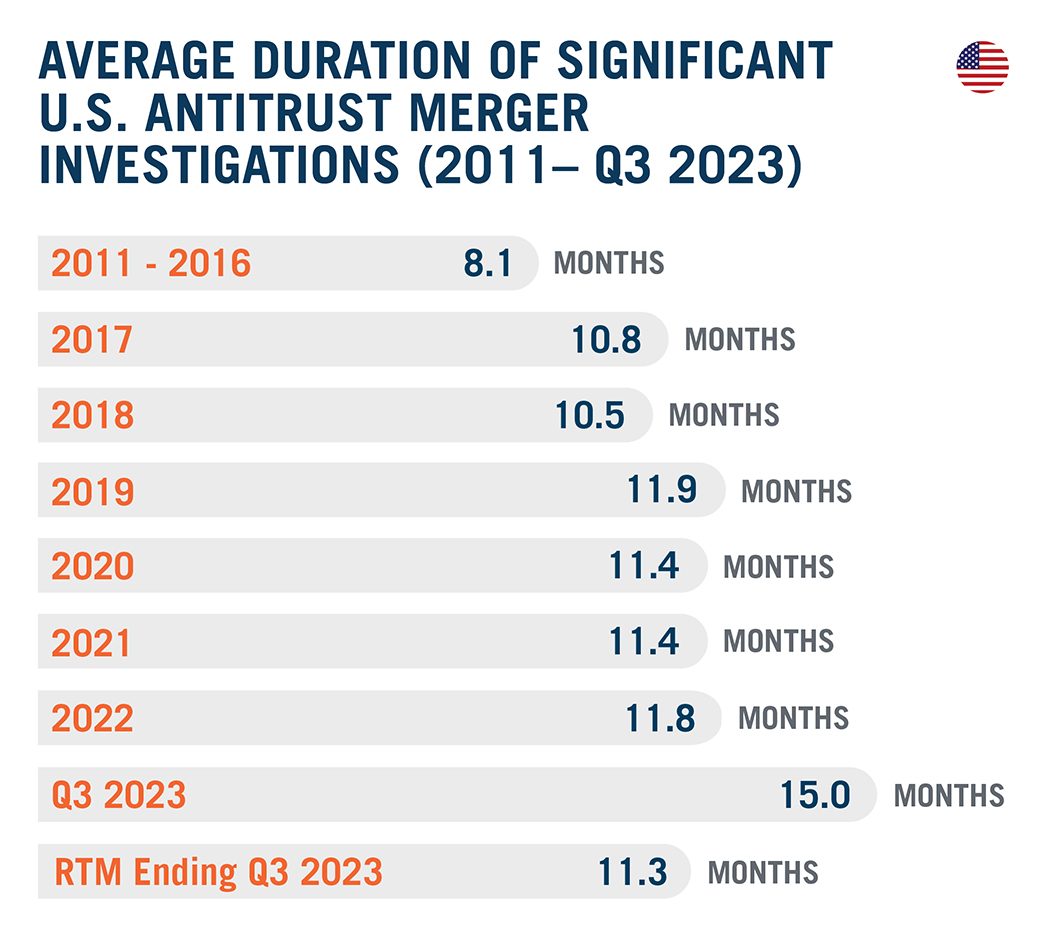

- The average duration of significant investigations over the last quarter shot up to 15.0 months—and that was for two transactions that were either abandoned or received a complaint. While the 11.3-month average over the last 12 months is in line with previous years, parties would be well-advised to keep an eye on the clock. Merger investigations may take longer than expected.

