Risk Retention

Dechert is one of the leading voices and thought leaders on the securitization and structured finance industry’s response to the risk retention rules of Dodd-Frank and the European Union. We’ve helped trade organizations and clients craft comment letters to the regulatory agencies and serve on key industry committees. As risk retention looms (it already applies to securitizations marked into Europe), we are actively developing structures and strategies for our clients to comply with this new and very consequential regulatory regime.

Dechert is one of four law firms working together to offer insight into key questions raised by the requirements of risk retention, commonly referred to as the Final Rule.

What is risk retention?

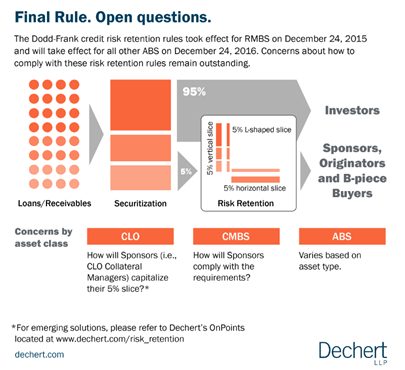

In late 2014, the Securities and Exchange Commission, the Board of Governors of the Federal Reserve System, the Department of Housing and Urban Development, the Federal Housing Finance Agency, the Federal Depositors Insurance Corporation and the Office of the Comptroller of the Currency promulgated final U.S. risk retention rules (the “Final Rule”) for asset-backed securities to implement the risk retention requirements of Section 941 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, codified as Section 15G of the Securities Exchange Act of 1934. The Final Rule became effective for residential mortgaged-backed securitizations on December 24, 2015 and will become effective for all other asset classes, including non-resi ABS, CLOs and CMBS on December 24, 2016.