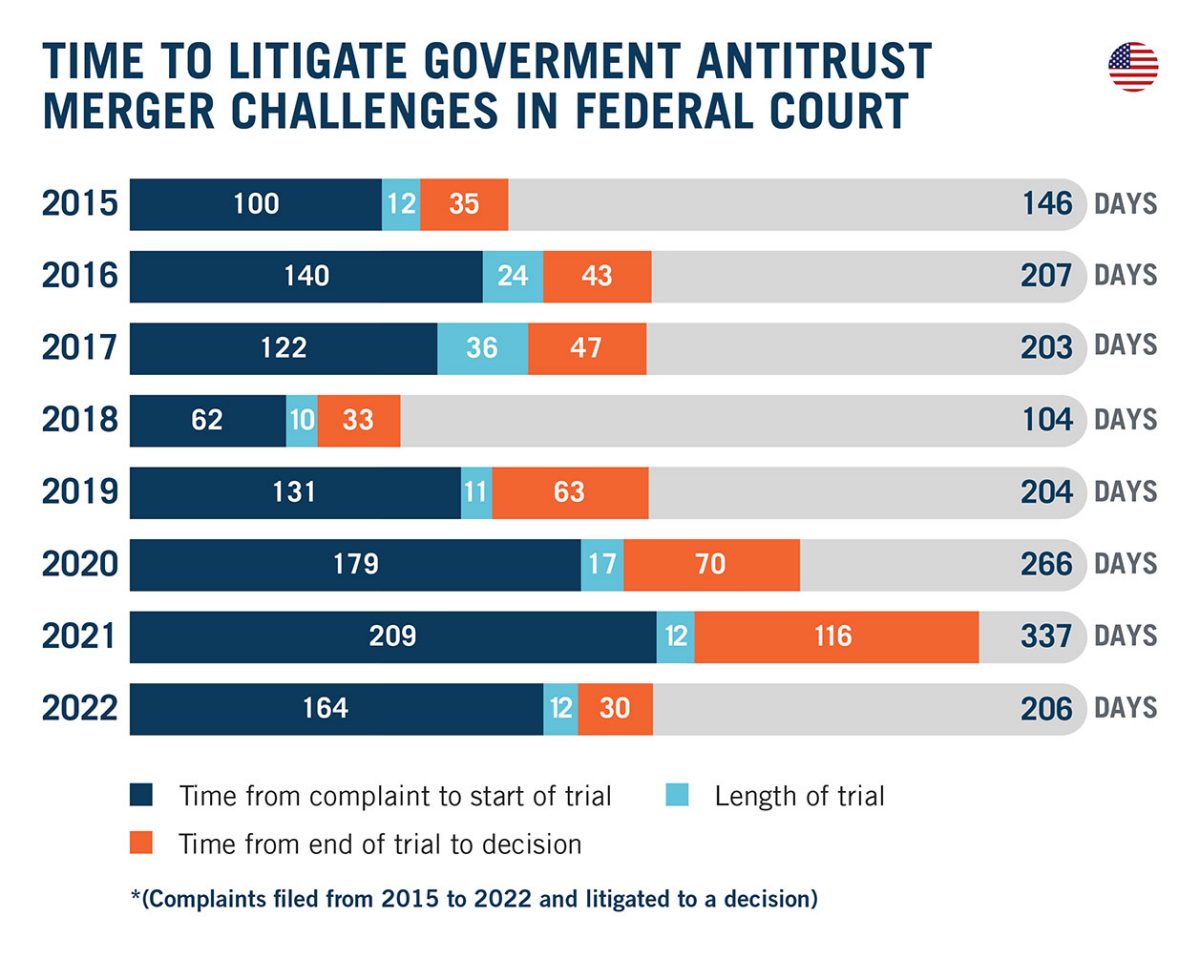

- By contrast, merger litigation is moving faster. For complaints filed in 2022, the average duration of a fully litigated merger trial was under 18 months from deal announcement to decision and the average duration to achieve a post-complaint settlement was 15.9 months. From the time of the complaint, the average duration to a court decision was 6.9 months and to a settlement was 5.9 months.

European Union

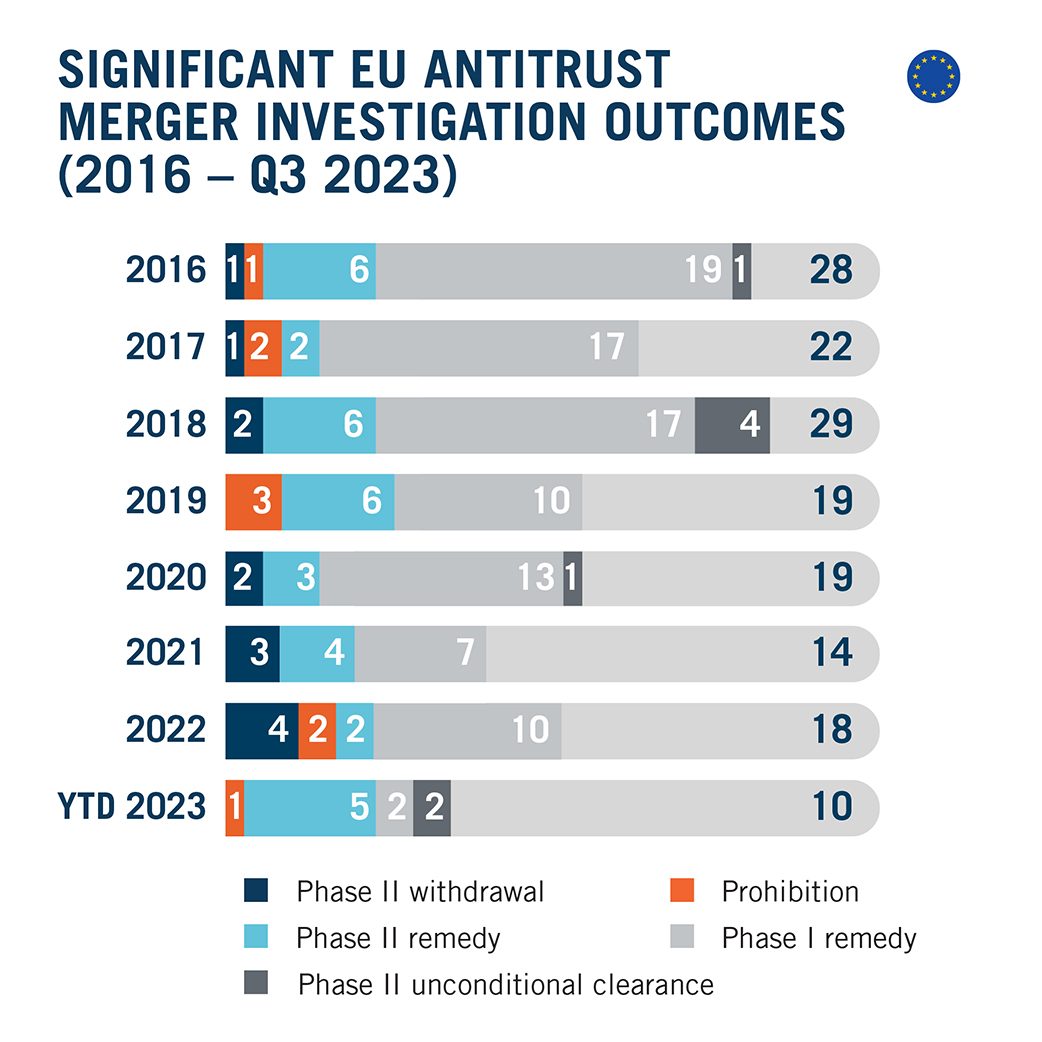

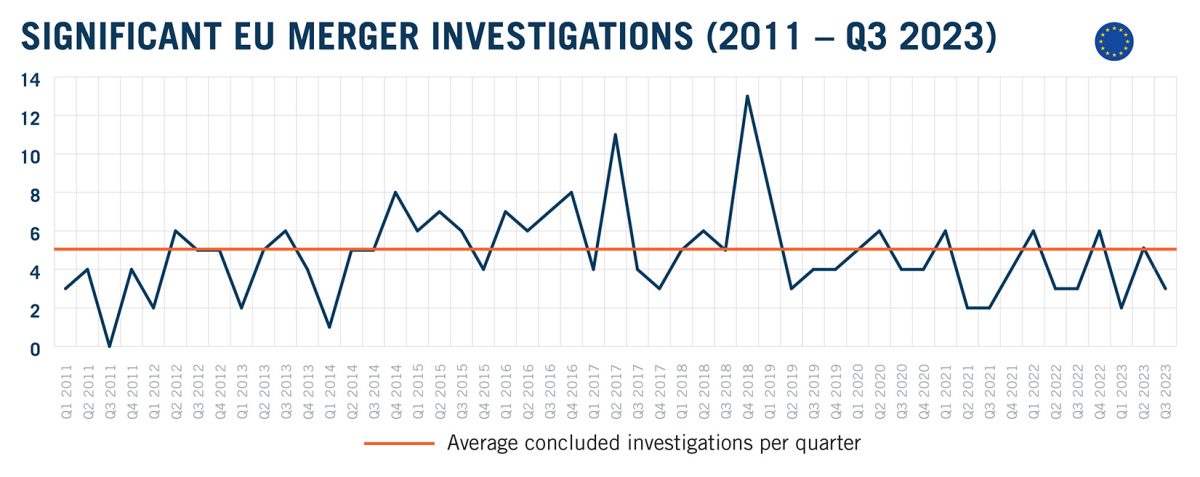

- With only 10 significant merger investigations concluded thus far in 2023, the EC is 30 percent below average for the first nine months of the year and will be hard pressed to catch up to previous levels.

- The EC issued its first prohibition this year, introducing an innovative theory of harm. The EU Courts will likely weigh in on the validity of this new EC practice, litigation against prohibition decisions being nearly systematic, but don’t hold your breath: the Court decision is unlikely to be issued before 2027 considering the average duration of previous appeals.

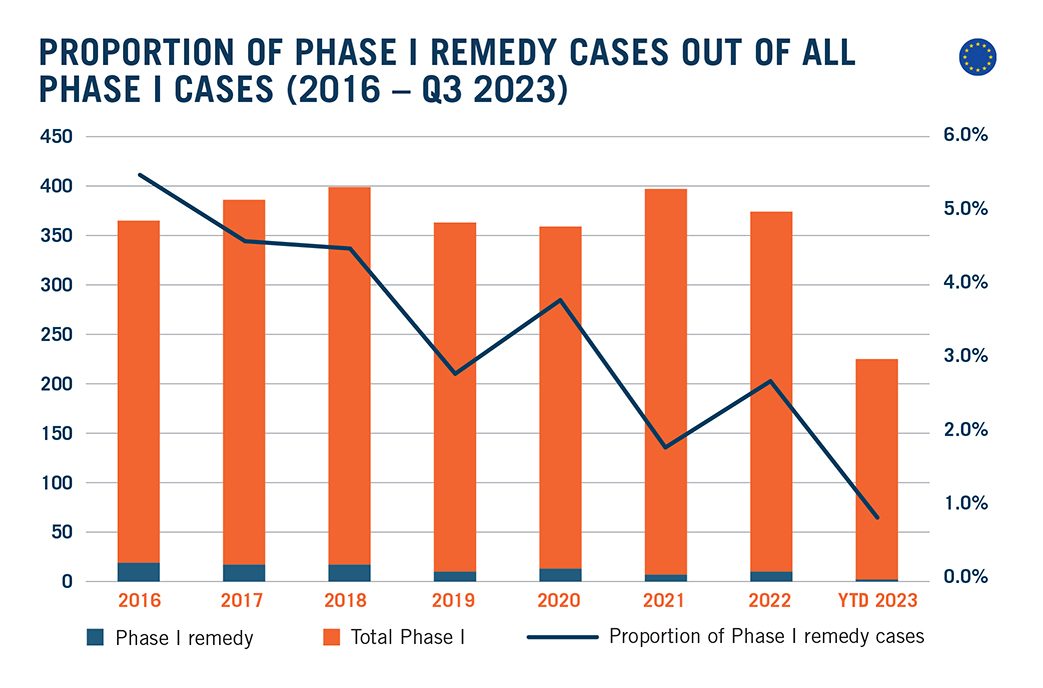

- The EC otherwise maintained the pace observed in the first half of 2023, with an increasing openness to behavioral remedies—but only in Phase II. Phase I Remedy cases, on the other hand, are nearly extinct.

- Pull-and-refiles made a comeback in the context of significant Phase I investigations, raising questions as to the suitability of the formal Phase I review period for deals requiring remedies.

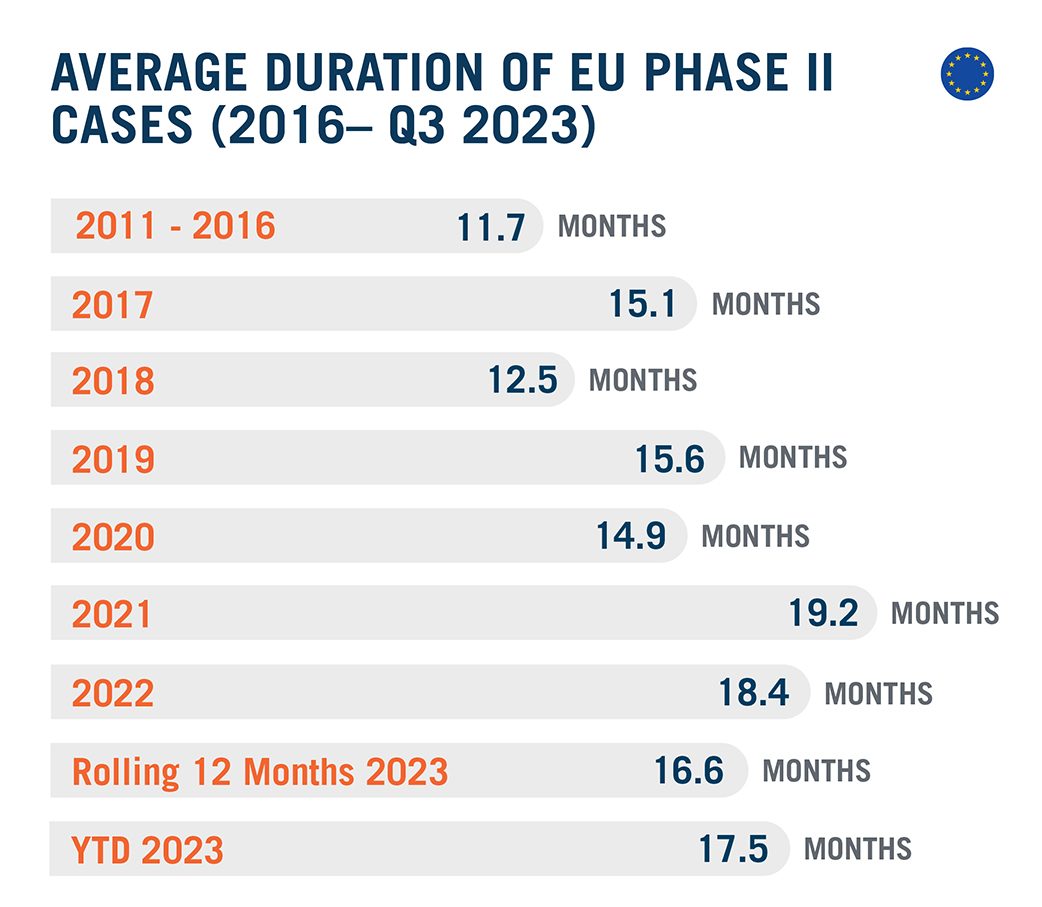

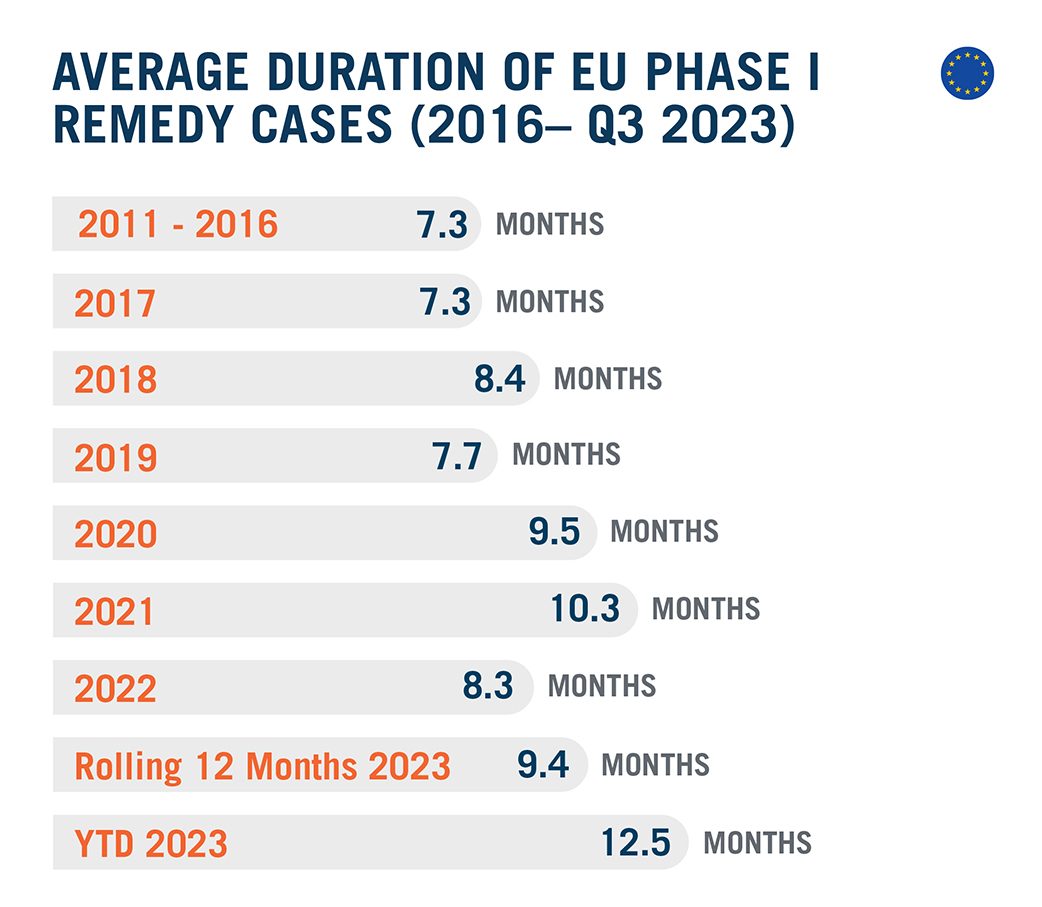

- The average duration of significant EU merger investigations fluctuated in different directions for Phase I and Phase II, but remains on the long end, averaging at 12.5 months and 17.5 months respectively for the first nine months of 2023.

As U.S. Merger Enforcement Levels Hit Historic Lows, the Agencies Turn to Post-complaint Settlements

U.S. Agencies Only Approve One Settlement Short of Litigation Over the Last Five Quarters

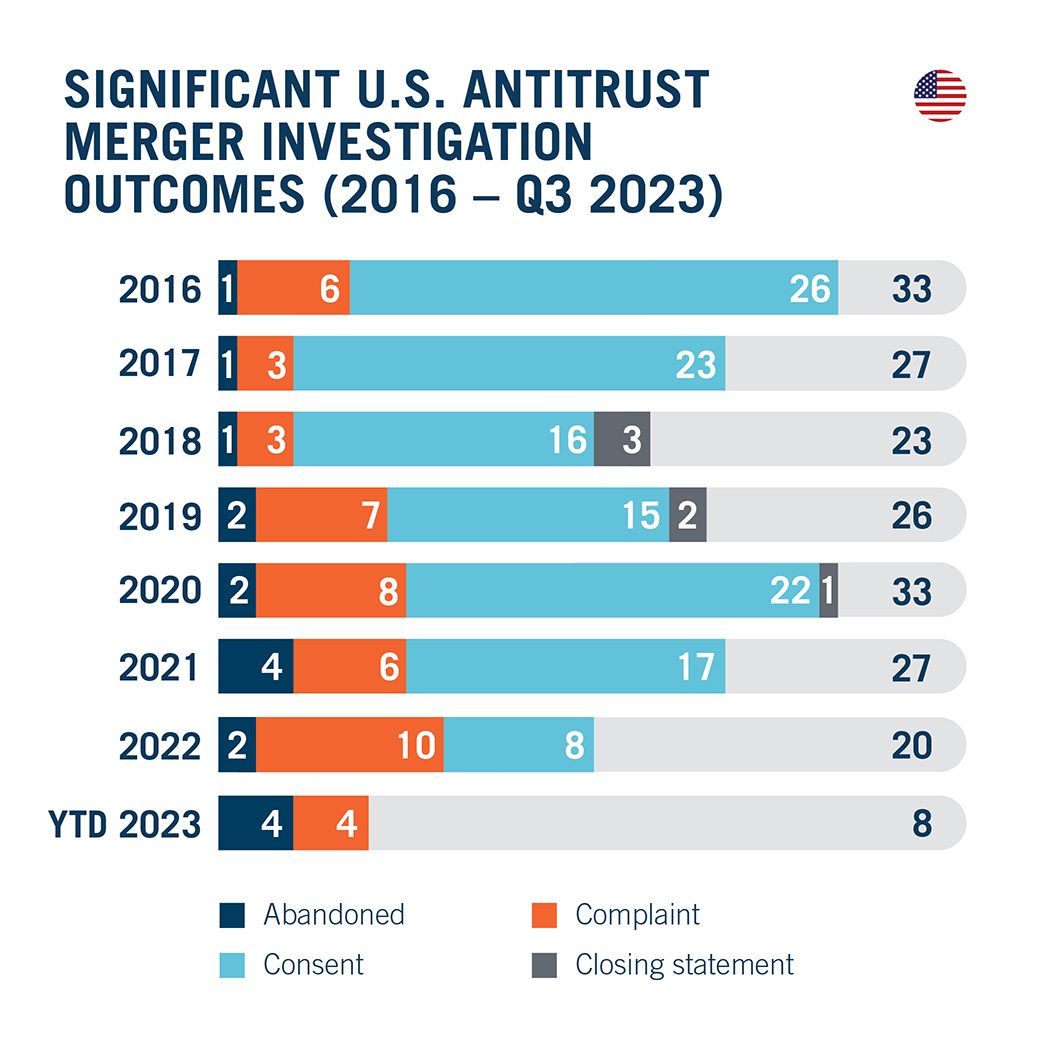

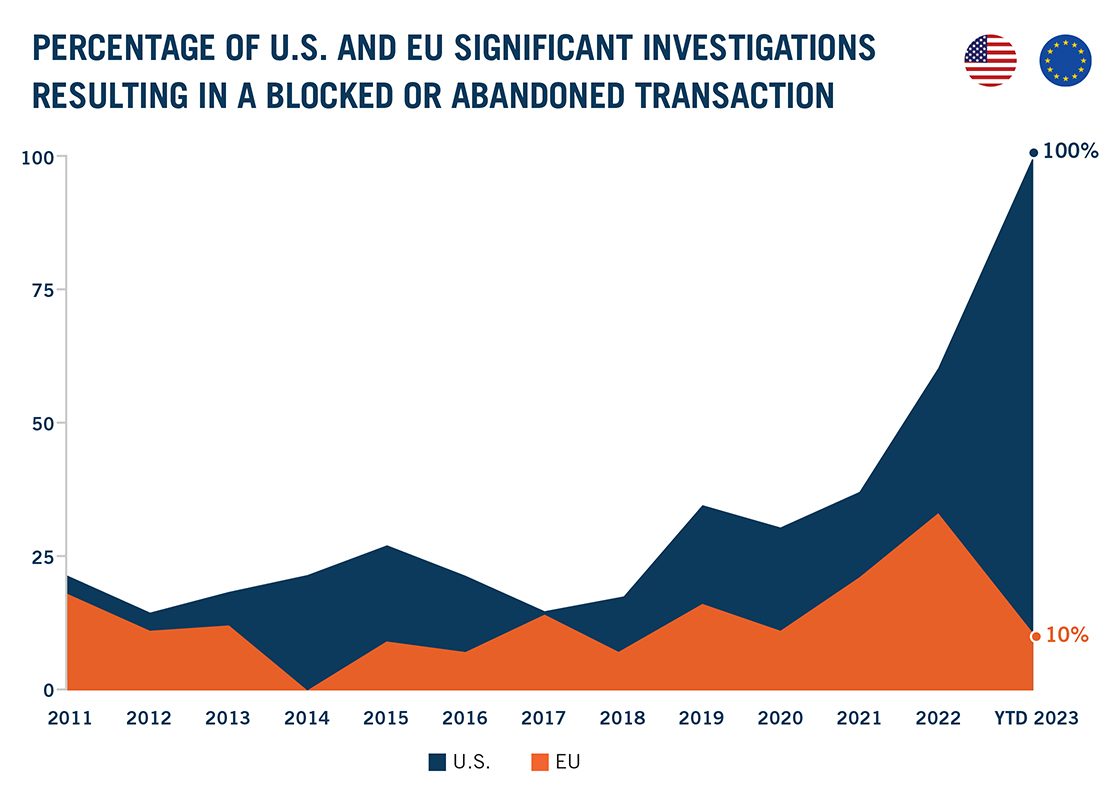

In our DAMITT 2021 Report, we warned that transactions subject to significant merger investigations were more likely to be abandoned or blocked. Back then, 37 percent of significant investigations resulted in a complaint or an abandoned transaction, the highest observed since DAMITT launched in 2011. That record was then shattered in 2022, when 60 percent of significant investigations resulted in either a complaint or an abandoned transaction.

With three quarters down, it looks like 2023 will set a new record as all significant investigations that concluded in the first three quarters of 2023 resulted in either a complaint or an abandoned transaction. Four of the last five quarters have seen no consent decrees from either agency.

These developments began at the DOJ, which has not entered into a single pre-complaint settlement to resolve a significant investigation since DOJ Assistant Attorney General Jonathan Kanter began warning, shortly after taking office in November 2021, that investigations resolved with merger remedies should be the “exception, not the rule.” But it has since spread to the FTC. As the former FTC Director of the Bureau of Competition warned in February 2023, “parties should expect the agency to be skeptical and risk averse when considering offers to settle in our merger investigations.” The same official has since compared the FTC’s current reluctance to enter into settlements with a prior policy of “getting cookie-cutter consent orders, one after another, on and on and on.” Based on the current record, however, it is difficult to assess what distinguishes a “cookie-cutter consent” from any other settlement. Given the mutual DOJ and FTC refusal to enter any pre-complaint settlements for an alleged illegal merger so far this year, pre-complaint merger settlements appear to be headed towards extinction under the current administration. (The FTC did enter a settlement of an alleged interlocking directorate violation in QEP Partners/EQT Corporation, but that complaint did not allege that the proposed merger was illegal.)

Post-Complaint Settlements Are Back After a Decade

At DAMITT we normally focus on pre-complaint settlements, or settlements that are made before the agencies file a formal complaint to challenge a transaction. The reason for this is simple: until this year, the most recent post-complaint merger settlement approved by either U.S. agency involved two complaints filed against Ardagh Group/Saint-Gobain Containers and American Airlines/US Airways in Q3 2013—exactly a decade ago (in full disclosure, Dechert’s antitrust group represented US Airways on that deal). Since that time, there were 181 pre-complaint settlements and no post-complaint settlements—until last quarter. The DOJ and FTC have now collectively settled three separate complaints in the last six months. This is a trend worth watching.

This trend began last quarter when DOJ ended up settling its Assa Abloy/Spectrum Holdings challenge after a complaint was originally filed in Q3 2022. In that case, the settlement followed direct criticism from the court of the DOJ’s settlement approach: “I think that you all saw a problem a mile away, in your view, and instead of giving the defense an opportunity to fully explain to you the divestiture, to fully set out the divestiture, to find a buyer, to get this done, you all cut off the talks and initiated a lawsuit.” Following this rebuke from the bench, DOJ proceeded to negotiate a merger settlement.

The FTC then followed suit by settling challenges against two additional transactions—Intercontinental Exchange/Black Knight and Amgen/Horizon Therapeutics—in Q3 2023. Of note, these settlements both followed our DAMITT Q2 2023 Report, where we asked: “When Avoiding Settlements, Does Merger Enforcement Settle for Less?” It appears the FTC may have been asking itself the same question.

Number of Concluded Significant Investigations Continues to Hit Historic Lows

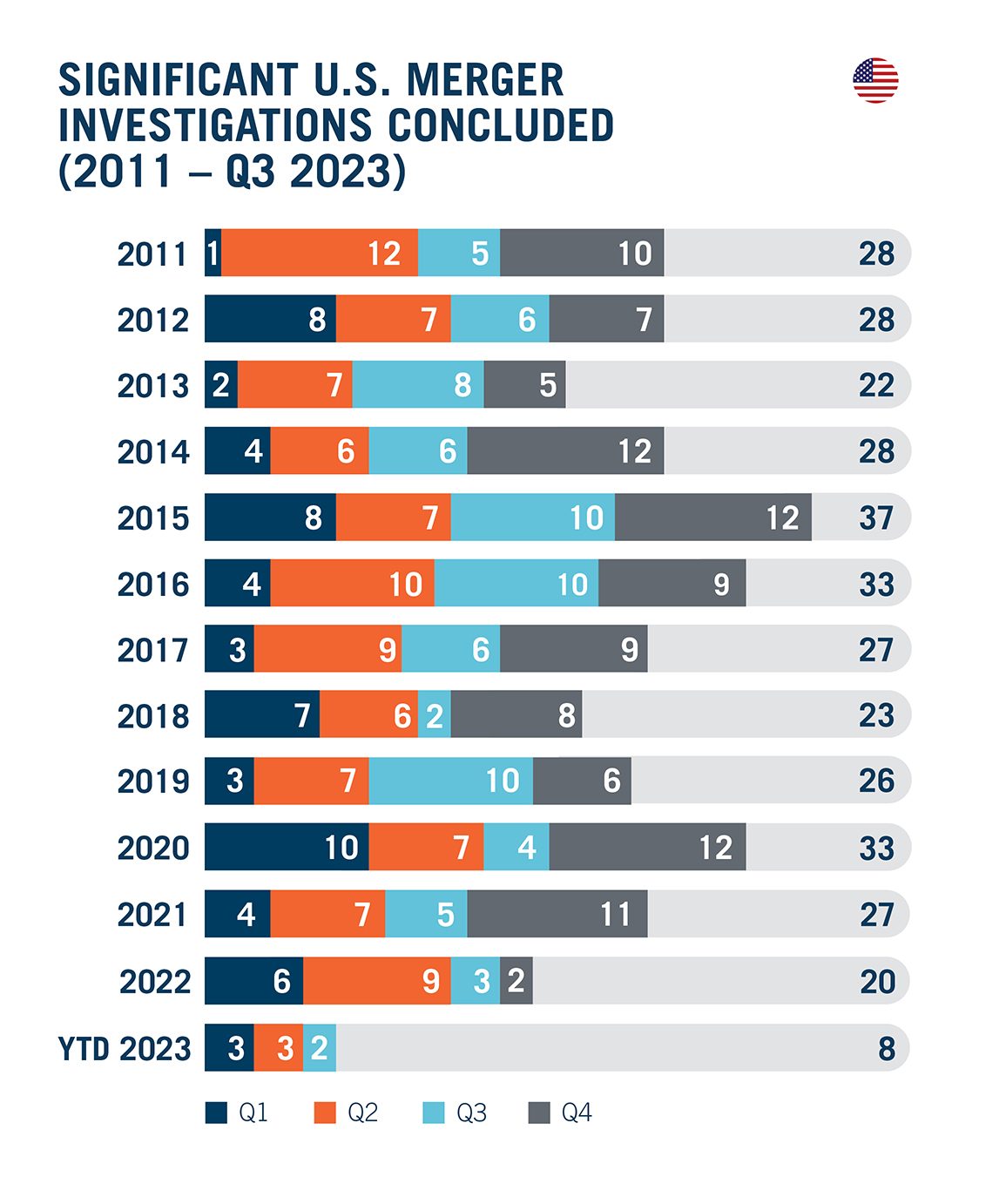

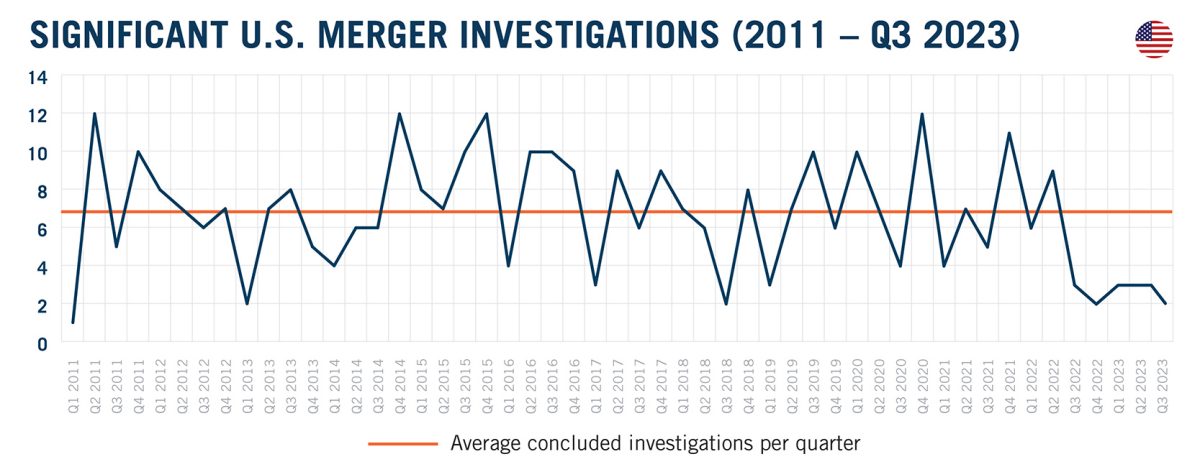

The U.S. agencies only concluded 10 significant investigations over the last 12 months, with the number of concluded investigations never rising above three per quarter for the last five quarters. For context, the 10 significant investigations over the last 12 months amount to only half the number concluded in all of 2022 and less than a third of all significant investigations concluded in the last year of the Trump administration.

As detailed in our DAMITT Q2 2023 Report, this prolonged drop is largely explained by the disappearance of pre-complaint settlements. There has not been an observable increase in complaints and abandoned transactions to replace that notable drop in consent decrees. To the contrary, there have been three fewer complaints and abandoned transactions announced by the agencies in the first three quarters of 2023 than there were in the first three quarters of 2022.

In our DAMITT Q1 2023 Report, we asked what three quarters of such low activity said about the health of merger enforcement. While there typically are quarters with higher and lower levels of concluded investigations, we typically expect to see quarters with higher and lower numbers hover around the average like a heartbeat. Over the last year, however, we have yet to see any bounce back in the number of significant investigations concluded by the agencies despite the significant spike in merger filings in 2021 and 2022. As shown below, the number of concluded investigations has been well below historical averages for a full five quarters.

In particular, the DOJ has not concluded a single significant investigation in the last two quarters, which is the first time we have seen consecutive quarters of no merger enforcement by DOJ since DAMITT started tracking in 2011. You can almost hear the crickets from where we are sitting.

The Average Duration Spikes, but Litigation Timelines Return to Pre-pandemic Norms

The publicly observable average duration of concluded significant merger investigations hit a high of 15.0 months in Q3 2023, well above historical DAMITT averages. Because this average only reflects two concluded investigations, we would caution against relying too heavily on this development. The average duration for the rolling-twelve-months ending Q3 2023 was 11.3 months, which is in line with the annual averages observed since 2017.

Keep in mind, however, that this does mark a reversal of a recent trend towards shorter average durations. For example, the average duration observed in Q2 2023 was 8.3 months and the average duration for the rolling-twelve-months ending Q2 2023 had fallen to 10.4 months. We have warned against relying too much on those shorter recorded durations in recent reports, and the most recent durations reinforce those warnings.

Parties also should keep in mind that the DAMITT average duration for the last 12 months only includes one pre-complaint consent. As a result, it is largely measuring the time from deal announcement to a settlement, abandoned transaction, closing statement, or complaint for transactions that received a complaint or were abandoned. Parties to transactions that receive complaints will need additional time to defend their transactions.

Here, however, there is some good news: after two years of increasing litigation timelines attributable in part to the pandemic, the average duration for complaints filed in 2022 to a court decision fell to just under 7 months. Altogether, the average duration of a litigated merger trial was under 18 months from deal announcement to decision.

It also is worth keeping in mind that litigation timelines may vary depending on the agency involved. Since 2015, the average duration from a complaint filed by the FTC to a decision was 5.9 months, as compared to 7.8 months for the DOJ.

These numbers do not include the three matters that were concluded with post-complaint settlements over the last two quarters. For those matters, the average duration from the complaint to the settlement was 5.9 months. The average duration from deal announcement to a post-complaint settlement was 15.9 months.

Despite Low Numbers of Significant EU Merger Investigations, Average Durations Remain Stubbornly High

The EC Has Issued Its First Prohibition in 2023 – and Its First Prohibition Based Solely on an Ecosystem Theory of Harm – but the Number of Significant EU Merger Investigations Remains Low, Especially for Phase I Remedy Cases

With only three significant merger investigations concluded in Q3 2023, the EC remained far below the quarterly average of 4.9 significant investigations concluded per month observed since 2011. As noted in our DAMITT Q2 2023 Report, this decrease is however driven exclusively by a decline in Phase I Remedy cases. This evolution mirrors the US agencies’ reluctance to settle cases pre-complaint, albeit in the different EU procedural setting.

On the other hand, the EC concluded two Phase II investigations this quarter, which is in line with the quarterly average observed since 2011. Q3 2023 saw the first prohibition of the year, in the Booking/eTraveli case, and the thirteenth prohibition since DAMITT started tracking significant merger investigations in 2011. This decision also marks a departure from previous practice, as it is the first prohibition based on a true ecosystem theory of harm, without any horizontal or vertical issues. The EC considered that the transaction would have allowed Booking to increase its dominance on its core market by growing the ecosystem of services it provides; in its review, the EC relied directly on the EUMR and departed from its merger review guidelines.

Senior officials from the EC commenting on the decision have made it clear that they intend to follow the same approach in the future if warranted by the facts of a case. Speaking at a GCR conference, Olivier Guersent, Director-General at DG COMP, stated that “if we were bound by our guidelines, then you would fossilize your practice to what it was when [we] issued the guidelines...we need to have some capacity to depart from guidelines, provided we justify in the decision why. That’s the only way for our merger control to be able to follow the evolution of the market.” Even with this new prohibition, however, the intervention rate of the EC remains low in 2023 compared to recent years and compared to trends in the United States.

The second Phase II investigation concluded this quarter resulted in a conditional clearance with behavioral remedies, confirming a trend observed in the DAMITT Q2 2023 Report of greater acceptance for non-structural remedies. With this new decision, the proportion of deals cleared with only behavioral commitments has risen to 43% so far this year, significantly above the 12% average observed over the 2011-2022 period.

Turning to Phase I, the EC has historically concluded 9 Phase I Remedy cases on average by the end of the third quarter between 2016 and 2022. By contrast, the EC has only concluded two cases in Phase I with remedies so far this year. As a result, the EC will be hard pressed to catch up to the historical average.

In addition, despite the new Phase I Remedy case concluded in Q3 2023, the proportion of transactions cleared in Phase I with remedies out of all Phase I cases remains below 1 percent in 2023, a sharp decrease since 2016 when these transactions represented approximately 5.5 percent of all Phase I cases.

Looking at EU significant merger control investigations overall per quarter, the numbers show a slow decline over time, albeit one that is far less pronounced than the sharp drop observed across the Atlantic.

The Average Duration of Phase II Investigations Slowly Declines While Average Duration of Phase I Remedy Cases Slightly Increases, but Both Remain Remarkably High

The average duration of EU Phase II investigations continues to slowly decline. With an average of 16.6 months observed over the past 12 months, this is nearly two months faster than the record-average duration observed in 2021, and one month less than in 2022.

The “shorter” average duration observed thus far in 2023 should, however, be viewed with caution since, as previously indicated, it was primarily driven by a limited number of shorter investigations. The median duration over the last 12 months was 17.2 months, closer to the 17.5-month average duration observed since the beginning of the year.

Glimpsing into the future, the four Phase II investigations currently pending with the EC have already clocked on average 18.8 months as we write this report, so 2023 is likely to conclude on the high end in terms of duration.

Parties should also be careful not to overlook that there are significant differences depending on the outcome of the review. As indicated in our DAMITT Q2 2023 Report, significant merger investigations concluded in 2023 have lasted longer than the average observed of the past five years in each category when looking at duration per outcome: 15.6 months vs 11.3 months on average for unconditional clearances; 17.3 months vs 15.4 months on average for Phase II with remedies; and 22.5 months vs 20.9 months on average for prohibitions.

While litigation is less in focus for merger investigations in Europe as the EC can prohibit a deal outside of a courtroom, litigation can still become relevant following an adverse EC decision. Of the deals blocked by the EC since 2011, all but two have been appealed by the acquirer or the parties. Parties to a deal prohibited by the EC wishing to appeal the decision should however be aware of the long timelines to obtain a ruling by the General Court. Leaving aside appeals that were withdrawn, the General Court ruled on the matters on average 41.8 months after issuance of the EC prohibition decision. And this does not account for the time necessary to obtain a decision from the higher EU Court, which can double that timeline.

Turning to Phase I cases with remedies, 2023 sets a new record of 12.5 months for Phase I investigations. This is nearly twice the average duration of Phase I Remedy investigations observed five years ago, and actually corresponds to the average duration of Phase II investigations back in 2018. As indicated in our DAMITT Q2 2023 Report, this increase is however driven by a 15.1-month Phase I investigation concluded in Q1 2023.

Both investigations concluded in 2023 with remedies after a Phase I investigation were pulled and refiled by the parties, adding on average 19 working days of “formal review” by the EC. This is a marked departure from previous practice in Europe, where pull-and-refile cases are infrequent; over the 2017-2022 period, only nine percent of Phase I Remedy cases had been pulled and refiled. In terms of timing, over the 2017-2023 period, pull and refiles added on average 126 working days to the clock, including 33 working days of “formal” review by the EC. If this trend continues, it will provide reason to question the relevance of the 35-working day cap of the formal Phase I review period provided by the EUMR.

Conclusion

Parties to transactions subject to significant merger investigations continue to face an elevated risk of seeing their deal blocked or abandoned on both sides of the Atlantic, even if the intervention rate shows relatively few deals actually receive this level of scrutiny. To ensure the ability to defend their deals through a potential investigation, parties to the average “significant” deal in the U.S. should plan on at least 12 months for the agencies to investigate their transaction and may want to add on additional time to address the continuing uncertainty at the agencies. Parties should also plan for another 6 to 12 months if they want to preserve their right to litigate an adverse agency decision.

On the EU side, parties to transactions likely to proceed to Phase II should allow for at least 18 months from announcement to clearance and should not rely on the theoretical deadlines provided for in the EU Merger Regulation, even after a deal has been formally notified. Parties should be aware that the EU Commission is less and less likely to accept remedies without an in-depth investigation; if parties still plan on obtaining a Phase I clearance with commitments, they should factor in around 10 months from announcement to a decision, with significant time set aside for pre-notification talks with the Commission and the potential need to pull and refile their filing.